Yei Finance (CLO)

Yei Finance (CLO)

- 39ソーシャル・センチメント・インデックス(SSI)- (24h)

- #57マーケット・パルス・ランキング(MPR)0

- 124時間ソーシャルメンション- (24h)

- 100%24時間のKOL強気比率1人のアクティブなKOL

- 概要CLO is regarded as a DeFi pioneer on Sei, with a 400% increase supported by Sei Labs, but down 2.73% in 24h.

- 強気のシグナル

- DeFi pioneer on Sei

- 400% increase since listing

- Incubated by Sei Labs

- Native Sei ecosystem

- Supported by TakaraLend and others

- 弱気のシグナル

- 24h down 2.73%

- Price pullback risk

- Single ecosystem dependency

- High valuation may correct

- Social hype not increased

ソーシャル・センチメント・インデックス(SSI)

- データ全体39SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (100%)SSIインサイトCLO social hotness is medium (38.83/100), sentiment max (+100%) but activity low (5.83/40) and KOL attention only 3/30, not affected by 24h pullback.

マーケット・パルス・ランキング(MPR)

- アラートインサイトCLO warning rank #57, sentiment polarization 100/100 is high, social anomalies and KOL shift are low, linked to 24h price pullback.

Xへの投稿

andrew.moh FA_Analyst Educator B53.38K @andrewmoh

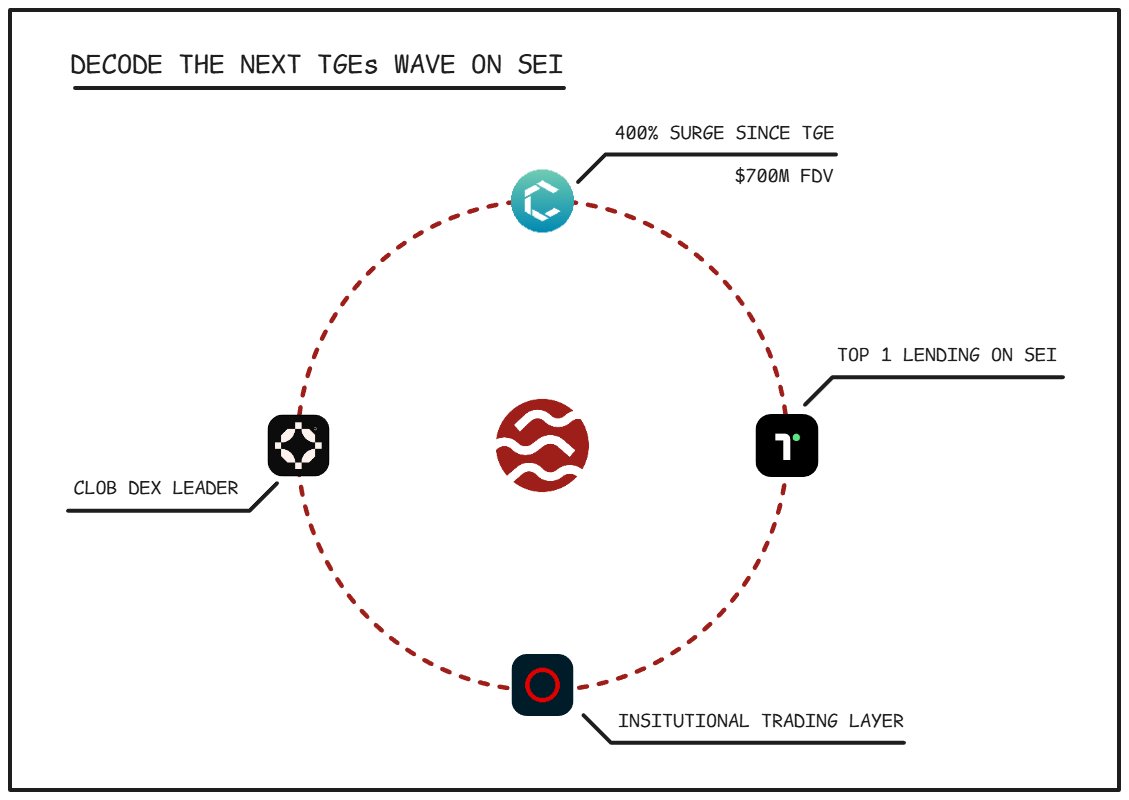

andrew.moh FA_Analyst Educator B53.38K @andrewmohWhy $CLO may serve as the pioneer of DeFi on @SeiNetwork? Take a look at how Clovis was formed: + Clovis is developed by @YeiFinance, which was once a leading lending protocol on Sei. + Yei soon grows with a new vision - becoming the ultimate DeFi hub on Sei. + Clovis serves as the unified liquidity layer that powers lending, swapping, bridging, and earning to ensure no assets sit idle. The 400% surge of CLO (since launch) is pushed by being native on Sei and incubated by @Sei_Labs. Thus, you may want to shift the focus more in the Sei's native ecosystem, protocols like: + @TakaraLend - for the largest lending market + @MonacoOnSei - for institutional finance + @oxiumxyz - for CLOB DEX TGEs move faster on Sei. ($/acc)

130 94 31.10K オリジナル >リリース後のCLOのトレンド非常に強気CLO, as a pioneer of DeFi on Sei, has risen 400%, and Sei ecosystem projects are developing rapidly.

130 94 31.10K オリジナル >リリース後のCLOのトレンド非常に強気CLO, as a pioneer of DeFi on Sei, has risen 400%, and Sei ecosystem projects are developing rapidly. Sjuul | AltCryptoGems TA_Analyst Media C477.19K @AltCryptoGems

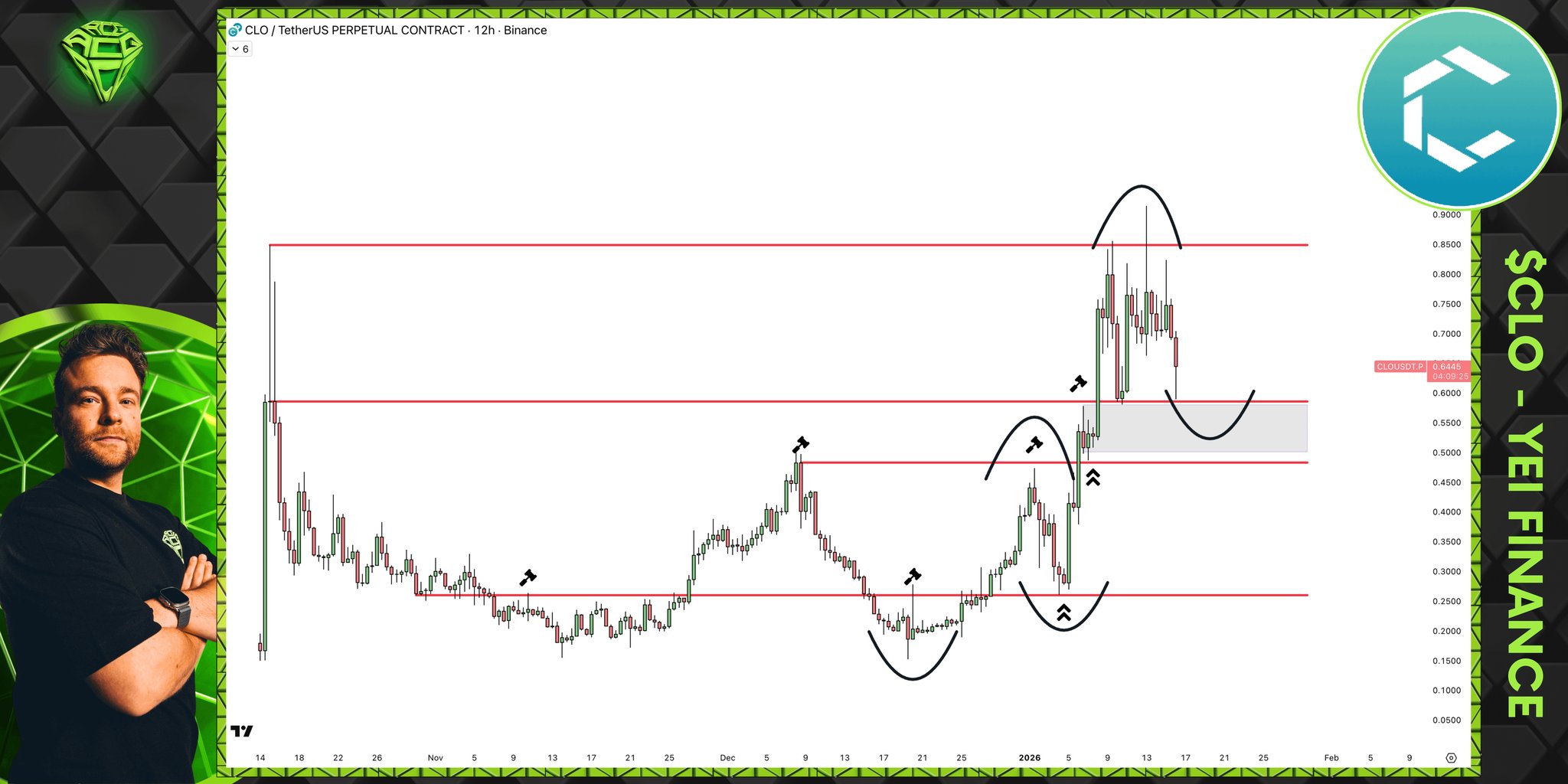

Sjuul | AltCryptoGems TA_Analyst Media C477.19K @AltCryptoGems$CLO chart is still looking really promising. 📈 We've got some initial resistance at the ATH level, but now the price is chilling and consolidating within the latest resistance level, which has now flipped into support and could be the next potential breakout level. 💪 As long we chill here, we should be good to go! ✨

474 17 28.25K オリジナル >リリース後のCLOのトレンド非常に強気CLO price is consolidating below its ATH, with the former resistance now acting as support, expected to trigger a new breakout.

474 17 28.25K オリジナル >リリース後のCLOのトレンド非常に強気CLO price is consolidating below its ATH, with the former resistance now acting as support, expected to trigger a new breakout. Sjuul | AltCryptoGems TA_Analyst Media C477.19K @AltCryptoGems

Sjuul | AltCryptoGems TA_Analyst Media C477.19K @AltCryptoGemsExcellent analysis once again from the @TokenRelations team! 🔥 $CLO, by @YeiFinance, is smashing new highs on all fronts. From token price, TVL, revenue, to user activity, Yei is on the rise and becoming one of the most notorious DeFi protocols in Web3. The @SeiNetwork’s core product, Yei and its recent success and milestones are just a clear signal that Sei Season is upon us, and for that, we should be keeping an eye on other key Sei players, such as @TakaraLend, @MonacoOnSei, and other top-tier protocols within the ecosystem… Oh, and if you missed our deep dive on Yei Finance, be sure to check it out, here 👉 https://t.co/Ph5F6xuRdJ

Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

502 11 37.19K オリジナル >リリース後のCLOのトレンド強気CLO has surged 400% recently, with trading volume skyrocketing, worth watching. Campbell | New York New York arc Media Influencer B5.05K @CampbellEaston

Campbell | New York New York arc Media Influencer B5.05K @CampbellEaston Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

75 14 16.77K オリジナル >リリース後のCLOのトレンド強気CLO up 400% due to volume and revenue growth, outlook positive. Okan Founder Community_Lead S16.16K @okanaksoy54

Okan Founder Community_Lead S16.16K @okanaksoy54$CLO is building something strong. Growing volume on @YeiFinance, rising revenue, and rewards flowing back to users. Add a deflationary model and low circulating supply, and everything lines up. @SeiNetwork momentum is only pushing this further. Solid.

Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

132 70 15.20K オリジナル >リリース後のCLOのトレンド強気CLO trading volume surges, revenue rises, expected to continue climbing nbdieu.sei 🔴💨 Community_Lead Media B3.71K @nbdieu

nbdieu.sei 🔴💨 Community_Lead Media B3.71K @nbdieu Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

75 14 16.77K オリジナル >リリース後のCLOのトレンド強気$CLO rises 400% due to Yei platform’s trading volume surge, outlook optimistic Sei Community_Lead DeFi_Expert C782.18K @SeiNetwork

Sei Community_Lead DeFi_Expert C782.18K @SeiNetwork Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

75 14 16.77K オリジナル >リリース後のCLOのトレンド強気Yei Finance $CLO up 400% in recent months, trading volume 685M, outlook bullish Phillip | SEI Founder Community_Lead A16.49K @phillip_xyz

Phillip | SEI Founder Community_Lead A16.49K @phillip_xyz Token Relations 📊 D11.46K @TokenRelations

Token Relations 📊 D11.46K @TokenRelationsSince @YeiFinance’s TGE in October, its $CLO token has increased 400%, with the majority of that growth occurring over the past month. But what is driving this growth? Let's dive into it. 👇 Yei Finance is a lending and liquidity protocol on @SeiNetwork. The $CLO token is used for governance and is distributed as an incentive to users who provide liquidity or participate in Yei’s markets. The platform allows users to supply assets to earn yield or borrow against collateral, while also integrating crosschain infrastructure. This allows assets to move between networks without actually exiting the protocol. Recently, Yei reached a cumulative trading volume of $685 million, across its Swap and Bridge apps, while total protocol revenue hit $7.3 million. Together, these milestones create a compounding effect for Yei. As trading volume and protocol revenue increase, more token rewards are distributed to participants. Thus, causing revenue to be flowed back to engaged users. Alongside Yei’s flywheel effect, the

75 14 16.77K オリジナル >リリース後のCLOのトレンド強気CLO remains bullish due to surging trading volume and rising revenues Powerpei.ip DeFi_Expert OnChain_Analyst S12.35K @PWenzhen76938

Powerpei.ip DeFi_Expert OnChain_Analyst S12.35K @PWenzhen76938 DD 滴滴./ D7.60K @rtk17025

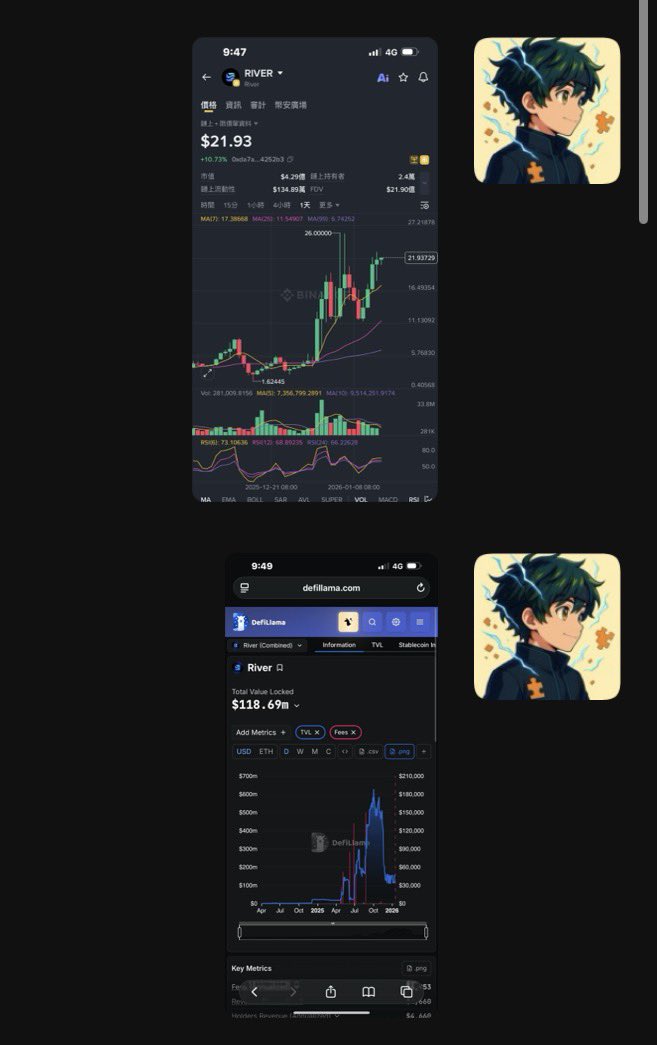

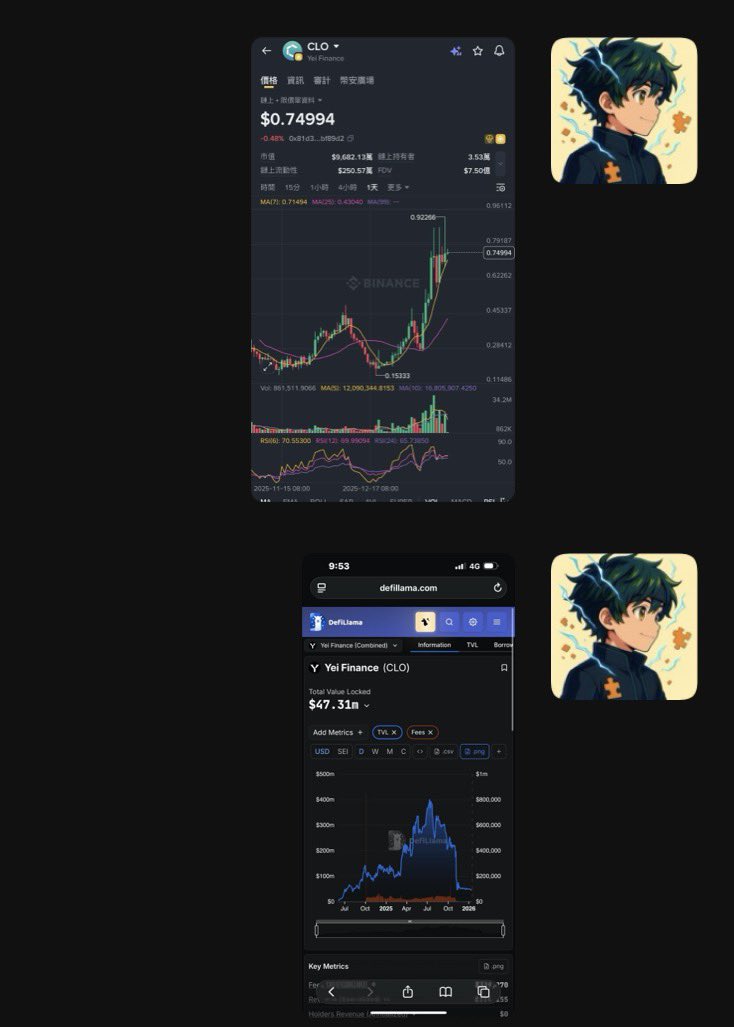

DD 滴滴./ D7.60K @rtk17025Didn't expect that a casual chat would bring so many people to me, hahaha. So many people ran to find me, hahahaha. Actually it was just a casual chat in the group yesterday. At that time I was discussing the latest updates of @ferra_protocol with @Jason23818126 and others. Because for us, posting any project or discussion on Twitter should be done rationally. So we ended up talking about the Ferra TVL that many people were mentioning. Some say it's 10M. Some say it's 2M. Indeed, it's quite volatile. So I opened Alpaca and found that around 1/1 the TVL was still over 10M, but recently it suddenly dropped to 1.92M. But an interesting discussion then unfolded. Is there a strong correlation between TVL and token price? At this point, @dajingou1 in the group suddenly shared two factors that could link TVL to token price. 1. Token price moves first, TVL changes passively. TVL is mostly denominated in USD. Token price rises → same amount of tokens locked → TVL naturally increases. 👉 This is price influencing TVL, not the other way around. 2. Bull market narrative phase: capital and sentiment come in together. New narratives (L2, Restaking, AI, RWA) TVL growth + token price rise happen simultaneously. 👉 Both are driven together by sentiment and capital. But then @PWenzhen76938 said, Many TVLs are: Subsidy-driven (high APY) The same pool of capital moving repeatedly VC/team funds Conversely, like $CLO $RIVER, Although TVL has sharply declined recently, the token price has surged due to short-covering sentiment. That's the interesting part of financial markets. Am I right? Wrong? The market always has its own answer.

59 53 2.44K オリジナル >リリース後のCLOのトレンド強気The tweet discusses the relationship between TVL and token price, with CLO and RIVER prices still soaring despite a decline in TVL.

59 53 2.44K オリジナル >リリース後のCLOのトレンド強気The tweet discusses the relationship between TVL and token price, with CLO and RIVER prices still soaring despite a decline in TVL. Jingle Bell 初号机 OnChain_Analyst Community_Lead S39.08K @ScarlettWeb3

Jingle Bell 初号机 OnChain_Analyst Community_Lead S39.08K @ScarlettWeb3 Jingle Bell 初号机 OnChain_Analyst Community_Lead S39.08K @ScarlettWeb3

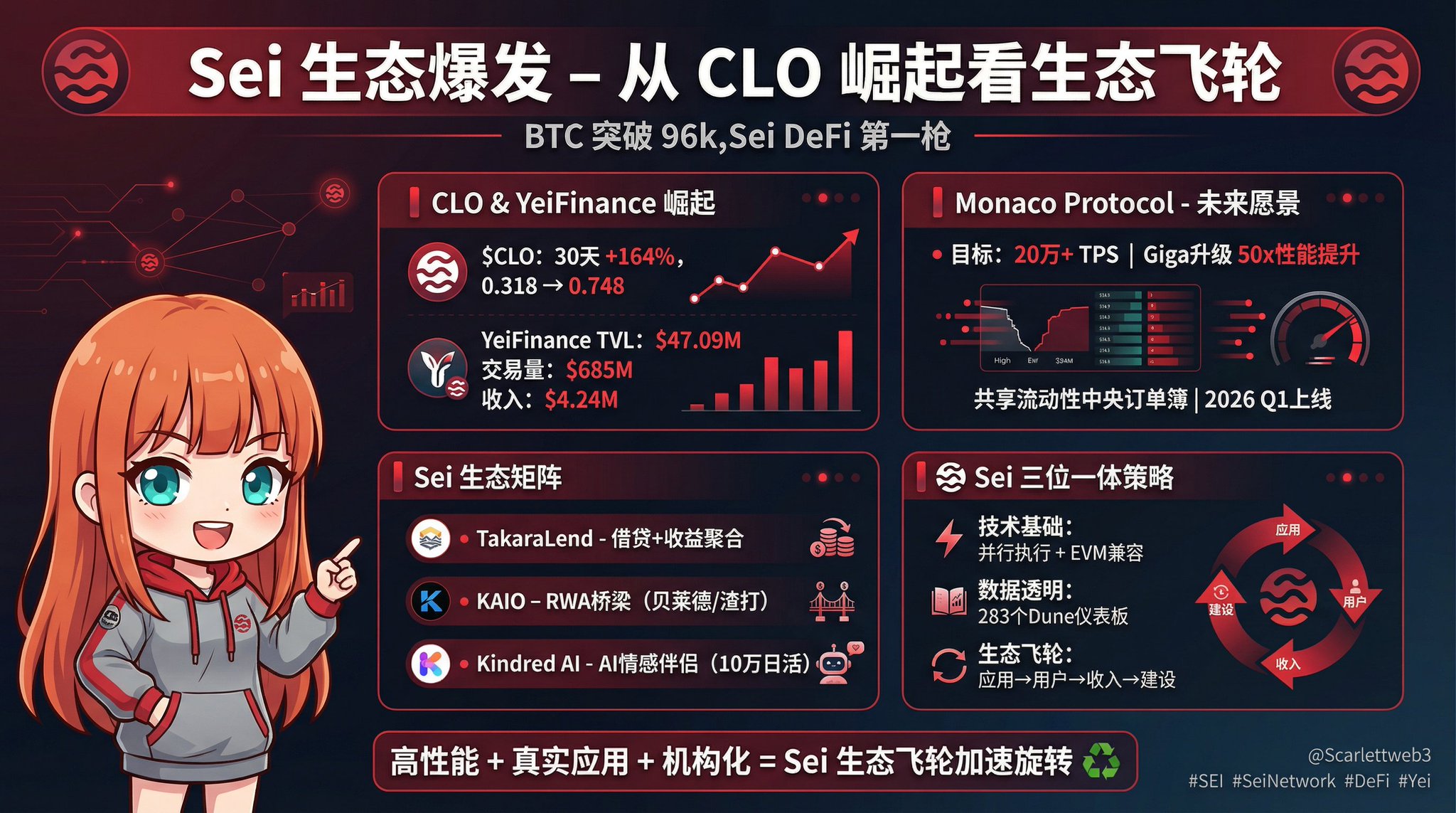

Jingle Bell 初号机 OnChain_Analyst Community_Lead S39.08K @ScarlettWeb3Bull market returns, quick rally. As BTC broke through 96k this morning The best-performing token in my watchlist is: $CLO (Sei ecosystem) 30 days 164%, climbing from 0.318 to 0.748, peaking at 0.91 $CLO is the governance token of @YeiFinance and YeiFinance is one of the most important DeFi protocols on @SeiNetwork 1⃣ Will the rise of $CLO be the first shot of Sei DeFi explosion? 🔫 The first model has always emphasized to everyone: Altcoins are not unbuyable, but you should buy projects that can be profitable Project teams, VCs, and retail investors come into the crypto space to make money. If a project team cannot make money through the project itself, then, while protecting its own interests, the team will act maliciously, sprinkling tokens to you in exchange for its own exit liquidity $CLO is the core economic token of Yei Finance, one of the largest DeFi protocols on Sei Yei protocol TVL is $47.09 million, cumulative trading volume exceeds $685 million Cumulative revenue is $4.24 million, fully capable of generating real protocol income 💰 For the Sei ecosystem, the impressive performance of $CLO means: ▪️ Capital and trading activity on Sei ▪️ On-chain user participation and asset liquidity ▪️ Recognition from researchers and mainstream investors for Sei YeiFinance's success proves that Sei's technical advantages (400ms finality, parallel execution) can be turned into real user value (or reflected in the token price ~ 🙃 But Sei's ambition and core battlefield are not limited to this; it has always been high-frequency trading 2⃣ Sei ecosystem has many great projects 🏆 👉 @MonacoProtocol 👈 Because if YeiFinance is the “present tense” of the Sei ecosystem, then Monaco Protocol may be the “future tense” — it represents Sei's ultimate vision in the high-frequency trading field Monaco Protocol is a shared liquidity central order book trading layer incubated by @Sei_Labs, built specifically for the Sei network In simple terms, it aims to: Bring the speed advantage of traditional centralized exchanges (the millisecond-level matching of Binance, OKX) into the decentralized world Monaco will directly leverage Sei's Giga upgrade (50x EVM performance boost), targeting over 200,000 TPS. If this is moved to decentralization, handling Hype's volume is not impossible 🤪 The future shape of the Sei ecosystem will likely be: ▪️ YeiFinance providing lending + spot trading ▪️ Monaco filling high-frequency derivatives and orderbook spot Monaco is currently in the pre‑mainnet stage (expected launch Q1 2026), but has already passed RFP

77 72 24.28K オリジナル >リリース後のCLOのトレンド非常に強気CLO token is performing strongly, Sei ecosystem DeFi is booming, and Monaco Protocol will bring a high-frequency trading vision.

77 72 24.28K オリジナル >リリース後のCLOのトレンド非常に強気CLO token is performing strongly, Sei ecosystem DeFi is booming, and Monaco Protocol will bring a high-frequency trading vision.

- データなし