On USDM GTM on Lending Markets

The first place of impact for USDM on MegaETH is the lending markets. This is because, for whatever token on Mega, people are likely to be stuck with it and would want to borrow capital out to utilize it for more yields.

For liquidity to enter, users will likely need to bridge in USDC or USDT. However, the fees and slippage from this conversion would erode a significant portion of the yield, especially if their native bridge is not supported (afaik USDC is not on Mega and USDT is not that well supported, or something like that based on a comment I saw).

Assuming a 1% loss on their capital and an average “safe asset” yield of 5%, the user would lose 20% of their time in the market, or the equivalent of 73 days per year, just trying to break even. Unacceptable.

You can say the same for other chains, but that's their problem. If you are young and nascent, likely to scam, oops, I mean attract others with temporary high APYs to attract capital, I am lowkey not believing that people would buy this strategy in such a bad market condition now.

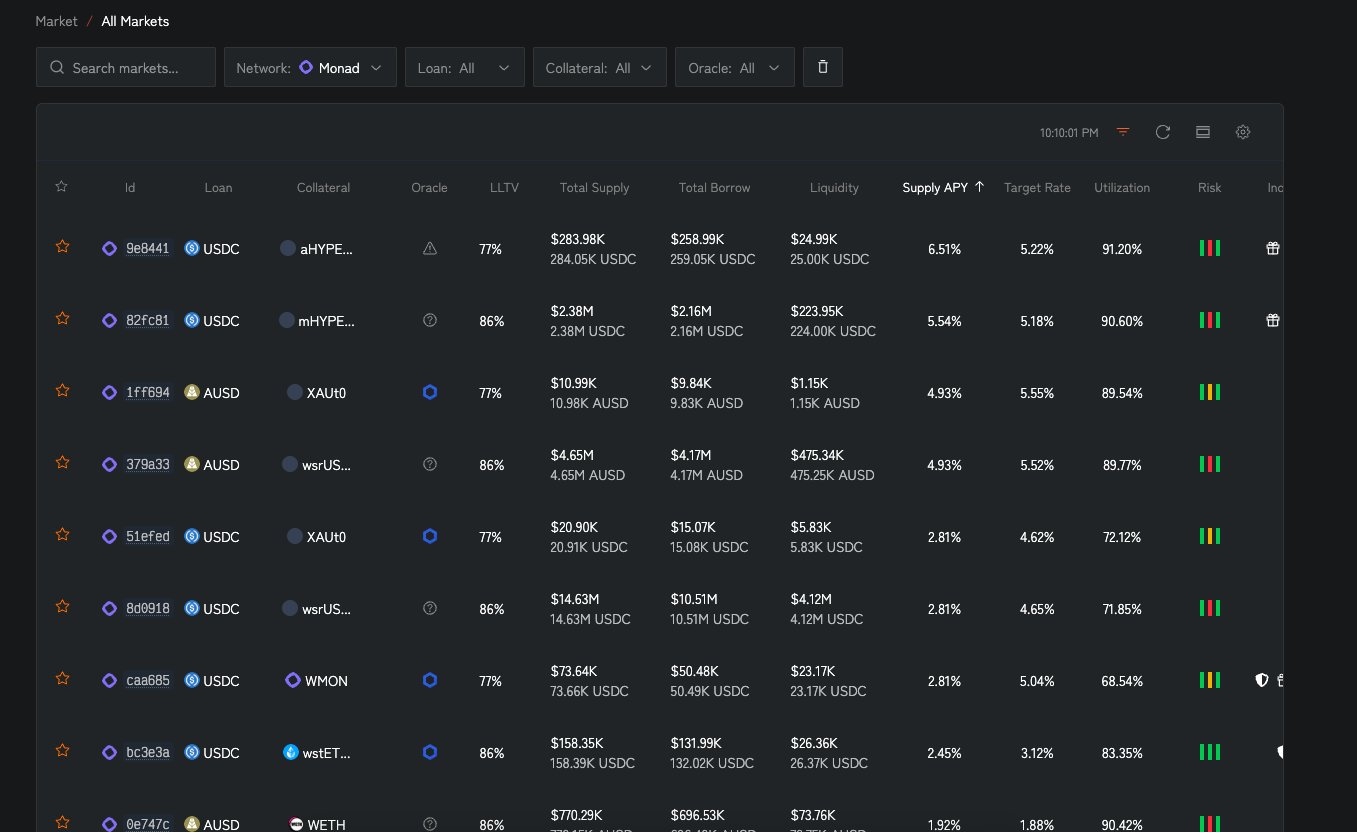

First Pic

Take a look around Monad on Monarch lend to get a sense of rates (AUSD), and you’d understand. In fact, as I am writing this, I remembered it was dominated with AUSD and now it’s USDC, lmao.

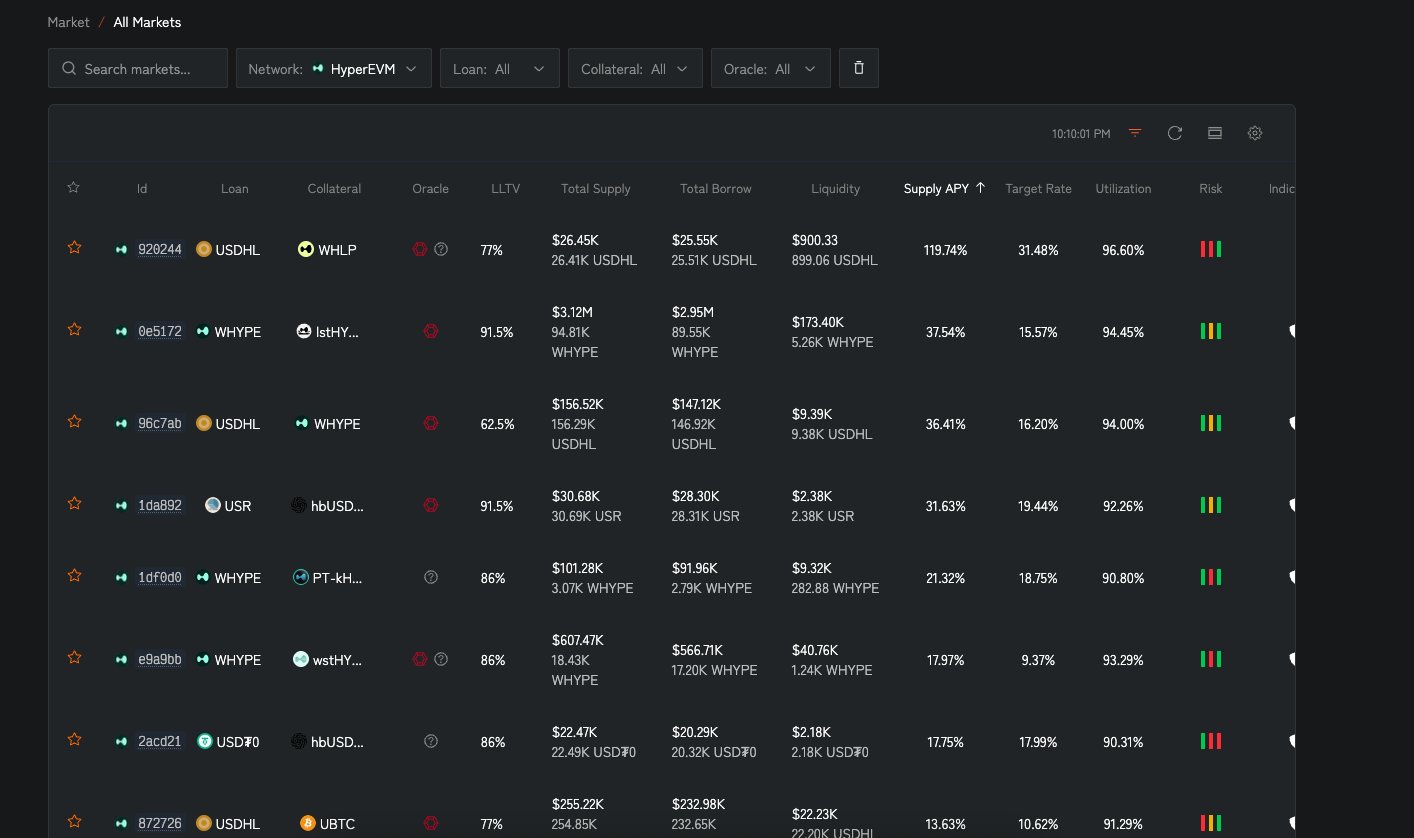

Second Pic

The only exception is that you GTM this stable with a collateral token where people are farming aggressively for points. A good, happy-ending example would be to see lesser-known stables like USDHL - (wrapped staked) Hype, for instance on HyperEVM.

I think this isn’t a long-term strat, but it’s a fairly powerful force to get a customer’s feet wet with your token. But you have to expand horizontally (range of use cases across verticals) really fast because it’s unsustainable.

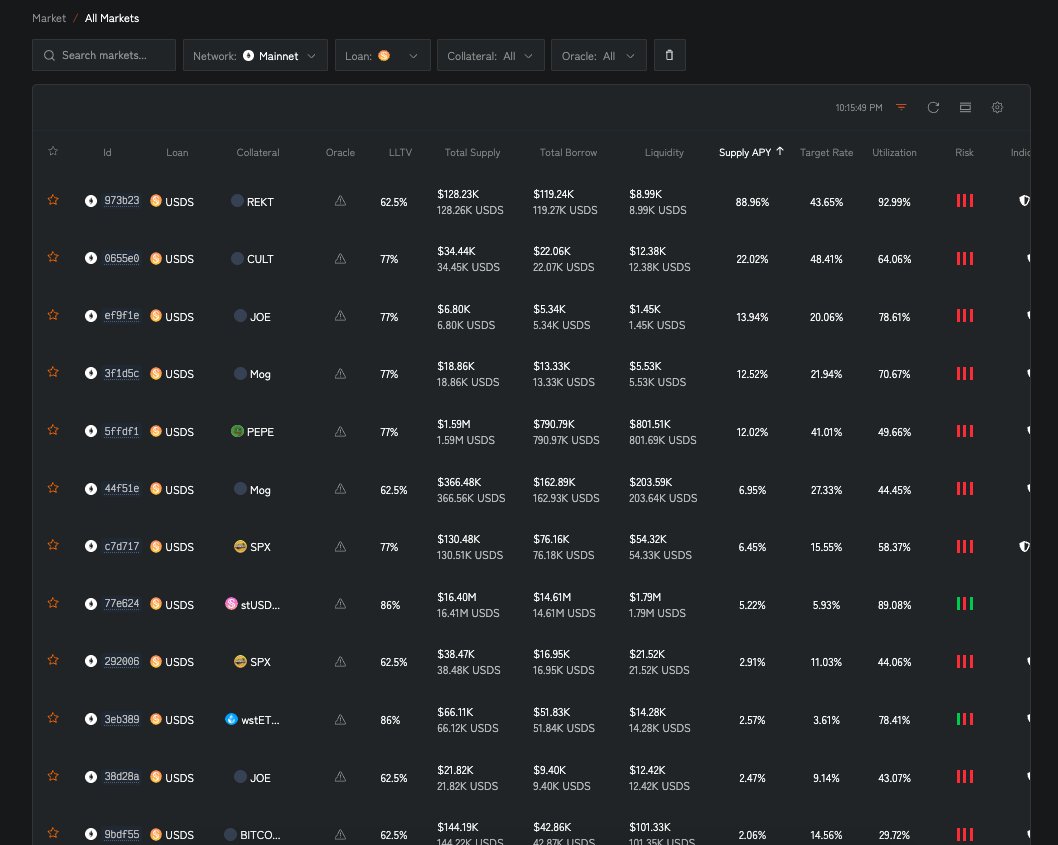

Third Pic

A good example of why diversity on the same stable is important is USDS (on ETH). From a yield-chasing and balancing perspective, I don’t have to worry about swaps and bridging, which saves me a lot of fees and increases my yield.

So you can’t have a couple of lame-ass markets with a lack of diversity, too, or else from an opportunity PoV and a portfolio optimisation perspective the stable becomes a blocker