⚛️ Cosmos chronicles 📰

🔎 Discover the latest developments and opportunities in the Cosmos network! 🌎

📣Spread the news! 🗞️

🔔Stay informed and updated!

1⃣ @axelar announces the successful integration of Stellar into their network, which connects Stellar's payment and asset issuance capabilities with Axelar's interoperability layer for broader institutional finance on the blockchain.

At the launch of the integration, applications such as SolvProtocol for cross-chain profitability with solvBTC, Stronghold for SHx mobility between Stellar and Ethereum, and Squid for routing and liquidity of assets such as XLM are already live.

2⃣ @frag_dude announces a key development advance for @JurisProtocol – integrating real testnet data into the React interface, allowing visualization of collateral (like $JURIS) and held positions (like $LUNC).

He cites an earlier update from February 11th about the completion of Figma design in React components, with an emphasis on optimism (“You're not bullish enough”), reflecting an evolution from design to functional backend: https://t.co/8YWVs8p2er

3⃣ @RujiraNetwork shares the THORCommunity Weekly Review for February 15, 2026, focusing on Rujira updates such as DeFi automation via AutoRujira and instructions for borrowing USDC with native BTC: https://t.co/ujpKCv0YtY

4⃣ @astroport_fi announces weekly APR updates for liquidity pools in the Cosmos ecosystem, following vxASTRO votes and emission allocations.

In the Neutron outpost, pools such as DYDX-USDC with 256% APR and MARS-NTRN with 245% APR, highlighted in BTCfi Phase 3, are leading.

In the Terra outpost, LUNA-USDC offers 31% APR (up to 104% with TLA staking), hinting at additional rewards through the Terra Liquidity Alliance.

5⃣ @cryptocom has announced the achievement of ISO/IEC 42001:2023 certification – the first digital asset platform to achieve this international standard for artificial intelligence management (AIMS) focused on ethics and security. The certification, issued by SGS, highlights a commitment to the responsible use of AI in services, reducing risks and increasing trust in the crypto ecosystem.

6⃣ @oraichain introduces three AI-driven investment vaults in Quant Terminal: Quant Signal for trading signals in crypto markets, Stable Yield for low volatility via protocols like Aave and Morpho, and Gold Alpha for systematic exposure to gold via Bybit.

As an AI Layer 1 blockchain, Oraichain integrates machine learning for automated strategies, allowing users to deposit USDC into Arbitrum and receive shares that track performance via estimated APRs.

The vaults aim for long-term asset accumulation, with a focus on rules-based execution to avoid manual trading.

7⃣ @dydxfoundation summarizes protocol governance for 2025, highlighting focus on merchant solutions such as market parameters, risk management, and incentive design. Key achievements include 131 approved proposals out of 135, including 100% fee waiver for BTC-USD and SOL-USD in November-December and a revamped revenue sharing model (75% for MegaVault)

8⃣ @provenancefdn highlights the first on-chain investment in a home equity value of $100,000 through Provenance’s Vesta Equity in January 2026, marking the beginning of real estate tokenization.

✅ Governance proposals 🔔

1⃣ @mars_protocol announced a MRC-165 proposal for a structured shutdown due to a lack of long-term sustainability following a December 2025 exploit that resulted in losses of approximately $1 million.

Reasons include high operating costs, management complexity, and weak growth prospects; the team unsuccessfully sought a third-party takeover before the decision.

The plan calls for a gradual reduction in LTV for liquidations from February 24 to March 21, 2026, allowing borrowers to close positions voluntarily, after which depositors receive prorated assets and the protocol shuts down.

🌐 Link: https://t.co/pkXyvmIpW6

⚛️Cosmos top 24h gainers

Agoric $BLD 17.4% ⬆️

Gravity Bridge $GRAV 11.2%⬆️

Haqq Network $ISLM 8.3%⬆️

#Cosmos #News #UPDATE #DeFi #Crypto #CryptoNews #NFT #Airdrop #IBC #CosmosEcosystem #ATOM

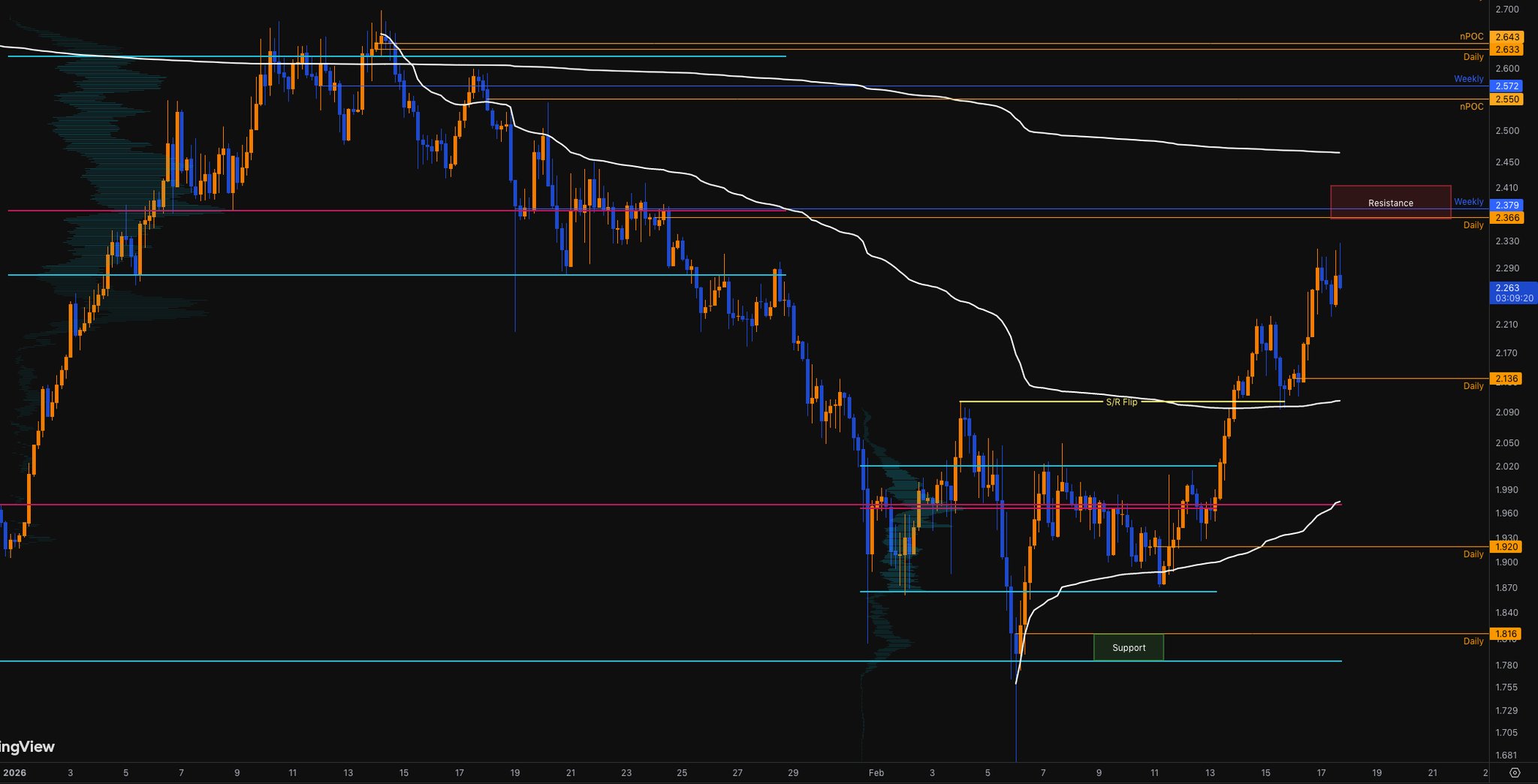

Cosmos (ATOM)

Cosmos (ATOM) CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875 17 0 887 Original >Tendance de ATOM après le lancementHaussier

17 0 887 Original >Tendance de ATOM après le lancementHaussier Nebraskangooner TA_Analyst Trader C405.26K @Nebraskangooner

Nebraskangooner TA_Analyst Trader C405.26K @Nebraskangooner Nebraskangooner TA_Analyst Trader C405.26K @Nebraskangooner850 120 65.76K Original >Tendance de ATOM après le lancementBaissier

Nebraskangooner TA_Analyst Trader C405.26K @Nebraskangooner850 120 65.76K Original >Tendance de ATOM après le lancementBaissier CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875

CosmosBG Degen Fight Club⚛️☯️🏴☠️🧪⚡️ 🛰 TA_Analyst DeFi_Expert B1.94K @IvanM10529875 11 2 505 Original >Tendance de ATOM après le lancementNeutre

11 2 505 Original >Tendance de ATOM après le lancementNeutre Cryptosailor FA_Analyst Influencer B2.19K @robertdavid010

Cryptosailor FA_Analyst Influencer B2.19K @robertdavid010 Cryptocito D123.86K @Cryptocito2 0 152 Original >Tendance de ATOM après le lancementExtrêmement baissier

Cryptocito D123.86K @Cryptocito2 0 152 Original >Tendance de ATOM après le lancementExtrêmement baissier