⏰What happened in Crypto in the last ~24h:

- $ESP Listed on Binance Spot

- $ASTEC, $ESP Listed on Coinbase spot

- $LIT Lighter launches first DEX Korean equity perpetuals with 10X leverage

- $WLFI Trump-linked World Liberty Financial to launch forex and remittance platform

- $ADA Hoskinson confirms LayerZero integration on Cardano to boost cross-chain liquidity and USDCx

- $STBL OKX Ventures and STBL to launch RWA-backed stablecoin on X Layer

- AAVE Aave Labs proposes 'Aave Will Win' framework for global financial infrastructure dominance

- Binance completes $1 billion SAFU fund conversion into 15,000 BTC

- Lightning Labs launches AI agent tools for native Bitcoin Lightning payments

- Polymarket debuts 5-minute Bitcoin price betting to leverage short-term crypto volatility

- Coinbase posts $667 million loss as revenue tumbles 20% in quarterly results

————————————————

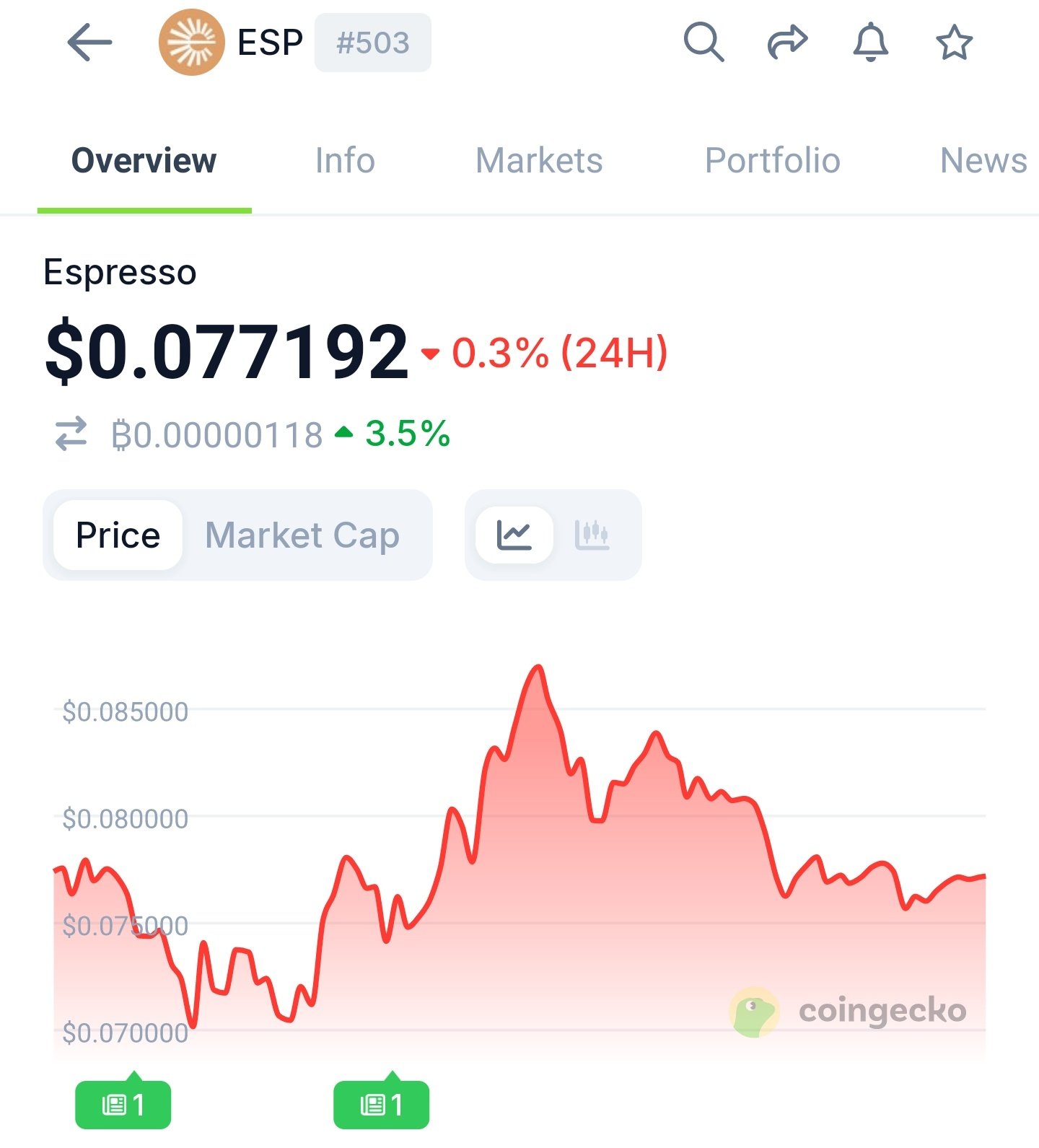

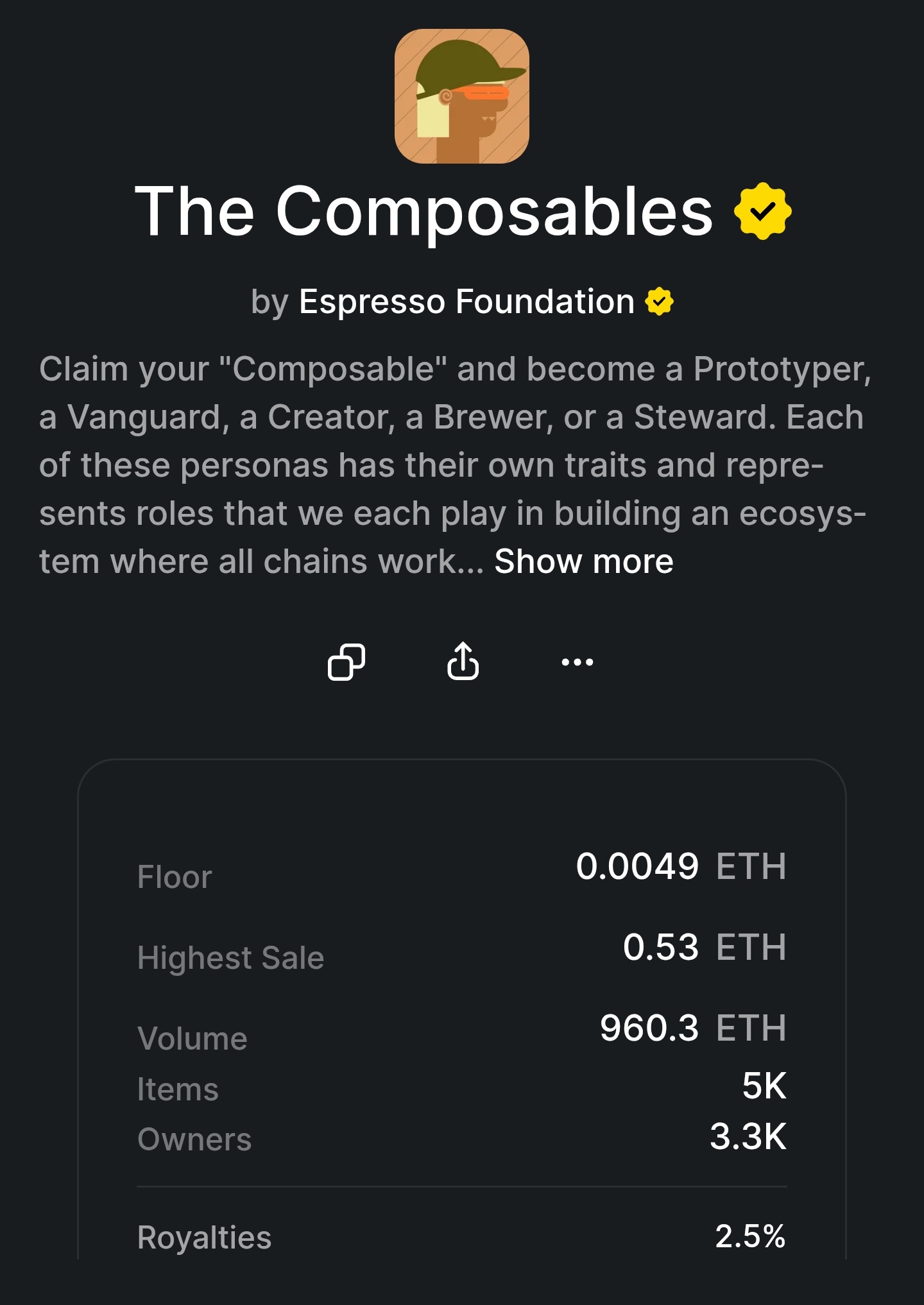

$ESP - Binance listed Espresso (ESP) for spot trading on February 12, 2026, featuring ESP/USDT, ESP/USDC, and ESP/TRY pairs. The project, which focuses on improving Layer 2 performance and security, transitioned from the "Binance Alpha" pre-listing pool to the main spot market.

$ASTEC, $ESP - Coinbase has launched spot trading for Aztec (AZTEC) and Espresso (ESP) with AZTEC-USD and ESP-USD pairs on February 12, 2026. The tokens are available across https://t.co/y10v06dZDi, the Coinbase app, and Coinbase Advanced, with direct access for institutional clients.

$LIT - Lighter has become the first DEX to launch Korean equity perpetuals, bridging traditional finance and DeFi. Major assets including Samsung, Hyundai, SK Hynix, and the KRCOMP index are now tradable with up to 10X leverage. This expansion allows global crypto users to gain on-chain exposure to South Korea’s leading stock market indicators.

$WLFI - World Liberty Financial is launching a blockchain-based platform focused on foreign exchange and global remittances. The expansion aims to offer faster, low-cost cross-border payments, competing directly with traditional financial institutions. This initiative broadens the Trump-linked project's scope from DeFi into the mainstream international money transfer market.

$ADA - Charles Hoskinson confirmed the integration of LayerZero into Cardano, connecting the network to over 150 blockchains and $80B+ in assets. This partnership enables the launch of USDCx, a ZK-powered, compliant privacy stablecoin with broad institutional and exchange support. The move aims to eliminate Cardano's ecosystem isolation by fostering cross-chain liquidity and high-performance DeFi interoperability.

$STBL - OKX Ventures has invested in STBL to launch an institutional-grade, RWA-backed stablecoin on its ZK-powered "X Layer" network. In partnership with Hamilton Lane and Securitize, the project will tokenize private credit assets to provide on-chain liquidity and yield. This "Ecosystem-Specific Stablecoin" (ESS) uses a dual-token model to separate spendable liquidity from yield-bearing asset claims.

$AAVE - Aave Labs proposed the "Aave Will Win" framework to establish Aave as a global financial infrastructure by ratifying Aave V4 as its core technical foundation. The proposal aligns incentives by directing 100% of Aave-branded product revenue (including https://t.co/453rvAe7PT and Aave App) to the DAO treasury. It requests a structured budget and operational autonomy for Aave Labs to scale product engineering, business development, and brand protection at an institutional level.

Binance finalized the transition of its $1 billion SAFU fund into Bitcoin with a final purchase of 4,545 BTC. The fund now holds 15,000 BTC, reinforcing Binance's strategy to use Bitcoin as its primary long-term reserve asset. This transparent conversion was completed within 30 days of the initial announcement to enhance asset security and resilience.

Lightning Labs released an open-source toolkit enabling AI agents to natively transact on the Bitcoin Lightning Network using the L402 protocol. The tools eliminate the need for traditional API keys or signup flows, allowing autonomous systems to pay for compute and data instantly. This "machine-payable web" infrastructure includes seven composable skills and a new CLI client, lnget, to facilitate seamless AI commerce.

Polymarket has launched ultra-short-term markets allowing users to bet on Bitcoin's price direction in 5-minute intervals. The feature is currently limited to Bitcoin but plans to expand to major altcoins to capture high-frequency trading demand. This expansion leverages real-time volatility, marking a strategic shift toward fast-paced, sentiment-driven financial wagering.

Coinbase reported a $667 million net loss for the quarter, missing analyst expectations significantly.

Revenue tumbled by 20% compared to the previous period as trading volumes declined amid market volatility. The exchange is facing pressure from lower transaction fees and rising operational costs despite its expansion efforts.

————————————————

➬ Follow me @layerggofficial , TG: https://t.co/mdmJAwb4y6

📷Sharing is welcome, just a nod to the source would be appreciated.

📷Please Like + Retweet if you enjoy this

ESP (ESP)

ESP (ESP) ZhongLi.eth | 不朽🇻🇳 FA_Analyst OnChain_Analyst A6.37K @Zhonglihunter

ZhongLi.eth | 不朽🇻🇳 FA_Analyst OnChain_Analyst A6.37K @Zhonglihunter ZhongLi.eth | 不朽🇻🇳 FA_Analyst OnChain_Analyst A6.37K @Zhonglihunter

ZhongLi.eth | 不朽🇻🇳 FA_Analyst OnChain_Analyst A6.37K @Zhonglihunter 29 28 1.60K Оригінал >Тенденція ESP після випускуВедмежий

29 28 1.60K Оригінал >Тенденція ESP після випускуВедмежий Tanned.edge🦭 🧬⚛️🦣🦥⛽️🏕️🧪(Ø,G)🥷 DeFi_Expert Influencer B2.00K @crabetan

Tanned.edge🦭 🧬⚛️🦣🦥⛽️🏕️🧪(Ø,G)🥷 DeFi_Expert Influencer B2.00K @crabetan Crypto PK D5.80K @Crypt0_PK

Crypto PK D5.80K @Crypt0_PK

4 2 167 Оригінал >Тенденція ESP після випускуНадзвичайно ведмежий

4 2 167 Оригінал >Тенденція ESP після випускуНадзвичайно ведмежий tochi Tokenomics_Expert DeFi_Expert B71.98K @oxtochi

tochi Tokenomics_Expert DeFi_Expert B71.98K @oxtochi tochi Tokenomics_Expert DeFi_Expert B71.98K @oxtochi

tochi Tokenomics_Expert DeFi_Expert B71.98K @oxtochi 61 15 2.95K Оригінал >Тенденція ESP після випускуНадзвичайно бичачий

61 15 2.95K Оригінал >Тенденція ESP після випускуНадзвичайно бичачий コゴロー.lens🐐(📽️, 🌿)(🌸, 🌿)♦️.ink | ETHGas ⛽ Media Influencer B2.21K @2AkuqpZMLTmvHBW

コゴロー.lens🐐(📽️, 🌿)(🌸, 🌿)♦️.ink | ETHGas ⛽ Media Influencer B2.21K @2AkuqpZMLTmvHBW Eron / eronfrozen.base.eth | ETHGas ⛽ D2.04K @EronFrozen4 0 503 Оригінал >Тенденція ESP після випускуБичачий

Eron / eronfrozen.base.eth | ETHGas ⛽ D2.04K @EronFrozen4 0 503 Оригінал >Тенденція ESP після випускуБичачий