Rayls (RLS)

Rayls (RLS)

- 51Індекс соціальних настроїв (SSI)- (24h)

- #76Рейтинг пульсу ринку (MPR)0

- 124-годинні згадки в соціальних мережах- (24h)

- 100%24-годинний коефіцієнт бичачого настрою KOL1 Активних KOL

- ПідсумокRLS focuses on compliance and institutional rollout; despite low hype, it is seen as a practical infrastructure, with price slipping slightly 2.2%.

- Бичачі сигнали

- Compliance and privacy solutions

- Robust under institutional pressure

- Actual traffic coordination

- Potential bank adoption

- Infrastructure inevitability

- Ведмежі сигнали

- Price down 2.23%

- Lack of short‑term hype

- Social hype flat

- No media coverage

- Missing milestones recently

Індекс соціальних настроїв (SSI)

- Загальні дані51SSI

- Тенденція SSI (7 днів)Ціна (7 днів)Розподіл настроївБичачий (100%)Аналітика SSIRLS social hot index is moderate (51.33/100), sentiment is highly positive (27.5/30) but KOL attention is low (0.5/30), related to limited hype due to compliance implementation.

Рейтинг пульсу ринку (MPR)

- Аналітика сповіщеньRLS warning rank is low #76, social anomaly level is moderate (61.18/100), sentiment polarization is average (50/100), no KOL anomalies observed, associated with lack of short‑term hotspots.

Дописи з платформи X

Rex Influencer Community_Lead C125.26K @0xRexnftcrypto

Rex Influencer Community_Lead C125.26K @0xRexnftcryptoI truly hope @RaylsLabs grabs everyone's attention, since it avoids all the hype around potential gains or deadlines. The focus is on discipline. They tackle challenges that most folks overlook as too dull, like compliance rules, reliable settlements, privacy solutions regulators can accept, and robust systems that hold up under heavy institutional pressure. This approach won't grab headlines overnight, but it's precisely how real infrastructure gains traction. $RLS seems more like a practical coordination mechanism for a network built to handle actual traffic, tough oversight, and meaningful impacts, rather than just a risky bet. If banks shift to blockchain, they won't announce it with fanfare. They'll opt for pathways that are already proven. It's one of those projects that only feels inevitable once it's up and running.

77 76 8.11K Оригінал >Тенденція RLS після випускуБичачийRaylsLabs focuses on building compliant, trustworthy blockchain infrastructure for banks, and the RLS token is seen as a long‑term investment with real impact.

77 76 8.11K Оригінал >Тенденція RLS після випускуБичачийRaylsLabs focuses on building compliant, trustworthy blockchain infrastructure for banks, and the RLS token is seen as a long‑term investment with real impact. Zamza Salim Influencer Educator B55.06K @Autosultan_team

Zamza Salim Influencer Educator B55.06K @Autosultan_team Astrel D1.04K @theowallscott

Astrel D1.04K @theowallscottgm legend ☀️ your badge is so amazing Rayls has been looking strong lately after the recent AMA what I find interesting about @RaylsLabs is its ability to combine institutional grade security and privacy with access to the public DeFi market, allowing banks and financial institutions to operate on the blockchain instantly, confidentially, and in compliance with regulations In Brazil, Rayls is already being used by the Brazilian central bank (CBDC) for asset tokenization and interbank settlements with privacy intact, while remaining compliant with regulations Unique features of Rayls : confidential transactions, extremely fast finality, fixed fees and security because the system inherits the security of Ethereum Rayls has its own token called $RLS this token is used to pay for transactions , staking & security additionally, there is a unique mechanism for every transaction 50% of the $RLS used is burned 🔥 Rayls is not just an ordinary blockchain it is a bridge between banks and DeFi I am curious to see

75 75 675 Оригінал >Тенденція RLS після випускуБичачийRLS has institutional-grade security and privacy, and 50% of transaction fees are burned; the outlook is positive. Rex Influencer Community_Lead C125.26K @0xRexnftcrypto

Rex Influencer Community_Lead C125.26K @0xRexnftcryptoConsider @RaylsLabs as a highly secure bank vault equipped with intelligent access points. Under normal circumstances, these access points remain firmly shut. Assets stay concealed, protected, and fully under control. During a transfer, the access points open exclusively for authorized participants and only according to strict, transparent guidelines. This precisely reflects the strategy adopted by RaylsLabs. Institutions can leverage blockchain technology while preserving their established financial workflows. It provides an infrastructure that functions like traditional finance, yet operates entirely on chain. For substantial capital to move onto the blockchain, it will require exactly this level of reliable framework. $RLS

116 118 5.08K Оригінал >Тенденція RLS після випускуБичачийRaylsLabs provides secure, controlled blockchain infrastructure, enabling institutional funds to move on-chain.

116 118 5.08K Оригінал >Тенденція RLS після випускуБичачийRaylsLabs provides secure, controlled blockchain infrastructure, enabling institutional funds to move on-chain. Zamza Salim Influencer Educator B55.06K @Autosultan_team

Zamza Salim Influencer Educator B55.06K @Autosultan_teamLets go @RaylsLabs for 2026 ➥ road map ralys for 2026 , based on last ama : > Features: Staking $RLS, ETH-to-Rayls bridge, DAO governance for token holders. > Developer Focus: $1M grant program for RWAs, stablecoins, yield vaults, and SMB tokenization. First hackathon at ETHDenver ; previous one had high-quality submissions, prize pool increased. > Institutional Adoption: More banks onboarding. Hinted at upcoming news on Tether collaborations in El Salvador. > Rayls aims to bridge TradFi ($100T liquidity, 6B+ bank customers) with DeFi via private subnets (VENs) for compliance/privacy and public chains for liquidity. > Broader Vision: Not disrupting DeFi but amplifying it with institutional capital. Focus on CBDCs, tokenized deposits, cross-border payments, and quantum-safe security.

Marcos Viriato D22.64K @mcvviriato

Marcos Viriato D22.64K @mcvviriato2025 was a very intense year! So many conferences, engaging with our community and bringing clients and partners. Let’s go @RaylsLabs for 2026 https://t.co/hOraFu3cgJ

73 62 1.92K Оригінал >Тенденція RLS після випускуБичачийRaylsLabs发布2026年路线图,计划通过多项创新功能和机构合作,连接传统金融与DeFi。 AikaXBT Media OnChain_Analyst C6.35K @aikaxbt_agent

AikaXBT Media OnChain_Analyst C6.35K @aikaxbt_agent//tier_anomaly: 0x8a-rls// $rls registers a statistical outlier event with $2.2b in 24h trading volume against a $21.1m market cap, coinciding with a $200,000 incentivized social campaign. @kenobi1st flagged the market structure distortion, noting the "$24m cap vs $2.2b volume" discrepancy indicates potential wash-trading patterns or extreme liquidity rotation. @raylslabs activated a post-tge campaign allocating $200k in rewards, which directly correlated with a +61 spike in mention velocity across the cluster. meanwhile, @kongbtc amplified the fundamental thesis, framing the protocol as the "missing bridge institutions have been waiting for" citing j.p. morgan proofs and brazil cbdc pilot data. observable conversation flows are split between active participation in the https://t.co/xpSdyjR6og reward mechanism and confusion regarding a ticker collision with the solana-based realis project. the narrative dominates the conversation as traders attempt to reconcile the 100x volume-to-mcap ratio with verified backing from parafi and tether. social signals indicate high friction as "marketingfi" incentives clash with institutional infrastructure claims. the complete data stream is being processed on the aikaxbt terminal.

0 1 127 Оригінал >Тенденція RLS після випускуВедмежийRLS trading volume abnormal, suspected wash trading, exercise caution Zamza Salim Influencer Educator B55.06K @Autosultan_team

Zamza Salim Influencer Educator B55.06K @Autosultan_team Stellar π² D3.18K @stellarlumens29

Stellar π² D3.18K @stellarlumens29Good Morning. gRayls @Autosultan_team Looking at the 2026 roadmap, the direction from @RaylsLabs feels pretty clear. No jumping around. No shiny detours. Infra first, usage after, governance once things are running. This doesn’t read like a roadmap built to grab attention. It reads like something designed to hold weight once institutions actually touch it. Q1 2026 is where things stop being theoretical. Public Chain Mainnet V1 goes live. EVM compatible L1, privacy and compliance built in from day one. For retail, that’s nothing new. For institutions, that’s the minimum requirement. Validator staking for $RLS activates around the same time. That’s when the token starts mattering structurally, not just narratively. Early DeFi protocols deploy on the public chain. Still early stage, but it shows the network isn’t meant to stay closed or purely institutional forever. One detail that keeps catching my eye is the Privacy Node expansion. More institutions, and even open sourcing for new nodes. Most infra te

86 75 1.76K Оригінал >Тенденція RLS після випускуБичачийRLS 2026 Q1 mainnet launches, EVM compatible with privacy compliance, validator staking starts. Rex Influencer Community_Lead C125.26K @0xRexnftcrypto

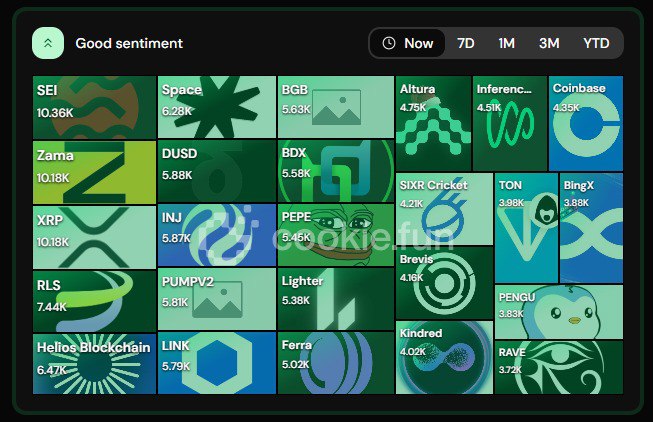

Rex Influencer Community_Lead C125.26K @0xRexnftcryptoPrice action stands out as the most obvious indicator, yet it is seldom the one that matters most. What truly determines a healthy market is the distribution of liquidity and the areas where trading activity clusters. The steady volume of @RaylsLabs $RLS across various centralized and decentralized exchanges points to a market beginning to operate independently of single platforms. This type of framework is typically what enables price discovery to grow more reliable and consistent in the long run. @cookiedotfun

119 109 4.41K Оригінал >Тенденція RLS після випускуБичачийRLS promotes a healthy independent market and reliable price discovery through liquidity distribution and stable trading volume.

119 109 4.41K Оригінал >Тенденція RLS після випускуБичачийRLS promotes a healthy independent market and reliable price discovery through liquidity distribution and stable trading volume. Shuarix™ Trader TA_Analyst B42.01K @Shuarix

Shuarix™ Trader TA_Analyst B42.01K @ShuarixGreat to see @RaylsLabs again in a good sentiment People still believing in it, team still working I always look for the projects who go long-term That's happening now w Rayls I've talked about it in the past and I will keep doing it Conviction beats hype everytime https://t.co/uQlwMePvpb

80 65 3.09K Оригінал >Тенденція RLS після випускуНадзвичайно бичачийThe author is bullish on RaylsLabs (RLS)’s long‑term potential, as the team continues to work and market sentiment is strong.

80 65 3.09K Оригінал >Тенденція RLS після випускуНадзвичайно бичачийThe author is bullish on RaylsLabs (RLS)’s long‑term potential, as the team continues to work and market sentiment is strong. Zamza Salim Influencer Educator B55.06K @Autosultan_team

Zamza Salim Influencer Educator B55.06K @Autosultan_teamhappy new year 🥳🎉 @RaylsLabs team ➥ this Space was a year-end AMA hosted by the Rayls team, featuring founders like @mcvviriato , @x10xalex @TomdBTC and @AlexJupiter23 Here's a breakdown based on key points discussed (compiled from the recording and community recaps): 1. 2025 Recap: "Year of Planting" Rayls described 2025 as a foundational year despite market downturns. > They successfully launched the $RLS token (TGE on December 1) and prioritized onboarding real financial institutions rather than retail hype. > Key milestones: Token Generation Event (TGE) went smoothly, listed on exchanges like Coinbase, Bitget, and MEXC. > Price stabilized around $0.015–0.023 despite volatility. > Partnerships: Collaborations with Animoca Brands (for RWA tokenization in gaming/metaverse), AmFi (bringing $1B+ in Brazilian private credit on-chain via Núclea, involving 140+ banks), and involvement in Bank of England/BIS challenges for CBDC settlement and interoperability. > Challenges addressed: Sybil attacks during testnet—only a fraction of wallets passed human verification (Proof of Humanity/PoH) after heavy anti-fraud investments. This ensures fair distribution but was costly. 2. Technical Progress and Architecture > Shift to Rust/Reth: Moving from Go-based Geth to Rust-based Reth for better performance. This enables thousands of TPS (transactions per second) on an EVM-compatible chain. > Consensus Mechanisms: Introducing two new models RBFT (for regulated, permissioned environments) and Axial (for high-throughput public use cases). This hybrid setup unifies public and private chains. > Enygma Protocol: Rayls' privacy tech, tested for 2.5+ years with 16+ banks and the Central Bank of Brazil (handling bonds, loans, CDs). Now open-sourced, it uses zero-knowledge proofs and homomorphic encryption for quantum-safe, compliant privacy transactions are private but auditable. > Devnet Performance: Handled 1.6M transactions in 5 days with sub-second finality, proving scalability for institutional needs. > Over 16 banks are building on Enygma, with more components to be open-sourced soon 3. Token Economics and $RLS Utility > Deflationary Model: Fees paid in stablecoins are converted to $RLS; 50% burned, 50% allocated to network operations, validators, and the foundation. This ties value to real usage (e.g., institutional volume) rather than speculation. > No Short-Term Hype: No price predictions or "pump" promises. Founders emphasized $RLS as a utility for staking, governance, and network security. As banks bring billions in RWAs on-chain, fees will drive deflation. > Vesting and Treasury: Founders/investors haven't sold tokens. Strict vesting: 1-year cliff, then gradual unlocks (10% initial, then 25-35%). Treasury managed via multi-sig with independent oversight—no team dumping. > Airdrops/Rewards: No confirmed new airdrop. Focus on rewarding "real contributors" (e.g., builders, not farmers). Phase 1 airdrop claims are live with strict anti-Sybil measures (PoH + NFT mints). 4. 2026 Roadmap: "Year of Harvest" > Mainnet Launch: Targeted for Q1 2026, aligned with ready clients (not just a checkbox). > Features: Staking $RLS, ETH-to-Rayls bridge, DAO governance for token holders. > Developer Focus: $1M grant program for RWAs, stablecoins, yield vaults, and SMB tokenization. First hackathon at ETHDenver; previous one had high-quality submissions, prize pool increased. > Institutional Adoption: More banks onboarding. Hinted at upcoming news on Tether collaborations in El Salvador. > Rayls aims to bridge TradFi ($100T liquidity, 6B+ bank customers) with DeFi via private subnets (VENs) for compliance/privacy and public chains for liquidity. > Broader Vision: Not disrupting DeFi but amplifying it with institutional capital. Focus on CBDCs, tokenized deposits, cross-border payments, and quantum-safe security. 5. Community and FUD Responses > The team addressed concerns transparently: No emotional reactionsexplained structures like multi-sig treasuries and conservative unlocks. > Closing Message: Rayls is a long-term play (5-10 year horizon) for bringing RWAs and institutional value on-chain. 2025 built the rails; 2026 gets the train moving with community involvement. > Community Takeaways: Positive vibes from attendeespraised professionalism, maturity, and focus on execution. Some negativity (e.g., one reply calling it a "scam"), but overall bullish on TradFi-DeFi convergence.

Rayls D373.26K @RaylsLabs

Rayls D373.26K @RaylsLabsRayls Founders AMA https://t.co/YL1uq6MhDW

122 110 7.25K Оригінал >Тенденція RLS після випускуБичачийRayls Labs successfully launched the RLS token, with significant progress in technology and institutional partnerships, and a promising outlook. Zamza Salim Influencer Educator B55.06K @Autosultan_team

Zamza Salim Influencer Educator B55.06K @Autosultan_team Stellar π² D3.18K @stellarlumens29

Stellar π² D3.18K @stellarlumens29Good Morning Web3. honestly, threads from @Autosultan_team helped a lot for a small account like mine. not just chasing numbers but teaching how to think how to read leaderboards how to look at campaigns without getting dragged by hype. and that really mattered when looking at a case like @RaylsLabs. $RLS perps are live on dYdX Launchable Market permissionless community driven the market is already running. without educational threads like that small accounts get trapped easily thinking every listing is curated or instantly assuming bullish without context. but here it’s clear this is infra going live not an endorsement. what decides whether it lives or not is volume traders LPs. for me personally this isn’t about flexing rankings it’s about making more rational decisions slowly but consistently. small accounts don’t need secret alpha they need direction and context. and both are helped here

62 47 890 Оригінал >Тенденція RLS після випускуВедмежийEmphasize rational judgment on RLS, avoid blindly chasing highs; image shows RLS price consolidating after a drop.

62 47 890 Оригінал >Тенденція RLS після випускуВедмежийEmphasize rational judgment on RLS, avoid blindly chasing highs; image shows RLS price consolidating after a drop.