Curve DAO Token (CRV)

Curve DAO Token (CRV)

$0.385 -1.53% 24H

- 51Índice de Sentimento Social (SSI)-20.52% (24h)

- #116Classificação do Pulso de Mercado (MPR)-94

- 7Menção Social 24H-22.22% (24h)

- 29%Índice Bullish dos KOLs (24h)7 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais51SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosBullish (29%)Neutro (43%)Bearish (28%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

- Tendência de CRV após o lançamentoNeutro

𝕯𝖆𝖓𝖌𝖊𝖗 Media DeFi_Expert D51.74K @safetyth1rd

𝕯𝖆𝖓𝖌𝖊𝖗 Media DeFi_Expert D51.74K @safetyth1rd Today in DeFi D17.25K @todayindefi4 0 545 Original >Tendência de CRV após o lançamentoNeutro

Today in DeFi D17.25K @todayindefi4 0 545 Original >Tendência de CRV após o lançamentoNeutro- Tendência de CRV após o lançamentoBearish

Trade Pro TA_Analyst Trader A2.01K @TradePro16

Trade Pro TA_Analyst Trader A2.01K @TradePro16

Trade Pro TA_Analyst Trader A2.01K @TradePro16

Trade Pro TA_Analyst Trader A2.01K @TradePro16 11 0 507 Original >Tendência de CRV após o lançamentoBullish

11 0 507 Original >Tendência de CRV após o lançamentoBullish- Tendência de CRV após o lançamentoNeutro

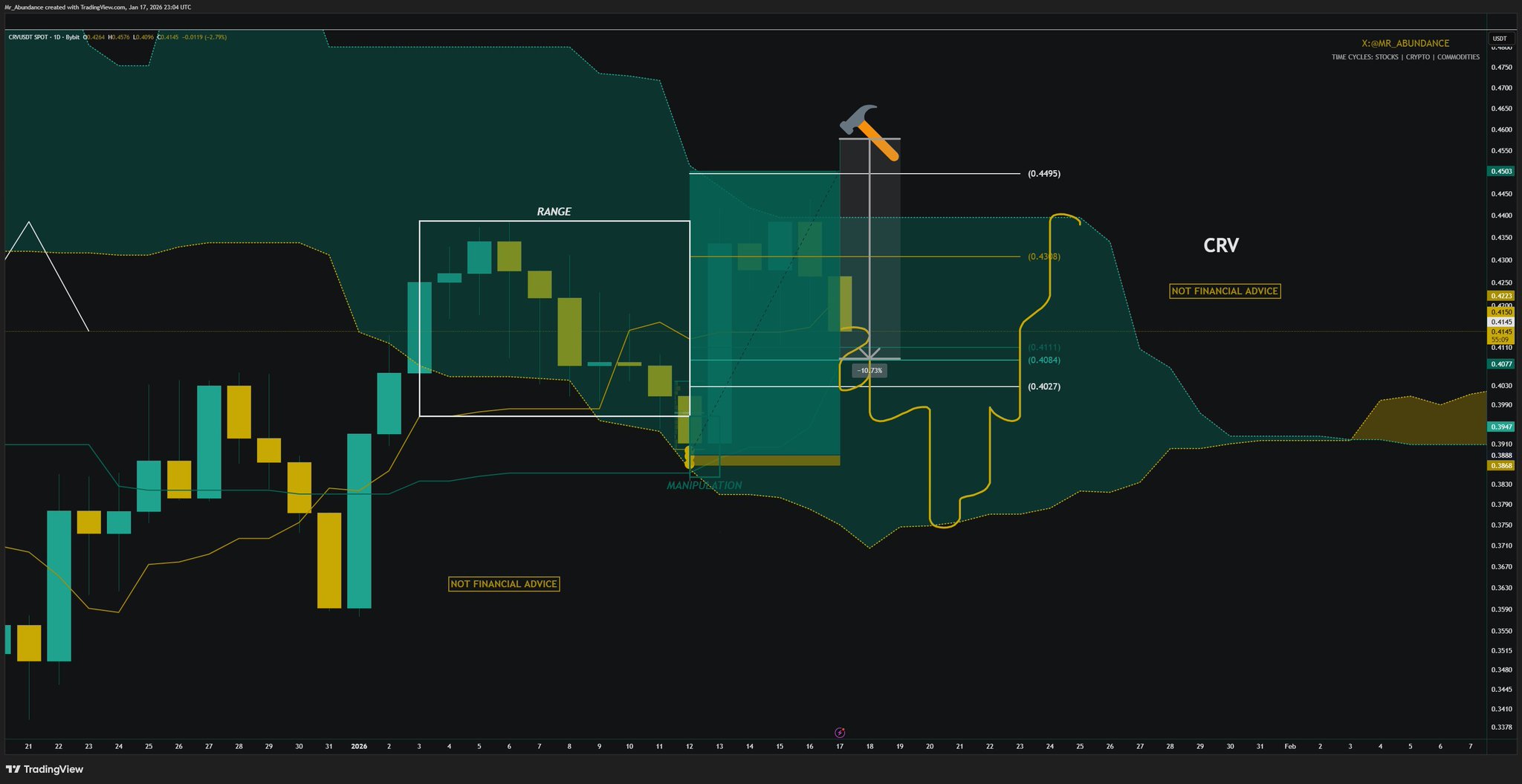

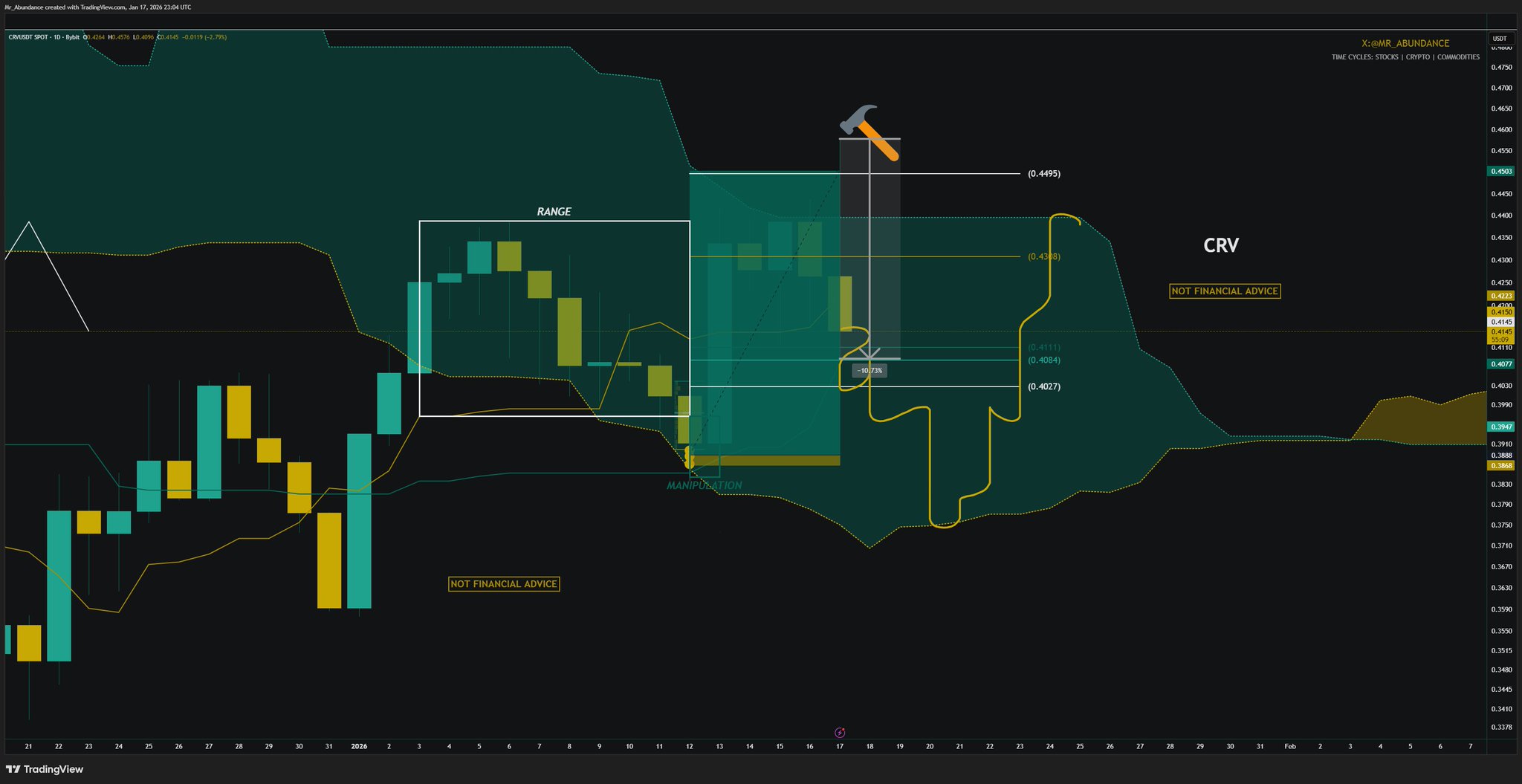

Mr.Abundance | Crypto & Commodities Cycles TA_Analyst Trader S5.36K @mr_abundance_

Mr.Abundance | Crypto & Commodities Cycles TA_Analyst Trader S5.36K @mr_abundance_

Mr.Abundance | Crypto & Commodities Cycles TA_Analyst Trader S5.36K @mr_abundance_

Mr.Abundance | Crypto & Commodities Cycles TA_Analyst Trader S5.36K @mr_abundance_ 87 7 9.86K Original >Tendência de CRV após o lançamentoBullish

87 7 9.86K Original >Tendência de CRV após o lançamentoBullish- Tendência de CRV após o lançamentoBullish

- Tendência de CRV após o lançamentoBearish

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG 🇨🇭 CaptainDaniel 🇹🇼 D1.89K @DLuthi32TW1 1 126 Original >Tendência de CRV após o lançamentoNeutro

🇨🇭 CaptainDaniel 🇹🇼 D1.89K @DLuthi32TW1 1 126 Original >Tendência de CRV após o lançamentoNeutro FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG13 2 400 Original >Tendência de CRV após o lançamentoBullish

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG13 2 400 Original >Tendência de CRV após o lançamentoBullish