Sei Network (SEI)

Sei Network (SEI)

$0.0659 -3.23% 24H

- 64ソーシャル・センチメント・インデックス(SSI)-12.86% (24h)

- #20マーケット・パルス・ランキング(MPR)+32

- 924時間ソーシャルメンション-9.09% (24h)

- 100%24時間のKOL強気比率7人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体64SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (33%)強気 (67%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot404

Block_Diversity v.8 ™️ TA_Analyst Trader A26.50K @i_bot404 Rektlife D78 @Rektlife_16 7 1.26K オリジナル >リリース後のSEIのトレンド強気

Rektlife D78 @Rektlife_16 7 1.26K オリジナル >リリース後のSEIのトレンド強気 Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork Ledger Enterprise D3.18K @ledger_business

Ledger Enterprise D3.18K @ledger_business 53 4 6.18K オリジナル >リリース後のSEIのトレンド強気

53 4 6.18K オリジナル >リリース後のSEIのトレンド強気 Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork221 31 5.86K オリジナル >リリース後のSEIのトレンド強気

Sei Media Community_Lead C780.46K @SeiNetwork221 31 5.86K オリジナル >リリース後のSEIのトレンド強気 Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

Web3 Princess 👑 Educator Influencer C16.37K @BrianneFrey

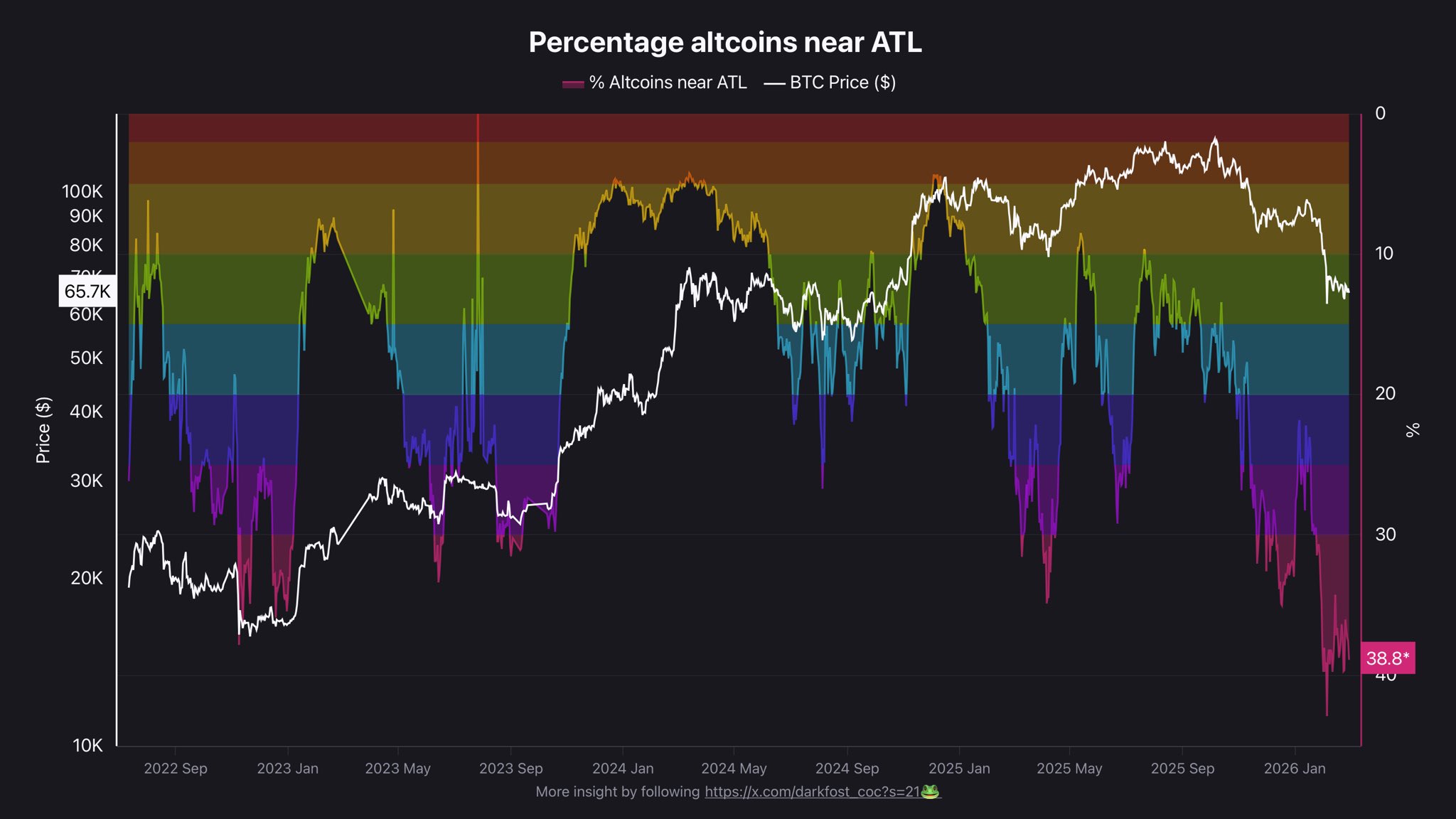

Darkfost OnChain_Analyst TA_Analyst S8.43K @Darkfost_Coc

Darkfost OnChain_Analyst TA_Analyst S8.43K @Darkfost_Coc 29 14 1.55K オリジナル >リリース後のSEIのトレンド強気

29 14 1.55K オリジナル >リリース後のSEIのトレンド強気 Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2

Tanaka DeFi_Expert FA_Analyst A41.54K @Tanaka_L2 Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork 655 61 40.84K オリジナル >リリース後のSEIのトレンド非常に強気

655 61 40.84K オリジナル >リリース後のSEIのトレンド非常に強気- リリース後のSEIのトレンド強気

- リリース後のSEIのトレンド強気

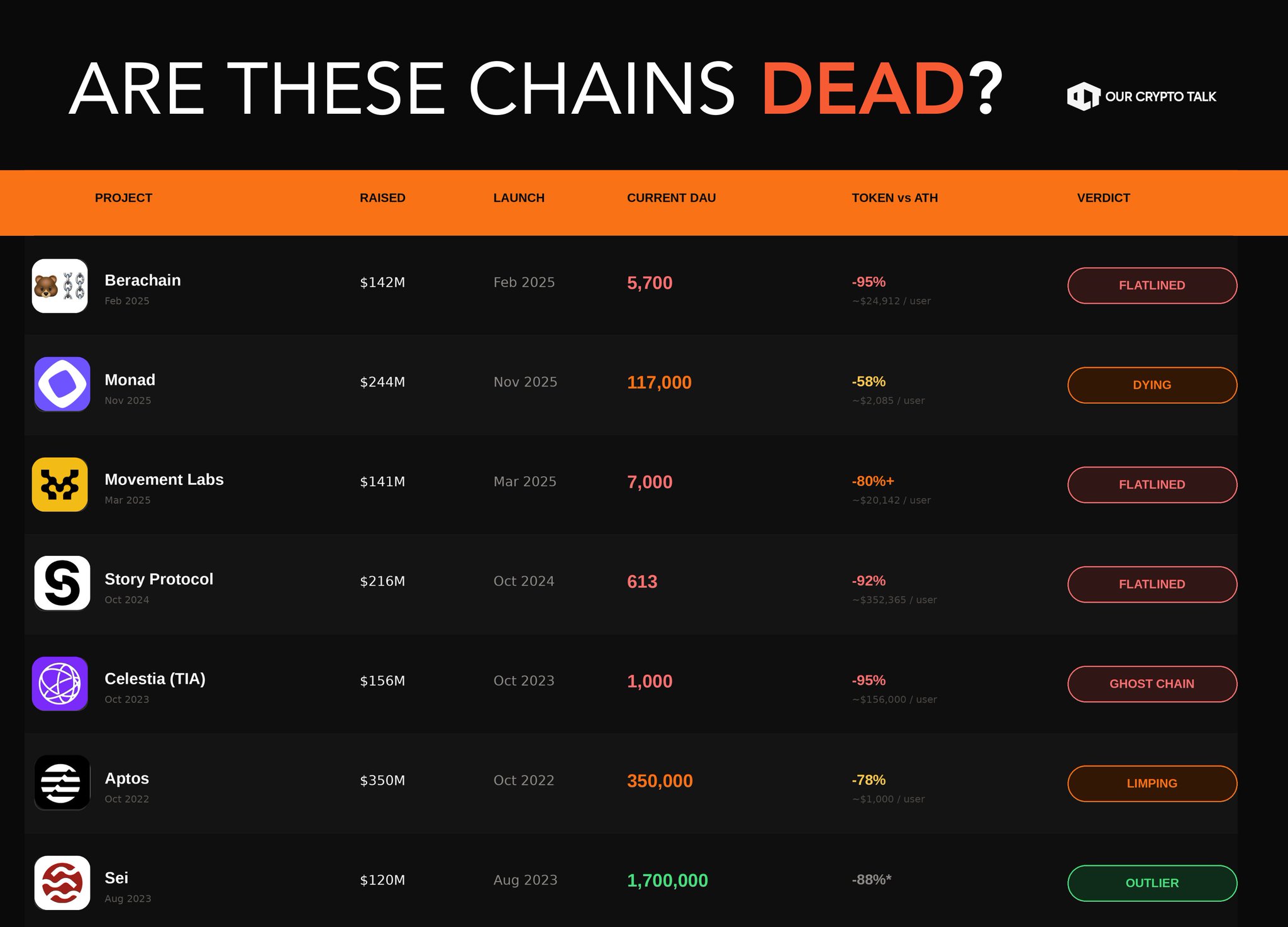

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk Our Crypto Talk Media Influencer C76.65K @ourcryptotalk

Our Crypto Talk Media Influencer C76.65K @ourcryptotalk 171 27 19.37K オリジナル >リリース後のSEIのトレンド非常に強気

171 27 19.37K オリジナル >リリース後のSEIのトレンド非常に強気 Sei Media Community_Lead C780.46K @SeiNetwork

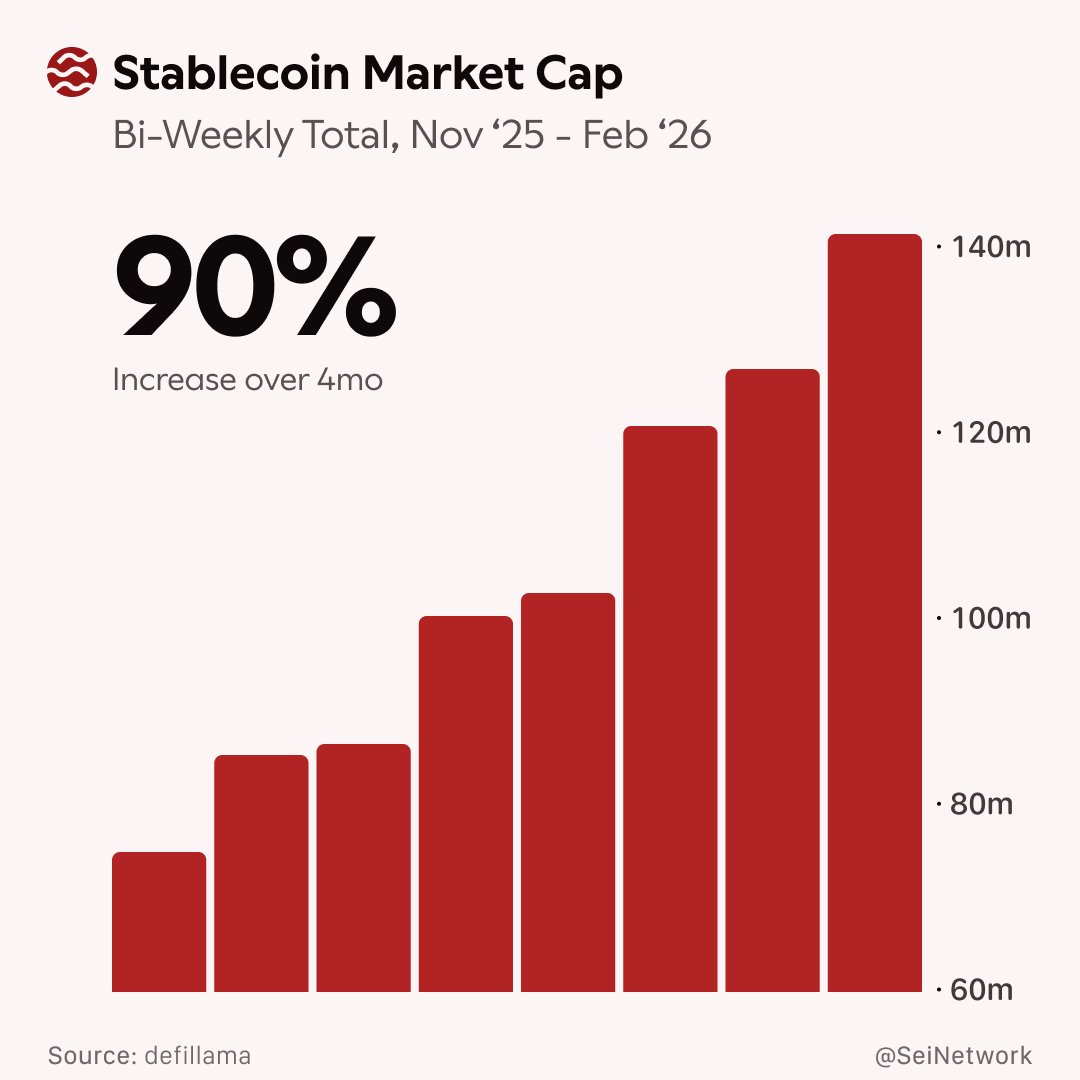

Sei Media Community_Lead C780.46K @SeiNetwork Sei Media Community_Lead C780.46K @SeiNetwork

Sei Media Community_Lead C780.46K @SeiNetwork 460 47 13.51K オリジナル >リリース後のSEIのトレンド非常に強気

460 47 13.51K オリジナル >リリース後のSEIのトレンド非常に強気- リリース後のSEIのトレンド非常に強気