ChainOpera AI (COAI)

ChainOpera AI (COAI)

- 33ソーシャル・センチメント・インデックス(SSI)-40.54% (24h)

- #131マーケット・パルス・ランキング(MPR)-43

- 124時間ソーシャルメンション-50.00% (24h)

- 0%24時間のKOL強気比率1人のアクティブなKOL

- 概要COAI price up 8%, high holding concentration, low liquidity, AI infrastructure partnership provides upside.

- 強気のシグナル

- Price up 8%

- OBV accumulates

- Lit protocol partnership

- AI prediction market launched

- Participating in NeurIPS research

- 弱気のシグナル

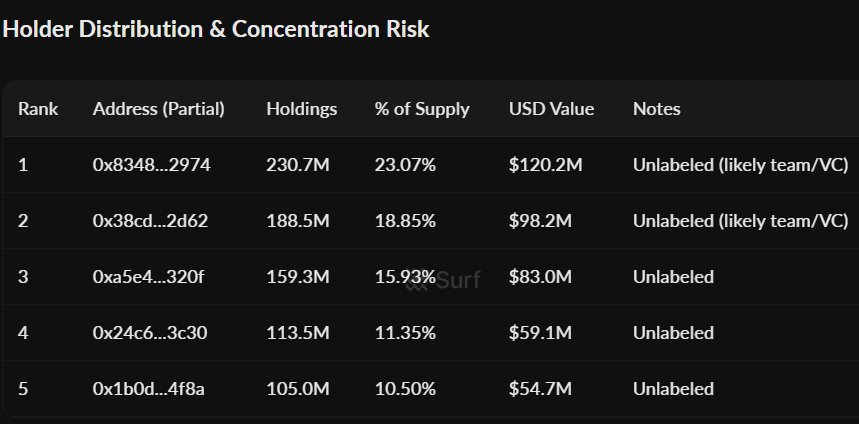

- Top 5 wallets hold 79.7%

- DEX liquidity is 0

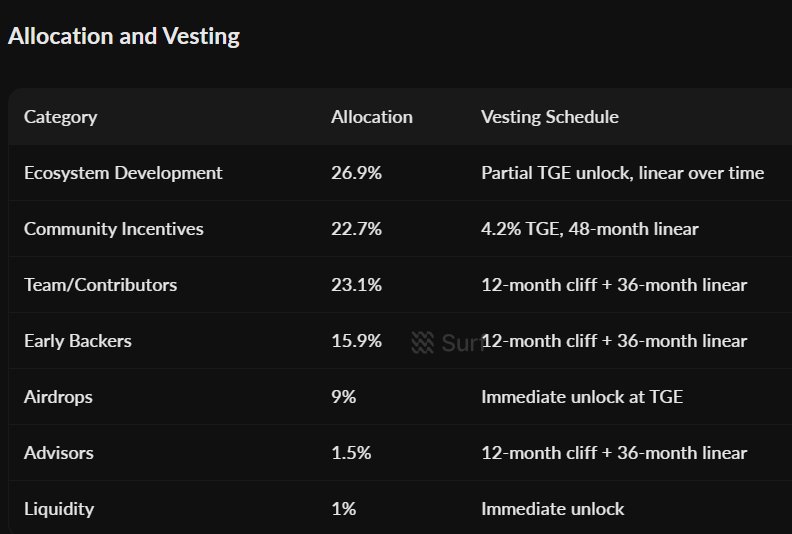

- Supply unlocks 36% in 2026

- Social heat declining

- High concentration risk

ソーシャル・センチメント・インデックス(SSI)

- データ全体33SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布弱気 (100%)SSIインサイトCOAI social heat is low (33/100, -40.5%), activity down 56% and KOL attention down 62%, positive sentiment up 66% correlates with 8% price gain and AI partnership benefits.

マーケット・パルス・ランキング(MPR)

- アラートインサイトCOAI warning rank fell to #131 (↓43), social anomaly dropped 61% to 38.8, sentiment polarization rose to 50, corresponding to liquidity depletion and 79.7% concentration risk.

Xへの投稿

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX🚨 #COAI: The AI L1 Token With 79.7% Held by 5 Wallets, Innovation or Imminent Breakdown? 🚨 #ChainOpera AI’s #COAI token is one of the most paradoxical projects in the AI-crypto sector: cutting-edge AI infrastructure built on BNB Chain… paired with some of the highest concentration risk in the entire market. #COAI trades around $0.53 with a $103M market cap, but here’s the real shock: 👉 Top 5 holders control 79.7% of all circulating supply 👉 Top 100 hold 94% 👉 0 active DEX liquidity pools on PancakeSwap or any major BNB DEX This means price discovery happens almost entirely on centralized exchanges, leaving the token vulnerable to single-wallet sell pressure and liquidity shocks, especially with ~36% of total supply unlocking in early 2026 after a 1-year cliff. Yet, the fundamentals shouldn’t be ignored: > Lit Protocol partnership (Dec 2) > Prediction-market & financial-advisor AI agents live > NeurIPS 2025 research participation > Strong OBV divergence suggesting quiet accumulation despite the 51.7% monthly drawdown The big picture: #COAI sits at the intersection of real AI infrastructure progress and extreme token-economic fragility. For abnormal AI traders, this is a classic high-risk, high-volatility setup: strong narrative, strong roadmap but a supply structure that can snap the chart in half at any moment.

4 0 486 オリジナル >リリース後のCOAIのトレンド弱気COAI project's fundamentals are strong but the token is highly concentrated and illiquid, facing high risk and potential collapse.

4 0 486 オリジナル >リリース後のCOAIのトレンド弱気COAI project's fundamentals are strong but the token is highly concentrated and illiquid, facing high risk and potential collapse. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto$COAI bears look exhausted for now Should move inside this range for a while Until the market decides which direction it takes https://t.co/Ein7Y2F5XG

75 21 5.23K オリジナル >リリース後のCOAIのトレンド中立COAI bearish pressure is weakening, expected to consolidate within the current range.

75 21 5.23K オリジナル >リリース後のCOAIのトレンド中立COAI bearish pressure is weakening, expected to consolidate within the current range. Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

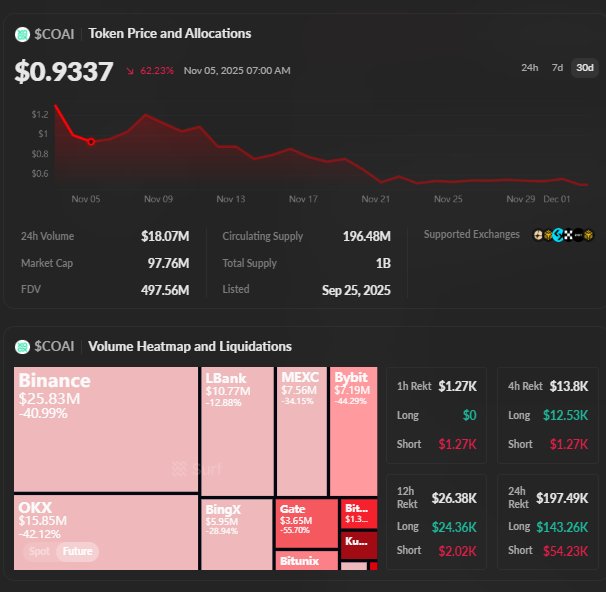

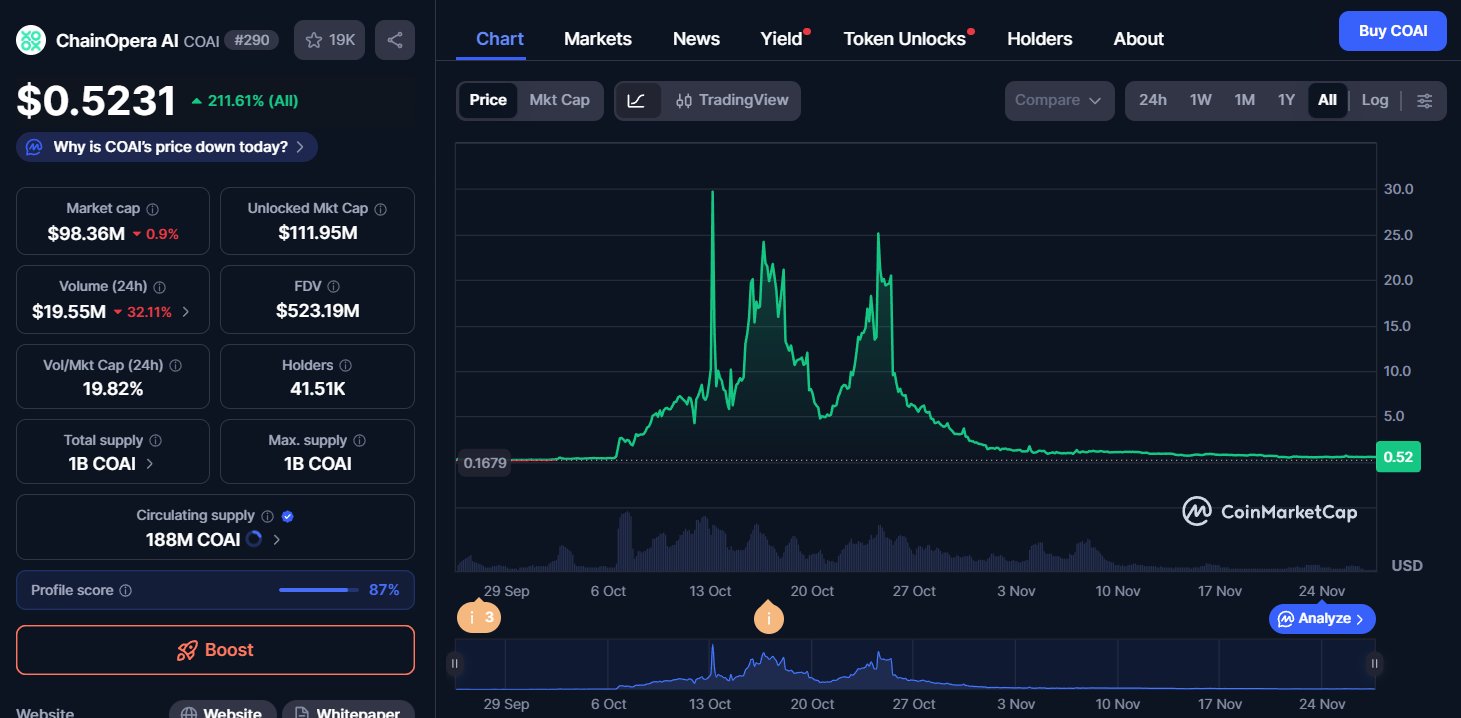

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX🔥 #COAI’s 96% Collapse: The AI Token With the Most Dangerous Red Flags of 2025?🔥 #ChainOpera AI (COAI) is one of 2025’s most alarming AI-crypto cases, a project with big tech ambition but catastrophic token risk signals. After hitting an ATH of $43.81, #COAI collapsed 96%, now trading near $0.49 despite claiming 3M+ users and $17M VC backing. The core red flag is unprecedented concentration: > Top 10 wallets control 94.1% of supply > Top 20 wallets control 97.5% > This level of centralization is almost unheard-of, enabling extreme price manipulation and existential liquidity risk. Additional warning signs intensify the concerns: > Zero organic community despite 467k followers -> engagement appears artificial. > Opaque governance & “black-box” AI models flagged by analysts as potential manipulation vectors. > 80% of supply locked, with a long unlock schedule creating ongoing sell-pressure for years. > Despite claiming to be a new L1, all real activity occurs on BNB Chain, no separate chain implementation is visible. Yet, the team continues active development: AI agents, prediction markets, enterprise partnerships, and academic conference participation. #COAI showcases strong technological ambition but severe structural risks. Until governance transparency and token distribution issues are addressed, #COAI remains an extremely high-risk exposure despite its innovation potential.

6 0 364 オリジナル >リリース後のCOAIのトレンド非常に弱気COAI has plummeted 96% due to structural risks such as high concentration and opaque governance, and now faces extremely high risk.

6 0 364 オリジナル >リリース後のCOAIのトレンド非常に弱気COAI has plummeted 96% due to structural risks such as high concentration and opaque governance, and now faces extremely high risk. Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

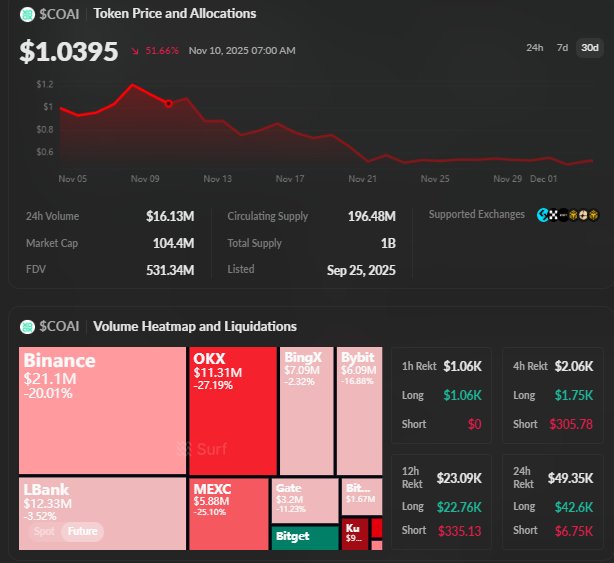

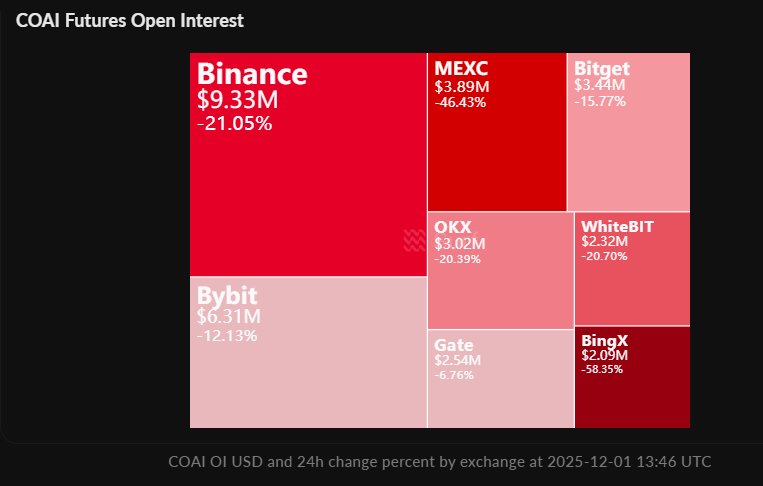

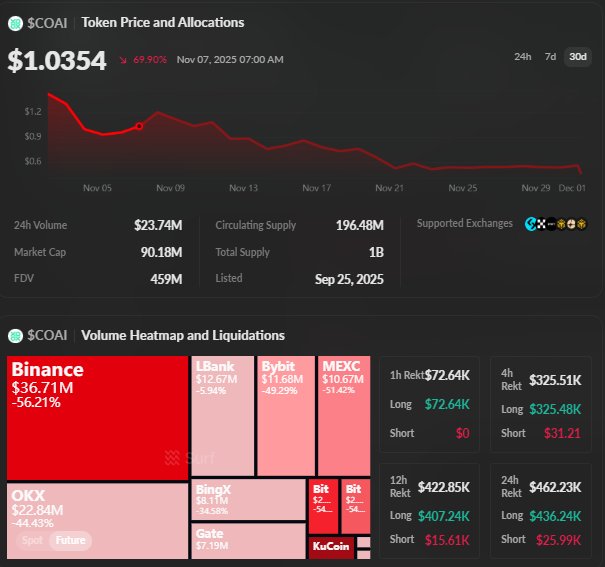

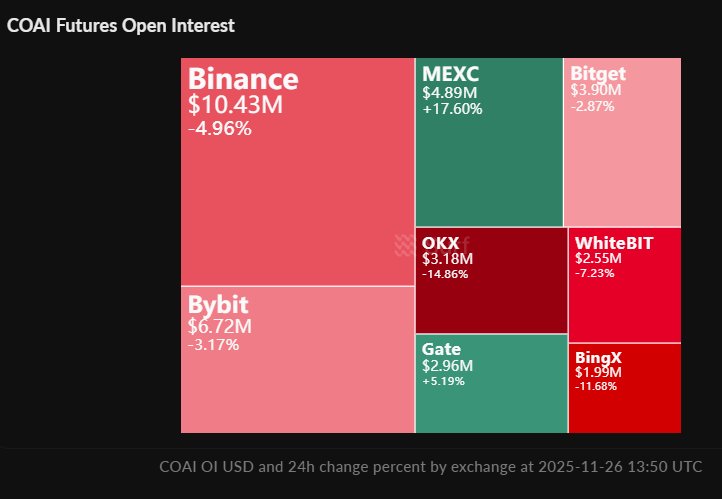

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX$COAI Tanks 65%, Top 10 Whales Control 77%! #ChainOperaAI ( $COAI ) collapses 65% in 30 days to $0.52, despite strong team, $17M funding, and multi exchange listings. Extreme whale dominance (77% of supply) and upcoming token unlocks fuel panic. Oversold technicals and positive AI blockchain hype may spark a short term bounce. Key Metrics: Market Cap: $102M | Circulating Supply: 19.6% Support: $0.45 to $0.48 | Resistance: $0.60 to $0.63 Open Interest: $35M (-27%), Funding slightly positive Watch: Can $COAI hold $0.45 ahead of December unlocks, or crash further toward $0.38?

4 0 722 オリジナル >リリース後のCOAIのトレンド弱気COAI plummets 65% due to whale control and token unlock panic, watch the $0.45 support level.

4 0 722 オリジナル >リリース後のCOAIのトレンド弱気COAI plummets 65% due to whale control and token unlock panic, watch the $0.45 support level. Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX🚨 #ChainOpera AI Is Bleeding Out But Whales Are Betting Big. What’s Really Happening? ChainOpera AI (#COAI) just dropped -14% in 24h and now sits at $0.458, a brutal fall from its $43.81 ATH. But beneath the red candles is one of the most extremeand risky, AI token structures on the market. 🔥 Top Insights 1. Insane Centralization: > The top 10 wallets control 94.4% of circulating supply. The largest holder alone owns 23% (~$105M). This is manipulation-level concentration rarely seen in major AI tokens. 2. Bearish Technicals: > RSI: 27–39 -> deeply oversold > Price trading below all EMAs -> confirmed downtrend > Strong liquidation cluster under $0.456, pressure building 3. Social Sentiment Turns Negative: > Community sentiment flipped bearish after the crash. Allegations surfaced around team token sales and project abandonment but were denied and blamed on cloud outages. Yet… Development Is Active: > AI Terminal + PrediMarket Agent launched > 1M+ daily active users > Partnerships: OKX Wallet, BNB Chain, EigenLayer, Google Cloud, Microsoft Azure ⚠️ Why It Matters > #COAI is a high-risk, high-potential AI-L1 play: real utility, big partnerships but the centralization + volatility + bearish structure make it a whale-controlled battlefield right now.

4 1 251 オリジナル >リリース後のCOAIのトレンド弱気COAI price crash, due to extreme centralization and bearish technicals, high risk.

4 1 251 オリジナル >リリース後のCOAIのトレンド弱気COAI price crash, due to extreme centralization and bearish technicals, high risk. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @TryrexcryptoAnd.... $COAI DUMPED 😅 Another fakeout Really a scam coin. It will pump one day... when everyday will have forgotten about it https://t.co/Y6dvguJ4Vt

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto$COAI is waking up If bulls manage to get a daily close around 0.65$ like here this is good news for them We don't have a confirmation yet though and I wouldn't trade this coin now though. Could be a fakeout. https://t.co/7tiBKOABra

107 26 23.83K オリジナル >リリース後のCOAIのトレンド弱気The author considers COAI a scam coin, recent rise may be a false breakout, and does not recommend trading.

107 26 23.83K オリジナル >リリース後のCOAIのトレンド弱気The author considers COAI a scam coin, recent rise may be a false breakout, and does not recommend trading. Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto

Tryrex Trader TA_Analyst S21.29K @Tryrexcrypto$COAI is waking up If bulls manage to get a daily close around 0.65$ like here this is good news for them We don't have a confirmation yet though and I wouldn't trade this coin now though. Could be a fakeout. https://t.co/7tiBKOABra

163 35 45.12K オリジナル >リリース後のCOAIのトレンド中立COAI shows signs of waking up, but the break above $0.65 is unconfirmed; beware of a fake breakout.

163 35 45.12K オリジナル >リリース後のCOAIのトレンド中立COAI shows signs of waking up, but the break above $0.65 is unconfirmed; beware of a fake breakout. Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX🚨 “The AI Layer-1 With $17M Funding… But 94% Controlled by 10 Wallets?” The Most Contradictory AI Chain You’ll See This Cycle (COAI Breakdown) 🚨 #ChainOpera AI (#COAI) is one of the rare AI-native Layer-1 blockchains actually shipping real infrastructure, yet its on-chain reality looks nothing like its enterprise image. 🔥 Why COAI Is a Serious Contender > Full-stack AI chain (AI Terminal, agent network, federated GPU marketplace). > Team includes an IEEE Fellow, ex-Meta/Amazon/Google researchers. > $17M VC backing (Finality, Road Capital, IDG). > Strong enterprise traction with Samsung, Toyota, Amazon, Qualcomm. This is not your typical AI-token vaporware. ⚠️ But Here’s the Abnormal Insight 1. 94.1% of all supply sits in 10 wallets. → One of the highest concentration risks across all AI tokens. 2. Extreme drawdown: –98% from ATH, yet whales added +26% during the correction. The mismatch between fundamentals and token structure is massive. 📉 Market Setup > Trading near long-term capitulation zone. > $0.491 = critical support. > Break above $0.552 = early trend reversal #COAI is a high-risk, high-potential asymmetric play: elite team + real AI infra vs. dangerous centralization and thin liquidity. Suitable only for investors who know how to size volatile AI L1 bets responsibly.

7 2 990 オリジナル >リリース後のCOAIのトレンド中立COAI is a high-risk, high-potential AI Layer-1 with a strong team and funding, but it faces risks of high centralization and a steep price decline.

7 2 990 オリジナル >リリース後のCOAIのトレンド中立COAI is a high-risk, high-potential AI Layer-1 with a strong team and funding, but it faces risks of high centralization and a steep price decline. Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX

Abnormal AI Tokenomics_Expert FA_Analyst A1.16K @AbnormalAIX🚀 #ChainOperaAI ( $COAI ) – 98% Crash, Bounce Incoming? $COAI has crashed -90% from its October ATH to $0.52, with top 5 wallets controlling nearly 80% of supply. The token suffers from limited liquidity and a futures first listing strategy, leaving retail access scarce and driving speculative volatility. Recent price action shows oversold conditions, hinting at a potential rebound if the $0.535 resistance is reclaimed. Key points: Market Cap: $102M | FDV: $520M Circulating Ratio: 19.6%, extreme scarcity Exchange Presence: Futures heavy, minimal SPOT, high slippage on DEX Unlock Schedule: 800M+ tokens unlocking by 2026, potential dump risk Technical Signals: MACD bullish divergence, oversold RSI, early accumulation signs Takeaway: $COAI is a high risk, high reward AI Web3 play, attractive only for sophisticated investors who can handle extreme volatility and concentration risk. A reclaim above $0.535 could trigger a short term bounce, but structural risks remain significant.

9 4 1.19K オリジナル >リリース後のCOAIのトレンド弱気COAI has experienced a 90% crash, with short‑term rebound signs, but faces high concentration and structural risks.

9 4 1.19K オリジナル >リリース後のCOAIのトレンド弱気COAI has experienced a 90% crash, with short‑term rebound signs, but faces high concentration and structural risks. Crypto En Afrique Educator FA_Analyst B4.04K @CryptoEnAfrique

Crypto En Afrique Educator FA_Analyst B4.04K @CryptoEnAfriqueIn the end it ended so sadly on $COAI, not even a hopeful rebound to give a chance to exit! https://t.co/TyAEgZ1zJh

14 3 1.04K オリジナル >リリース後のCOAIのトレンド非常に弱気The COAI price crashed with no rebound, and the author feels desperate.

14 3 1.04K オリジナル >リリース後のCOAIのトレンド非常に弱気The COAI price crashed with no rebound, and the author feels desperate.

- データなし