Bitcoin (BTC)

Bitcoin (BTC)

-3.88% 24H

- 67Índice de Sentimento Social (SSI)-7.03% (24h)

- #66Classificação do Pulso de Mercado (MPR)-54

- 1,788Menção Social 24H-10.38% (24h)

- 56%Índice Bullish dos KOLs (24h)610 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais67SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosExtremamente Bullish (19%)Bullish (37%)Neutro (14%)Bearish (25%)Extremamente Bearish (5%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

Walker⚡️ Media Influencer B81.64K @WalkerAmerica

Walker⚡️ Media Influencer B81.64K @WalkerAmerica THE Bitcoin Podcast D15.33K @titcoinpodcast1 0 117 Original >Tendência de BTC após o lançamentoBullish

THE Bitcoin Podcast D15.33K @titcoinpodcast1 0 117 Original >Tendência de BTC após o lançamentoBullish- Tendência de BTC após o lançamentoExtremamente Bearish

A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onX

A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onX A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onX

A•R•A ꐠ DeFi_Expert Influencer B4.05K @ARA_onX 0 0 6 Original >Tendência de BTC após o lançamentoExtremamente Bullish

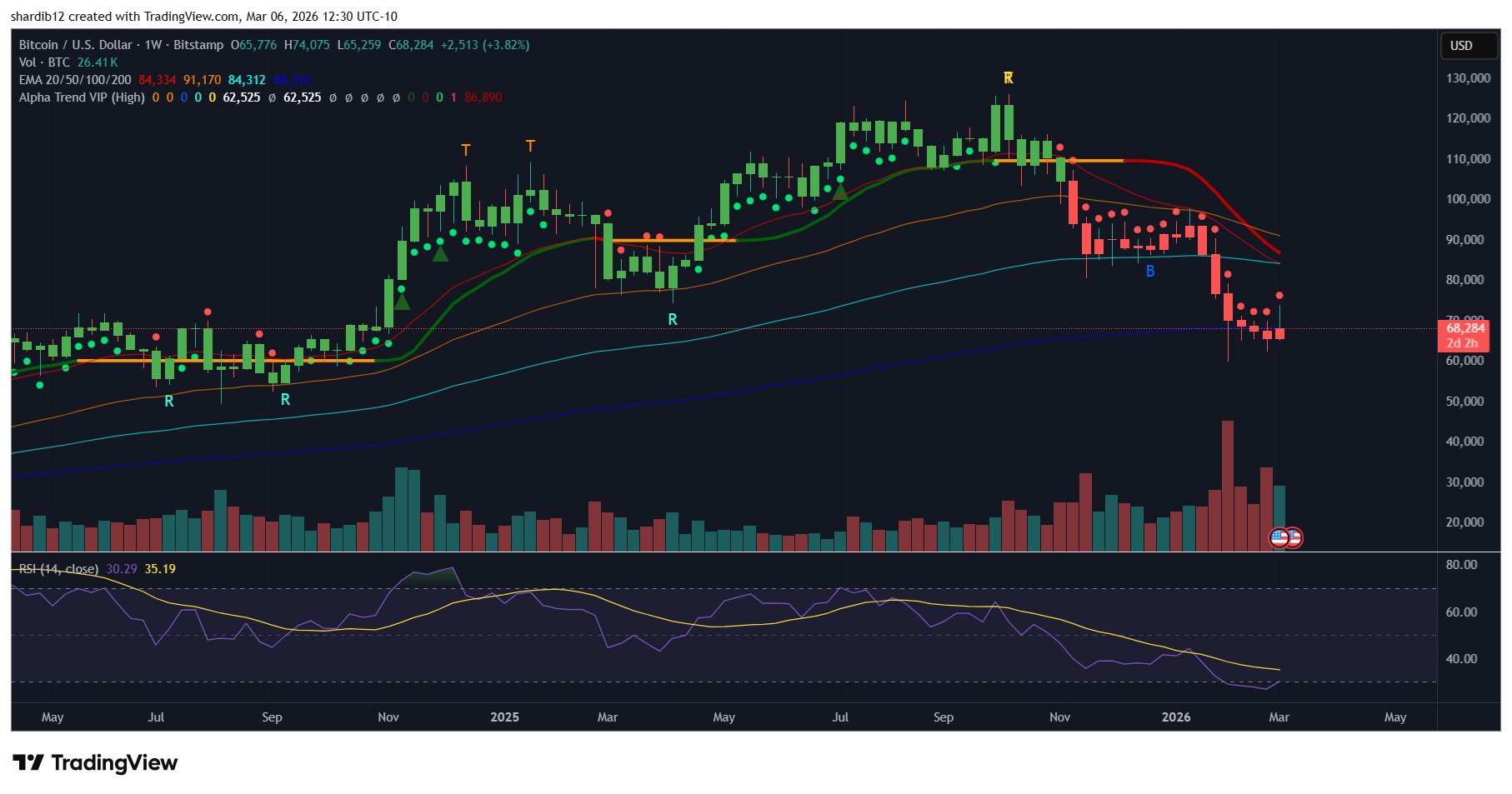

0 0 6 Original >Tendência de BTC após o lançamentoExtremamente Bullish Team Shardi Trading and Research TA_Analyst Trader C252.21K @ShardiB2

Team Shardi Trading and Research TA_Analyst Trader C252.21K @ShardiB2

Team Shardi Trading and Research TA_Analyst Trader C252.21K @ShardiB2

Team Shardi Trading and Research TA_Analyst Trader C252.21K @ShardiB2 33 3 1.69K Original >Tendência de BTC após o lançamentoNeutro

33 3 1.69K Original >Tendência de BTC após o lançamentoNeutro CBduck 🛡️ Influencer Media B14.66K @CoinbaseDuck

CBduck 🛡️ Influencer Media B14.66K @CoinbaseDuck Coinbase Institutional 🛡️ D132.79K @CoinbaseInsto

Coinbase Institutional 🛡️ D132.79K @CoinbaseInsto 7 2 729 Original >Tendência de BTC após o lançamentoBullish

7 2 729 Original >Tendência de BTC após o lançamentoBullish Michael Tanguma Founder Regulatory_Expert B3.63K @MTanguma

Michael Tanguma Founder Regulatory_Expert B3.63K @MTanguma Michael Tanguma Founder Regulatory_Expert B3.63K @MTanguma

Michael Tanguma Founder Regulatory_Expert B3.63K @MTanguma 3 1 224 Original >Tendência de BTC após o lançamentoBullish

3 1 224 Original >Tendência de BTC após o lançamentoBullish- Tendência de BTC após o lançamentoBearish

Michael Tanguma Founder Regulatory_Expert B3.63K @MTanguma

Michael Tanguma Founder Regulatory_Expert B3.63K @MTanguma Michael Tanguma Founder Regulatory_Expert B3.63K @MTanguma15 2 583 Original >Tendência de BTC após o lançamentoBullish

Michael Tanguma Founder Regulatory_Expert B3.63K @MTanguma15 2 583 Original >Tendência de BTC após o lançamentoBullish- Tendência de BTC após o lançamentoNeutro

- Tendência de BTC após o lançamentoBearish