There aren't many projects in the market that are seriously doing AI these days. The two tokens I carefully selected this time, Kite and Ub, barely dropped during market swings, further confirming one point: a good product deserves a good price.

The rise of Moltbook actually shows that the autonomous agent internet is already materializing.

AI is no longer just for chatting; it is now actually working, earning money, and collaborating. The underlying capability that supports all this is the call path of x402 plus ERC-8004.

In plain terms, ERC-8004 provides AI with an ID card and credit record. Each AI is bound to an NFT that serves as its on‑chain identity; its work history, whether it has actually received payments, and user reviews are publicly recorded and can be queried by anyone. For important tasks, mandatory verification can be enforced to prevent misuse.

When AI has an identity, credit, and can be verified, the autonomous agent internet can truly take off, and ERC-8004 is what Unibase has been working on recently.

Kite Dados de preços ao vivo

Kite KITE Histórico de Preços USD

Adquira KITE agora

Compre e venda KITE de forma fácil e segura na BitMart.Ganhar

Coloque suas criptomoedas ociosas para trabalhar e ganhe renda passiva com poupança, staking e muito mais.Kite X Insight

https://t.co/OhBcSxCHPi

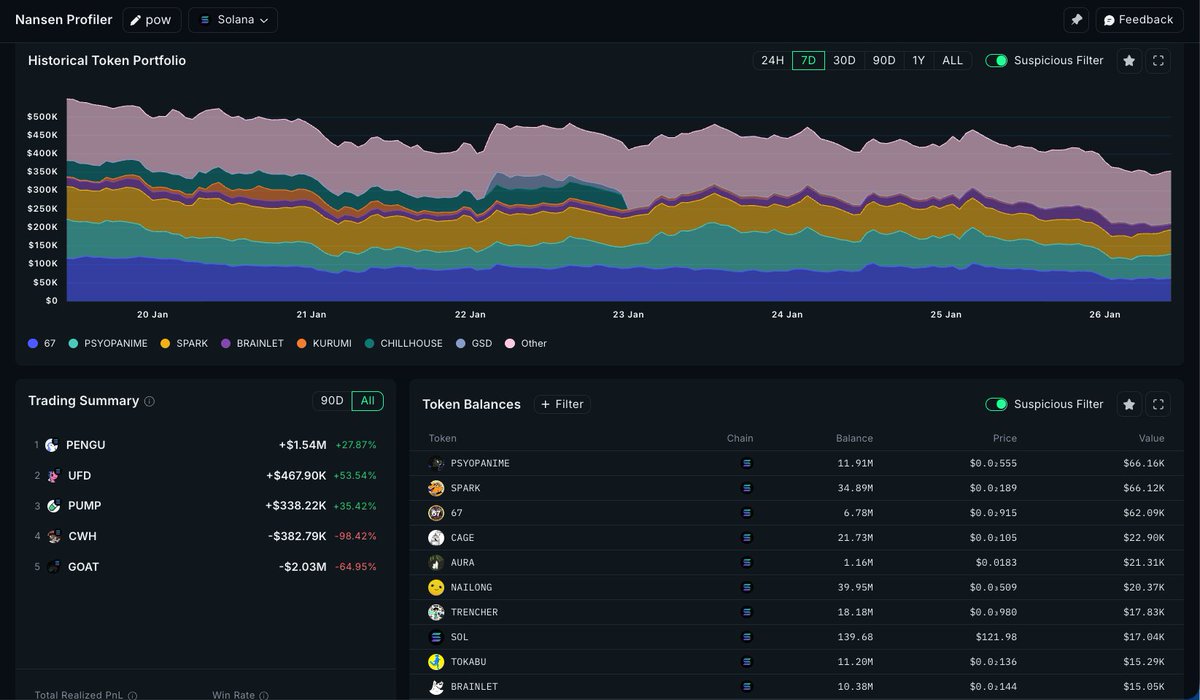

Just discovered a rarely mentioned perspective in @nansen_ai: Counterparty Reaction Lens (that's what I call it). It doesn't look at who is buying, but at “who reacts fastest, who is slow‑warm”, clustering labels by response latency, first‑move frequency, and follow‑up window.

Looked at a small‑cap $KITE:

- Fast‑reaction cohort (median latency ~6s) instantly exits the pool after oracle fluctuations.

- Slow‑warm cohort (average follow‑up 6‑12h) steadily takes orders during price pull‑back.

Conclusion: Within the same chain of actions, the tempo contrast can determine whether it’s a split‑second liquidity‑scraping cut or a later, slowly accumulated “clean” buying pressure.

Playbook I ran:

1) Open Reaction Lens → filter label = market‑maker / grant / algo

2) Set threshold: first‑move latency <10s and follow‑ratio >0.6 as high‑tempo cohort alert

3) For the target, place three orders: first a very shallow maker (0.25%), set exchange‑inflow auto‑abort; rebuild the main position 50%/50% after the slow‑warm cohort kicks in

4) Attach the tempo alert to a shared Playbook for the team to vote on scaling up

Live result: avoided a sudden pool‑clearing slippage, later captured an about 2.1% cleaner entry price in the slow‑warm entry window.

Who is using response time / execution tempo to rhythmically adjust positions? Any latency thresholds you can share? #onchain #trading #risk

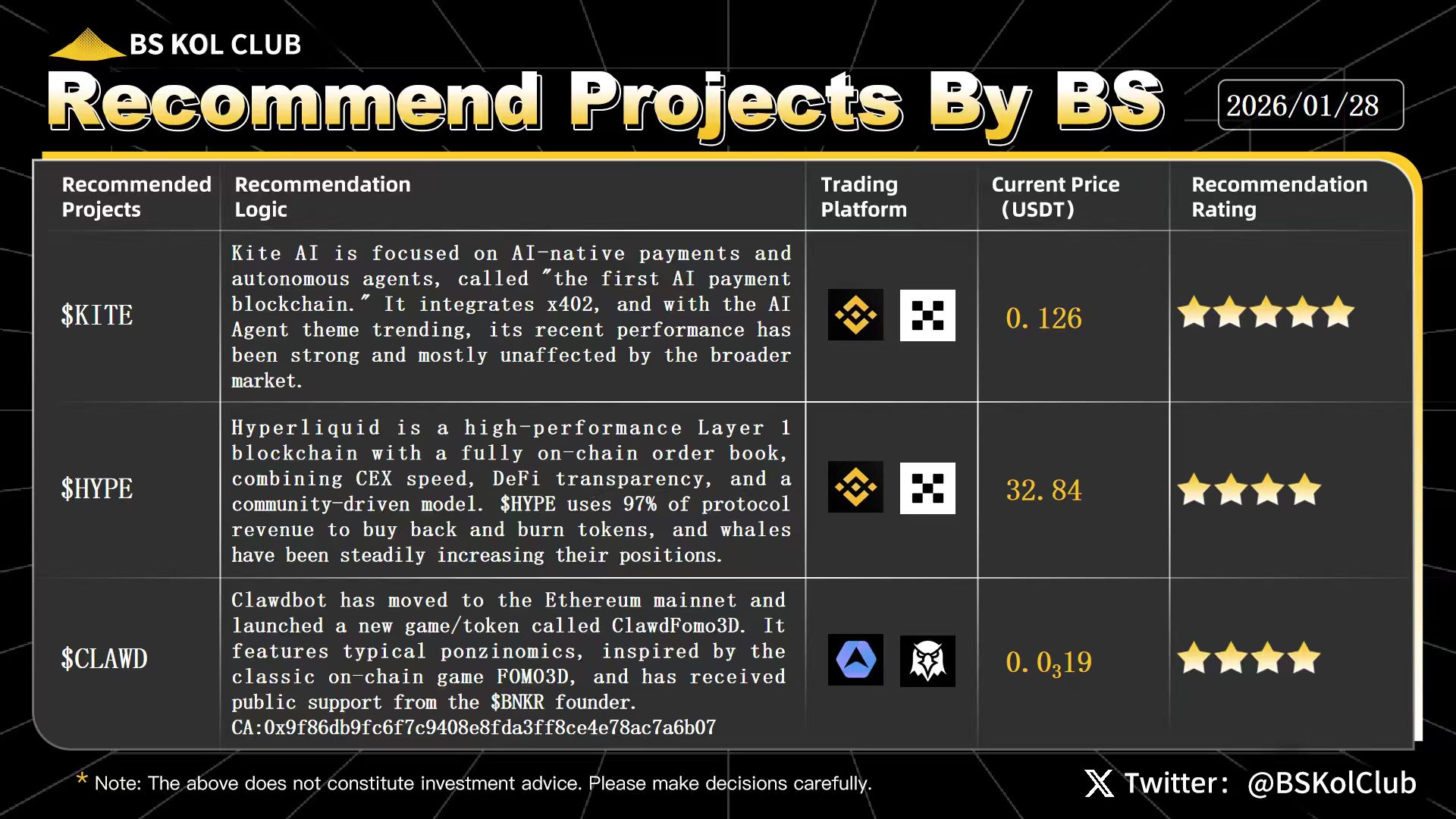

✨ BS KOL Club Weekly Recommended Projects|#Issue91

This week’s picks: $KITE, $HYPE, $CLAWD

Overnight and into this morning, the crypto market extended its rebound, with Bitcoin holding above USD 89,000 and Ethereum breaking past USD 3,000. U.S. equities were mixed: the Dow fell 0.83%, while the S&P 500 rose 0.41% and the Nasdaq gained 0.91%. Crypto-related stocks showed divergence—treasury-focused firms MSTR (+0.62%), BMNR (+5.5%), and ALTS (+10.05%) advanced, while sector companies COIN (-1.24%), GEMI (-4.88%), and CRCL (-1.33%) declined.

On-chain data shows Bitcoin’s network hashrate plunged from 1.16 ZH/s to 690 EH/s, marking the largest drop on record, before beginning to recover. Analysts attribute this to the U.S. winter storm “Fernand,” where extreme cold and widespread power outages forced multiple mining pools offline, causing a temporary hashrate decline.

On the macro front, Wall Street’s Rick Rieder is seen as a potential driver of more market-oriented Fed policy. He previously advocated a 50-basis-point rate cut last year and opposed forward guidance on future rates. Economists at Evercore ISI suggest he may support three rate cuts this year. While interest rate swaps currently price in fewer than two cuts, SOFR options indicate market bets on multiple cuts, potentially down to 1.5%.

This week coincides with the Federal Reserve’s FOMC meeting. Analysts caution that FOMC weeks are often accompanied by heightened Bitcoin volatility and short-term downside risk. Even if markets remain optimistic ahead of the meeting due to rate-cut expectations, post-announcement price reactions are often bearish, underscoring the need for prudent position sizing and risk management.

#cryptocurrency #AI #Kite #Hyperliquid #memes #L1

Previsão de preço

Quando é um bom momento para comprar KITE? Devo comprar ou vender KITE agora?

Previsão do Beacon

Previsão Probabilística de Preço (Próximas 24 horas)Explore Mais

BM Discovery

Nova Listagem