dYdX (DYDX)

dYdX (DYDX)

$0.166 -2.35% 24H

- 57Indice de Sentiment Social (SSI)- (24h)

- #69Classement du Pouls du Marché (MPR)0

- 1Mention sur les réseaux sociaux sur 24 h- (24h)

- 100%Ratio haussier KOL 24h1 KOL actif

- Résumé

- Signaux haussiers

- Signaux baissiers

Indice de Sentiment Social (SSI)

- Données globales57SSI

- Tendance SSI (7 JOURS)Prix (sur sept jours)Répartition des sentimentsHaussier (100%)Analyses SSI

Classement du Pouls du Marché (MPR)

- Informations sur les alertes

Publications X

Meraj | MemeMax⚡️ Influencer Community_Lead B3.52K @0xMerajj

Meraj | MemeMax⚡️ Influencer Community_Lead B3.52K @0xMerajj Meraj | MemeMax⚡️ Influencer Community_Lead B3.52K @0xMerajj

Meraj | MemeMax⚡️ Influencer Community_Lead B3.52K @0xMerajj 166 71 557 Original >Tendance de DYDX après le lancementHaussier

166 71 557 Original >Tendance de DYDX après le lancementHaussier- Tendance de DYDX après le lancementHaussier

- Tendance de DYDX après le lancementHaussier

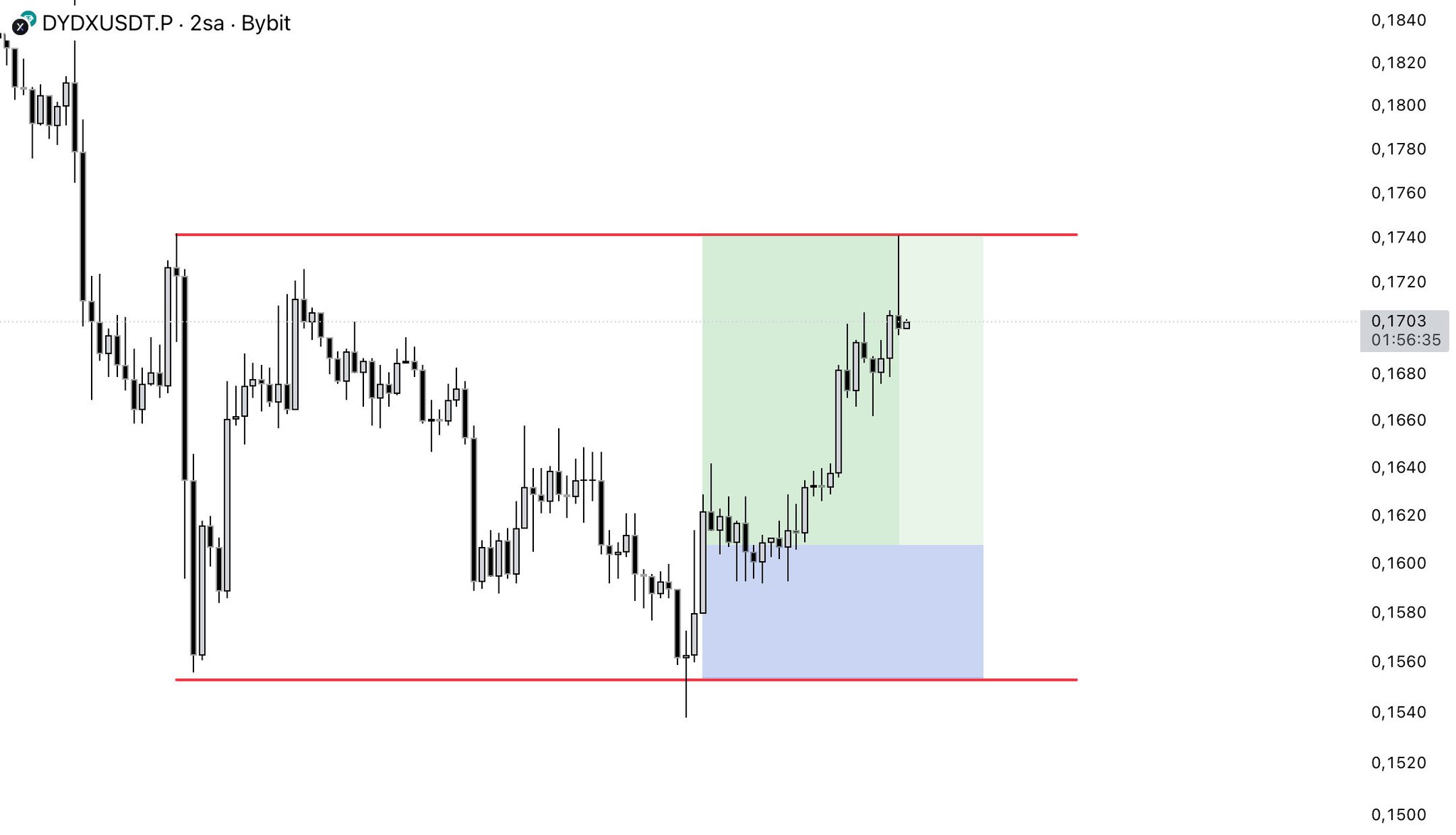

LSTRADER TA_Analyst Trader A35.93K @LSTraderCrypto

LSTRADER TA_Analyst Trader A35.93K @LSTraderCrypto

LSTRADER TA_Analyst Trader A35.93K @LSTraderCrypto

LSTRADER TA_Analyst Trader A35.93K @LSTraderCrypto 100 6 32.57K Original >Tendance de DYDX après le lancementHaussier

100 6 32.57K Original >Tendance de DYDX après le lancementHaussier- Tendance de DYDX après le lancementExtrêmement haussier

- Tendance de DYDX après le lancementHaussier

- Tendance de DYDX après le lancementExtrêmement baissier

- Tendance de DYDX après le lancementNeutre

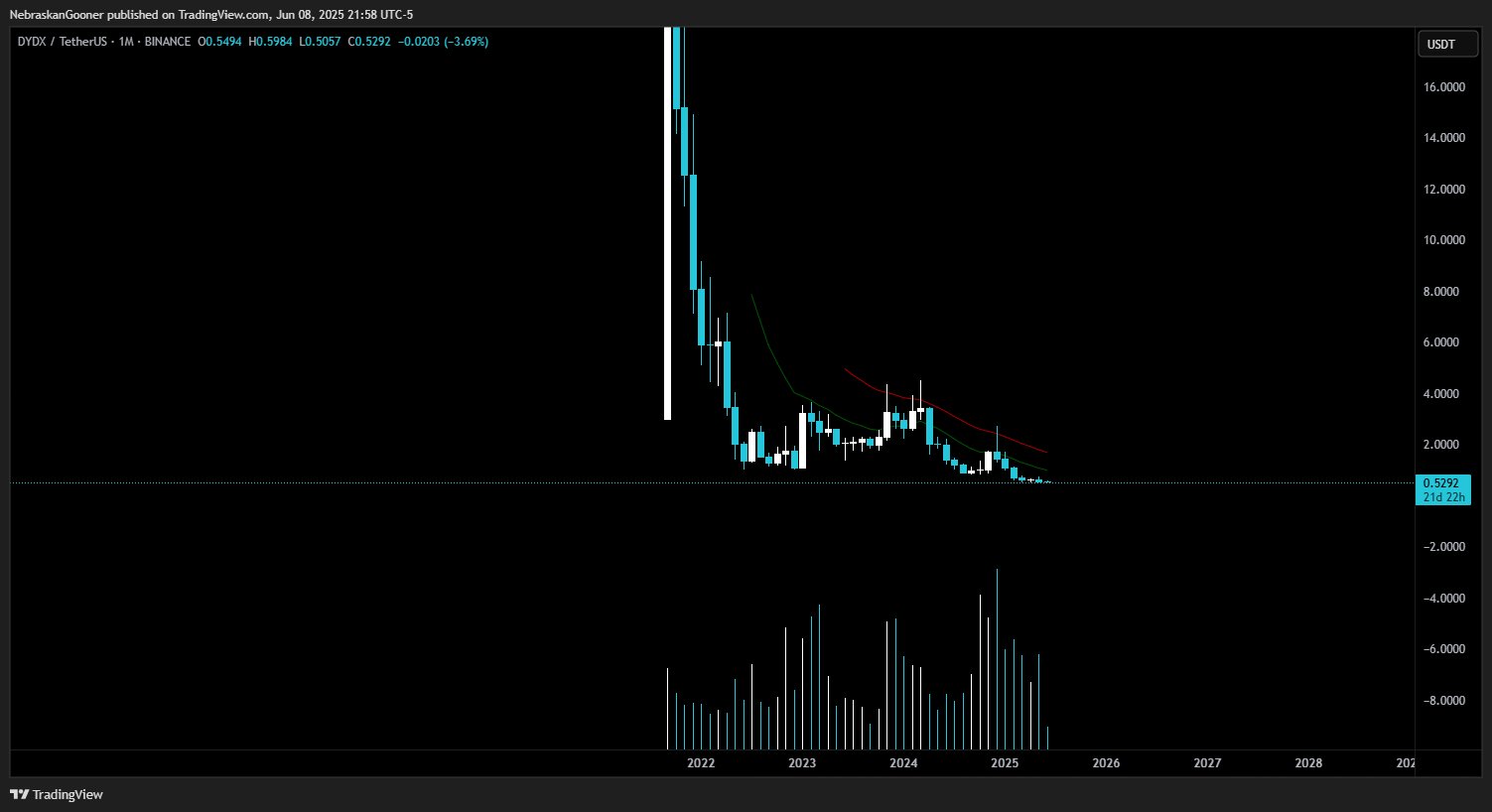

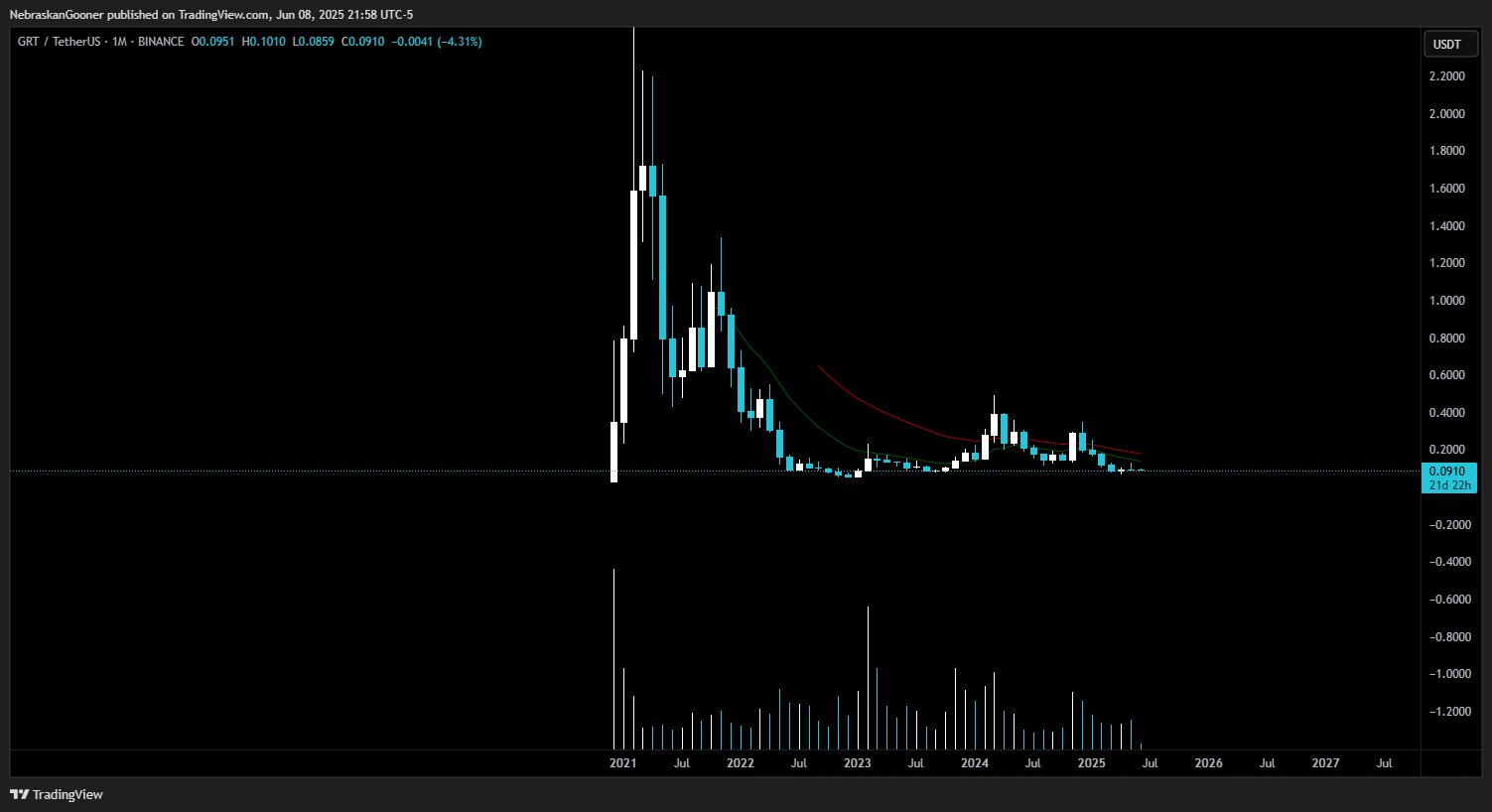

Nebraskangooner TA_Analyst Trader C402.44K @Nebraskangooner

Nebraskangooner TA_Analyst Trader C402.44K @Nebraskangooner Nebraskangooner TA_Analyst Trader C402.44K @Nebraskangooner

Nebraskangooner TA_Analyst Trader C402.44K @Nebraskangooner

99 16 21.31K Original >Tendance de DYDX après le lancementBaissier

99 16 21.31K Original >Tendance de DYDX après le lancementBaissier- Tendance de DYDX après le lancementHaussier