Yes, good move. Stablecoin issuers will need to be licensed in Australia under recently passed federal legislation.

Australian Digital Dollar ライブ価格データ

Australian Digital Dollar AUDD Price History USD

Own AUDD Now

Buy and sell AUDD easily and securely on BitMart.Australian Digital Dollar Xインサイト

AUDC has been granted an Australian Financial Services Licence (AFSL) by ASIC to provide non-cash payment facilities. The licence reinforces AUDC’s position as a regulated issuer of @AUDD_digital and supports Australia’s evolving digital payments and settlement infrastructure. https://t.co/wCycpVGBPb

🧵 AUDD gets licensed. Hedera gets validated.

Why this matters more than people think.

This week, AUDD’s issuer (AUDC) was granted an AFSL licence by Australia’s regulator.

That’s not a crypto headline.

That’s financial infrastructure.

AUDD is a regulated Australian dollar stablecoin, fully backed 1:1 by AUD and issued by a licensed Australian financial services provider.

It is designed for real‑world payments, settlements, and treasury use, not speculation.

By running on @HederaFndn, AUDD combines fiat compliance with public DLT settlement at production scale.

An AFSL allows the issuer to provide non‑cash payment facilities under Australian law.

Translation:

AUDD is now a regulated digital payment instrument, not a grey‑zone stablecoin.

Here’s the key detail many miss:

AUDD runs on Hedera.

Not as an experiment.

Not as a pilot.

As the production settlement layer.

This means a licensed fiat stablecoin is settling value on a public DLT that regulators are comfortable with.

That’s a major signal for how fut

AUDC has been granted an Australian Financial Services Licence (AFSL) by ASIC to provide non-cash payment facilities. The licence reinforces AUDC’s position as a regulated issuer of @AUDD_digital and supports Australia’s evolving digital payments and settlement infrastructure. https://t.co/wCycpVGBPb

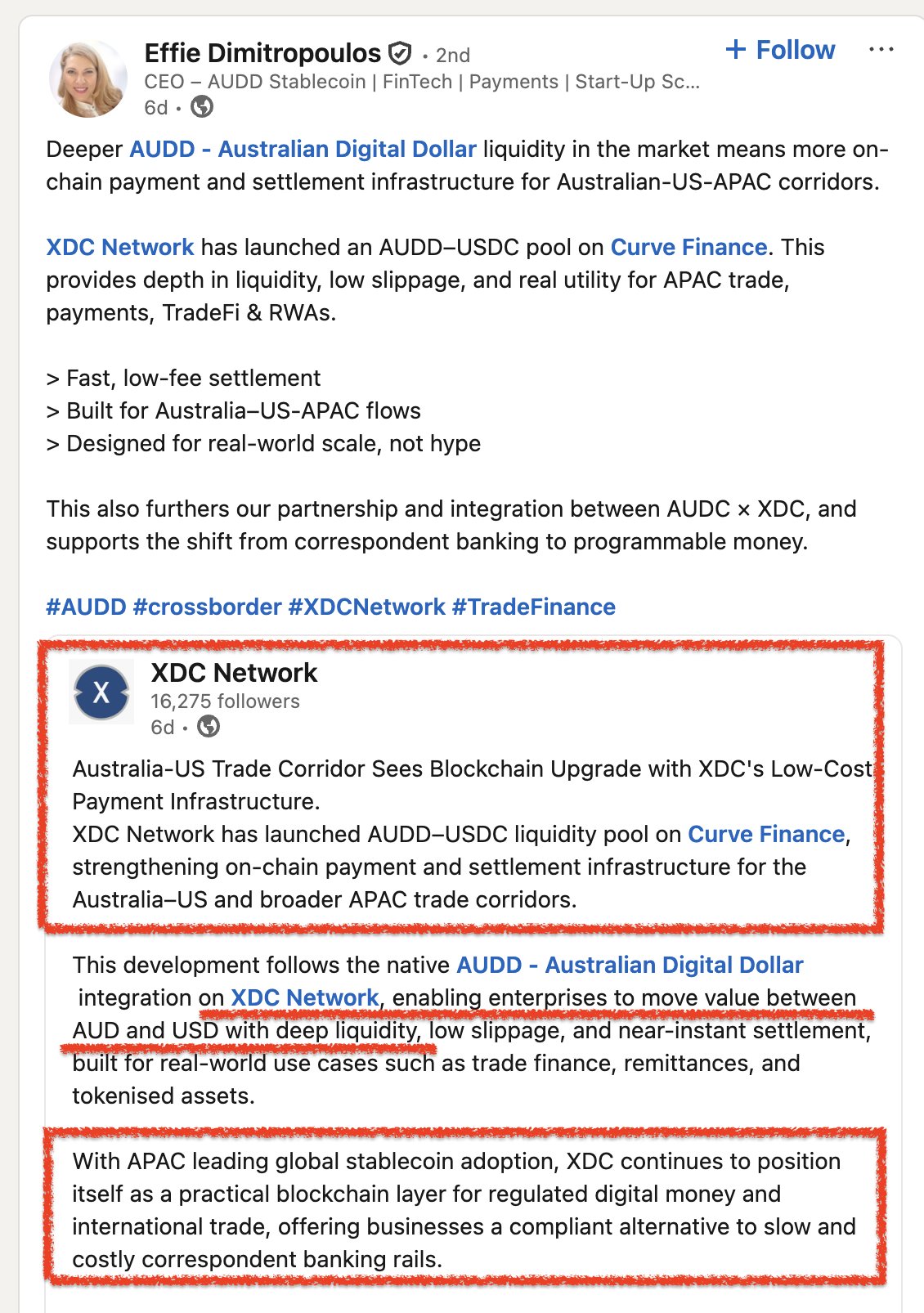

🧵 AUDD is building both liquidity and rails: XDC/Curve + Hedera/Acacia 🇦🇺

$AUDD’s expansion isn’t a who wins story, it’s a two‑layer build:

✅ Liquidity where it trades/routes (XDC + Curve)

✅ Rails where it settles/integrates (Hedera + wholesale pilots)

Quick context: AUDD (Australian Digital Dollar) is an AUD‑denominated stablecoin. The point isn’t speculation, it’s payments + settlement.

The pain point is real: AU↔US business transfers can mean multi‑day settlement + meaningful fees. That’s exactly why firms look for digital payment alternatives.

This is where XDC x AUDD fits: modernizing payment infrastructure for Australia–US / broader APAC trade corridors with a focus on efficiency (TradeFi/RWA vibes).

And the Curve piece matters: a deep AUDD–USDC pool isn’t just DeFi. It’s practical plumbing:

• better on‑chain FX (AUD↔USD)

• lower slippage

• easier routing for real flows

In other words: liquidity is utility. You can’t use a stablecoin at scale if it’s hard/expensive to swap, hedge, or move between stable assets.

Now the other layer: Hedera. AUDD launched as a native Hedera deployment with the usual pitch institutions care about: fast finality + predictable low fees + stablecoin tooling.

This is why the “XDC vs Hedera” framing misses it:

• XDC/Curve helps AUDD move (liquidity + routing)

• Hedera helps AUDD settle (rails + predictable cost structure)

The macro signal in Australia is wholesale digital money experimentation (Project Acacia / tokenized settlement trials). That’s where rails narratives get tested beyond marketing.

Project Acacia (RBA + DFCRC) is Australia’s sandbox for wholesale digital money + tokenized settlement — aimed at banks/institutions, not retail payments.

They’re testing multiple settlement assets (stablecoins / deposit tokens / pilot wCBDC) across a multi‑DLT setup — with Hedera named as one of the platforms.

The clean thesis: AUDD wants to be the programmable AUD layer for trade/payment use cases and that requires both:

• liquid markets (Curve‑style venues)

• settlement‑grade rails (institutional lanes)

Final take: This is what progress looks — not tribal chains — multi‑chain money.

AUDD where it trades. AUDD where it settles.

👉 https://t.co/S19MugRI6a

$XDC Network has partnered with AUDD to modernize payments infrastructure for business transactions between Australia and the United States, one of Australia’s largest national trading partners. 🥶 https://t.co/exuzta8tEb

価格予測

When is a good time to buy AUDD? Should I buy or sell AUDD now?

ビーコン予測

Probabilistic Price Forecast (Next 24 Hours)Explore More

BM Discovery

新規上場