Having been in the Crypto community for a long time, my trust in emerging stablecoins has basically worn away. After experiencing stablecoin peg loss and protocol runs, people's perspective on assets has changed: compared to inflated APY, the underlying risk structure's resilience to scrutiny is the core consideration.

Recently I dissected BitFi's bfUSD, its pathway design is interesting and does not follow the complex old routes.

Tier 1: The "simple" underlying logic

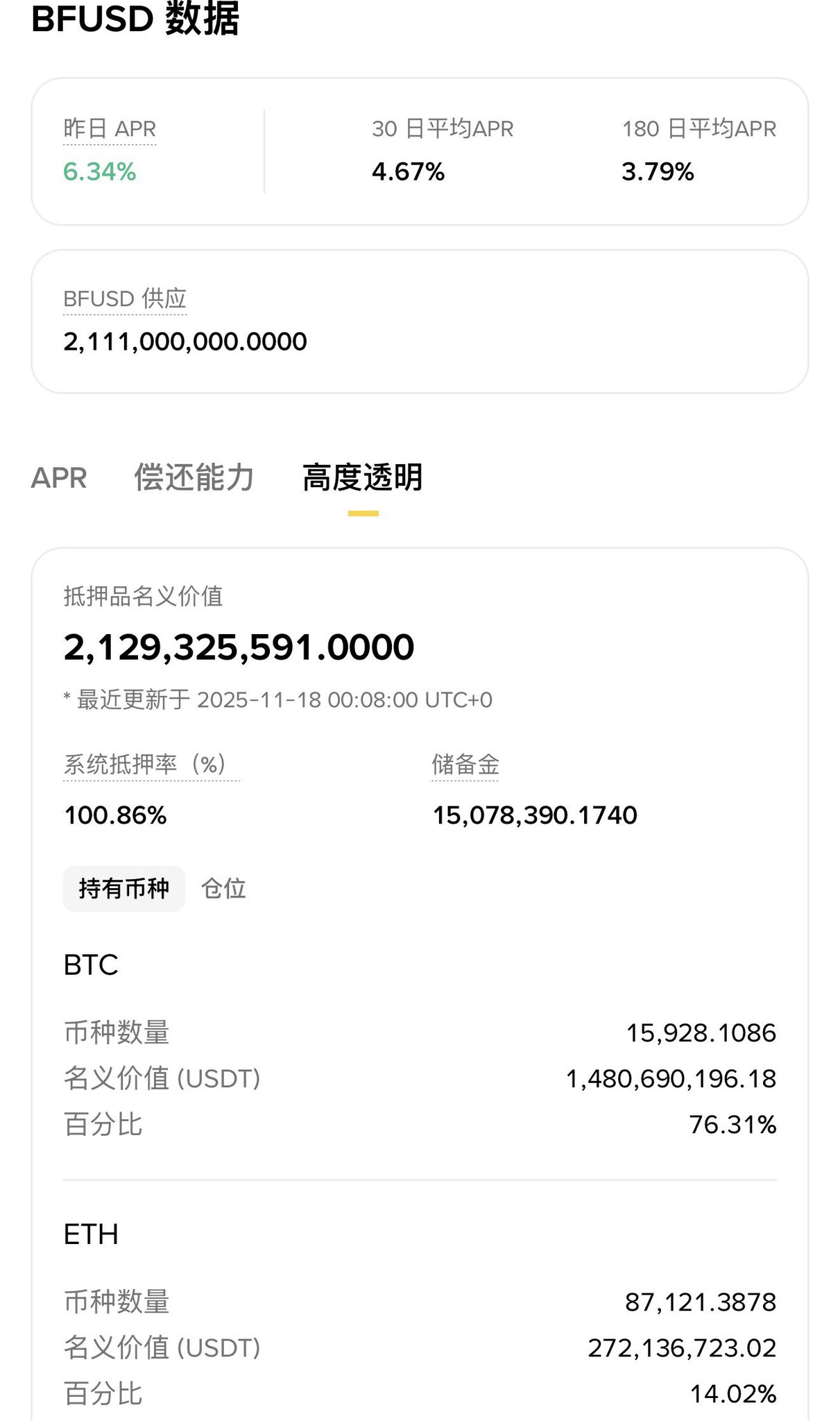

bfUSD does not innovate on the anchoring mechanism. Users mint 1:1 with USDT or USDC, fully collateralized, price tied to Chainlink feed. No complex algorithms or internal pricing are introduced, keeping risk within USDT/USDC itself, daring to "do less" as the most direct answer to safety.

Tier 2: Segmentation and risk pricing

The real change happens after minting. BitFi splits bfUSD into two paths, completely separating funds with different preferences, avoiding a “one‑size‑fits‑all” risk exposure:

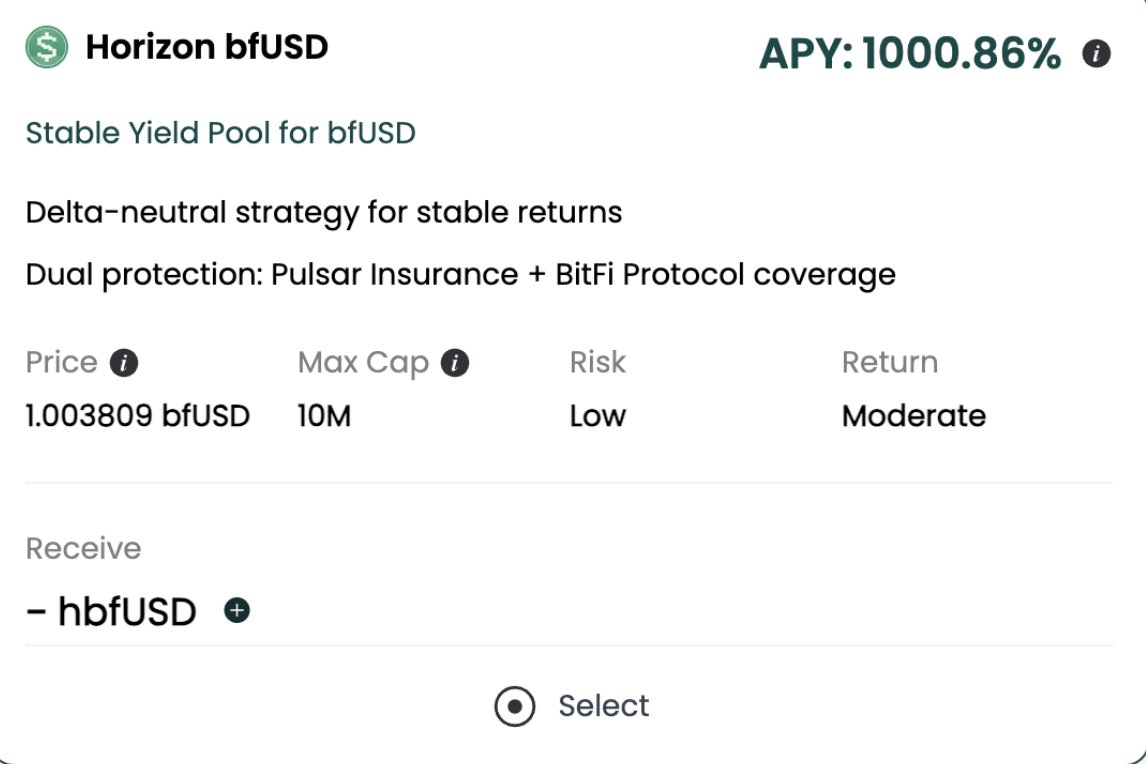

🌟 Horizon (hbfUSD): seeks smooth asset curve. Yield consists of real strategies plus BFI subsidies. The protocol allocates part of the earnings to "buy protection", aiming for zero drawdown. After seeing the website's stacked activity‑point yield, the APY looks attractive, but mainly because the program just launched and TVL is still small; the point benefit will be gradually diluted, so the earlier you join the higher the point weight and the larger the return.

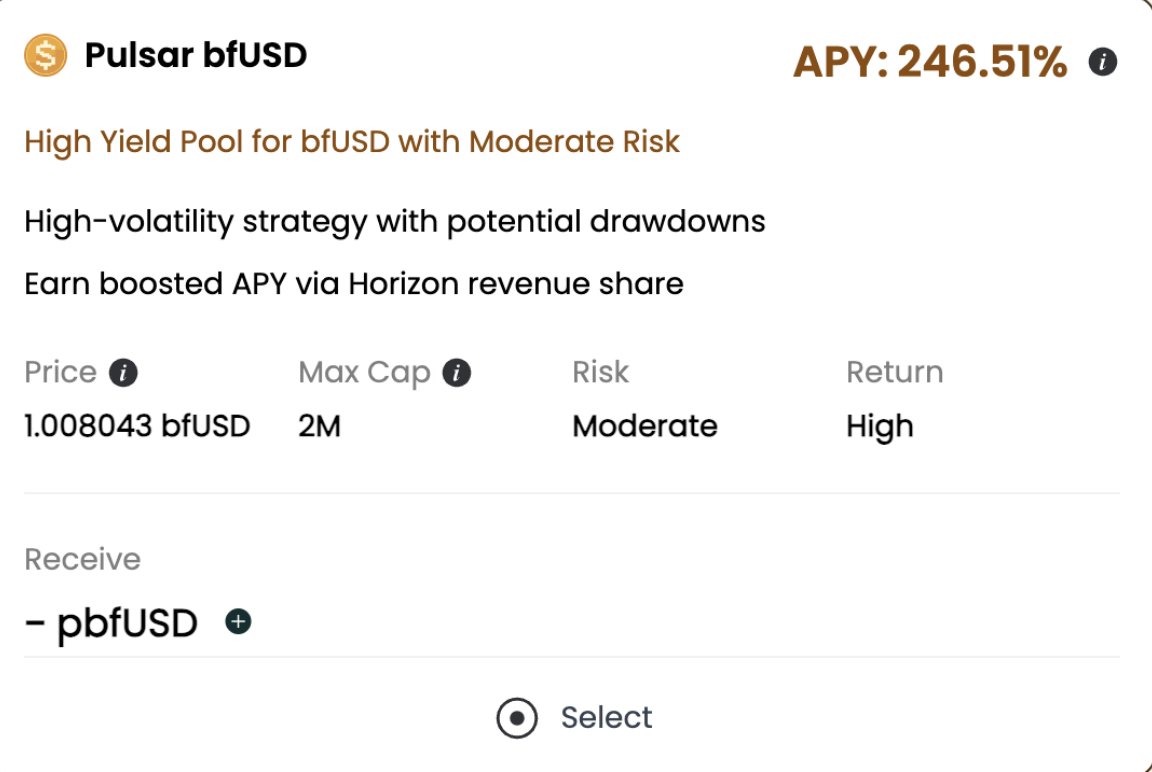

🌟 Pulsar (pbfUSD): acts as the system's "shock absorber". This cohort voluntarily takes short‑term volatility in exchange for higher profit sharing and protocol premium.

In short, those willing to bear volatility get more, while those seeking stability are prioritized for protection.

Tier 3: On‑chain transparency and security

For stablecoins, security and risk resistance are paramount. A review shows BitFi not only passed SlowMist's risk audit, but also puts reserve status and asset flows on‑chain for real‑time queries. This clear, visible safety boundary is a scarce certainty in the uncertain DeFi world.

Moreover, we are currently in the bfUSD points activity phase, the highest‑weight early‑points stage since bfUSD launched. The earlier and longer you participate, the higher the initial weight in future points airdrop rewards. Simply holding or interacting with bfUSD accumulates points. Additionally, the annual yield can be stacked with separate BFI Token reward subsidies, providing actual returns for early users. Participation link: 👇🔗https://t.co/bqd0xVikBU