Ore ORE Price History USD

Track the price of Ore for today, 7 days, 30 days and 90 days

期間

24H変動幅

24H変動率 (%)

本日

--

--

7日

--

--

30日

--

--

90日

--

--

Own ORE Now

Buy and sell ORE easily and securely on BitMart.

Ore 相場情報

$ 49.73 24H変動幅 $ 118.67

過去最高値

$ 0

過去最安値

$ 0

24H変動幅

24H取引高

0

供給量

425.00K

ORE

時価総額

0

最大供給量

3.00M

ORE

完全希薄化後時価総額

0

取引 ORE

Ore Xインサイト

ORE miners have high activity on Seeker, no clear trend yet

I have been surprised by how many ORE miners are active on Seeker https://t.co/gUT4GnrspH

10 時間 前

リリース後のOREのトレンド

データなし

中立

ORE miners have high activity on Seeker, no clear trend yet

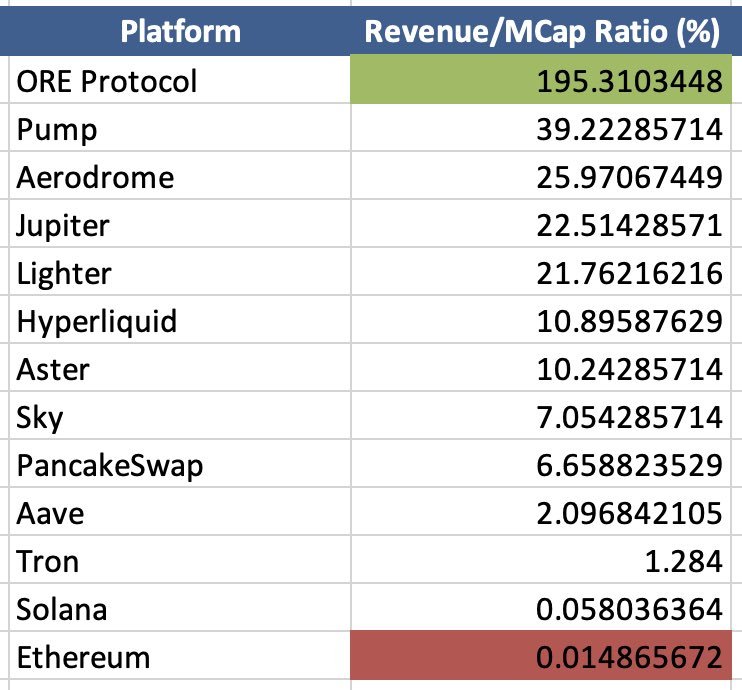

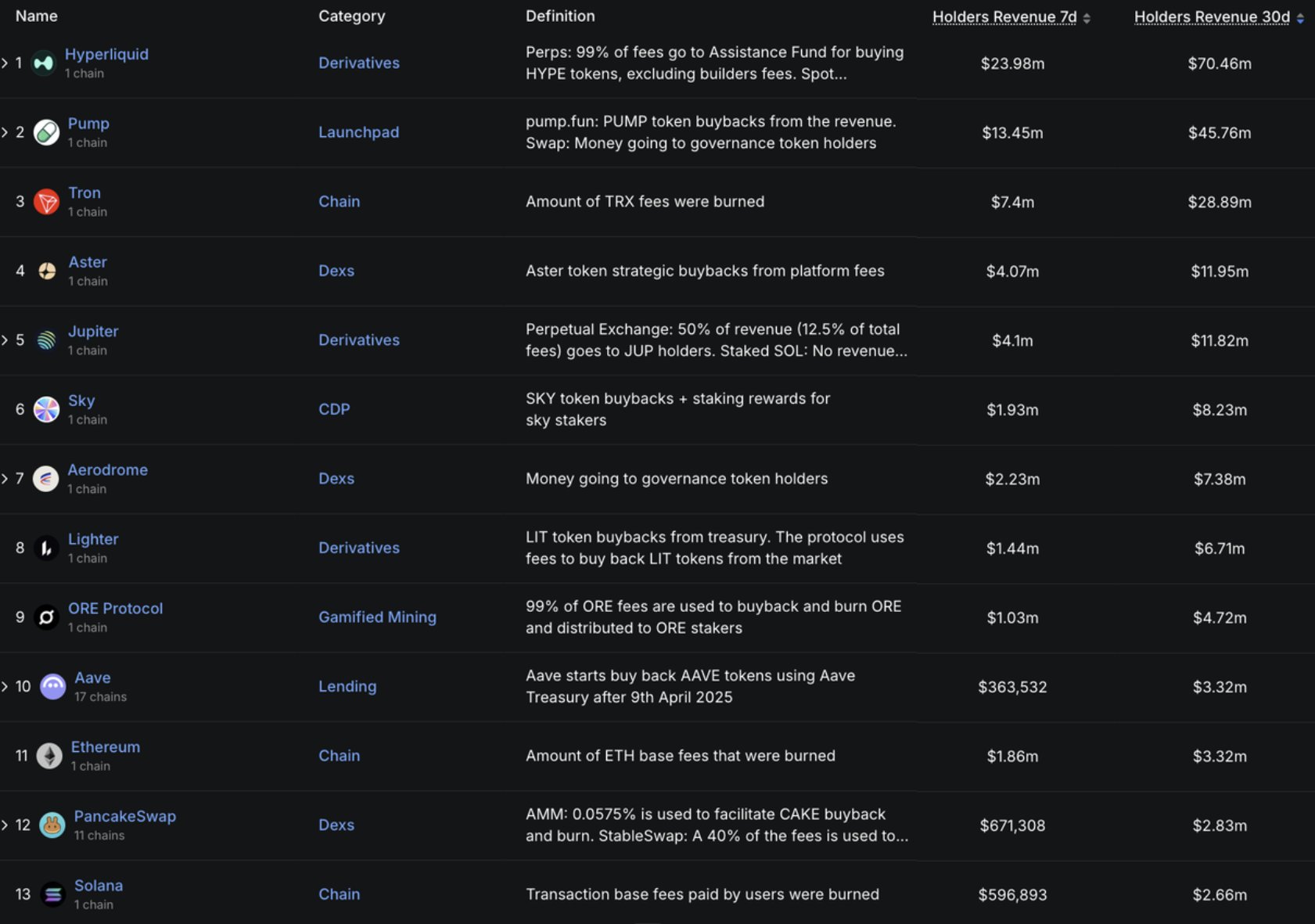

The tweet analyzes the ability of on-chain projects to generate returns for token holders and points out market valuation discrepancies.

Things that should not be on here:

- ORE

Things that should be but revenue is hard to verify onchain:

- Tether

- Circle

- Ethena

Things that surprise me:

- how much Tron makes on stablecoin transfer gas fees alone when other chains have them for free

- that market does not value Pump buybacks

- why Lighter trades at half the relative value of Hyperliquid and Aster

credit to my replyguy @0xSmite

The list of things that actually make money for their tokenholders onchain:

- Perps: Hyperliquid / Lighter / Aster

- Aggregator/AMM: Jupiter / Aerodrome / Pancake

- Banks: Sky / Aave

- Random ponzis with mischaracterized revenue

- Ethereum/Solana/Tron

source @DefiLlama https://t.co/wTm4cUd29s

3 日 前

リリース後のOREのトレンド

データなし

中立

The tweet analyzes the ability of on-chain projects to generate returns for token holders and points out market valuation discrepancies.

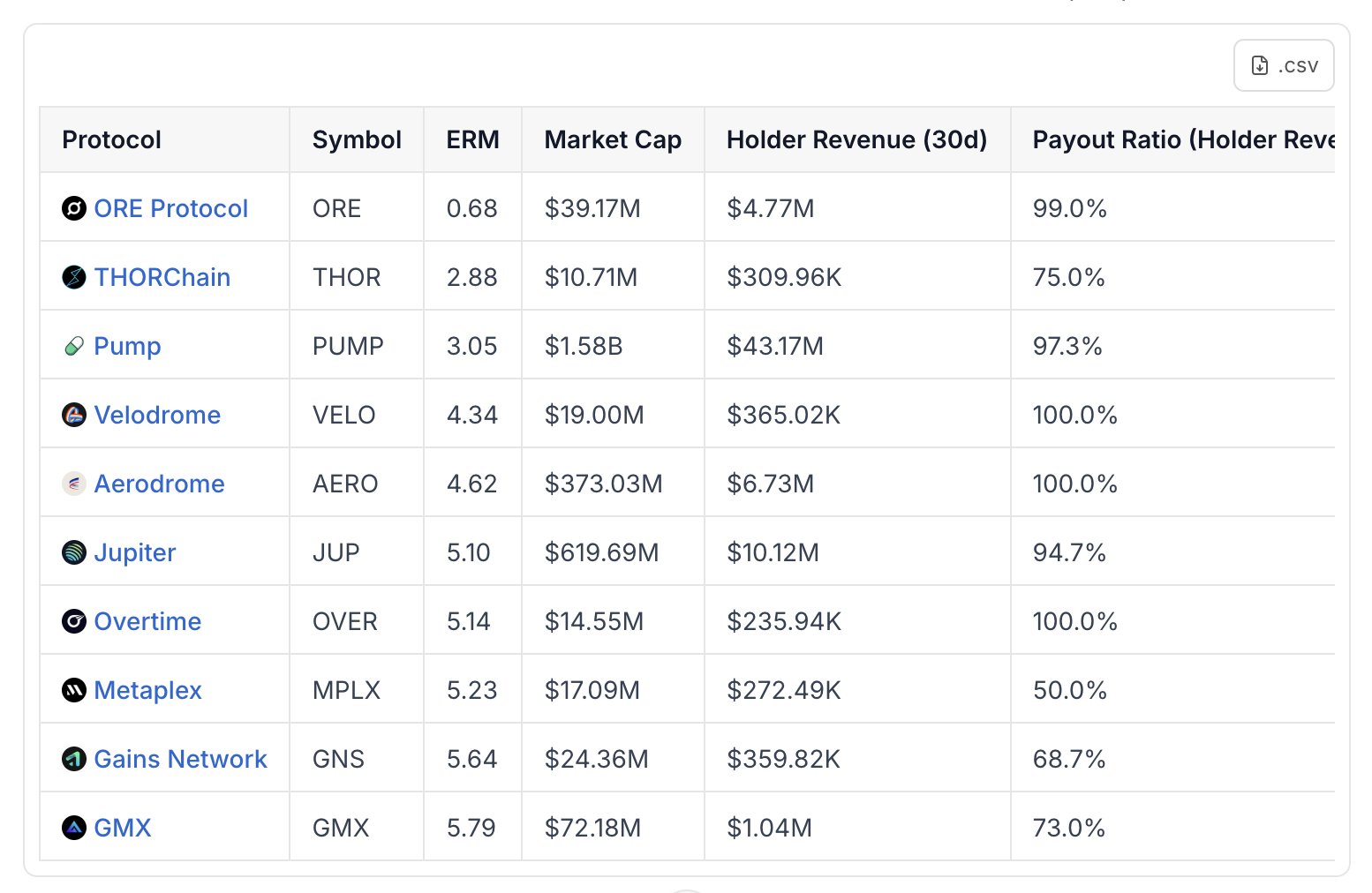

The tweet introduces the ERM valuation method and lists tokens such as PUMP, JUP, and AERO that have high cash‑flow efficiency.

Most P/S ratios in crypto are lying to you.

P/S = Market Cap ÷ Revenue

It tells you how much you're paying for every $1 of revenue.

1. Low P/S (2x) = paying $2 per $1 revenue. Cheaper.

2. High P/S (20x) = paying $20 per $1 revenue. Pricier.

But in crypto, this breaks down:

- Not all tokens receive revenue

- Not all revenue goes to holders

- Circulating supply ≠ eligible supply

A protocol can print $100M in fees while token holders see nothing.

Effective Revenue Multiplier is the fix here:

→ Only count supply that actually receives cashflow

→ Only count cashflow that actually reaches holders

Here are the tokens with the strongest ERM👇

$PUMP $JUP $AERO are the ones with biggest mcap.

(A lower ERM indicates a more efficient valuation from a token holder's cash flow perspective)

h/t to @DefiLlama for the data

8 日 前

リリース後のOREのトレンド

データなし

強気

The tweet introduces the ERM valuation method and lists tokens such as PUMP, JUP, and AERO that have high cash‑flow efficiency.

価格予測

When is a good time to buy ORE? Should I buy or sell ORE now?

When deciding whether it’s a good time to buy or sell Ore (ORE), it’s important to first align with your own trading strategy and risk profile.Long-term investors and short-term traders often interpret market conditions differently, so your decision should reflect your personal approach. According to the latest ORE 4-hour technical analysis, the current trading signal is Hold.

ビーコン予測

Probabilistic Price Forecast (Next 24 Hours)crypto.loading

アプリバージョン Ore

Ore (ORE) is a cryptocurrency launched in 2024and operates on the Solana platform. Ore has a current supply of 425,030.52317181. The last known price of Ore is 76.16188996 USD and is down -2.74 over the last 24 hours. It is currently trading on 83 active market(s) with $909,801.43 traded over the last 24 hours. More information can be found at https://ore.supply/.

続きを読む

Explore More

BM Discovery

新規上場

SOFION SoFi Technologies Ondo Tokenized

0 0.00%

ARMON Arm Holdings plc Ondo Tokenized

0 0.00%

IBMON IBM Ondo Tokenized

0 0.00%

ADBEON Adobe Ondo Tokenized

0 0.00%

NKEON Nike Ondo Tokenized

0 0.00%

TCU29 TCU29

0 0.00%

RUNE THORChain

0 0.00%

GSON Goldman Sachs Ondo Tokenized

0 0.00%

SPOTON Spotify Ondo Tokenized

0 0.00%

INTCON Intel Ondo Tokenized

0 0.00%