Uniswap (UNI)

Uniswap (UNI)

$3.373 -4.34% 24H

- 37Indice de Sentiment Social (SSI)+30.65% (24h)

- #122Classement du Pouls du Marché (MPR)+8

- 10Mention sur les réseaux sociaux sur 24 h+57.14% (24h)

- 80%Ratio haussier KOL 24h9 KOL actif

- Résumé

- Signaux haussiers

- Signaux baissiers

Indice de Sentiment Social (SSI)

- Données globales37SSI

- Tendance SSI (7 JOURS)Prix (sur sept jours)Répartition des sentimentsExtrêmement haussier (10%)Haussier (70%)Neutre (20%)Analyses SSI

Classement du Pouls du Marché (MPR)

- Informations sur les alertes

Publications X

Juan Leon FA_Analyst Influencer A7.38K @singularity7x

Juan Leon FA_Analyst Influencer A7.38K @singularity7x Ishmael Asad D1.09K @AsadIshmael12 1 544 Original >Tendance de UNI après le lancementNeutre

Ishmael Asad D1.09K @AsadIshmael12 1 544 Original >Tendance de UNI après le lancementNeutre David Duong🛡️ FA_Analyst Derivatives_Expert B4.21K @DavidDuong

David Duong🛡️ FA_Analyst Derivatives_Expert B4.21K @DavidDuong David Duong🛡️ FA_Analyst Derivatives_Expert B4.21K @DavidDuong10 0 928 Original >Tendance de UNI après le lancementHaussier

David Duong🛡️ FA_Analyst Derivatives_Expert B4.21K @DavidDuong10 0 928 Original >Tendance de UNI après le lancementHaussier- Tendance de UNI après le lancementHaussier

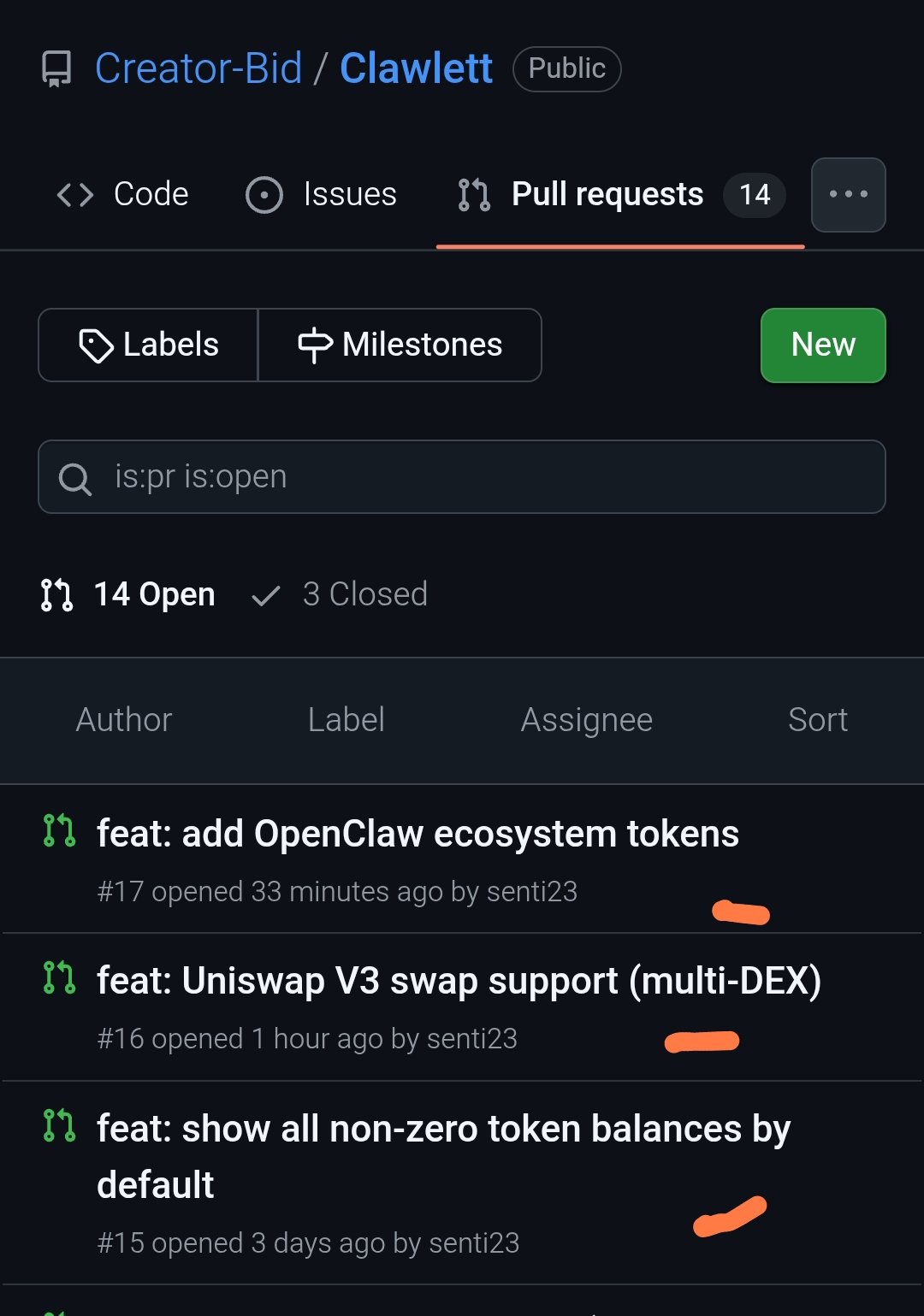

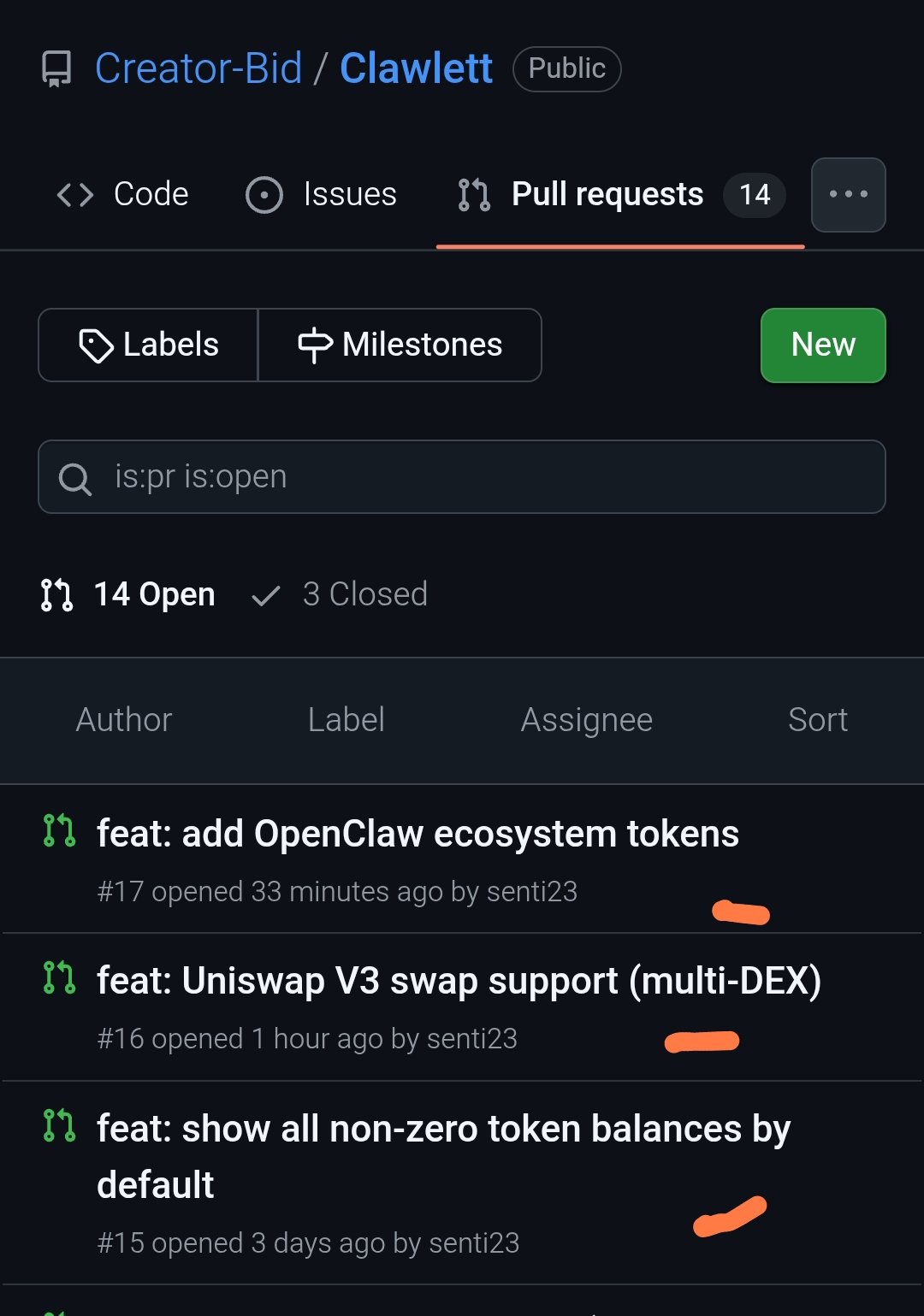

Senti 🪄 FA_Analyst OnChain_Analyst B2.65K @Senti__23

Senti 🪄 FA_Analyst OnChain_Analyst B2.65K @Senti__23 Senti 🪄 FA_Analyst OnChain_Analyst B2.65K @Senti__23

Senti 🪄 FA_Analyst OnChain_Analyst B2.65K @Senti__23 17 5 483 Original >Tendance de UNI après le lancementHaussier

17 5 483 Original >Tendance de UNI après le lancementHaussier- Tendance de UNI après le lancementHaussier

- Tendance de UNI après le lancementHaussier

Ethereum Media Educator D4.08M @ethereum

Ethereum Media Educator D4.08M @ethereum Enterprise Onchain D676 @enteronchain

Enterprise Onchain D676 @enteronchain 67 16 14.21K Original >Tendance de UNI après le lancementExtrêmement haussier

67 16 14.21K Original >Tendance de UNI après le lancementExtrêmement haussier Senti 🪄 FA_Analyst OnChain_Analyst B2.65K @Senti__23

Senti 🪄 FA_Analyst OnChain_Analyst B2.65K @Senti__23 Senti 🪄 FA_Analyst OnChain_Analyst B2.65K @Senti__23

Senti 🪄 FA_Analyst OnChain_Analyst B2.65K @Senti__23 17 5 483 Original >Tendance de UNI après le lancementHaussier

17 5 483 Original >Tendance de UNI après le lancementHaussier LunarCrush Media Researcher D305.68K @LunarCrush

LunarCrush Media Researcher D305.68K @LunarCrush

LunarCrush Media Researcher D305.68K @LunarCrush21 11 4.43K Original >Tendance de UNI après le lancementNeutre

LunarCrush Media Researcher D305.68K @LunarCrush21 11 4.43K Original >Tendance de UNI après le lancementNeutre エックスウィンリサーチ 「市場変動を先読み、デジタル資産戦略の新基準を学ぶ」 OnChain_Analyst DeFi_Expert C2.33K @xwinfinancejp

エックスウィンリサーチ 「市場変動を先読み、デジタル資産戦略の新基準を学ぶ」 OnChain_Analyst DeFi_Expert C2.33K @xwinfinancejp 1 0 72 Original >Tendance de UNI après le lancementHaussier

1 0 72 Original >Tendance de UNI après le lancementHaussier