⏰What happened in Crypto in the last ~24h:

Wishing you a wonderful end of the year. 😁

- Grayscale - Crypto Sectors Quarterly: A Preference for Privacy

- $BREV Binance, Bybit Perpetual Listing (Pre-Market)

- $LIGHTER Coinbase Spot Listing

- $ZAMA is Live on Mainnet

- Unleash Protocol $3.9M Exploited

- $TAKE Experienced a Sharp Price Decline

- Metaplanet Acquires Additional 4,276 BTC; Total Holdings Reach 35,102 $BTC

- Grayscale Files S-1 for $TAO ETF

- CARF Tax Rules Go Live on Jan 1, 2026

- elizaOS, Shaw announced polymarket plugin

- Rezolve AI announced the launch of Revenue Pools by $SQD

—————————————————

According to @Grayscale research, The dominant crypto investing theme in Q4 was privacy. The rising focus on privacy led to outperformance of crypto asset with these features in Q4, especially Zcash ( $ZEC). Zcash is a decentralized digital currency like Bitcoin but incorporates optional privacy features through “shielded” accounts and transactions.

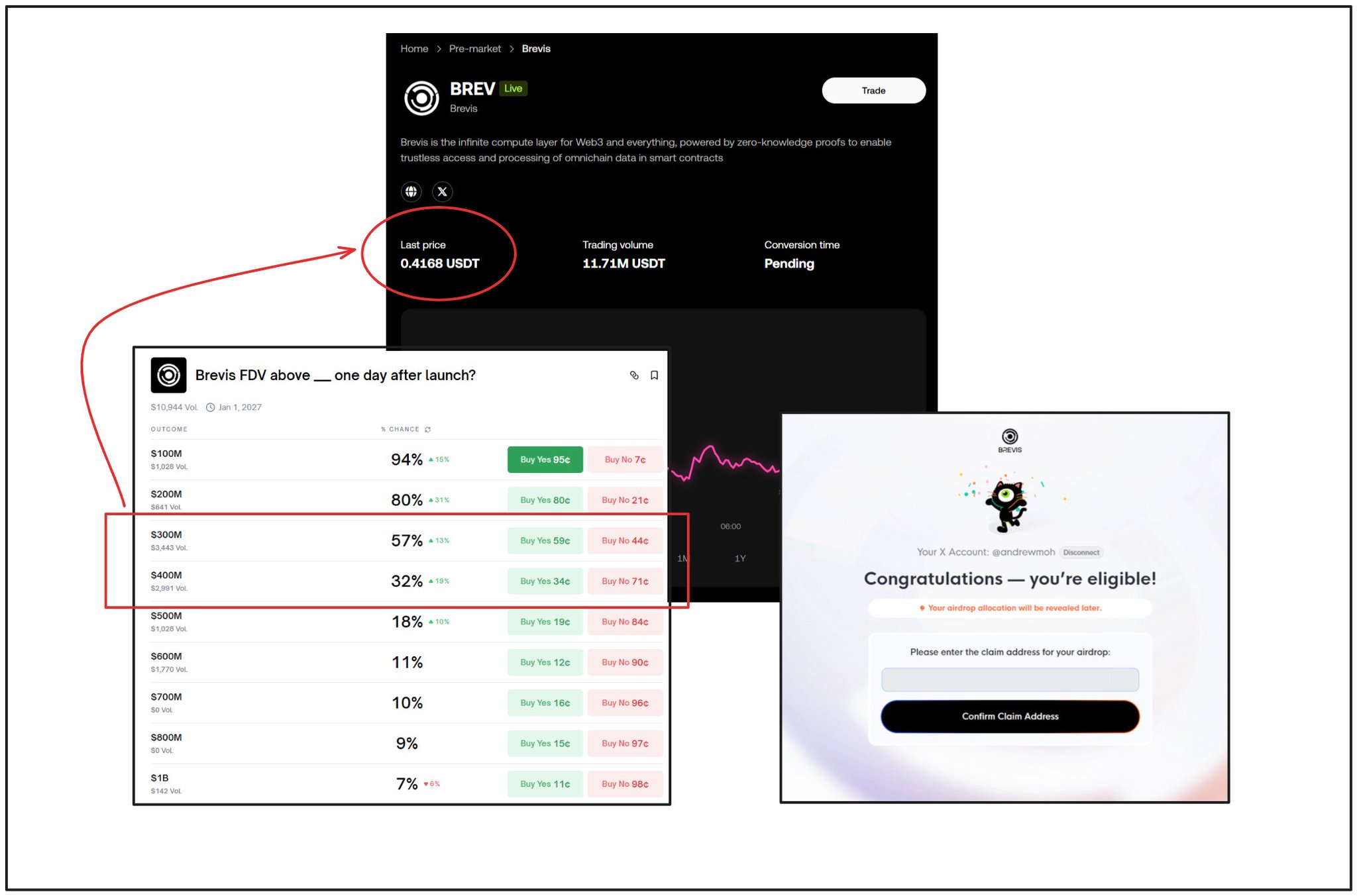

$BREV - Binance and Bybit have announced that Brevis (BREV), $BREVUSDT Perpetual Contract pre-market trading starting at 2025-12-30 10:45 (UTC+0) and 2025-12-30 13:45 (UTC+0) respectively.

$LIGHTER - Coinbase has announced that Lighter (LIGHTER) will go live when liquidity conditions are met, in regions where trading is supported for our LIGHTER-USD trading pair.

$LIT - Lighter is launching the Lighter Infrastructure Token ($LIT), designed to power its next-generation financial infrastructure and align community incentives. Half of the supply goes to the ecosystem, with 25% of the FDV airdropped to Points Season 1 & 2 users and the rest reserved for future seasons, while the remaining 50% is allocated to the team and investors with a 1-year cliff followed by 3-year linear vesting.

$ZAMA - Zama announced on X that the Zama Protocol is now live on mainnet, completing the first confidential stablecoin (cUSDT) transfer on Ethereum. Zama recently announced its tokenomics.

Unleash Protocol, an intellectual property finance platform built on the Story ecosystem, suffered a $3.9 million security breach, as reported by blockchain security firm PeckShield, due to a governance failure that enabled unauthorized control and asset drainage. The attacker laundered the stolen funds through Tornado Cash before bridging them to Ethereum.

$TAKE - Overtake announced on X that the $TAKE token experienced a sharp price decline due to large-scale liquidations in the derivatives market. The team is reviewing the details, confirming no security breach or hack, with all foundation and team wallets secure, and asks the community to await an official update.

Metaplanet CEO Simon Gerovich disclosed that the Japan-listed firm purchased 4,279 BTC in Q4 2025 for about $451M, at an average price of roughly $105,412 per bitcoin. As of December 30, 2025, the company holds 35,102 BTC acquired for approximately $3.78B at an average cost of around $107,606 per BTC, and it reported a 2025 BTC Yield of 568.2%

Grayscale filed a registration statement with the SEC for the Grayscale Bittensor Trust (TAO), marking the first U.S. spot ETF to provide direct exposure to Bittensor. Grayscale’s Bittensor ETF will trade on NYSE Arca, under the ticker symbol GTAO. Coinbase Custody Trust Company LLC and BitGo Trust Company, Inc., would be the custodians, according to Tuesday’s filing.

$ZEC - Cypherpunk Technologies (ticker $CYPH), the Nasdaq-listed firm backed by Gemini co-founder Tyler Winklevoss, expanded its Zcash treasury by adding over $29M worth of $ZEC towards a 5% supply target. The company acquired 56,418 $ZEC for about $29M at an average price of $514 per coin, boosting total holdings to 290,062 $ZEC, or roughly 1.8% of Zcash’s circulating supply.

From Jan. 1, 2026, crypto users in 48 jurisdictions, including the United Kingdom and the European Union, will start to feel the first real effects of the Organization for Economic Co-operation and Development’s (OECD’s) Crypto-Asset Reporting Framework (CARF) as early‑moving jurisdictions begin collecting standardized data from exchanges and platforms. CARF requires in-scope providers to gather more detailed customer information, verify tax residency and report users’ balances and transactions annually to their domestic tax authorities, which will then share that data across borders under existing information‑exchange agreements.

Plugin provides integration with Polymarket prediction markets through the CLOB (Central Limit Order Book) API, enabling AI agents to interact with prediction markets. Features include Retrieve all available prediction markets, Get simplified market data with reduced schema, Query market data and pricing information, Support for market filtering and pagination, Real-time market data access, TypeScript support with comprehensive error handling.

SQD provides high-performance blockchain data services to major global companies, including Deutsche Telekom, as well as leading DeFi protocols such as Morpho and PancakeSwap. The launch of SQD’s Revenue Pool will begin with a limited capacity and will gradually expand as enterprise customer usage increases.

————————————————

➬ Follow me @layerggofficial, TG: https://t.co/mdmJAwb4y6

📷 Sharing is welcome, just a nod to the source would be appreciated.

💞 Please Like + Retweet if you enjoy this

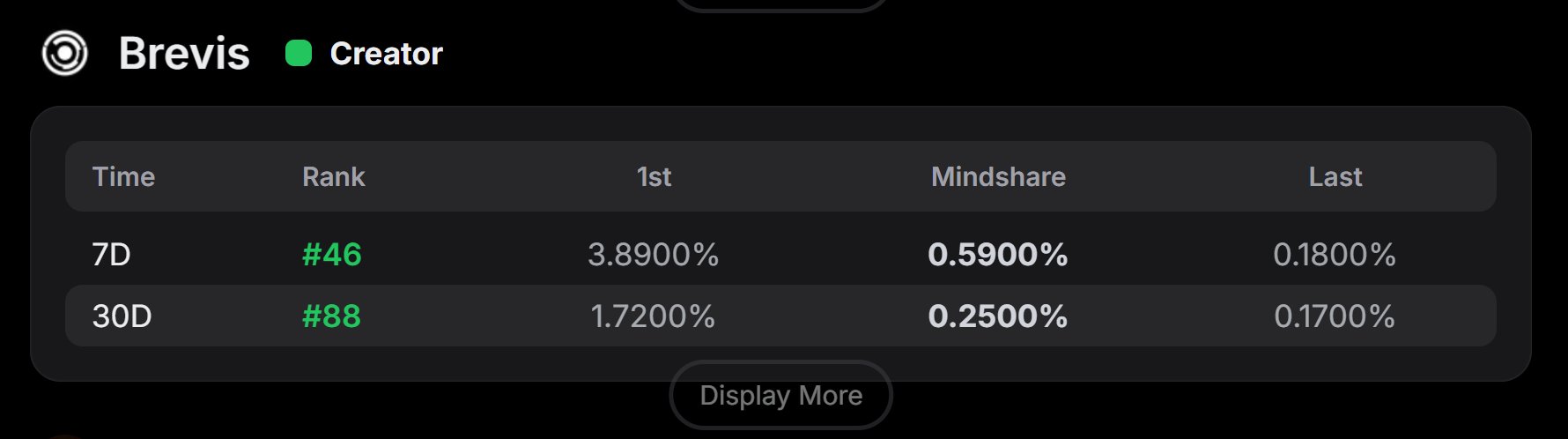

BREV (BREV)

BREV (BREV) andrew.moh FA_Analyst Educator B53.38K @andrewmoh

andrew.moh FA_Analyst Educator B53.38K @andrewmoh

andrew.moh FA_Analyst Educator B53.38K @andrewmoh

andrew.moh FA_Analyst Educator B53.38K @andrewmoh 64 51 7.80K Original >Tendance de BREV après le lancementHaussier

64 51 7.80K Original >Tendance de BREV après le lancementHaussier Kierian OnChain_Analyst Educator B18.36K @KierianV

Kierian OnChain_Analyst Educator B18.36K @KierianV

Kierian OnChain_Analyst Educator B18.36K @KierianV118 88 2.02K Original >Tendance de BREV après le lancementHaussier

Kierian OnChain_Analyst Educator B18.36K @KierianV118 88 2.02K Original >Tendance de BREV après le lancementHaussier