Tether Gold (XAUT)

Tether Gold (XAUT)

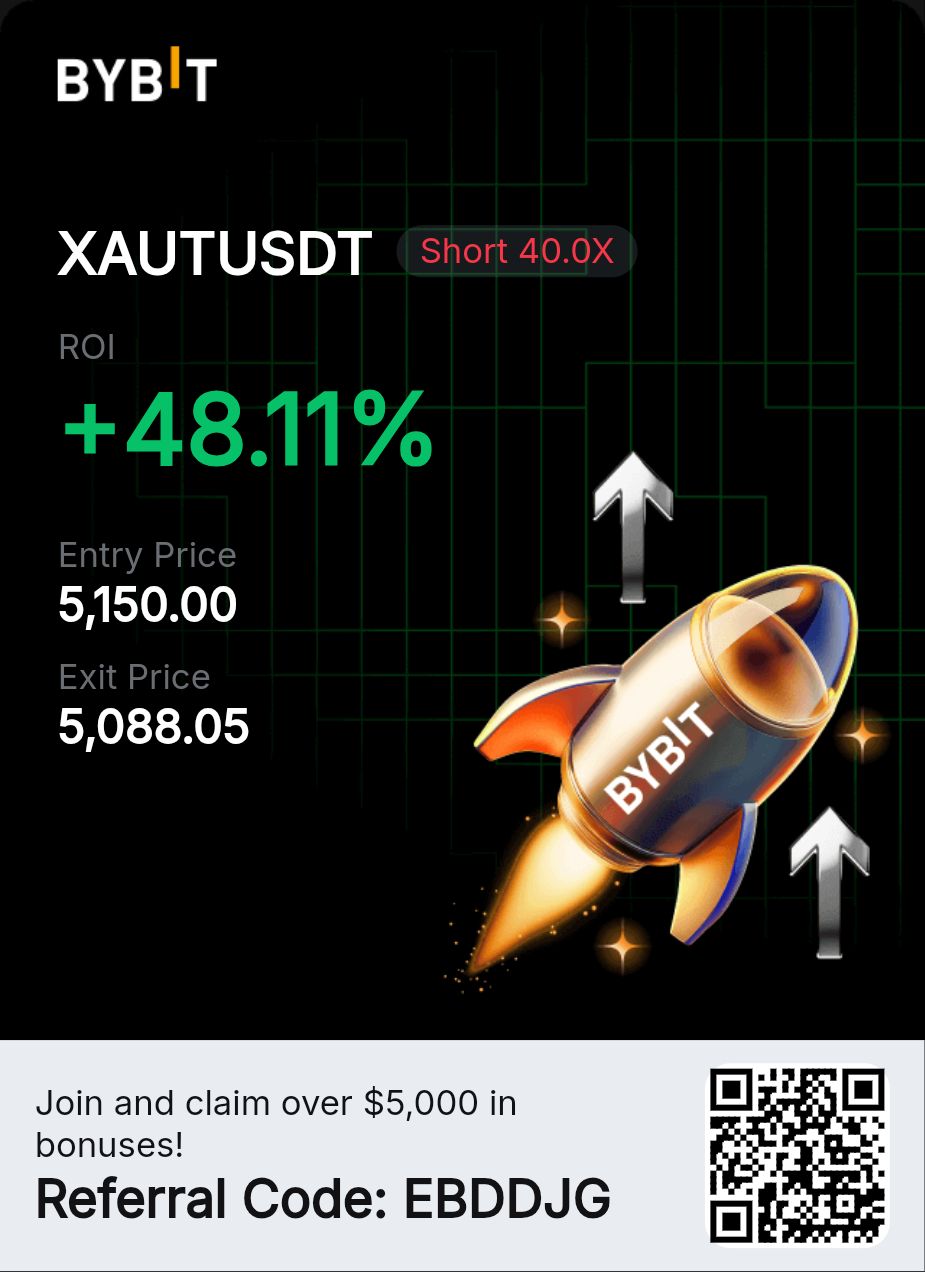

$5,140.1 +0.94% 24H

- 53ソーシャル・センチメント・インデックス(SSI)+22.45% (24h)

- #89マーケット・パルス・ランキング(MPR)+22

- 724時間ソーシャルメンション+40.00% (24h)

- 28%24時間のKOL強気比率4人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体53SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (14%)強気 (14%)中立 (57%)弱気 (15%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA73 13 1.65K オリジナル >リリース後のXAUTのトレンド中立

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA73 13 1.65K オリジナル >リリース後のXAUTのトレンド中立 Raphaël Bloch 🐳 Media Researcher B61.31K @Raph_Bloch

Raphaël Bloch 🐳 Media Researcher B61.31K @Raph_Bloch Aleksandar Bukovski D213 @BukovskiBuko3

Aleksandar Bukovski D213 @BukovskiBuko3 2 1 1.19K オリジナル >リリース後のXAUTのトレンド非常に強気

2 1 1.19K オリジナル >リリース後のXAUTのトレンド非常に強気 Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA73 13 1.65K オリジナル >リリース後のXAUTのトレンド中立

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA73 13 1.65K オリジナル >リリース後のXAUTのトレンド中立 Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA73 13 1.65K オリジナル >リリース後のXAUTのトレンド中立

Zeus 🏴 FA_Analyst Tokenomics_Expert C24.03K @ZeusRWA73 13 1.65K オリジナル >リリース後のXAUTのトレンド中立- リリース後のXAUTのトレンド強気

- リリース後のXAUTのトレンド中立

The Composite Trader TA_Analyst Trader S15.16K @Larskooistra_

The Composite Trader TA_Analyst Trader S15.16K @Larskooistra_ Tradebull D68 @TradebullTrades

Tradebull D68 @TradebullTrades

24 4 3.27K オリジナル >リリース後のXAUTのトレンド弱気

24 4 3.27K オリジナル >リリース後のXAUTのトレンド弱気- リリース後のXAUTのトレンド中立

- リリース後のXAUTのトレンド中立

- リリース後のXAUTのトレンド中立