Privacy-first onchain infrastructure for institutions.

@RaylsLabs connects private EVMs to public DeFi while preserving compliance and confidentiality.

Full Pulse report from @0xWeiler below👇 https://t.co/B6MJF1Zb2C

Rayls Dados de preços ao vivo

Rayls RLS Histórico de Preços USD

Adquira RLS agora

Compre e venda RLS de forma fácil e segura na BitMart.Ganhar

Coloque suas criptomoedas ociosas para trabalhar e ganhe renda passiva com poupança, staking e muito mais.Rayls X Insight

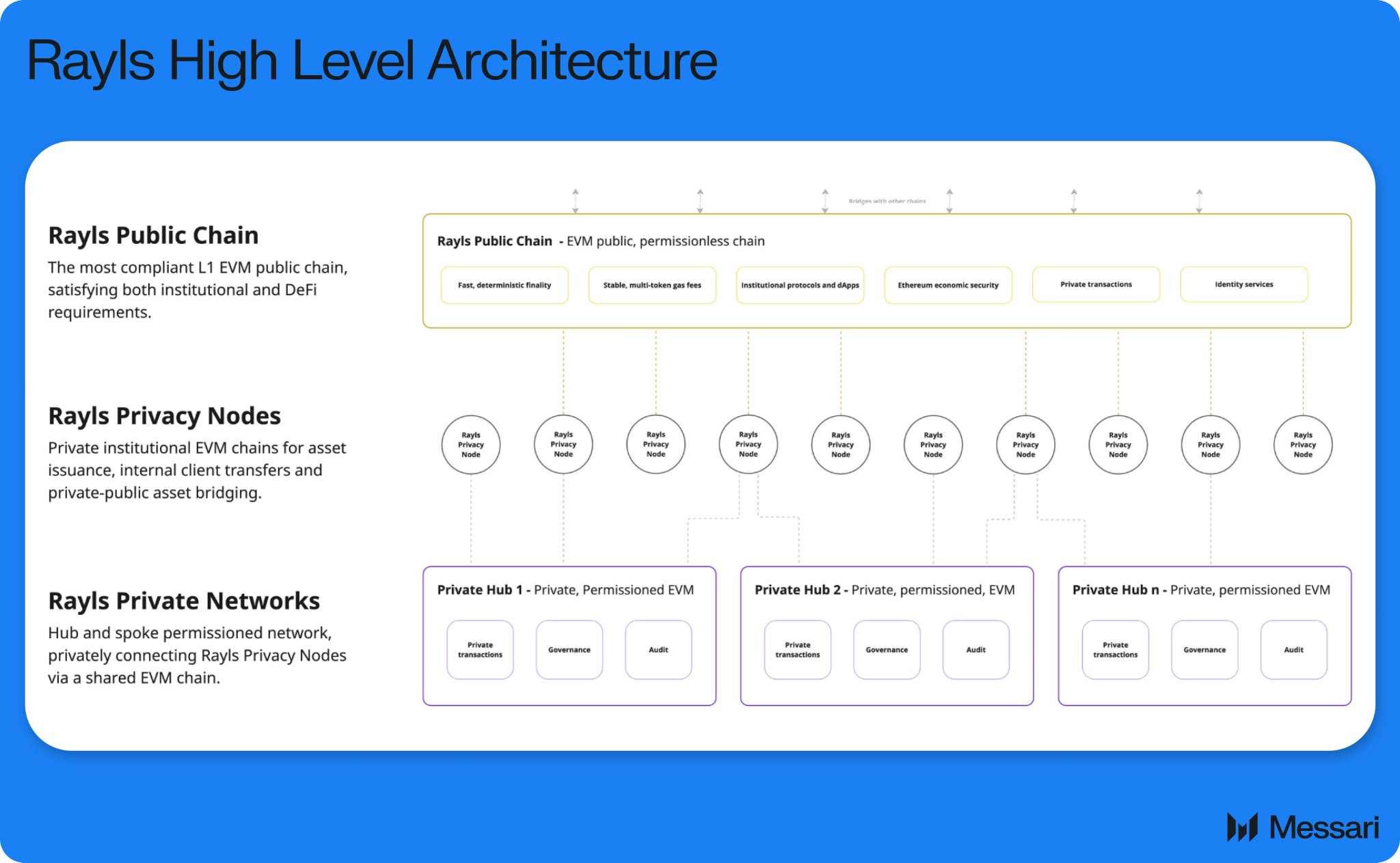

1/ Rayls ($RLS) is a blockchain infrastructure stack built for institutions and retail users to transact onchain while maintaining transaction privacy, account privacy, and regulatory compliance.

@RaylsLabs modular stack connects private institutional chains with public chains to access DeFi primitives. It has multiple components, including:

1. Privacy Nodes

2. Private Networks

3. Rayls Public Chain, an EVM-compatible L1

Could it be that the key infrastructure for RWA is not designed for retail investors!

What makes Rayls @RaylsLabs special is not “getting retail on‑chain”, but “getting banks to want to go on‑chain”:

This is the fundamental difference between it and about 90% of RWA projects on the market.

The RWA narrative has been hot for the past two years, but you’ll notice an awkward reality: the parties that actually hold quality assets (banks, clearing houses, payment networks) have moved hardly at all.

There are three hard constraints here:

1) Privacy is non‑negotiable (accounts, transactions, counterparties must remain undisclosed);

2) Compliance must be auditable (but not “fully public”);

3) Settlement must have deterministic finality (no reorgs, rollbacks, etc.)

These three points lead to one fact: banks cannot directly join any existing “regular public chain”;

For banks, the safest and most realistic approach is only one: launch their own chain first, then “controlledly” connect to the public‑chain world.

Rayls’s positioning and essence is:

Help banks, under the premise that these three “traditional finance bottom lines” are not violated, move real assets into the EVM world and build on‑chain structures that align better with banks’ intuition:

1️⃣ Private side: the bank’s own “privacy chain”:

Each institution runs its own Privacy Node, achieving EVM compatibility while being 100% private;

Thus deposits, receivables, internal clearing, and even CBDC / commercial paper can be processed on‑chain,

This step is crucial: it makes the first tokenisation of assets “compliant + private” from the start.

2️⃣ Public side: a true DeFi liquidity pool:

DeFi, vaults, secondary liquidity can reside here, forming a “global capital distribution” hub;

Rayls’s path is very clear:

First tokenise receivables in the privacy node → then structure them on a public chain into yield‑bearing assets that DeFi can ingest.

3️⃣ Enygma: the core that truly links the two sides

This is the point I value most personally.

Enygma does not simply provide cross‑chain; it uses ZKP + FHE, meaning transaction data is encrypted, somewhat like data desensitisation:

1) Selective auditability for regulators;

2) No disclosure of any commercial‑sensitive information to the market;

In other words, banks can “move out” assets, but the market will never see the underlying ledger. Security + privacy are the deepest layers for financial institutions.

4) Finally, note that Rayls’s core developer Parfin is funded by Tether, and several banks have already partnered with Rayls.

For example, Núclea (Brazil’s largest payment infrastructure) AmFi: a $1 billion‑scale receivables pipeline – these are real data endpoints in operation.

5) Future outlook;

Currently $RLS depends on regulatory progress, faces fierce competition, and early airdrops caused dissatisfaction, so $RLS price has been quite volatile,

Projects of this “bank‑grade infrastructure” type are inherently hard for the market to grasp quickly in early stages; their pace is slow, narrative heavy, and thus not suited for short‑term speculation.

However, FDV remains relatively low – partly because the broader market is down, and partly because a temporary price mismatch stems from overall market sentiment and the current stage of RWA awareness rather than fundamentals being fully priced in.

Therefore, in the long term Rayls is building a chain‑level infrastructure that banks can truly accept. If you believe in these three fundamentals:

1) RWA is more than “on‑chain sovereign bonds”;

2) Real returns come from genuine trade and cash flow;

3) TradFI will eventually go on‑chain, just not via typical Web3 methods;

Then it may become a key infrastructure in the RWA space and is worth tracking.

Enygma is Rayls’ privacy layer for real-world asset settlement:

> Transactions are confidential by default

> Balances, flows, and counterparties stay private

> Regulators get selective, verifiable disclosure

> Settlement remains deterministic and final

No tradeoff between privacy and composability.

This isn’t “privacy for privacy’s sake.”

It’s privacy so real assets can actually move onchain.

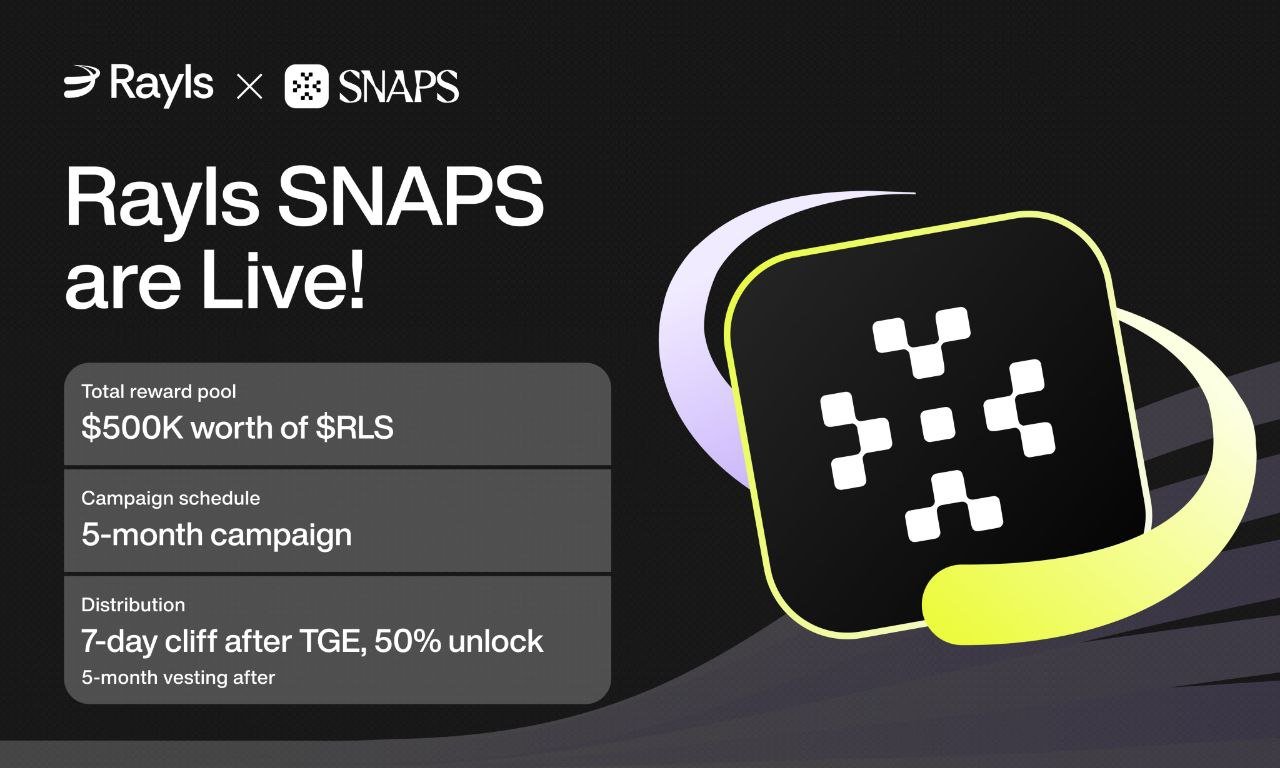

GM and Congratulations to everyone who received phase 2 of the Rayls Lab Cookie rewards.

Woke up this morning and decided to search for "RaylsLabs" on my Twitter to see the people eligible for RAYLS airdrop.

I discovered that majority of people that were eligible for 4 figs allocation(50% will be vested) had followers ranging from 500 to 2k. And they were able to make the least $350 from Rayls.

Meanwhile others were busy celebrating the Infofi ban last week. Make una no worry, Dem don ban Infofi. If you no make money from Testnets this year, na that time we go get problem.

I was among the first people to start preaching about cookie here on the TL, I'm also part of the people that fudded them after their first few launches executed poorly.

Now, I can see so many good looking launches on there. One of them is @RaylsLabs. Rayls @RaylsLabs is an EVM blockchain system built to unite Traditional Finance and Decentralised Finance.

I've checked them out and I think it might be a good cook. I might be wrong though. I'm definitely gonna grind hard on it. $RLS ⚡️⚡️

Previsão de preço

Quando é um bom momento para comprar RLS? Devo comprar ou vender RLS agora?

Previsão do Beacon

Previsão Probabilística de Preço (Próximas 24 horas)Explore Mais

BM Discovery

Nova Listagem