Algorand (ALGO)

Algorand (ALGO)

$0.0845 -3.54% 24H

- 54ソーシャル・センチメント・インデックス(SSI)-14.48% (24h)

- #109マーケット・パルス・ランキング(MPR)-52

- 624時間ソーシャルメンション-25.00% (24h)

- 66%24時間のKOL強気比率5人のアクティブなKOL

- 概要

- 強気のシグナル

- 弱気のシグナル

ソーシャル・センチメント・インデックス(SSI)

- データ全体54SSI

- SSIトレンド(7日間)価格(7日間)センチメントの分布非常に強気 (33%)強気 (33%)中立 (34%)SSIインサイト

マーケット・パルス・ランキング(MPR)

- アラートインサイト

Xへの投稿

- リリース後のALGOのトレンド強気

Crypto Coin Show Media Influencer C25.54K @CryptoCoinShow

Crypto Coin Show Media Influencer C25.54K @CryptoCoinShow Algorand Foundation Founder Community_Lead C208.21K @AlgoFoundation157 11 3.27K オリジナル >リリース後のALGOのトレンド中立

Algorand Foundation Founder Community_Lead C208.21K @AlgoFoundation157 11 3.27K オリジナル >リリース後のALGOのトレンド中立 Ⱥlex | france.algo 🇫🇷 Influencer OnChain_Analyst S4.99K @algerstmehn

Ⱥlex | france.algo 🇫🇷 Influencer OnChain_Analyst S4.99K @algerstmehn

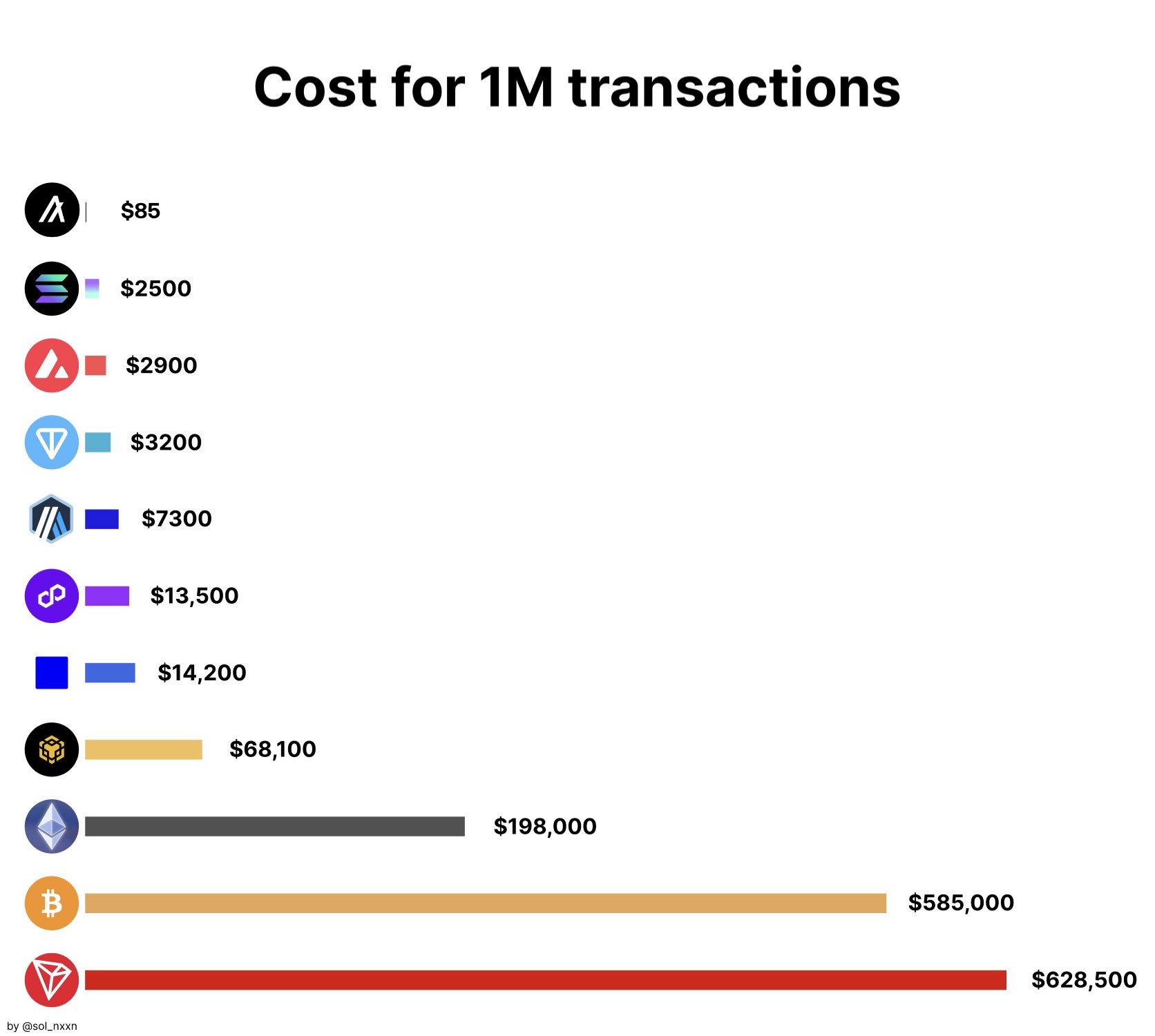

nxxn D24.24K @sol_nxxn

nxxn D24.24K @sol_nxxn 105 4 1.85K オリジナル >リリース後のALGOのトレンド非常に強気

105 4 1.85K オリジナル >リリース後のALGOのトレンド非常に強気 Algorand Foundation Founder Community_Lead C208.21K @AlgoFoundation

Algorand Foundation Founder Community_Lead C208.21K @AlgoFoundation Cointelegraph Media Influencer C2.90M @Cointelegraph303 36 21.69K オリジナル >リリース後のALGOのトレンド強気

Cointelegraph Media Influencer C2.90M @Cointelegraph303 36 21.69K オリジナル >リリース後のALGOのトレンド強気- リリース後のALGOのトレンド中立

Algorand Foundation Founder Community_Lead C208.21K @AlgoFoundation

Algorand Foundation Founder Community_Lead C208.21K @AlgoFoundation GoPlausible D3.52K @GoPlausible

GoPlausible D3.52K @GoPlausible 118 10 7.10K オリジナル >リリース後のALGOのトレンド非常に強気

118 10 7.10K オリジナル >リリース後のALGOのトレンド非常に強気- リリース後のALGOのトレンド強気

- リリース後のALGOのトレンド非常に強気

- リリース後のALGOのトレンド中立

- リリース後のALGOのトレンド中立