Solana (SOL)

Solana (SOL)

$89.88 +6.30% 24H

- 64Індекс соціальних настроїв (SSI)-10.43% (24h)

- #82Рейтинг пульсу ринку (MPR)-22

- 11124-годинні згадки в соціальних мережах-28.21% (24h)

- 69%24-годинний коефіцієнт бичачого настрою KOL76 Активних KOL

- Підсумок

- Бичачі сигнали

- Ведмежі сигнали

Індекс соціальних настроїв (SSI)

- Загальні дані64SSI

- Тенденція SSI (7 днів)Ціна (7 днів)Розподіл настроївНадзвичайно бичачий (22%)Бичачий (47%)Нейтральні (16%)Ведмежий (7%)Надзвичайно ведмежий (8%)Аналітика SSI

Рейтинг пульсу ринку (MPR)

- Аналітика сповіщень

Дописи з платформи X

yueya FA_Analyst OnChain_Analyst A50.12K @yueya_eth

yueya FA_Analyst OnChain_Analyst A50.12K @yueya_eth

yueya FA_Analyst OnChain_Analyst A50.12K @yueya_eth

yueya FA_Analyst OnChain_Analyst A50.12K @yueya_eth 15 12 905 Оригінал >Тенденція SOL після випускуНадзвичайно бичачий

15 12 905 Оригінал >Тенденція SOL після випускуНадзвичайно бичачий- Тенденція SOL після випускуБичачий

- Тенденція SOL після випускуНейтральні

- Тенденція SOL після випускуБичачий

- Тенденція SOL після випускуВедмежий

- Тенденція SOL після випускуБичачий

- Тенденція SOL після випускуБичачий

- Тенденція SOL після випускуНадзвичайно бичачий

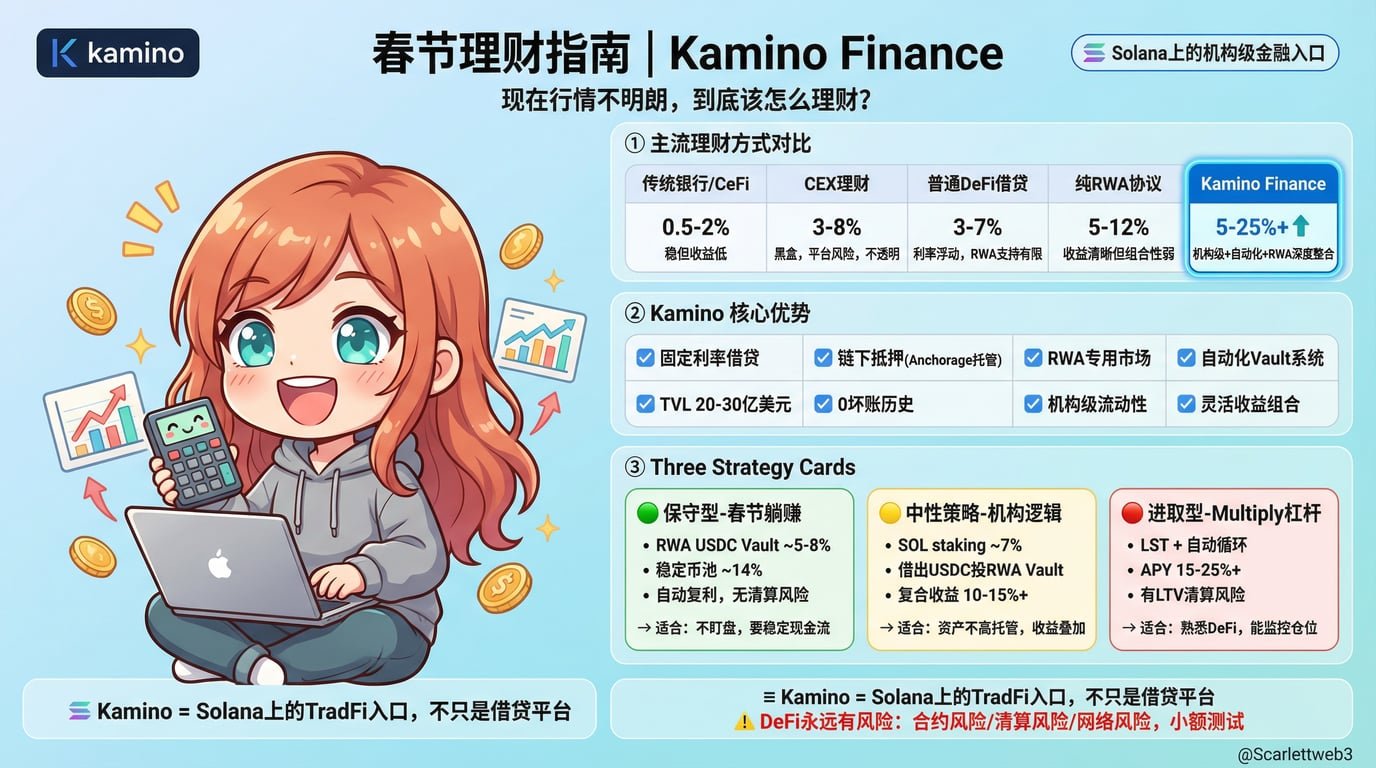

Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3

Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3 Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3

Jingle Bell 初号机 OnChain_Analyst Community_Lead S41.40K @ScarlettWeb3 71 42 6.99K Оригінал >Тенденція SOL після випускуНадзвичайно бичачий

71 42 6.99K Оригінал >Тенденція SOL після випускуНадзвичайно бичачий CM FA_Analyst DeFi_Expert A54.63K @cmdefi

CM FA_Analyst DeFi_Expert A54.63K @cmdefi Solana Media Influencer D3.68M @solana16 5 4.23K Оригінал >Тенденція SOL після випускуБичачий

Solana Media Influencer D3.68M @solana16 5 4.23K Оригінал >Тенденція SOL після випускуБичачий