Aave (AAVE)

Aave (AAVE)

$110.93 -5.17% 24H

- 55Índice de Sentimento Social (SSI)-31.80% (24h)

- #125Classificação do Pulso de Mercado (MPR)-60

- 18Menção Social 24H-53.85% (24h)

- 61%Índice Bullish dos KOLs (24h)14 KOLs Ativos

- Resumo

- Sinais Bullish

- Sinais Bearish

Índice de Sentimento Social (SSI)

- Dados Gerais55SSI

- Tendência SSI (7D)Preço (7D)Distribuição de SentimentosExtremamente Bullish (33%)Bullish (28%)Neutro (6%)Bearish (28%)Extremamente Bearish (5%)Insights de SSI

Classificação do Pulso de Mercado (MPR)

- Insight dos Alertas

Posts no X

Rish 🤝 | StationX VC OnChain_Analyst Valid B2.37K @0xrishavb

Rish 🤝 | StationX VC OnChain_Analyst Valid B2.37K @0xrishavb 100x Research D84 @The100xresearch

100x Research D84 @The100xresearch

1 1 19 Original >Tendência de AAVE após o lançamentoNeutro

1 1 19 Original >Tendência de AAVE após o lançamentoNeutro Peter / ‘pet3rpan’ VC OnChain_Analyst B42.29K @pet3rpan_

Peter / ‘pet3rpan’ VC OnChain_Analyst B42.29K @pet3rpan_ jakub rusiecki D4.22K @jakub_rusiecki

jakub rusiecki D4.22K @jakub_rusiecki 18 4 1.29K Original >Tendência de AAVE após o lançamentoBullish

18 4 1.29K Original >Tendência de AAVE após o lançamentoBullish Laura Shin Media Influencer C281.41K @laurashin

Laura Shin Media Influencer C281.41K @laurashin Laura Shin Media Influencer C281.41K @laurashin28 14 4.05K Original >Tendência de AAVE após o lançamentoBearish

Laura Shin Media Influencer C281.41K @laurashin28 14 4.05K Original >Tendência de AAVE após o lançamentoBearish Uddalak OnChain_Analyst Community_Lead A3.22K @ninja_writer21

Uddalak OnChain_Analyst Community_Lead A3.22K @ninja_writer21 Kevin Schellinger D14.22K @k_schellinger

Kevin Schellinger D14.22K @k_schellinger 12 2 1.06K Original >Tendência de AAVE após o lançamentoExtremamente Bearish

12 2 1.06K Original >Tendência de AAVE após o lançamentoExtremamente Bearish Laura Shin Media Influencer C281.41K @laurashin

Laura Shin Media Influencer C281.41K @laurashin Ignas | DeFi DeFi_Expert Tokenomics_Expert B158.50K @DefiIgnas

Ignas | DeFi DeFi_Expert Tokenomics_Expert B158.50K @DefiIgnas 269 61 34.10K Original >Tendência de AAVE após o lançamentoBearish

269 61 34.10K Original >Tendência de AAVE após o lançamentoBearish- Tendência de AAVE após o lançamentoBullish

- Tendência de AAVE após o lançamentoBullish

- Tendência de AAVE após o lançamentoExtremamente Bullish

Paul Frambot 🦋 Founder DeFi_Expert S15.30K @PaulFrambot

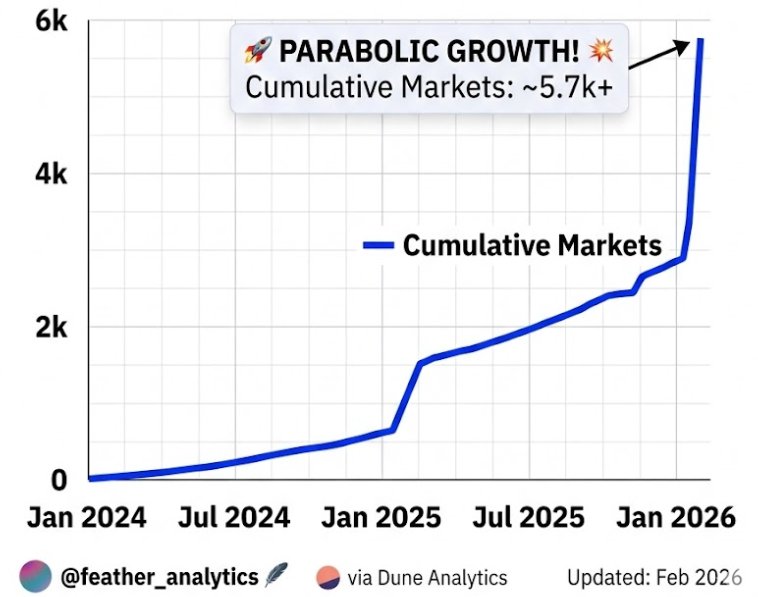

Paul Frambot 🦋 Founder DeFi_Expert S15.30K @PaulFrambot Feather.zone D1.00K @Featherlend

Feather.zone D1.00K @Featherlend 86 8 6.35K Original >Tendência de AAVE após o lançamentoExtremamente Bullish

86 8 6.35K Original >Tendência de AAVE após o lançamentoExtremamente Bullish- Tendência de AAVE após o lançamentoExtremamente Bullish