A new shared margin layer is live on $SUI.

@DeepBookonSui made Margin a shared layer for the whole ecosystem.

Here’s a simple guide to use Margin and earn yield with DeepBook-enabled apps. https://t.co/iIctCgZerd

A new shared margin layer is live on $SUI.

@DeepBookonSui made Margin a shared layer for the whole ecosystem.

Here’s a simple guide to use Margin and earn yield with DeepBook-enabled apps. https://t.co/iIctCgZerd

What DeepBook Margin is:

You trade with leverage on Sui, but liquidity comes from DeepBook's shared liquidity layer.

So you get:

• onchain borrowing + leverage

• visible execution onchain

• self-custody throughout https://t.co/7vnxvBnVl5

Why this matters for Sui DeFi:

• More margin activity usually drives more trades

• More trades usually deepen liquidity

• Deeper liquidity usually improves execution for everyone https://t.co/Q8DawcrfRq

Where Margin is live today via DeepBook partners:

@_deeptrade

@CetusProtocol

@abyssdotxyz

@PebbleProtocol

@Turbos_finance

@Scallop_io

@Lotusfinance_io

More integrations are coming. https://t.co/PewKau3gjn

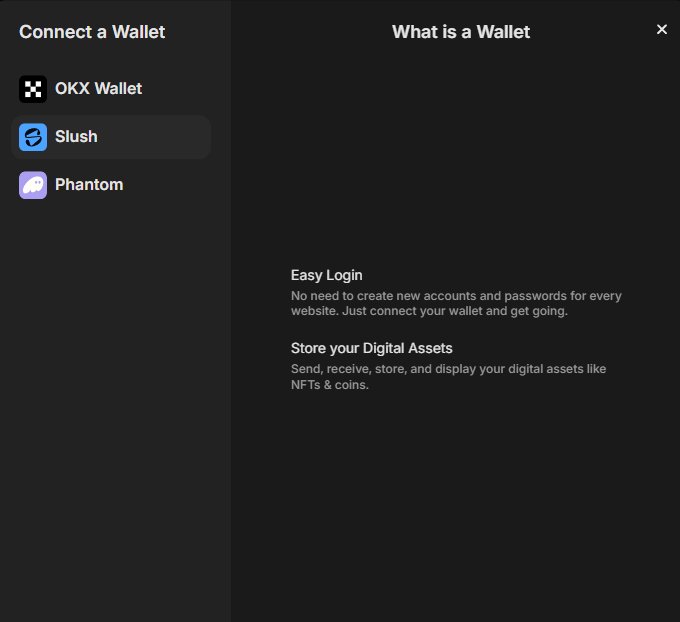

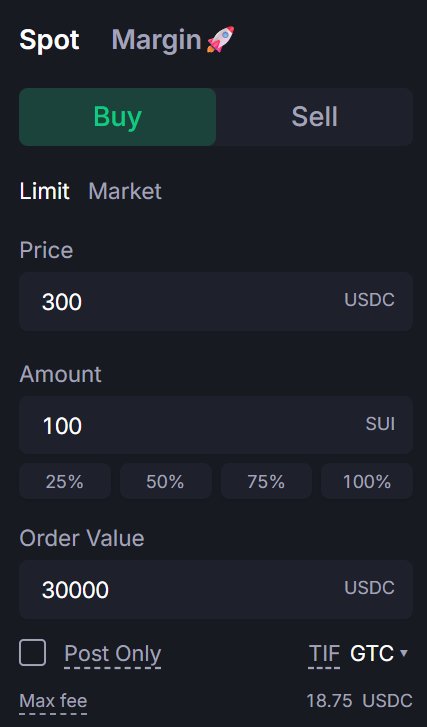

How to use Margin:

1) Go to https://t.co/secDphiNC4

2) Pick an app

3) Connect your Sui wallet (you can use Slush)

4) Deposit collateral

5) Choose a market + leverage

6) Open a position https://t.co/4wlvbMwAFt

What to monitor after opening

• liquidation price

• borrow / funding costs (depends on the app)

• position size vs collateral

Close any time inside the app UI. https://t.co/wGUJ681X0W

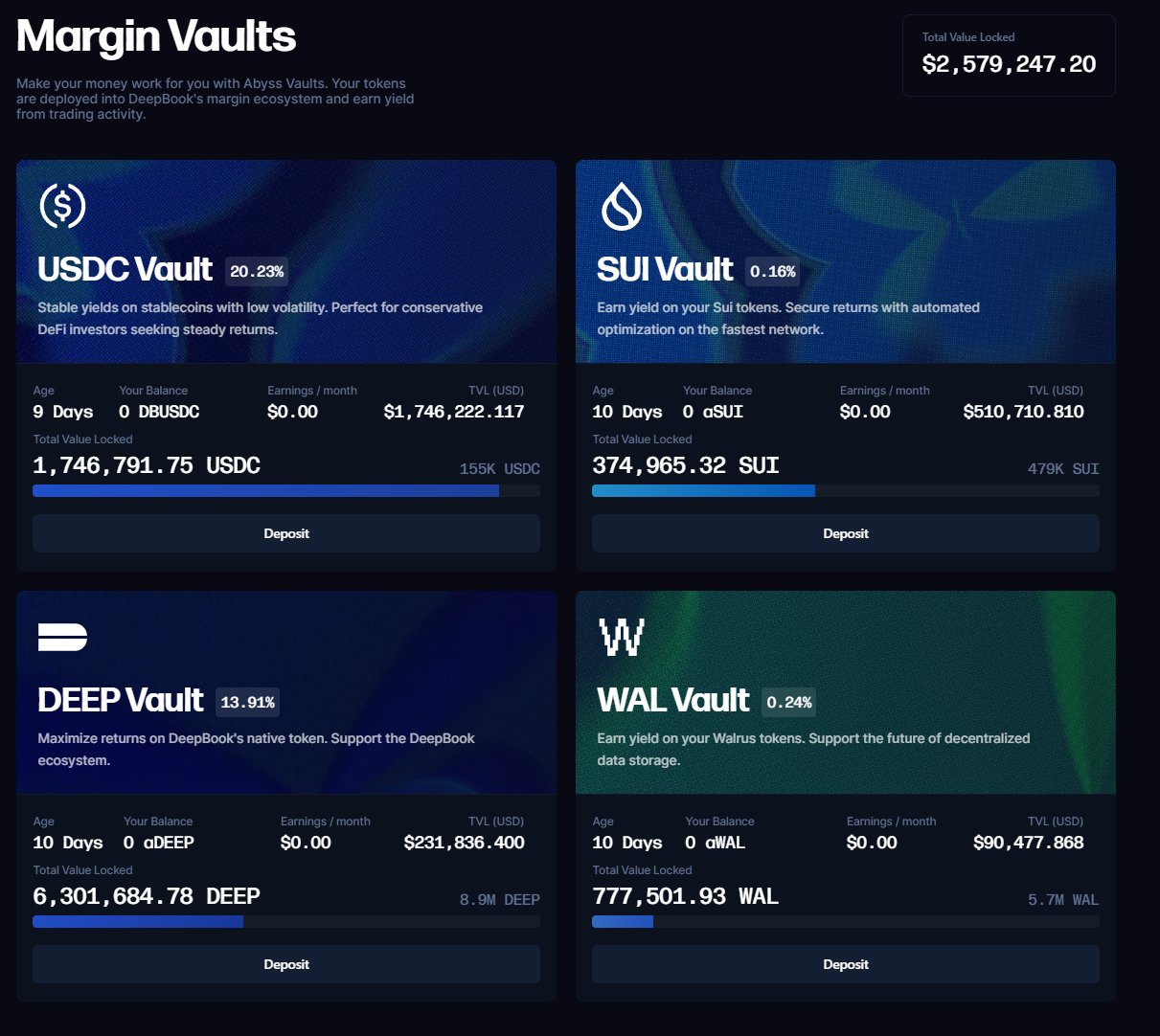

Some DeepBook-enabled apps also offer vaults/pools.

This is where the yield comes from:

• usage-driven fees/interest from Margin activity

• app incentives (varies by protocol) https://t.co/7b81HpZ9oJ

Example: earning yield on Abyss vaults

https://t.co/4YNLlSHlQi

1) Open the vaults page

2) Connect wallet (you can connect with Slush)

3) Pick a vault

4) Deposit

5) Track APY over time

Important: APY isn’t fixed. It moves with demand and activity. https://t.co/cMQa1HbHoH

Bookmark this.

When Sui volume picks up again, you’ll know where margin liquidity lives and where yield tends to show up.

Trade small. Stay vigilant. (•‿•)

Why this matters for Sui DeFi:

• More margin activity usually drives more trades

• More trades usually deepen liquidity

• Deeper liquidity usually improves execution for everyone https://t.co/Q8DawcrfRq

Margin is live!

It’s the next step in DeepBook becoming more than a liquidity engine.

We’re building a complete platform to supercharge Sui DeFi builders.

https://t.co/kHPGAfOgF8 https://t.co/rl8DBywWed

What DeepBook Margin is:

You trade with leverage on Sui, but liquidity comes from DeepBook's shared liquidity layer.

So you get:

• onchain borrowing + leverage

• visible execution onchain

• self-custody throughout https://t.co/7vnxvBnVl5

I spend a significant amount of my day looking at transaction blocks on @SuiNetwork . Always wished explorers could give an English summary of transactions, before I dive into details.

So I made sui-explain, largely for myself. It makes reports like: https://t.co/8vEQTwxVyI