PactSwap transparent mature fee model and risk management, granting PACT token direct value.

The fee structure is where @Pact_Swap basically says “I’m serious, not by words but by design.”

In my head it looks like this:

in most places “cheap, fast, secure” is just a slogan, here they actually show, naked, where every slice goes. The formula is literally:

➜ this much goes to the protocol (0.1%)

➜ this much is the cost of keeping collateral alive

➜ this much is L1 gas

➜ and this much is LP profit

So there’s no CEX-style “fee is 0 but I drain your soul through spread” game. What the LP earns and what you pay are both on the table in math. That alone is a kind of honesty you almost never see in DeFi.

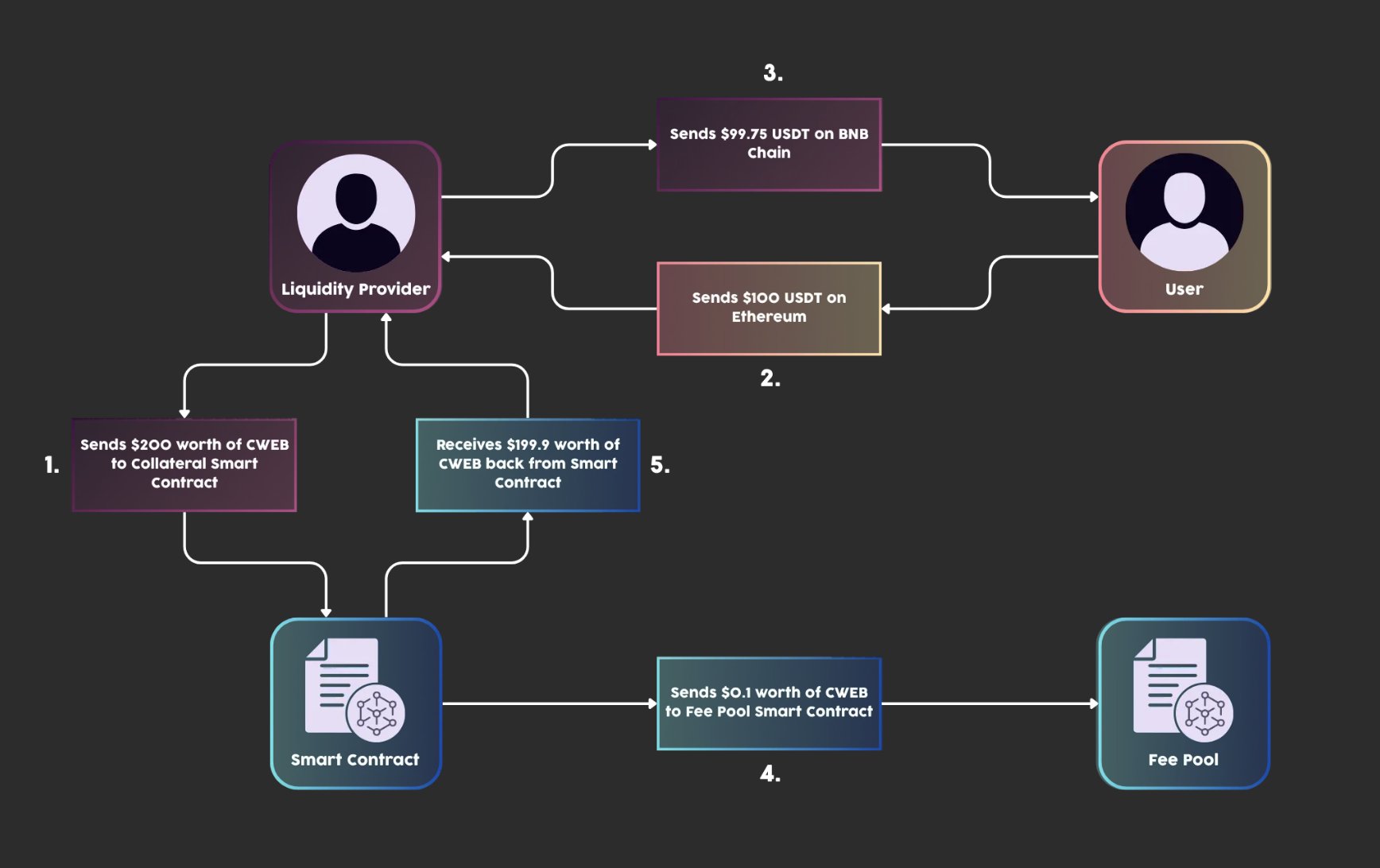

The 2x collateral and fee pool part, for me, completes the story.

Risk gets pulled away from the user and parked on the LP’s CWEB collateral: “if you run, you burn.” That’s a totally different risk split from bridge models; instead of leaving a giant vault in the middle, every market maker is responsible with their own pocket.

At the same time, every swap drips CWEB into the fee pool, and to tap that pool you have to burn PACT.

That turns PACT from “just a governance token” into direct leverage on protocol cash flow. If there’s volume, there’s value. If there’s no volume, there’s no story. I like that clarity.

Why do I see this as important? Because in this model all three sides are honestly placed: user, LP and token holder.

PactSwap’s fee model looks pretty “grown up” compared to others. It’s not selling hype, it’s showing the accounting and I think that’s exactly what makes the difference long term.