Bittensor $TAO

SN 59: Babelit

@babelbit

Recognizing the value of solid projects is well deserved.

Long live Babelit!

Bittensor Dados de preços ao vivo

Bittensor TAO Histórico de Preços USD

Adquira TAO agora

Compre e venda TAO de forma fácil e segura na BitMart.Ganhar

Coloque suas criptomoedas ociosas para trabalhar e ganhe renda passiva com poupança, staking e muito mais.Bittensor X Insight

Introducing our lead investor: @mogmachine

Mog is stepping up from shareholder to join Babelbit's board as a non-executive director - and help turn our vision into reality.

Much, much more to come. Thanks to all of our backers for making this possible. https://t.co/JeynKONHkB

Bittensor / $TAO

During the weekend, while scrolling through X, I came across a post about Bittensor’s growth and current price action. Someone left this comment, and it made me pause:

"Write an article about what’s killing (stopping) Bittensor, make it research‑grade, and make better counterarguments for your side. This isn’t helping anyone either."

I wanted to respond, share my perspective, and add my take on Bittensor and the ecosystem’s growth.

Picture this, in late 2021.

Most people believed AI would always belong to a handful of trillion‑dollar companies. Closed models. Closed data. Closed doors. Then Bittensor showed up. No VC war chest. No flashy pre‑mine. Just a radical idea: turn machine intelligence into a permissionless, tradable commodity.

Miners produce useful AI work. Validators score it honestly. TAO flows to whoever actually delivers value.

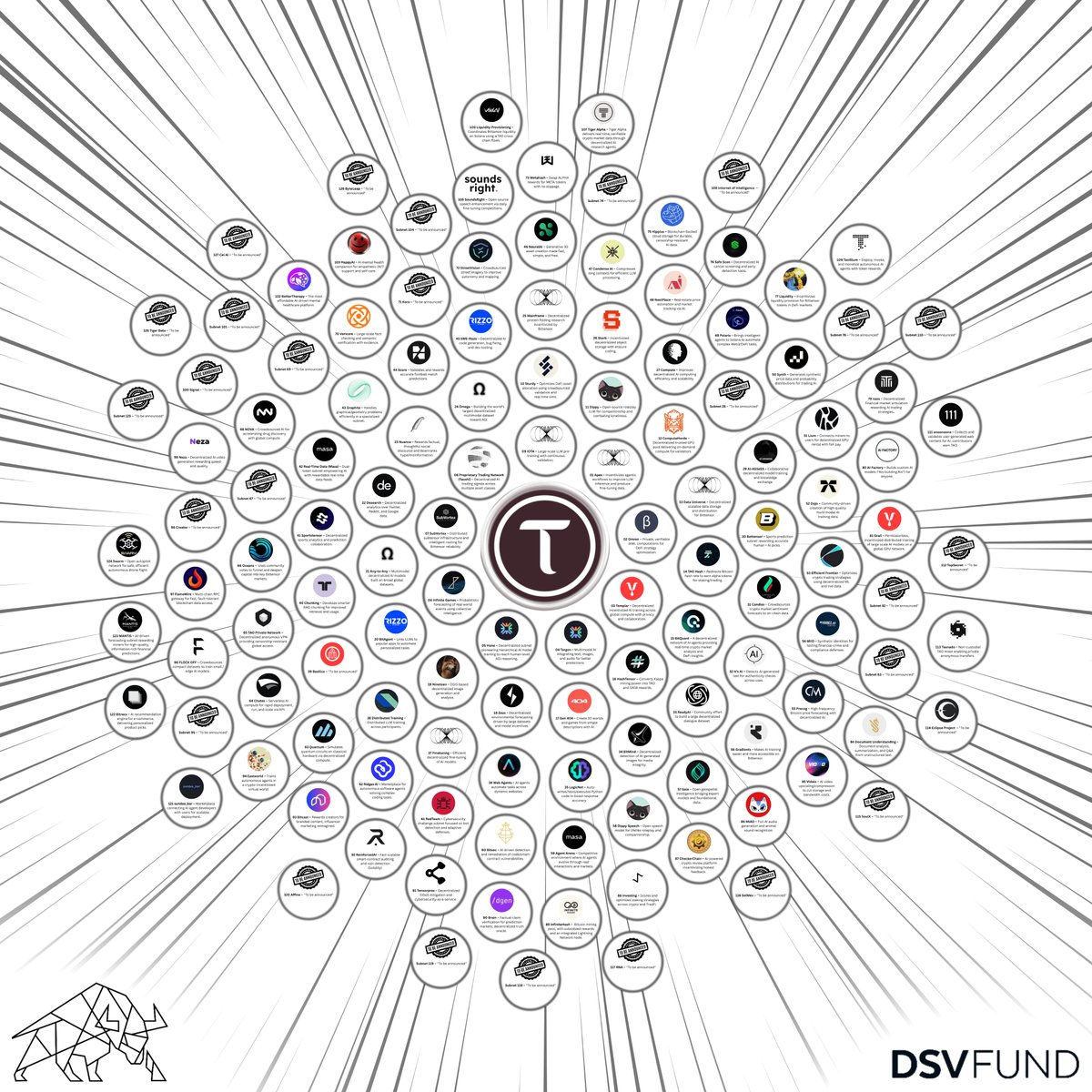

Subnets emerged like small, specialized villages:

• one pushing video upscaling to absurd levels

• another training weather models that rival major forecasts

• others experimenting with agents, inference, tooling, even drug discovery

It felt like the early internet again. Messy, open, experimental.

And in many ways, it still does.

Fast-forward to today. February 2026.

TAO is hovering around the $190–200 range after a rough stretch. Price action hasn’t been kind. The halving tightened supply, but the spot market hasn’t fully absorbed what that means yet. The broader AI‑crypto narrative feels quieter after last year’s hype wave.

There are real challenges:

• Liquidity can be thin in some subnets

• Onboarding is still tough if you’re not technical

• Every validator move or subnet stumble sparks “it’s dying” or “centralization risk” takes

But zoom out.

Grayscale’s Bittensor trust (GTAO) exists, and institutions clearly want regulated exposure to TAO. Many can’t or won’t buy spot directly yet, so the trust becomes their on‑ramp. That demand shows up in steady trading activity and occasional premiums. It’s not loud hype, but quiet, persistent interest building behind the scenes.

At the same time, subnets are shipping real products:

• serverless inference

• low‑latency models

• agent frameworks

Builders are choosing Bittensor over easier centralized paths because the incentives actually align. You get paid for usefulness, not hype.

The growing pains are real, but they’re the kind that make systems stronger.

Complexity filters out tourists.

Volatility tests conviction.

Security scares forced better audits and safeguards.

Slower mainstream adoption is buying time to fix UX and harden the foundation.

This isn’t a network that peaked and faded. It’s one figuring out how to scale decentralized intelligence without turning into another walled garden.

Every halving tightens the system.

Every subnet that finds product‑market fit pulls the whole network forward.

Every cycle sharpens the signal.

Bittensor isn’t getting killed.

It’s growing up, publicly and painfully, which is usually how the systems that last are forged.

Still early.

Still building.

Still worth watching.

Just so you know — Bittensor ( $TAO) is home.

I’d love to hear what others think about the comment that inspired this post. Do you see it differently?

@const_reborn @markjeffrey @MarkCreaser @CryptoZPunisher @LouiseBeattie @SubnetSummerT @bittingthembits @SiamKidd @BarrySilbert @KeithSingery @mogmachine and others...

For Bittensor to become the global back-end for AI, it cannot exist in a vacuum. Capital is like water...

...it flows along the path of least resistance.

Bridges and onramps are the economic plumbing that turns an "isolated island of intelligence" into a globally integrated financial utility, allowing liquidity to flood in from the likes of @ethereum, @solana, and @base.

Shout out to a few projects within the ecosystem that are paving the way for more liquidity to flow into $TAO:

1. @AstridIntel (SN127 / formerly @_taofi_):

Now under the Astrid Intelligence umbrella, this is the institutional-grade rail for $USDC. It simplifies the transition from fiat and stablecoins into the TAO ecosystem, providing the settlement layer necessary for enterprise adoption.

2. @v0idai (SN106):

The vital link to high-velocity capital in the Solana ecosystem. By incentivizing deep $wTAO liquidity on DEXs like @Raydium, Void ensures the most active retail capital in crypto can enter Bittensor without friction.

3. @Rubicon_Bridge:

Leveraging Chainlink CCIP and @AerodromeFi, Rubicon brings Bittensor "Alpha" to Base. By creating liquid-staked tokens for specific subnets, it allows TAO’s utility to be used as collateral and traded within the broader DeFi landscape.

These aren't just tools; they're the gates.

By removing the "technical tax" of entry, these protocols ensure that the intelligence explosion is fuelled by the world's capital, not just its developers.

Previsão de preço

Quando é um bom momento para comprar TAO? Devo comprar ou vender TAO agora?

Previsão do Beacon

Previsão Probabilística de Preço (Próximas 24 horas)Explore Mais

BM Discovery

Nova Listagem