🔴 Exclusive @TheBigWhale_ : @qivaliseu’ CEO on building Europe’s on-chain euro - his first ever public interview.

Jan-Oliver Sell: "We are building the European infrastructure for the on-chain euro."

Backed by a consortium of major European banks, Qivalis aims to launch a euro stablecoin capable of challenging the dominance of the U.S. dollar.

In this long first public interview, Jan-Oliver Sell shares insights on technology, market ambition, the project’s business model, and Europe’s chance to reclaim its monetary influence.

👉 Why Ethereum?

"Our position is clear: we are building an open token, a public euro stablecoin designed for broad usage across the ecosystem. This is not a closed token restricted to a handful of institutions on a private network. So yes, @ethereum and the EVM ecosystem are a natural starting point, because that is where most liquidity and live use cases currently exist - particularly in DeFi and crypto markets. If you want to create a meaningful on-chain euro, you need to be where activity already happens."

But Qivalis is thinking beyond Ethereum:

"We want Qivalis to be an omni-chain token. If a shareholder bank or an institutional player has a large-scale use case on a network like Canton, or another permissioned infrastructure, we will obviously consider it."

👉 Ambition to overtake Circle quickly

"Probably, yes. EURC is currently the most visible euro stablecoin internationally. But @circle remains a private American company. In the current geopolitical context, many European actors see strategic value in a strong European alternative."

"A robust, widely used euro stablecoin is a pillar of European strategic autonomy. If blockchain rails become dominant and the euro lacks credible on-chain presence, the risk is gradual digital dollarization."

👉 The euro vs. the dollar: a growth opportunity

"Today, the euro accounts for roughly 0.2% of global stablecoin flows - an extremely small share. By contrast, in fiat flows like cross-border payments, reserves, and digital asset purchases, the euro represents closer to 20–25%. The gap is massive.

For me, it is not a question of ‘if,’ but ‘when.’ European actors, European users, and European companies need to operate in euros. And the more finance becomes tokenized, the more euro-denominated settlement will assert itself."

"Economically, it is more profitable to place capital in euros than in dollars when you consider FX risks and yields in on-chain finance. The euro can catch up - and even overtake - the dollar in this ecosystem."

👉 Business model & distribution

"The main challenge for a stablecoin, beyond the technology itself, is distribution. How do you drive adoption of a new on-chain euro in a market dominated by dollar-denominated stablecoins? A single institution - even a large bank - has limited distribution capacity. A consortium, by contrast, allows us to aggregate channels, use cases, and balance sheets."

"Each member bank develops its own use cases on top of shared rails: cross-border payments, delivery-versus-payment for tokenized assets, treasury management, and so on. This creates a far more powerful and organic distribution engine than a single issuer could achieve."

"Yield on reserves is your main revenue source… The only sustainable path is to help build a sufficiently deep euro DeFi ecosystem that generates native yield. This is a collective effort involving other issuers, protocols, and market makers."

Qivalis is building an open, MiCA-compliant European infrastructure, with a stablecoin ready to be used immediately upon licensing, while ensuring operational independence and robustness.

🧠 A must-read for anyone who wants to understand how Europe can reclaim the euro’s global relevance, while asserting monetary sovereignty and offering a more profitable on-chain alternative to the dollar.

The full interview 👇 https://t.co/1eGF8VWVqc

EURC ライブ価格データ

EURC EURC Price History USD

Own EURC Now

Buy and sell EURC easily and securely on BitMart.EURC Xインサイト

Join us on February 18 for an exclusive Deep Dive in Paris 🇫🇷 with @SocieteGenerale - FORGE, @ODDO_BHF, and @Morpho. A few spots still available! https://t.co/JiuFbIOlpr

stablecoin issuers are no longer USD only

Tether is finding success with XAUT

Circle with EURC

given current USD weakness we're probably going to see all the major currencies on chain soon

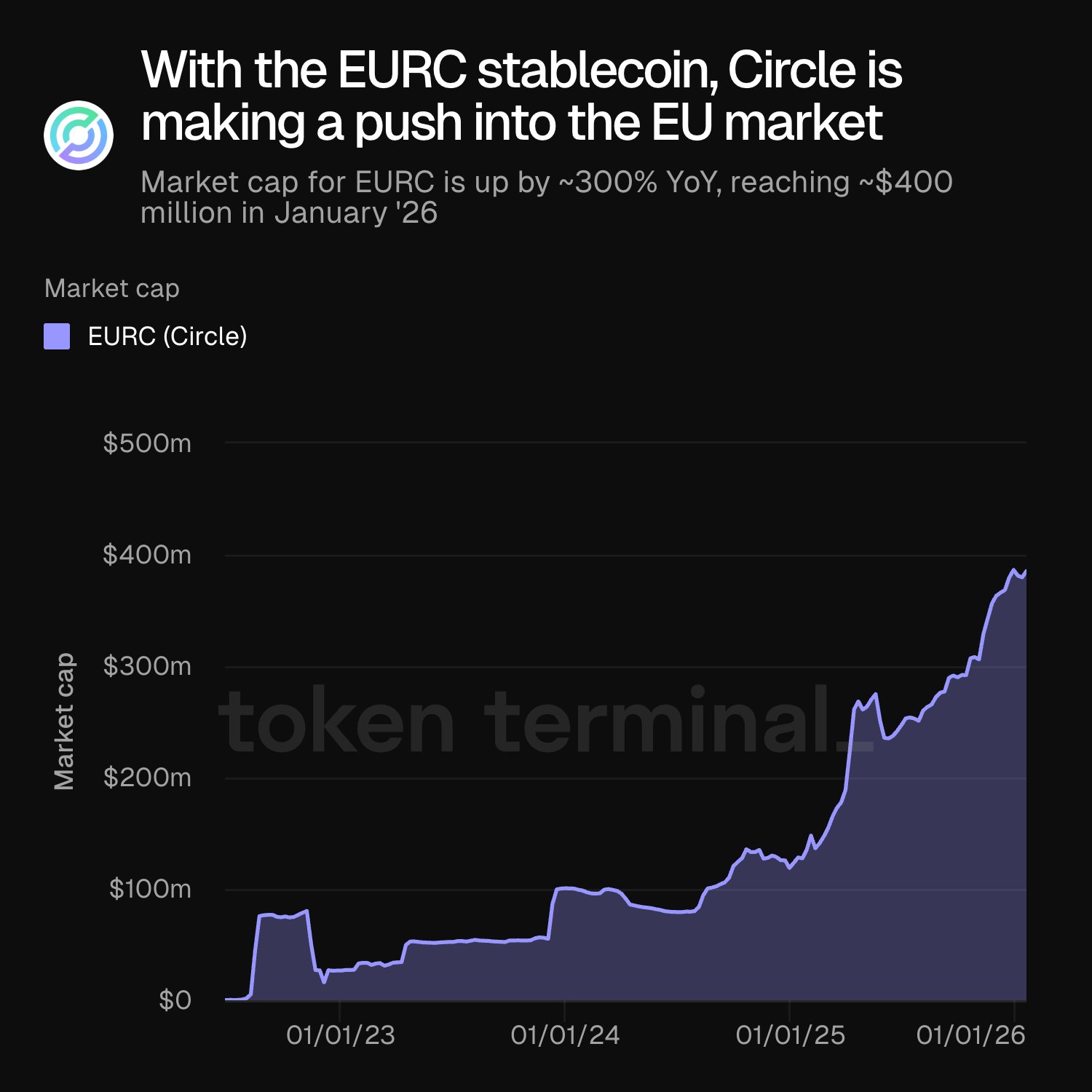

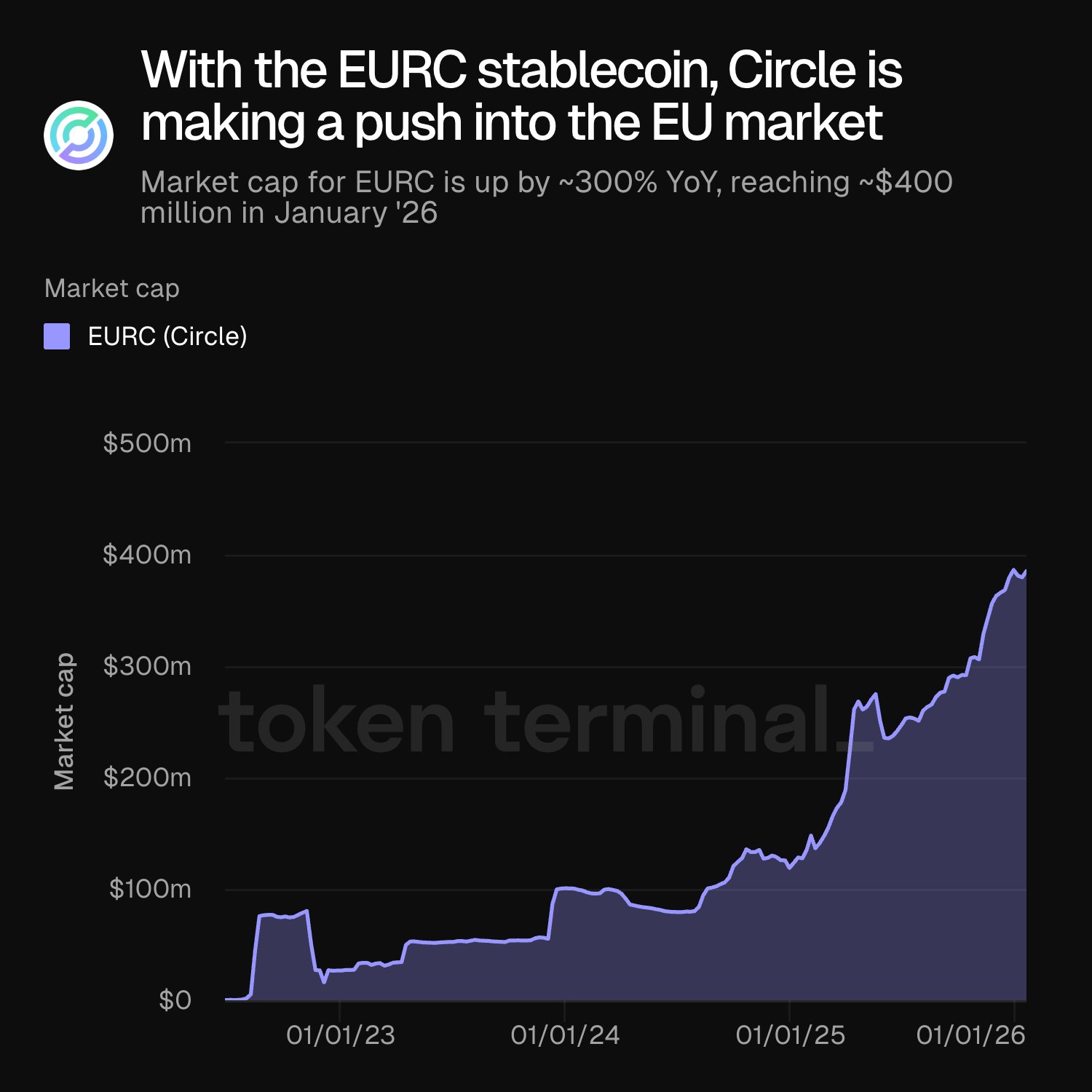

🇪🇺⛓️ With the EURC stablecoin, @circle is making a push into the EU market.

Market cap for EURC is up by ~300% YoY, reaching ~$400 million in January '26.

USDC, EURC, USYC, CCTP, CPN, Arc ... (there's a pattern here) https://t.co/hDuY2bmkI8

🇪🇺⛓️ With the EURC stablecoin, @circle is making a push into the EU market.

Market cap for EURC is up by ~300% YoY, reaching ~$400 million in January '26.

USDC, EURC, USYC, CCTP, CPN, Arc ... (there's a pattern here) https://t.co/hDuY2bmkI8

価格予測

When is a good time to buy EURC? Should I buy or sell EURC now?

ビーコン予測

Probabilistic Price Forecast (Next 24 Hours)Explore More

BM Discovery

新規上場