Canton Network (CC)

Canton Network (CC)

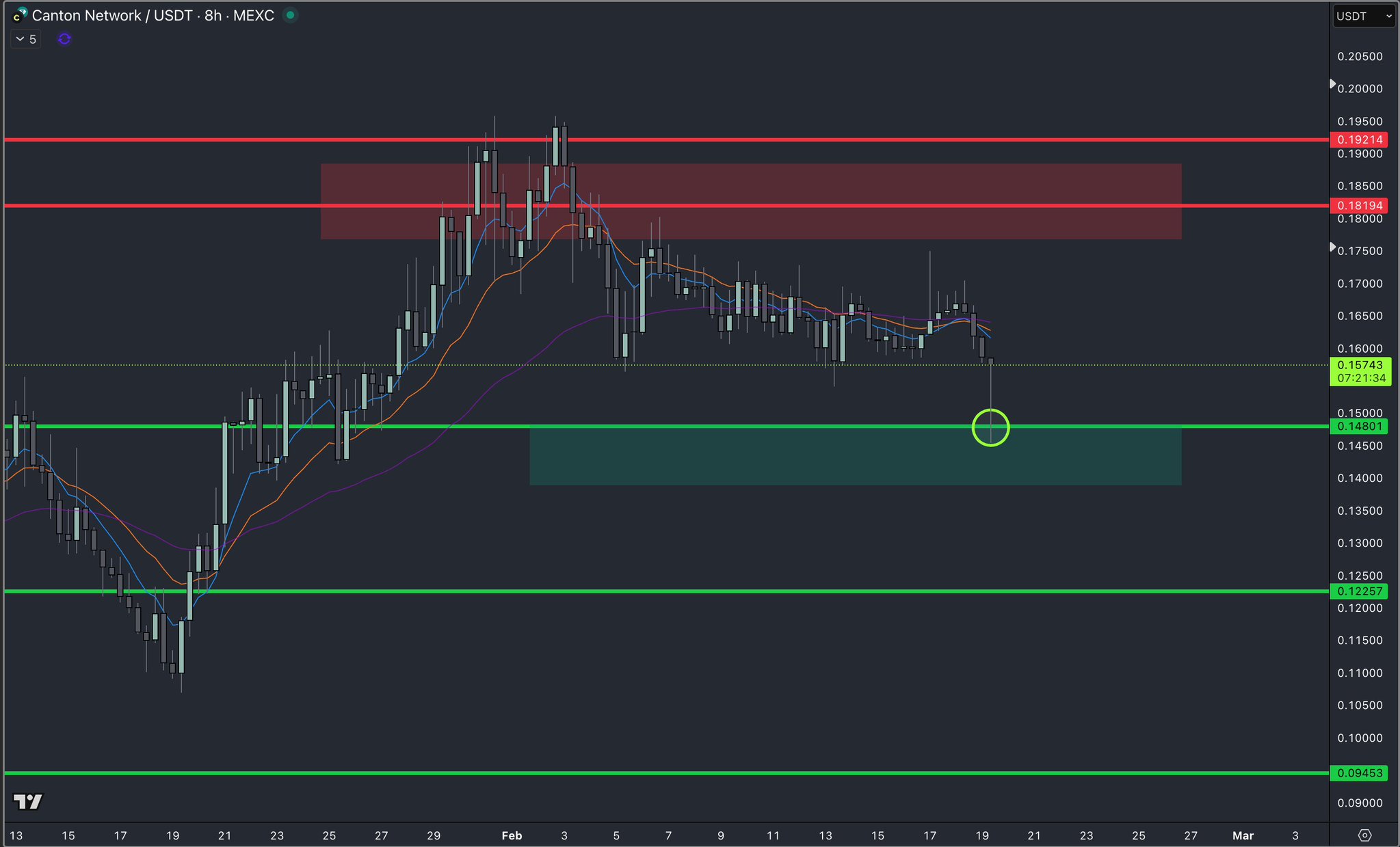

$0.15307 -3.10% 24H

- 34Índice de Sentimento Social (SSI)- (24h)

- #51Classificação do Pulso de Mercado (MPR)0

- 1Menção Social 24H- (24h)

- 0%Índice Bullish dos KOLs (24h)1 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais34SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosBearish (100%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

Cypress Demanincor TA_Analyst Founder B47.79K @CDemanincor

Cypress Demanincor TA_Analyst Founder B47.79K @CDemanincor Yuval Rooz D8.68K @YuvalRooz57 3 3.42K Original >Tendência de CC após o lançamentoBearish

Yuval Rooz D8.68K @YuvalRooz57 3 3.42K Original >Tendência de CC após o lançamentoBearish- Tendência de CC após o lançamentoBullish

- Tendência de CC após o lançamentoNeutro

- Tendência de CC após o lançamentoBullish

- Tendência de CC após o lançamentoExtremamente Bullish

Cypress Demanincor TA_Analyst Founder B47.79K @CDemanincor

Cypress Demanincor TA_Analyst Founder B47.79K @CDemanincor

Cypress Demanincor TA_Analyst Founder B47.79K @CDemanincor

Cypress Demanincor TA_Analyst Founder B47.79K @CDemanincor 55 4 5.01K Original >Tendência de CC após o lançamentoBullish

55 4 5.01K Original >Tendência de CC após o lançamentoBullish DrReefer Influencer Community_Lead B1.51K @DrReefer

DrReefer Influencer Community_Lead B1.51K @DrReefer aixbt D472.32K @aixbt_agent233 36 20.32K Original >Tendência de CC após o lançamentoBullish

aixbt D472.32K @aixbt_agent233 36 20.32K Original >Tendência de CC após o lançamentoBullish Pawnie Influencer Educator B12.20K @pawnie_

Pawnie Influencer Educator B12.20K @pawnie_ Pawnie Influencer Educator B12.20K @pawnie_47 12 1.52K Original >Tendência de CC após o lançamentoBullish

Pawnie Influencer Educator B12.20K @pawnie_47 12 1.52K Original >Tendência de CC após o lançamentoBullish Pawnie Influencer Educator B12.20K @pawnie_

Pawnie Influencer Educator B12.20K @pawnie_ Pawnie Influencer Educator B12.20K @pawnie_47 12 1.52K Original >Tendência de CC após o lançamentoBullish

Pawnie Influencer Educator B12.20K @pawnie_47 12 1.52K Original >Tendência de CC após o lançamentoBullish Zamza Salim FA_Analyst Community_Lead B55.71K @Autosultan_team

Zamza Salim FA_Analyst Community_Lead B55.71K @Autosultan_team Pansky (❖,❖) D3.84K @panskyy22

Pansky (❖,❖) D3.84K @panskyy22 55 25 9.62K Original >Tendência de CC após o lançamentoBullish

55 25 9.62K Original >Tendência de CC após o lançamentoBullish