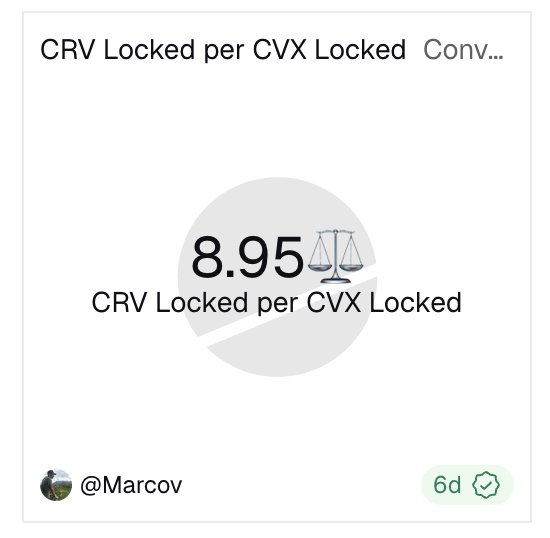

Curve DAO Token (CRV)

Curve DAO Token (CRV)

$0.240 -2.04% 24H

- 39Indice de Sentiment Social (SSI)-43.80% (24h)

- #114Classement du Pouls du Marché (MPR)-91

- 1Mention sur les réseaux sociaux sur 24 h-75.00% (24h)

- 100%Ratio haussier KOL 24h1 KOL actif

- Résumé

- Signaux haussiers

- Signaux baissiers

Indice de Sentiment Social (SSI)

- Données globales39SSI

- Tendance SSI (7 JOURS)Prix (sur sept jours)Répartition des sentimentsHaussier (100%)Analyses SSI

Classement du Pouls du Marché (MPR)

- Informations sur les alertes

Publications X

- Tendance de CRV après le lancementHaussier

CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto 514 51 67.58K Original >Tendance de CRV après le lancementExtrêmement haussier

514 51 67.58K Original >Tendance de CRV après le lancementExtrêmement haussier CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto

CrediBULL Crypto TA_Analyst Educator B485.18K @CredibleCrypto Stable Summit 🦫 D4.84K @stable_summit

Stable Summit 🦫 D4.84K @stable_summit 147 3 19.31K Original >Tendance de CRV après le lancementHaussier

147 3 19.31K Original >Tendance de CRV après le lancementHaussier- Tendance de CRV après le lancementHaussier

Michael Egorov Founder DeFi_Expert B42.28K @newmichwill

Michael Egorov Founder DeFi_Expert B42.28K @newmichwill Curve Finance D385.47K @CurveFinance130 5 4.41K Original >Tendance de CRV après le lancementHaussier

Curve Finance D385.47K @CurveFinance130 5 4.41K Original >Tendance de CRV après le lancementHaussier- Tendance de CRV après le lancementExtrêmement haussier

- Tendance de CRV après le lancementExtrêmement haussier

- Tendance de CRV après le lancementExtrêmement haussier

- Tendance de CRV après le lancementExtrêmement haussier

- Tendance de CRV après le lancementNeutre