USDC (USDC)

USDC (USDC)

$0.999485 <+0.01% 24H

- 75ソーシャル・センチメント・インデックス(SSI)-3.54% (24h)

- #88マーケット・パルス・ランキング(MPR)+24

- 6024時間ソーシャルメンション+34.09% (24h)

- 69%24時間のKOL強気比率44人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体75SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (27%)強気 (42%)中立 (13%)弱気 (12%)非常に弱気 (6%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

- リリース後のUSDCのトレンド中立

OCT News Media Influencer C1.87K @news_oct

OCT News Media Influencer C1.87K @news_oct OCT News Media Influencer C1.87K @news_oct

OCT News Media Influencer C1.87K @news_oct 2 2 29 オリジナル >リリース後のUSDCのトレンド強気

2 2 29 オリジナル >リリース後のUSDCのトレンド強気- リリース後のUSDCのトレンド強気

- リリース後のUSDCのトレンド非常に強気

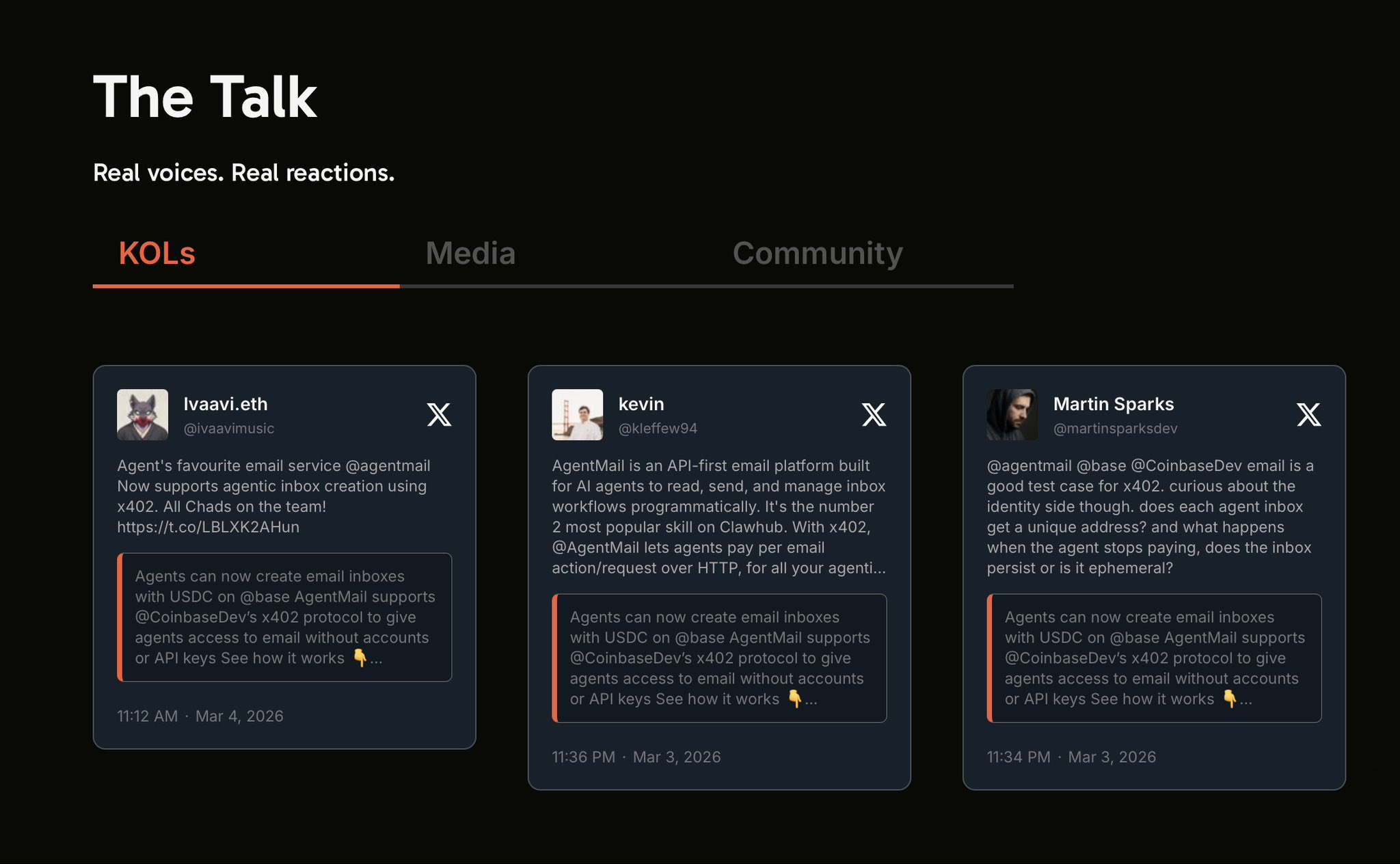

Ivaavi.eth TA_Analyst Trader C2.83K @ivaavimusic

Ivaavi.eth TA_Analyst Trader C2.83K @ivaavimusic AgentMail (YC S25) D4.17K @agentmail

AgentMail (YC S25) D4.17K @agentmail 3 0 98 オリジナル >リリース後のUSDCのトレンド強気

3 0 98 オリジナル >リリース後のUSDCのトレンド強気- リリース後のUSDCのトレンド強気

- リリース後のUSDCのトレンド非常に弱気

- リリース後のUSDCのトレンド弱気

- リリース後のUSDCのトレンド弱気

- リリース後のUSDCのトレンド非常に強気