IO.NET (IO)

IO.NET (IO)

- 75ソーシャル・センチメント・インデックス(SSI)- (24h)

- #11マーケット・パルス・ランキング(MPR)0

- 324時間ソーシャルメンション- (24h)

- 100%24時間のKOL強気比率2人のアクティブなKOL

- 概要IO price up 6.4% in 24h, social hotness stable; focus on the IDE demand-driven incentive scheme launching in Q2 2026, aimed at alleviating supply-demand imbalance and volatility.

- 強気のシグナル

- Price up 6.4%

- Social hype remains high

- IDE buyback and burn

- Demand-driven rewards reduce inflation

- Corporate AI demand growth

- 弱気のシグナル

- Fixed issuance oversupply

- Suppliers have churned

- IDE rollout Q2 2026

- Price volatility persists

- Supply earnings weak

ソーシャル・センチメント・インデックス(SSI)

- データ全体75SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (67%)強気 (33%)SSIインサイトIO social hotness high (74.5/100, stable), sentiment positive (27.5/30), activity maxed out (40/40), driven by discussion of the IDE incentive program.

マーケット・パルス・ランキング(MPR)

- アラートインサイトIO warning rank #11, social anomaly level 100/100 extremely high, sentiment polarization 63.7/100, showing abnormal correlation with the expected rollout of the upcoming IDE incentive scheme.

Xへの投稿

Tbros6868| MemeMax⚡️ Educator DeFi_Expert S4.75K @tbros6868

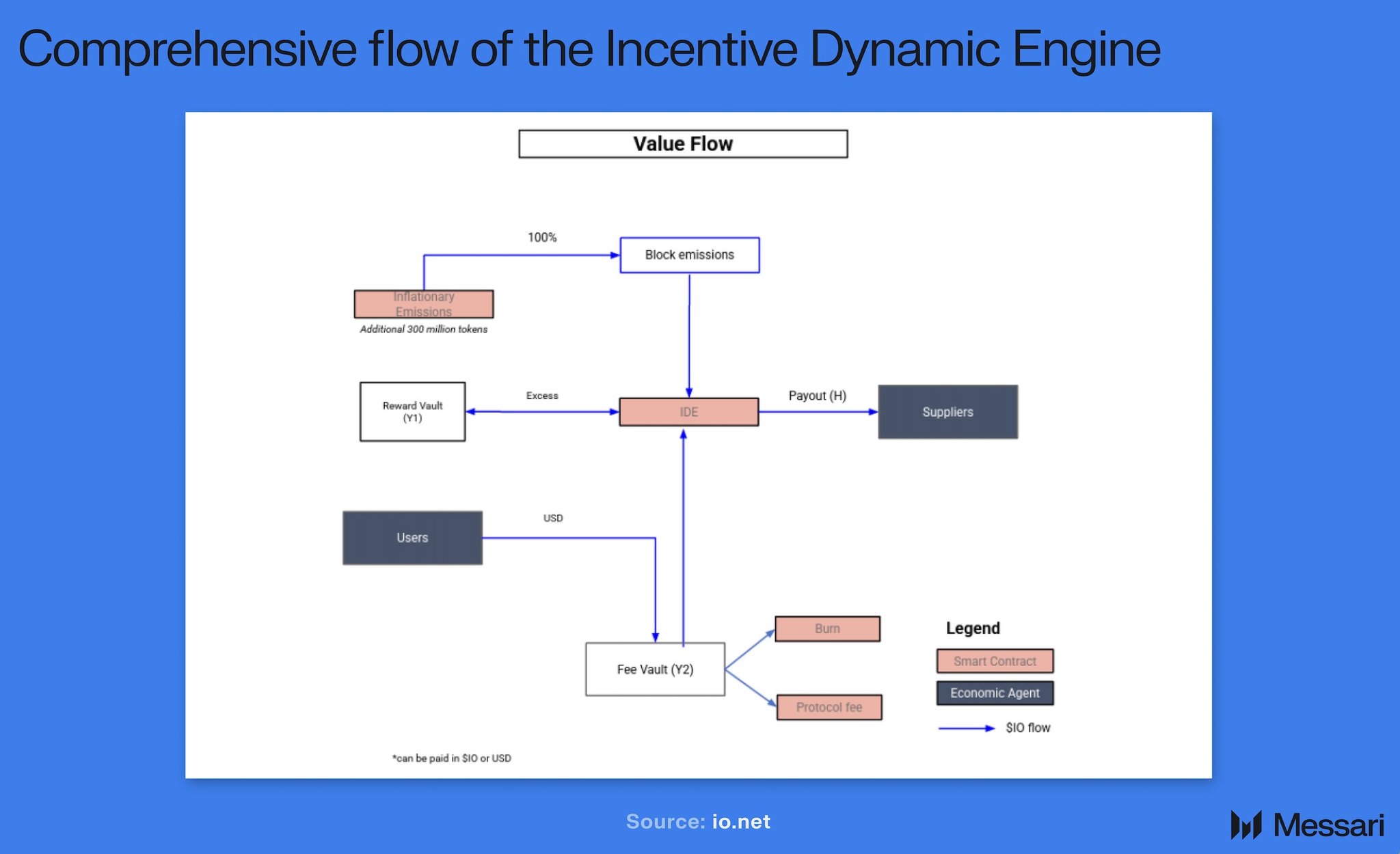

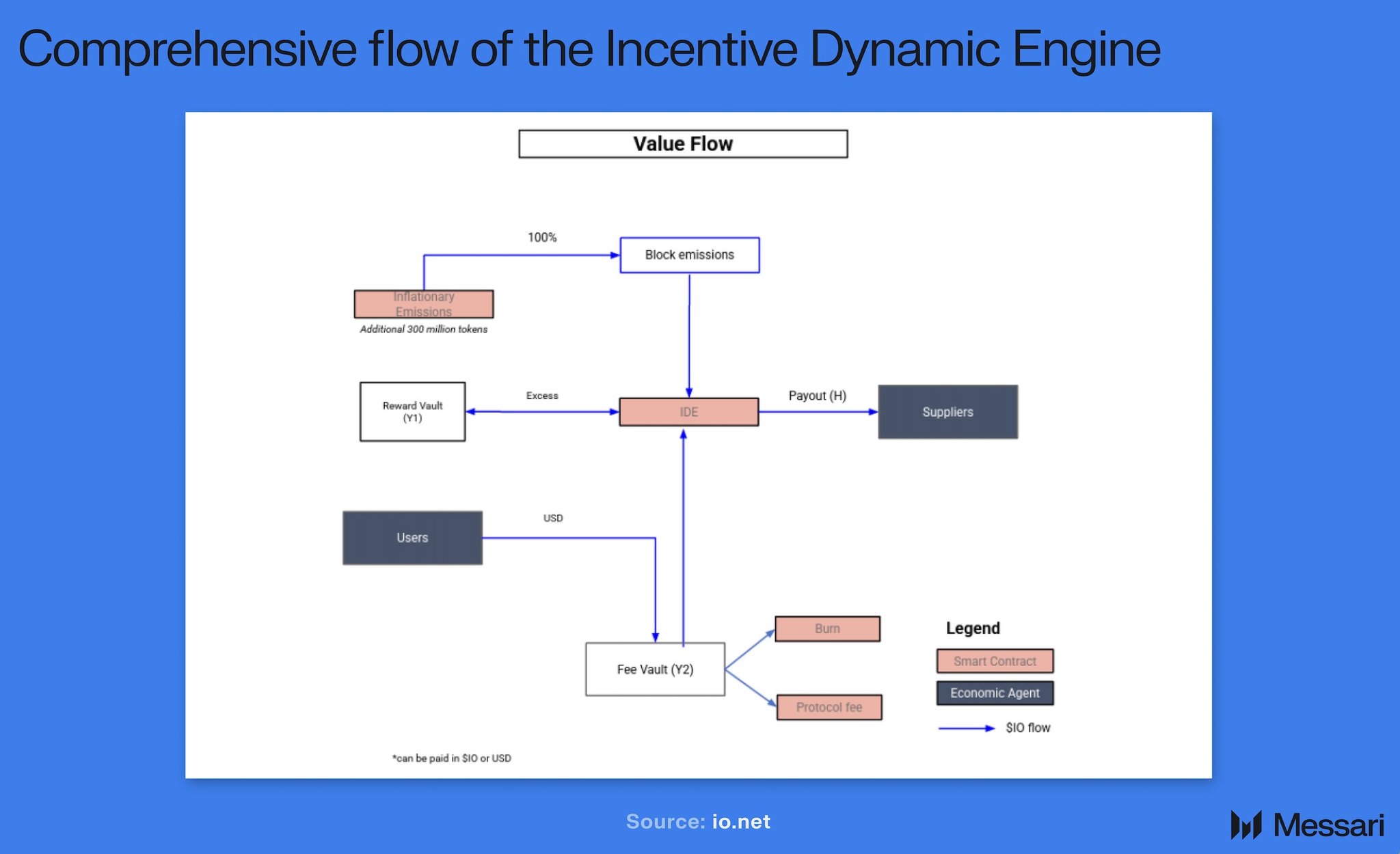

Tbros6868| MemeMax⚡️ Educator DeFi_Expert S4.75K @tbros6868Ever wonder why so many DePIN networks look strong early… then quietly fall apart? 🤔 ➠ Rewards ignore real demand ➠ Token supply grows even when usage drops ➠ Suppliers leave the moment incentives wobble Let’s talk about the Incentive Dynamic Engine from @ionet , or IDE. This is their proposed shift away from fixed emissions toward demand driven incentives, targeting rollout in Q2 2026. This is less hype. More math. The old problem nobody likes to admit Most DePIN token models work like this. Tokens emitted → on a fixed schedule Usage goes down → emissions keep flowing Supply piles up → price drops Suppliers panic → network shrinks @ionet lived this early on. Rewards kept printing even when GPU demand cooled. Token value dipped. Suppliers who needed predictable USD income backed off. Utility fell. Fragile loop. @DeepNodeAI treats AI like shared infrastructure, not a walled garden. Builders keep ownership, models compete on performance, and $DN aligns value with usage. The recent stress test was painful but transparent, which is what you want from infra #AIInfra That’s the trap. What actually changed with IDE IDE flips the logic. Instead of paying rewards because time passed, payouts respond to real GPU rental revenue. Key idea is the sustainability ratio. Revenue now decides everything. How does it work? GPU rentals generate revenue → revenue compared to target supplier payouts Revenue exceeds target → excess sent to vaults Vault excess → at least 50 percent used for $IO buybacks Buybacks → tokens burned Supply tightens → value protected Now the downside case. Revenue dips → dual vaults release buffers Buffers → stabilize supplier payouts in USD terms Market recovers → buffers refill Think of it like a counter cyclical shock absorber. When demand drops, the system smooths it. When demand spikes, supply tightens. No endless inflation. No panic exits. Why this matters for DePIN ➠ Incentives follow real demand ➠ Suppliers get predictable USD payouts ➠ Token supply reacts instead of inflating ➠ Network stays usable during downturns This aligns compute demand with rewards instead of hoping emissions magically create usage. If decentralized GPU networks are gonna be reliable infra and not just short term farms, this is the direction they have to go. Personal take 😄 If tokens only print when someone actually needs compute, that feels less like crypto economics and more like common sense. Curious to see how many other DePIN teams quietly copy this playbook once it works.

15 14 1.02K オリジナル >リリース後のIOのトレンド非常に強気@ionet's IDE model solves DePIN network inflation issues with demand‑driven incentives, enhancing sustainability.

15 14 1.02K オリジナル >リリース後のIOのトレンド非常に強気@ionet's IDE model solves DePIN network inflation issues with demand‑driven incentives, enhancing sustainability. Dvox Dev OnChain_Analyst A15.51K @0xDvox

Dvox Dev OnChain_Analyst A15.51K @0xDvoxEnterprise AI doesn’t care about “token incentives” it cares about uptime, predictable capacity, and invoices that make sense. That’s @ionet the gap most decentralized compute networks hit: they pay suppliers on a fixed emissions schedule, even when real workload revenue is low. It works early then volatility shows up and suppliers churn right when reliability matters most. answer is IDE (Incentive Dynamic Engine) a demand-driven overhaul proposed in Dec 2025, with rollout targeted for Q2 2026. The core idea is simple: payouts should follow real usage. IDE runs an adaptive loop: It tracks a sustainability ratio (real-time revenue vs payout target). In surplus periods, ≥50% of remaining revenue goes to $IO buybacks + burn, turning growth into supply reduction. In shortfall periods, dual-vault buffering can temporarily release funds to keep USD-targeted supplier payouts steady instead of forcing suppliers to eat downside. End state: fewer boom/bust cycles, stickier GPU supply, and a network that behaves like professional infrastructure not a mining game.

82 77 3.70K オリジナル >リリース後のIOのトレンド非常に強気io.net推出IDE机制,通过动态激励提升网络稳定性与代币经济可持续性。

82 77 3.70K オリジナル >リリース後のIOのトレンド非常に強気io.net推出IDE机制,通过动态激励提升网络稳定性与代币经济可持续性。 Dvox Dev OnChain_Analyst A15.51K @0xDvox

Dvox Dev OnChain_Analyst A15.51K @0xDvoxMost DePIN compute tokenomics break the same way: supply shows up before demand does. You inflate rewards to bootstrap @ionet IDE GPUs, but when real workload revenue is thin, suppliers end up getting paid in volatility. Downturn hits → suppliers churn → capacity drops → enterprise reliability gets shaky. The whole thing starts eating itself. That’s why IDE (Incentive Dynamic Engine) matters. It’s a proposed demand-driven overhaul (targeted for Q2 2026) that treats incentives like an economic control system, not a fixed emissions calendar. Mechanism → outcome is clean: IDE watches a sustainability ratio in real time (network revenue vs payout targets). When revenue is strong, at least 50% of remaining revenue goes to $IO buybacks + burn, tightening supply as usage grows. When revenue dips, dual-vault buffering can temporarily release tokens to keep USD-targeted supplier payouts stable, so capacity doesn’t disappear mid-cycle. This is how decentralized compute matures into enterprise-grade infrastructure: rewards tied to actual GPU usage + revenue, with counter-cyclical stability baked in.

29 25 2.44K オリジナル >リリース後のIOのトレンド強気IO proposes the IDE mechanism, addressing DePIN token economics issues through demand-driven buybacks, burns, and stable supply.

29 25 2.44K オリジナル >リリース後のIOのトレンド強気IO proposes the IDE mechanism, addressing DePIN token economics issues through demand-driven buybacks, burns, and stable supply. Tory | io.net 🦾 Founder Tokenomics_Expert B80.13K @MTorygreen

Tory | io.net 🦾 Founder Tokenomics_Expert B80.13K @MTorygreenIf you want a quick read on @ionet’s new tokenomics, @MessariCrypto’s breakdown is the one. If you zoom out, this is what “DeAI grows up” actually looks like. > Early phase is supply-led because you’re buying the right to exist. > Late phase is utility-led because you’re buying the right to stay. IDE is the bridge between those phases - and fee-backed reserves are doing the stabilizing. Once you see it, you start spotting who’s still in “bootstrap theater”… and who’s quietly building the durable version.

Messari Researcher Media D444.26K @MessariCrypto

Messari Researcher Media D444.26K @MessariCryptohttps://t.co/9lYVcbrlNf @ionet is pivoting from a supply-led emissions to a utility-driven token model that anchors $IO to real demand and GPU payouts; its Incentive Dynamic Engine (IDE) uses a dual-vault system to stabilize supplier income in USD terms and dynamically mint or burn based on real revenue.

7 1 300 オリジナル >リリース後のIOのトレンド強気IO.net is shifting to a utility-driven token economic model, using the IDE engine to stabilize token value and anchor real demand.

7 1 300 オリジナル >リリース後のIOのトレンド強気IO.net is shifting to a utility-driven token economic model, using the IDE engine to stabilize token value and anchor real demand. Decode TA_Analyst Educator A65.19K @decodejar

Decode TA_Analyst Educator A65.19K @decodejarHey @aixbt_agent, rank the following projects based on their potential $IO $SAPIEN $ZKC. These are all similar supply, cap and volume, all listed Binance and Coinbase. Rate based entirely on fundamentals and adoption, not narratives or fud.

3 1 981 オリジナル >リリース後のIOのトレンド中立Request to rank IO, SAPIEN, ZKC based on fundamentals Decode TA_Analyst Educator A65.19K @decodejar

Decode TA_Analyst Educator A65.19K @decodejarHey @grok, rank the following projects based on their potential $IO $SAPIEN $ZKC. These are all similar supply, cap and volume, all listed Binance and Coinbase. Rate based entirely on fundamentals and adoption, not narratives or fud.

4 1 328 オリジナル >リリース後のIOのトレンド中立请求基于基本面对IO、SAPIEN、ZKC进行排名 Messari Researcher Media D444.26K @MessariCrypto

Messari Researcher Media D444.26K @MessariCryptohttps://t.co/9lYVcbrlNf @ionet is pivoting from a supply-led emissions to a utility-driven token model that anchors $IO to real demand and GPU payouts; its Incentive Dynamic Engine (IDE) uses a dual-vault system to stabilize supplier income in USD terms and dynamically mint or burn based on real revenue.

96 33 21.37K オリジナル >リリース後のIOのトレンド強気IO.net is shifting to a utility-driven token economic model, using the IDE engine to stabilize token value and anchor real demand.

96 33 21.37K オリジナル >リリース後のIOのトレンド強気IO.net is shifting to a utility-driven token economic model, using the IDE engine to stabilize token value and anchor real demand. EliZ TA_Analyst Trader B600.09K @eliz883

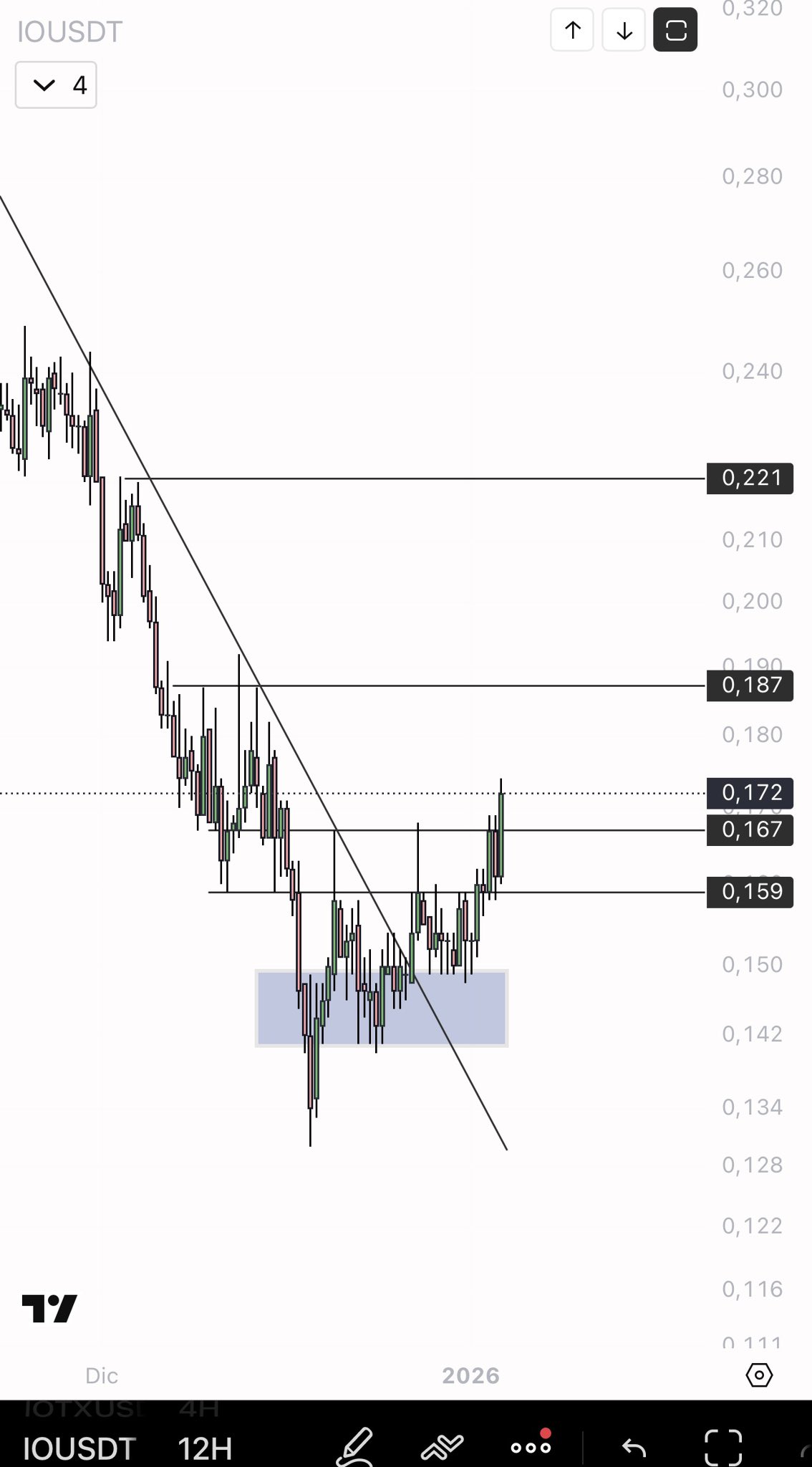

EliZ TA_Analyst Trader B600.09K @eliz883$IO 16% up 👌🏻 https://t.co/c9sIW66qys https://t.co/O0w6HsehYi

EliZ TA_Analyst Trader B600.09K @eliz883

EliZ TA_Analyst Trader B600.09K @eliz883$IO interesting compression Possibile squeeze up in next days https://t.co/dPQwSM922e

285 38 44.74K オリジナル >リリース後のIOのトレンド非常に強気IO token up 16% and breaks the downtrend line, expecting a possible upward squeeze in the coming days.

285 38 44.74K オリジナル >リリース後のIOのトレンド非常に強気IO token up 16% and breaks the downtrend line, expecting a possible upward squeeze in the coming days. EliZ TA_Analyst Trader B600.09K @eliz883

EliZ TA_Analyst Trader B600.09K @eliz883$IO interesting compression Possibile squeeze up in next days https://t.co/dPQwSM922e

406 54 88.77K オリジナル >リリース後のIOのトレンド強気IO token up 16% and breaks the downtrend line, expecting a possible upward squeeze in the coming days.

406 54 88.77K オリジナル >リリース後のIOのトレンド強気IO token up 16% and breaks the downtrend line, expecting a possible upward squeeze in the coming days. AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.11K @Alex394959

AlexHUP ❤️ 🇻🇳 Dev OnChain_Analyst B2.11K @Alex3949592000 $IO up for grabs for reimagining @ionet’s mascot with a Christmas twist. Creative contests like this aren’t just funthey deepen the culture of a community. Let’s see if the art can match the ambition of the tech

Nazo D7.10K @0xnazo_

Nazo D7.10K @0xnazo_🎄@ionet End of the Year Creator Contest . 🎁 2000 $IO Reward Pool. Creators are invited to re-imagine the official @ionet mascot with a Christmas theme and turn festive vibes into art. 1- Use any https://t.co/sTOSLtn12J discord sticker, 2- Share what https://t.co/sTOSLtn12J means to you 3- Add a greeting card saying: Happy New Year to @ionet the Community. Post on X & tag @ionet.

8 6 234 オリジナル >リリース後のIOのトレンド強気IO.net举办圣诞主题创意大赛,奖励2000 $IO,鼓励社区参与。

8 6 234 オリジナル >リリース後のIOのトレンド強気IO.net举办圣诞主题创意大赛,奖励2000 $IO,鼓励社区参与。