The longer I stay in the market, the less I try to value fundamentals.

Before, the market looked at the team, the product, the technology, the tokenomics. People tried to understand what was “actually worth money.” Some of us even read tons of whitepapers. The classic “smart investor” approach.

Now I mostly look at one thing:

Where attention and money are flowing. And where they’re flowing out from.

It sounds primitive, but it works better than any deep analysis.

Why do new coins go up while old ones don’t? Not because they’re better. Just attention. Money goes into whatever is being talked about right now. Yesterday’s favorite is already irrelevant.

This isn’t even second-order thinking. It’s first-order. The dumbest and most effective one.

Most tokens have a problem people rarely say out loud. Their natural state is to go down.

Constant unlocks, emissions, people who want to exit to cash. Sell pressure never stops. For price to even stay flat you need constant new money coming in.

For price to grow - inflow must be stronger than outflow. That happens rarely and usually not for long.

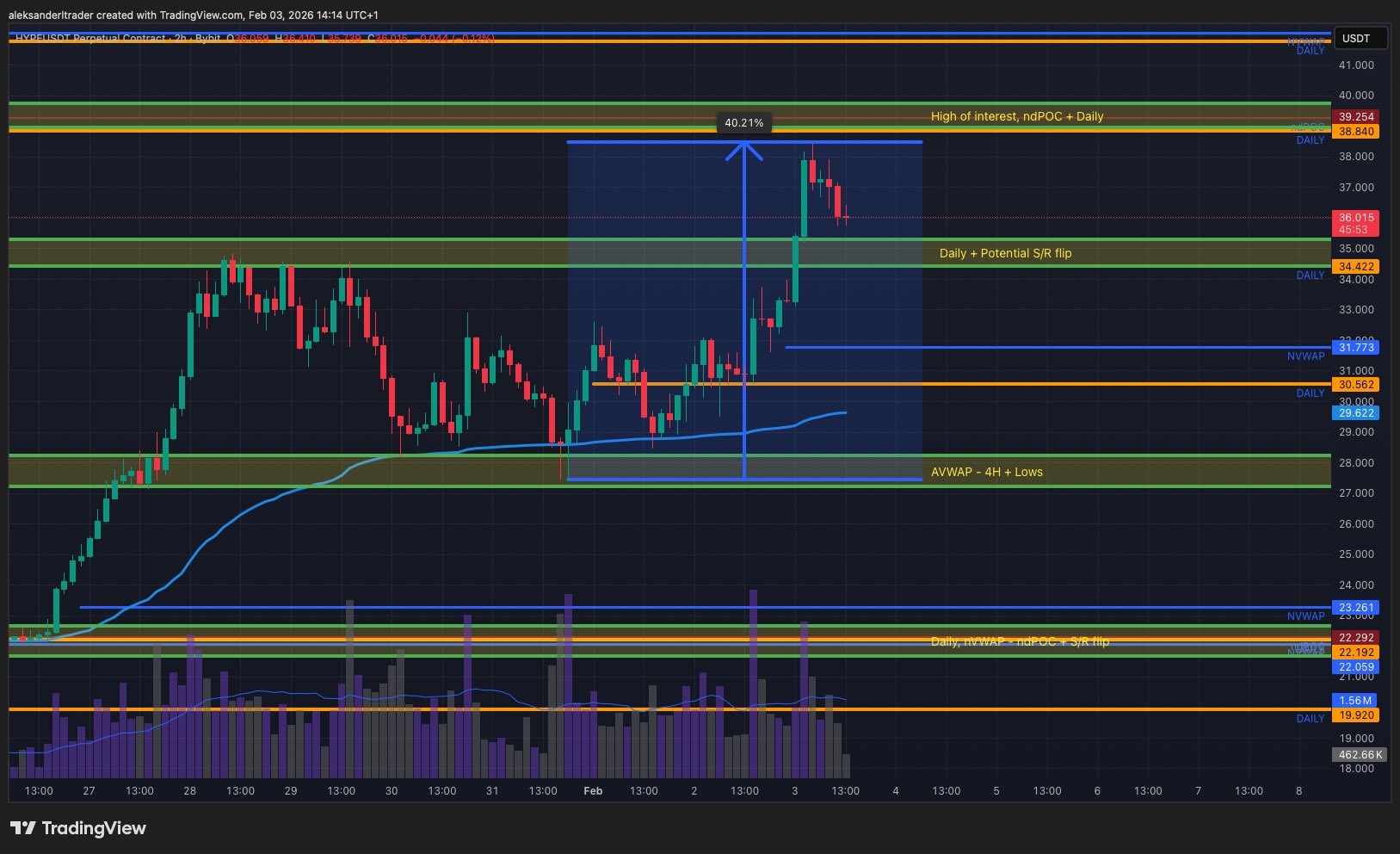

All these mechanics like buybacks, burns, lockups — they are attempts to change this balance. Sometimes it works. Hyperliquid can afford to aggressively buy back its token through liquidations. Most projects can’t.

DATs are the same story. While the treasury buys price goes up. Once it stops gravity takes over.

Fundamentals don’t disappear in this model. They just change roles. A good product and good metrics are tools to attract attention. Attention brings money. Money moves price.

By themselves, fundamentals guarantee nothing. I’ve seen great projects bleed for years. And complete garbage do massive multiples.

The difference is not quality. The difference is where attention is pointed at the moment