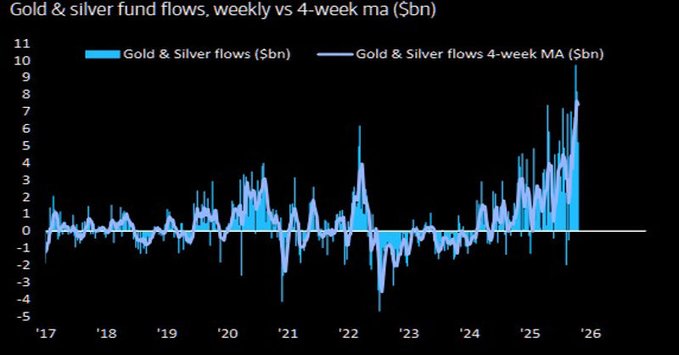

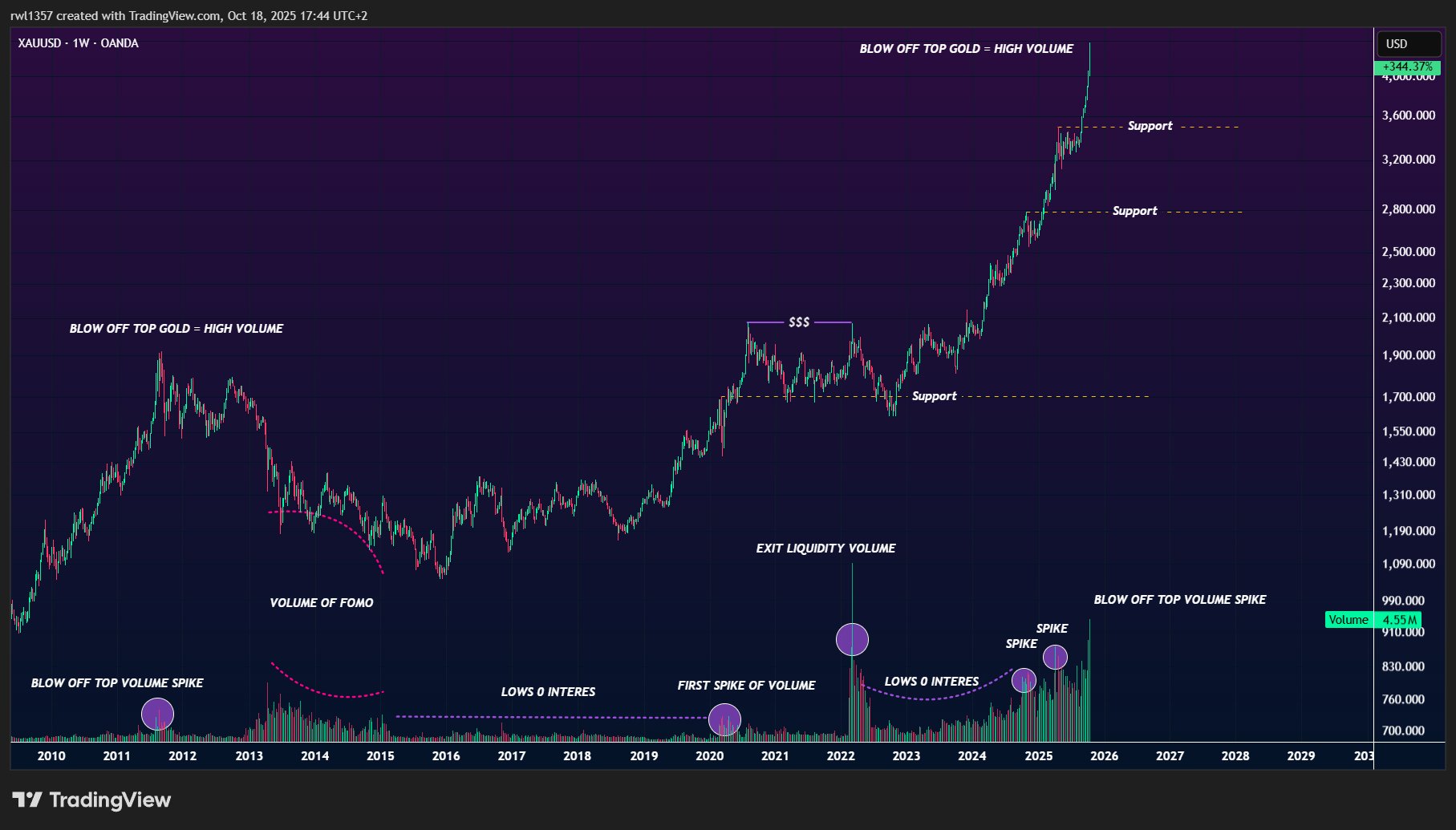

Basically, this post is explaining that everyone is currently buying and selling gold, creating huge trading volume as it is in a blow-off top phase. This phase usually comes right before a correction after a strong move to the upside, late buyers often end up getting punished.

Reading volume isn’t too complicated. When you see an asset with unusually high volume near its highs, it often signals the end of a run. For example, before Trump launched his meme coin, several others like Fartcoin, AI16z, Zerebro, GOAT + more pumped hard right after launch. But by the time most people heard about them, it was too late. The surge in volume came after the big move, meaning traders were buying the top.

On the flip side, when you see high volume at market lows sometimes even higher than during all-time highs that often means whales are accumulating quietly, anticipating a reversal. This pattern shows up across the board, from ETFs like TLT to lesser-known altcoins like XDB. It’s a sign of bottom formation and silent accumulation before the crowd catches on.

So, in gold’s case, this move is a textbook example: high volume during a blow-off top means everyone’s piling in, pushing prices up but without realizing they’re likely getting trapped.

As a final note, volume can also help identify support and resistance levels.