Bitcoin (BTC)

Bitcoin (BTC)

-3.94% 24H

- 68ソーシャル・センチメント・インデックス(SSI)-6.67% (24h)

- #55マーケット・パルス・ランキング(MPR)-47

- 1,84524時間ソーシャルメンション-9.21% (24h)

- 57%24時間のKOL強気比率622人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体68SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (19%)強気 (38%)中立 (14%)弱気 (24%)非常に弱気 (5%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

- リリース後のBTCのトレンド強気

Walker⚡️ Media Influencer B81.64K @WalkerAmerica

Walker⚡️ Media Influencer B81.64K @WalkerAmerica Walker⚡️ Media Influencer B81.64K @WalkerAmerica4 0 1.61K オリジナル >リリース後のBTCのトレンド強気

Walker⚡️ Media Influencer B81.64K @WalkerAmerica4 0 1.61K オリジナル >リリース後のBTCのトレンド強気- リリース後のBTCのトレンド弱気

- リリース後のBTCのトレンド非常に強気

Tim Kotzman Media Influencer B26.46K @TimKotzman

Tim Kotzman Media Influencer B26.46K @TimKotzman Tim Kotzman Media Influencer B26.46K @TimKotzman7 0 458 オリジナル >リリース後のBTCのトレンド強気

Tim Kotzman Media Influencer B26.46K @TimKotzman7 0 458 オリジナル >リリース後のBTCのトレンド強気 Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives

Digital Perspectives Influencer Community_Lead B205.57K @DigPerspectives The Bitcoin Historian Influencer Media B208.20K @pete_rizzo_171 15 7.76K オリジナル >リリース後のBTCのトレンド強気

The Bitcoin Historian Influencer Media B208.20K @pete_rizzo_171 15 7.76K オリジナル >リリース後のBTCのトレンド強気- リリース後のBTCのトレンド非常に強気

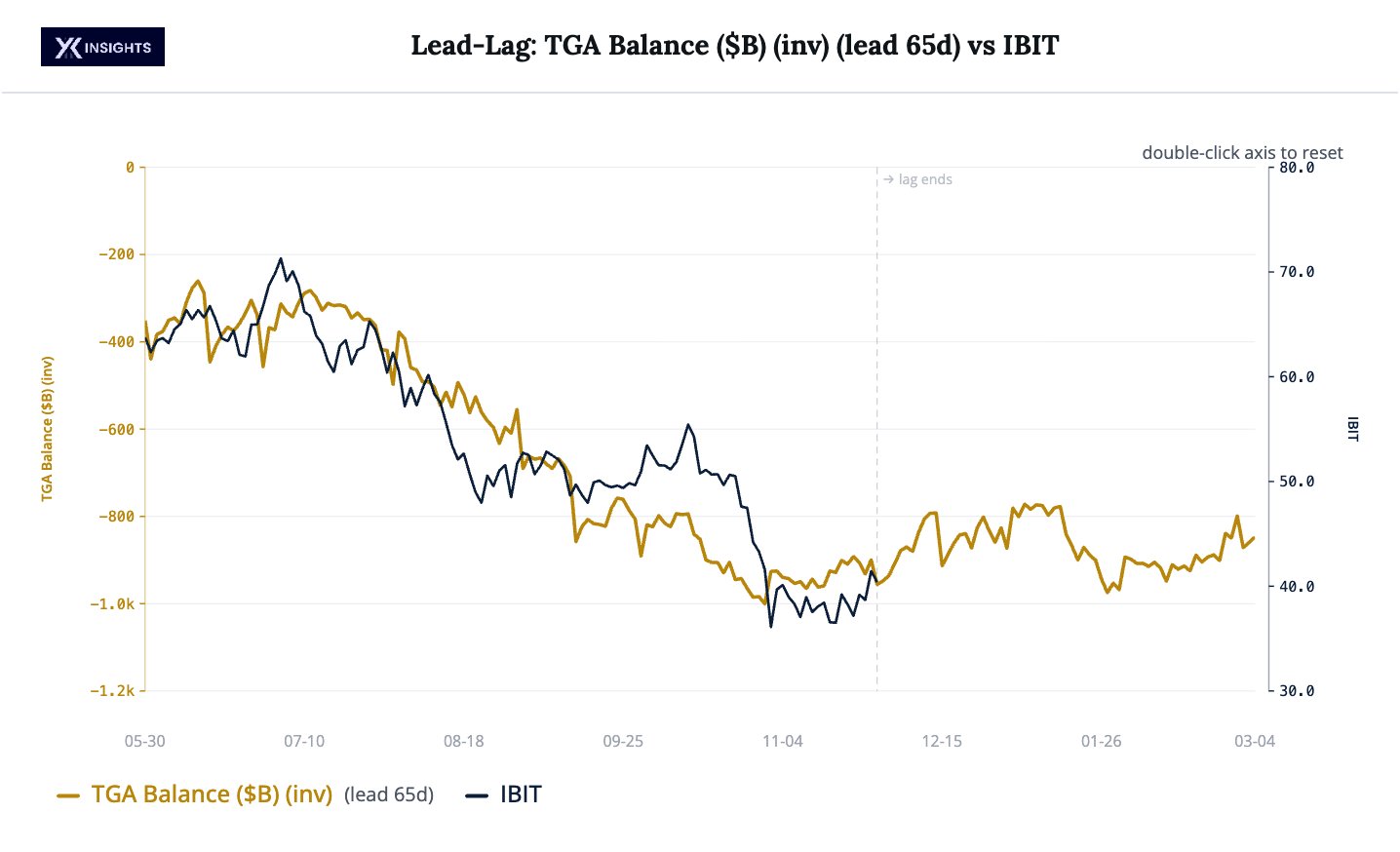

Yimin X TA_Analyst Quant A12.39K @yxinsights

Yimin X TA_Analyst Quant A12.39K @yxinsights Yimin X TA_Analyst Quant A12.39K @yxinsights

Yimin X TA_Analyst Quant A12.39K @yxinsights 13 3 1.30K オリジナル >リリース後のBTCのトレンド非常に強気

13 3 1.30K オリジナル >リリース後のBTCのトレンド非常に強気 The Bitcoin Historian Influencer Media B208.20K @pete_rizzo_

The Bitcoin Historian Influencer Media B208.20K @pete_rizzo_ The Bitcoin Historian Influencer Media B208.20K @pete_rizzo_171 15 7.76K オリジナル >リリース後のBTCのトレンド非常に強気

The Bitcoin Historian Influencer Media B208.20K @pete_rizzo_171 15 7.76K オリジナル >リリース後のBTCのトレンド非常に強気- リリース後のBTCのトレンド強気