Real capital efficiency in next-gen commodity carry trades on @StandX_Official

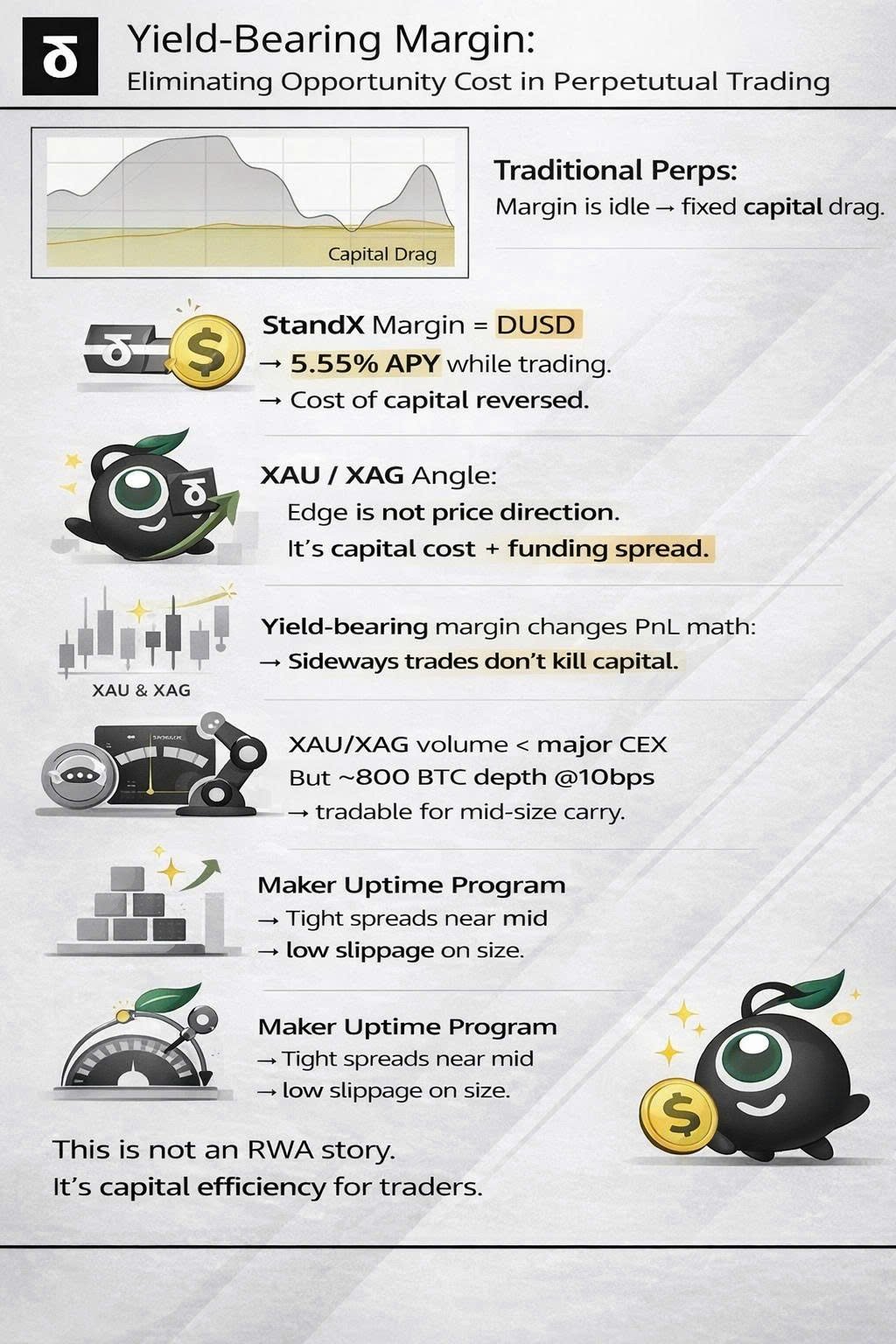

Most traders are overlooking a large hidden cost:

→ idle margin capital that doesn’t earn yield.

On traditional venues, margin only serves as collateral,

while PnL must fully cover funding, fees, and slippage.

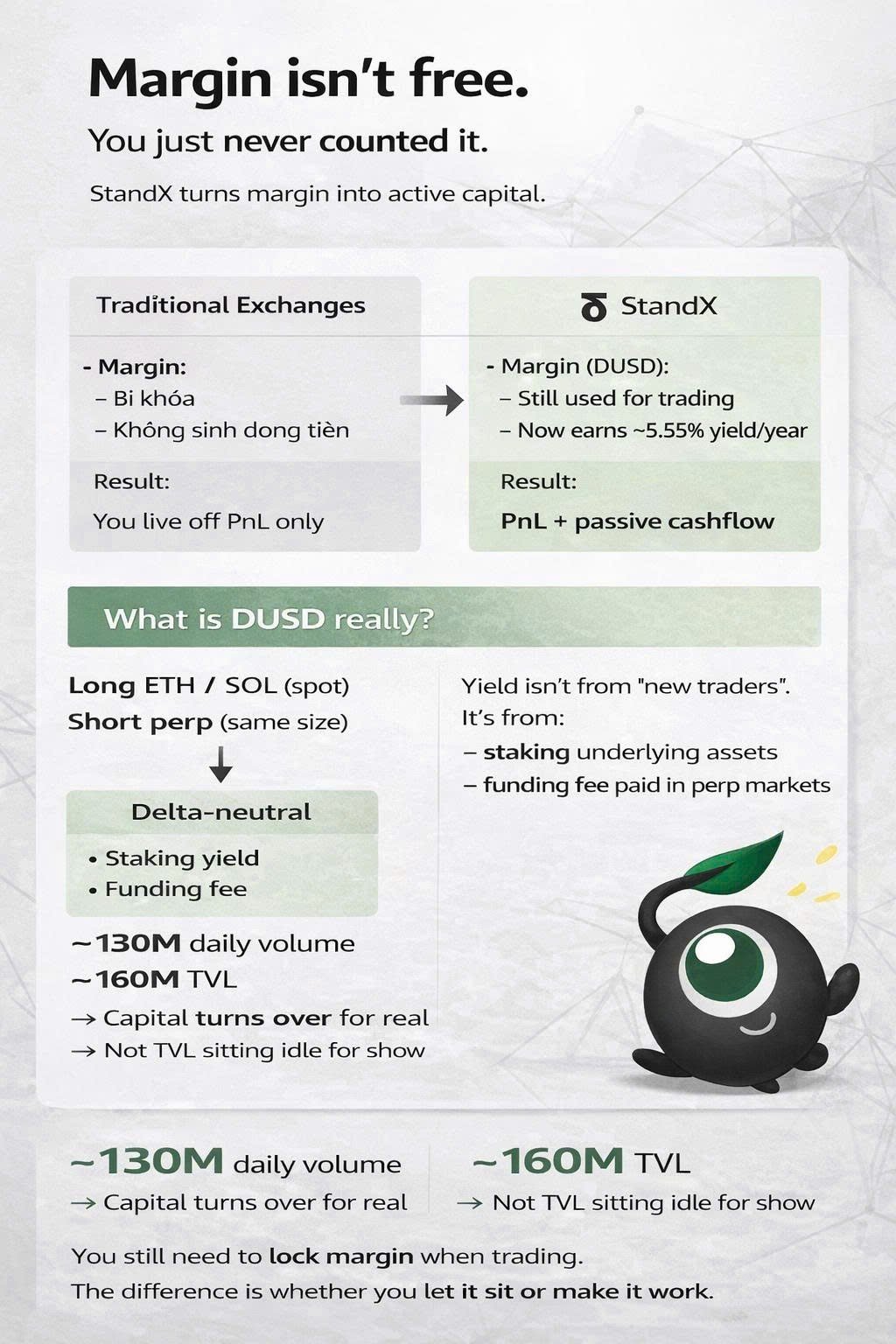

StandX introduces a structural difference by allowing margin to be held as DUSD earning ~5.55% APY,

while maintaining exposure to $XAU and $XAG pairs.

→ This is especially relevant because most commodity strategies focus more on carry, funding, and risk management than pure directional bets.

From an execution standpoint, I don’t expect XAU/XAG on StandX to immediately compete with major CEXs on volume.

But with ~800 BTC depth within 10 bps, low slippage, and the Maker Uptime Program,

liquidity at a mid scale is clean enough to deploy carry trades, delta-neutral setups, or light market making.

What matters most to me is the cost of capital differential.

When margin both preserves exposure and generates yield,

the way I calculate capital efficiency changes entirely.

For strategies sensitive to funding and capital utilization,

this is a measurable edge, not a theoretical one.