Just read the State of DePIN 2025 report by @MessariCrypto .

It clearly supports the point I’ve been making for a long time.

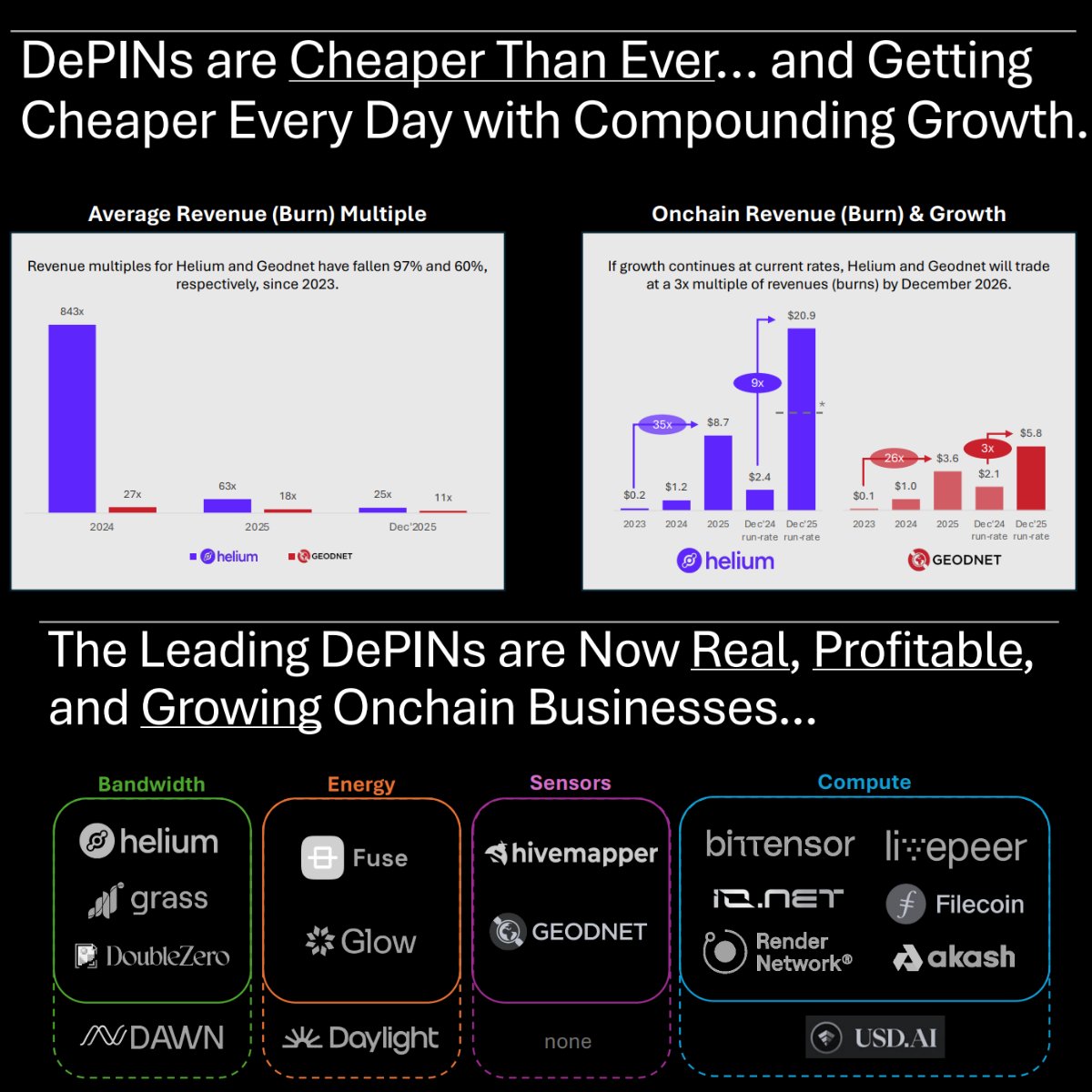

Yes, prices are ugly.

Most tokens are down 90%+ from highs. But that's the trap.

The gap between perception and reality is wild.

Perception:

DePIN is dying

Reality:

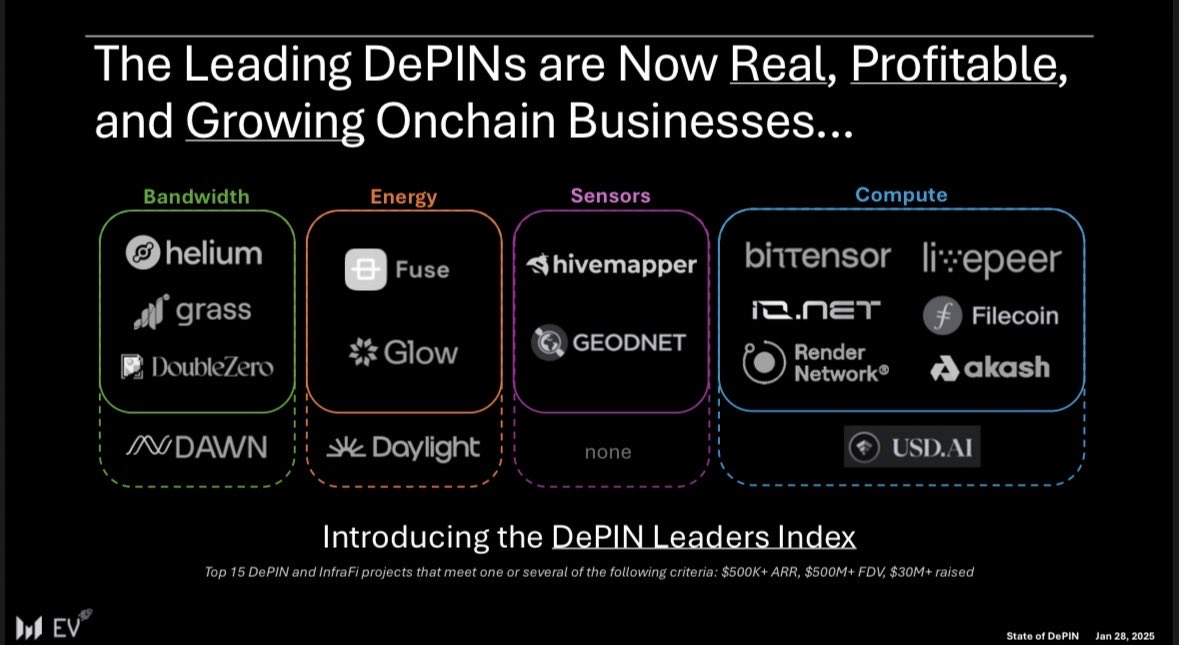

• $10B sector

• $72M onchain revenue

• Supply constrained networks

• Real users, real payments

People judge DePIN with a 2021 mindset: pre-revenue, heavy inflation, speculation driven.

Two examples that prove it:

@helium : Millions of daily users through carrier partnerships. Your phone is probably using their network right now without you knowing.

@GEODNET : Centimeter-level GPS for agriculture and robotics. Paying enterprise customers. Revenue directly burns tokens.

These aren't crypto experiments anymore.

They're infrastructure companies with crypto rails.

The report is honest about the physics:

You can't build infrastructure without capital.

Only 3 paths survive:

1. InfraFi with stablecoin capital

2.