Pendle (PENDLE)

Pendle (PENDLE)

$1.9996 +5.33% 24H

- 65ソーシャル・センチメント・インデックス(SSI)+3.80% (24h)

- #66マーケット・パルス・ランキング(MPR)+28

- 424時間ソーシャルメンション0% (24h)

- 50%24時間のKOL強気比率4人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体65SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (50%)中立 (50%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

- リリース後のPENDLEのトレンド非常に強気

Lord of Crypto Trader Influencer A133.80K @lord_of_crypto_

Lord of Crypto Trader Influencer A133.80K @lord_of_crypto_

Lord of Crypto Trader Influencer A133.80K @lord_of_crypto_

Lord of Crypto Trader Influencer A133.80K @lord_of_crypto_ 85 12 24.91K オリジナル >リリース後のPENDLEのトレンド非常に強気

85 12 24.91K オリジナル >リリース後のPENDLEのトレンド非常に強気 Data Wolf 🐺 OnChain_Analyst Educator C2.53K @0xDataWolf

Data Wolf 🐺 OnChain_Analyst Educator C2.53K @0xDataWolf Data Wolf 🐺 OnChain_Analyst Educator C2.53K @0xDataWolf

Data Wolf 🐺 OnChain_Analyst Educator C2.53K @0xDataWolf Data Wolf 🐺 OnChain_Analyst Educator C2.53K @0xDataWolf0 1 20 オリジナル >リリース後のPENDLEのトレンド中立

Data Wolf 🐺 OnChain_Analyst Educator C2.53K @0xDataWolf0 1 20 オリジナル >リリース後のPENDLEのトレンド中立 Neo Nguyen DeFi_Expert Educator B3.03K @Neoo_Nav

Neo Nguyen DeFi_Expert Educator B3.03K @Neoo_Nav Neo Nguyen DeFi_Expert Educator B3.03K @Neoo_Nav83 7 10.53K オリジナル >リリース後のPENDLEのトレンド中立

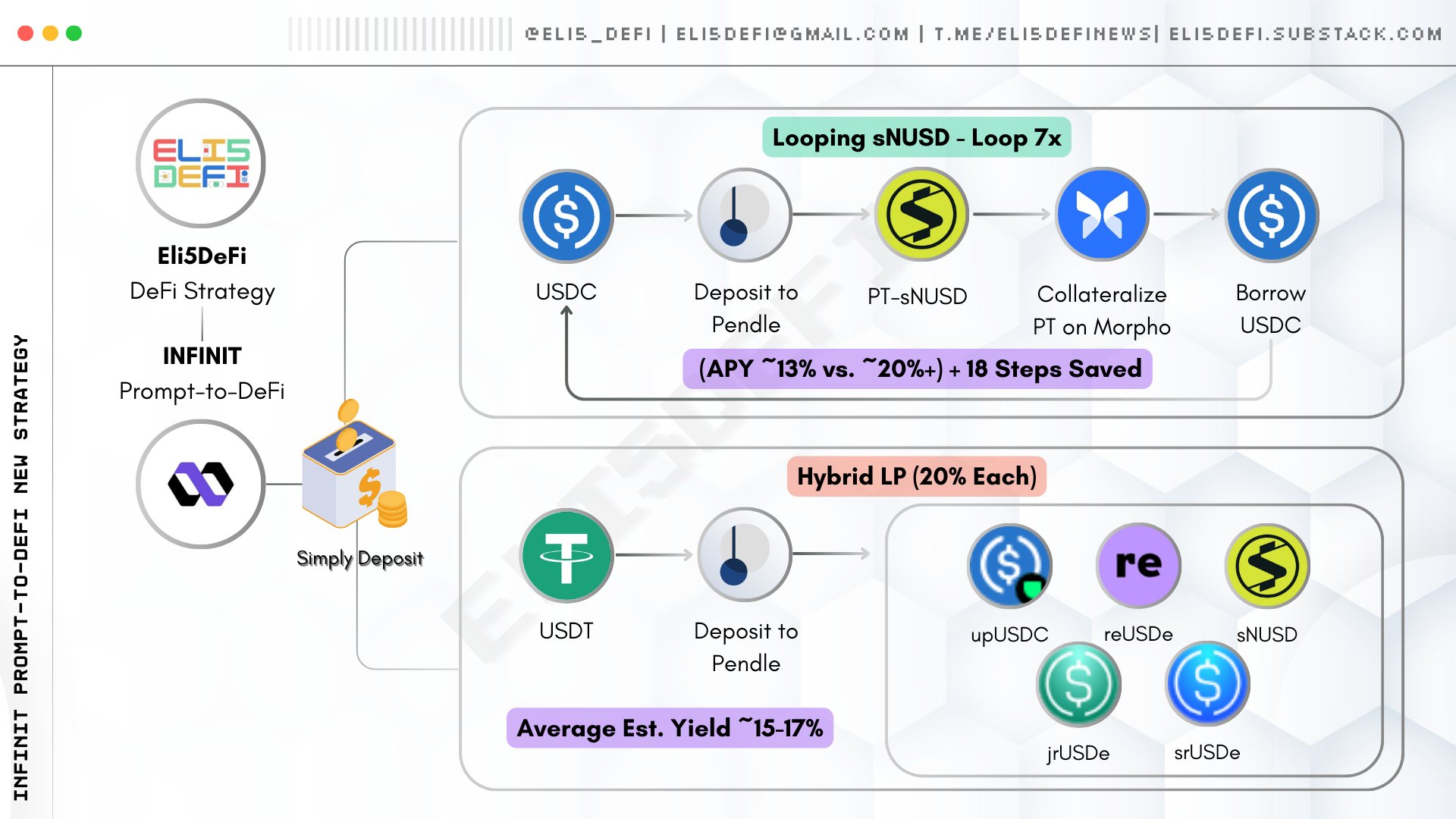

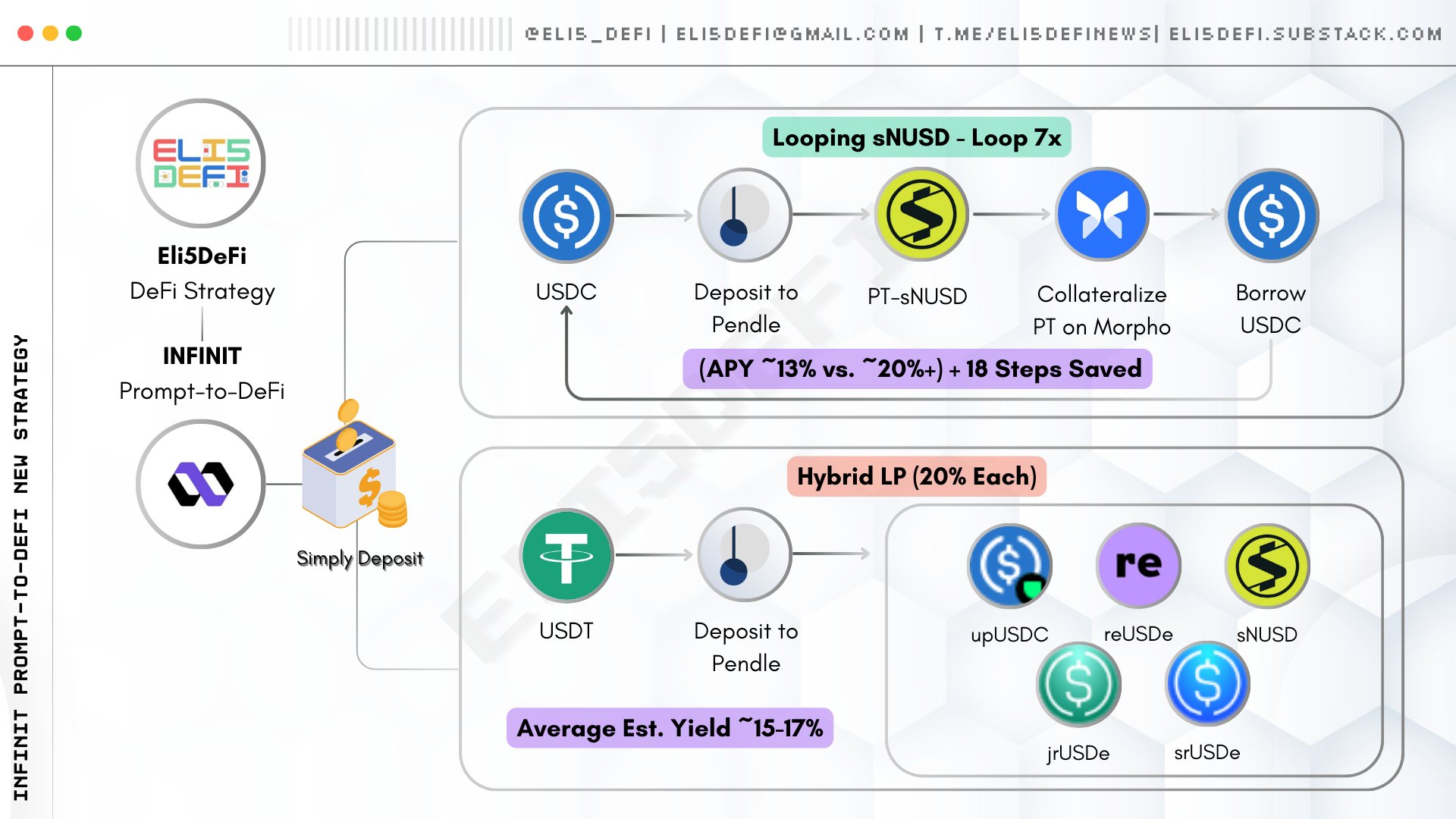

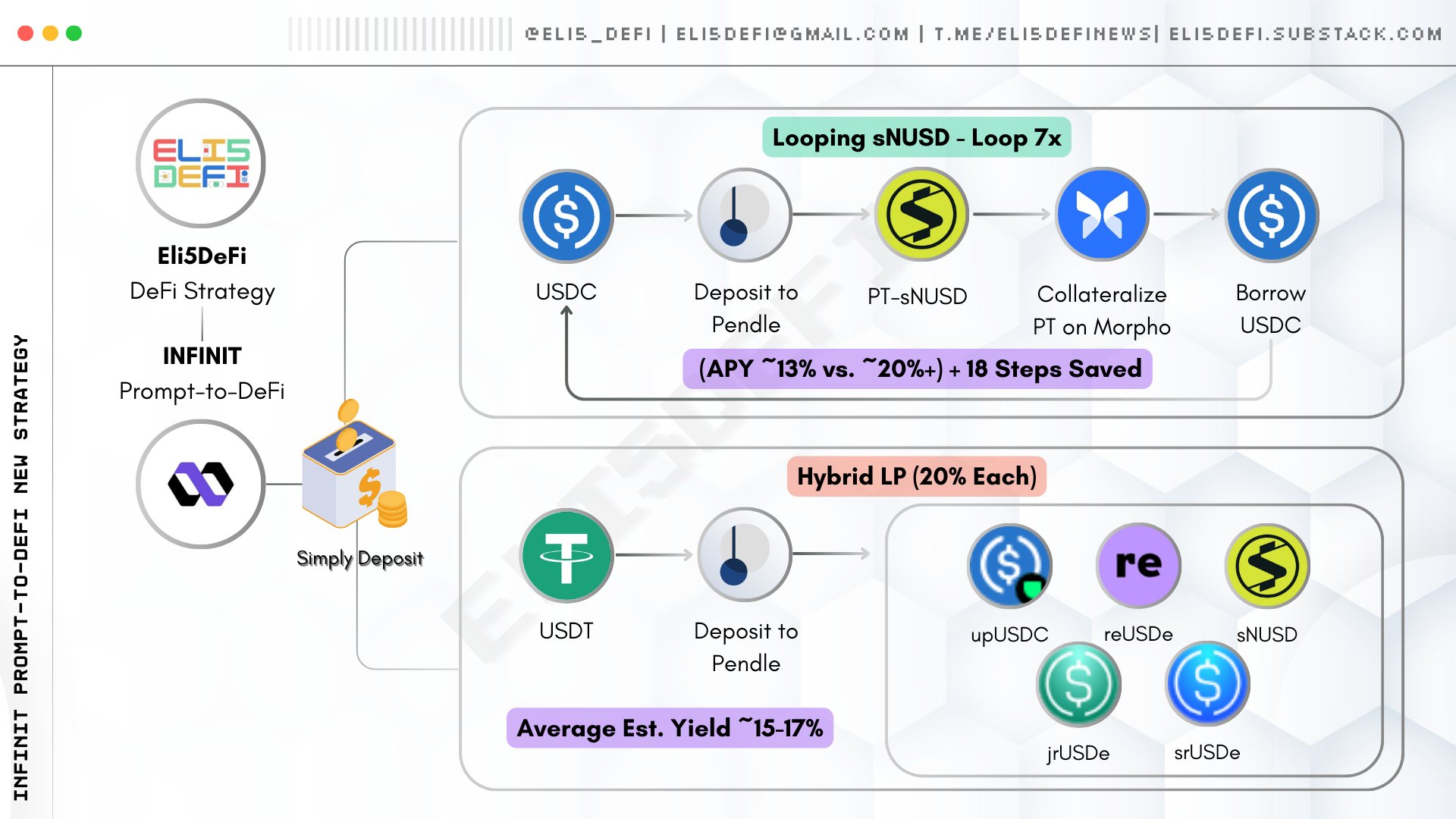

Neo Nguyen DeFi_Expert Educator B3.03K @Neoo_Nav83 7 10.53K オリジナル >リリース後のPENDLEのトレンド中立 Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi 101 50 2.80K オリジナル >リリース後のPENDLEのトレンド強気

101 50 2.80K オリジナル >リリース後のPENDLEのトレンド強気 Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi 101 50 2.80K オリジナル >リリース後のPENDLEのトレンド非常に強気

101 50 2.80K オリジナル >リリース後のPENDLEのトレンド非常に強気 Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi 101 50 2.80K オリジナル >リリース後のPENDLEのトレンド非常に強気

101 50 2.80K オリジナル >リリース後のPENDLEのトレンド非常に強気- リリース後のPENDLEのトレンド非常に弱気

The DeFi Investor 🔎 FA_Analyst DeFi_Expert B160.90K @TheDeFinvestor

The DeFi Investor 🔎 FA_Analyst DeFi_Expert B160.90K @TheDeFinvestor Alea Research D23.28K @AleaResearch

Alea Research D23.28K @AleaResearch 95 29 22.59K オリジナル >リリース後のPENDLEのトレンド強気

95 29 22.59K オリジナル >リリース後のPENDLEのトレンド強気- リリース後のPENDLEのトレンド弱気