Arbitrum (ARB)

Arbitrum (ARB)

$0.0993 -10.38% 24H

- 58Indice de Sentiment Social (SSI)+49.54% (24h)

- #63Classement du Pouls du Marché (MPR)+41

- 13Mention sur les réseaux sociaux sur 24 h+62.50% (24h)

- 85%Ratio haussier KOL 24h9 KOL actif

- Résumé

- Signaux haussiers

- Signaux baissiers

Indice de Sentiment Social (SSI)

- Données globales58SSI

- Tendance SSI (7 JOURS)Prix (sur sept jours)Répartition des sentimentsExtrêmement haussier (54%)Haussier (31%)Neutre (8%)Baissier (7%)Analyses SSI

Classement du Pouls du Marché (MPR)

- Informations sur les alertes

Publications X

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth Ricardo "Gordon" (💙,🧡) 🇵🇹 D3.04K @Ricardo__Gordon

Ricardo "Gordon" (💙,🧡) 🇵🇹 D3.04K @Ricardo__Gordon

10 2 141 Original >Tendance de ARB après le lancementExtrêmement haussier

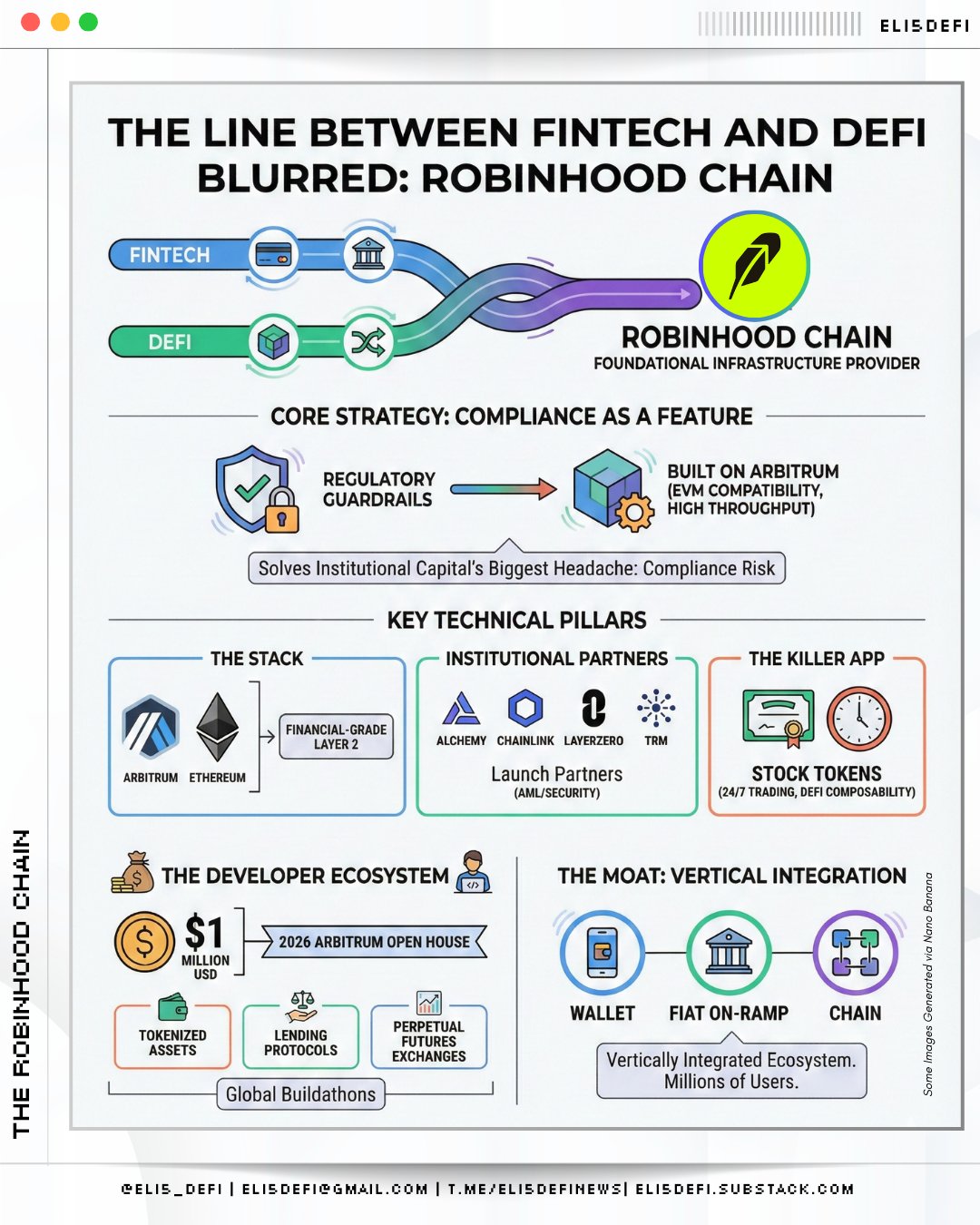

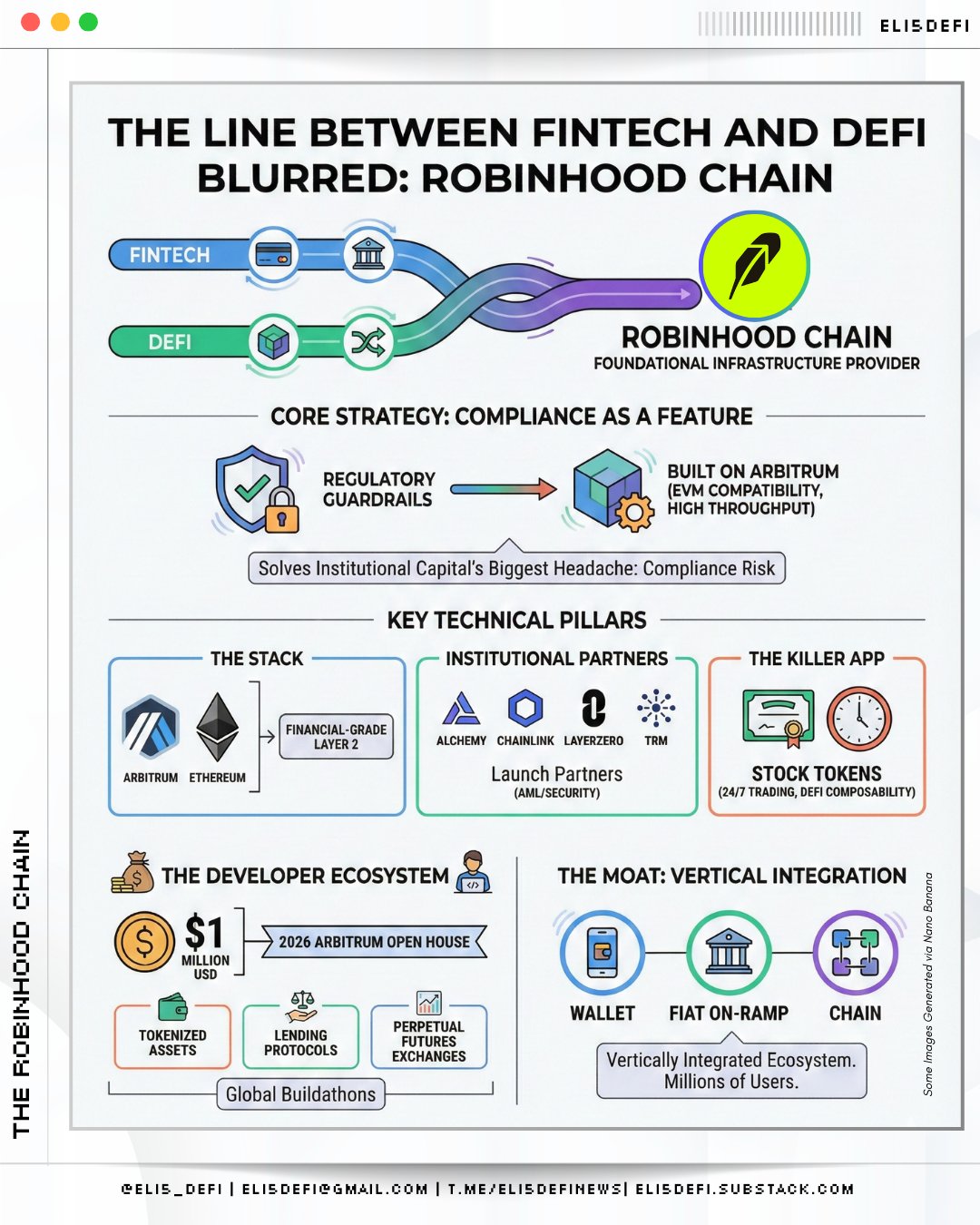

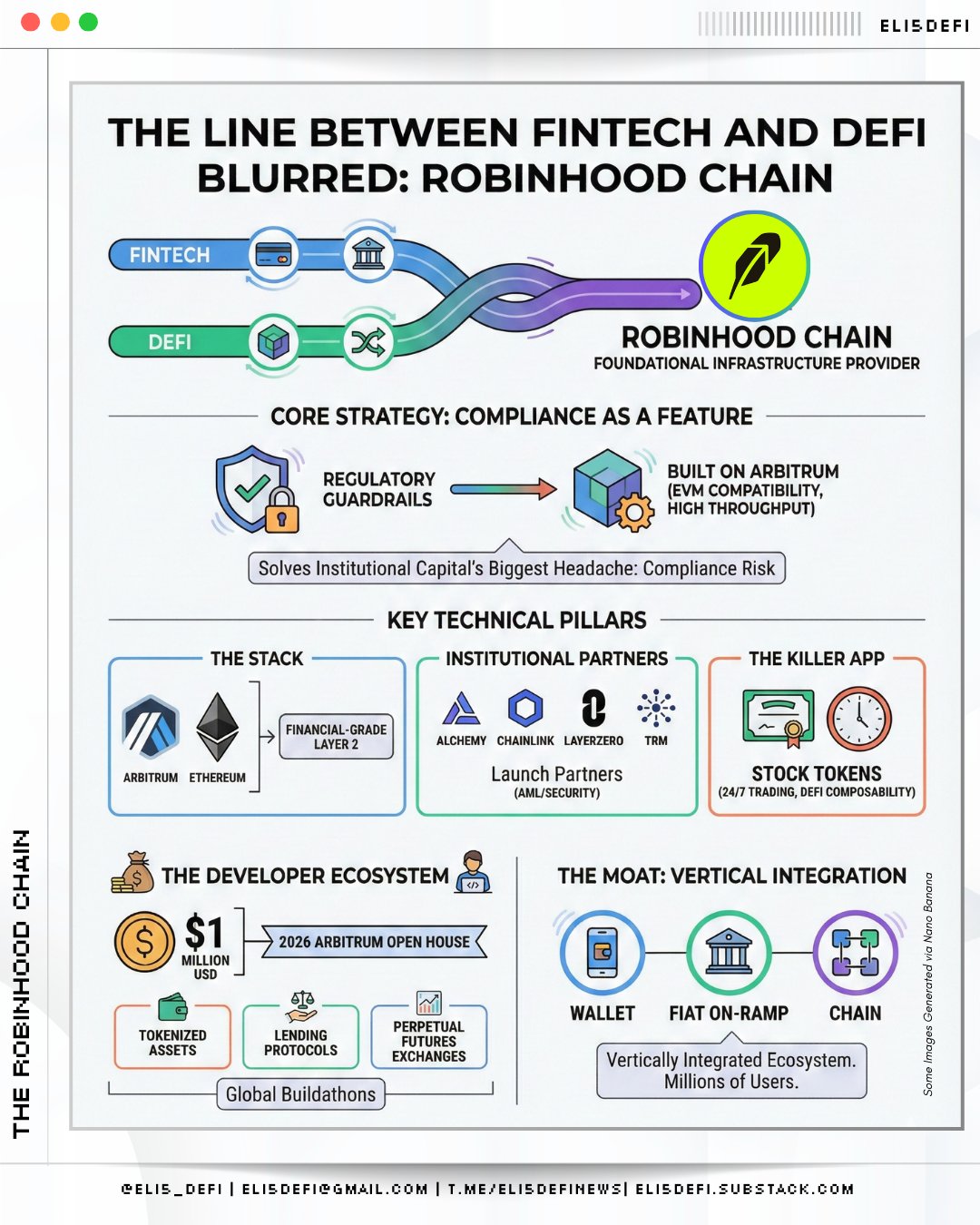

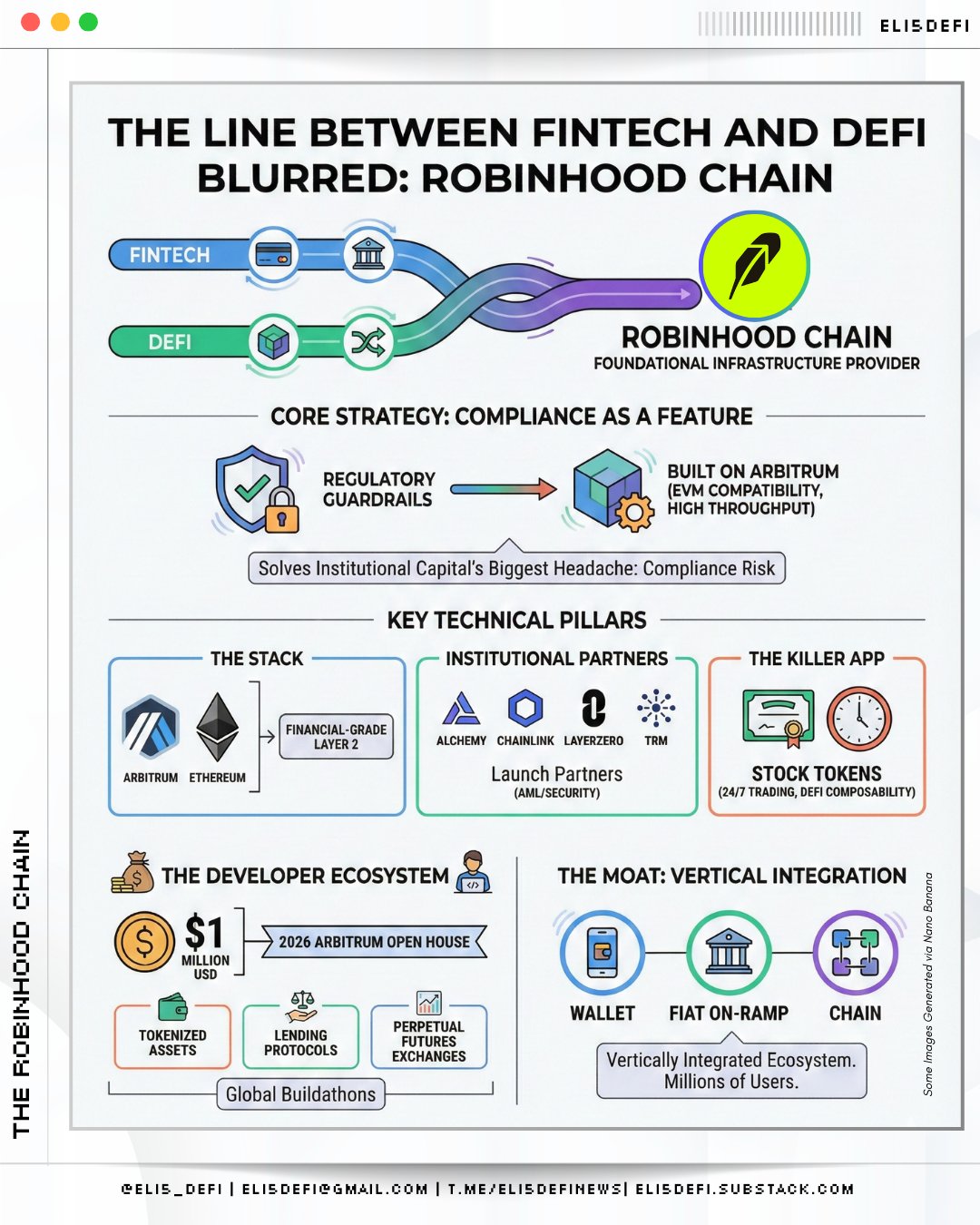

10 2 141 Original >Tendance de ARB après le lancementExtrêmement haussier Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 56 29 2.20K Original >Tendance de ARB après le lancementExtrêmement haussier

56 29 2.20K Original >Tendance de ARB après le lancementExtrêmement haussier Cooker.hl | Kms.eth | 版本之子 | Cooker Founder Trader C130.41K @CookerFlips

Cooker.hl | Kms.eth | 版本之子 | Cooker Founder Trader C130.41K @CookerFlips Veee D3.88K @vikktorrrre

Veee D3.88K @vikktorrrre 31 11 5.68K Original >Tendance de ARB après le lancementHaussier

31 11 5.68K Original >Tendance de ARB après le lancementHaussier- Tendance de ARB après le lancementHaussier

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 56 29 2.20K Original >Tendance de ARB après le lancementExtrêmement haussier

56 29 2.20K Original >Tendance de ARB après le lancementExtrêmement haussier- Tendance de ARB après le lancementExtrêmement haussier

Ibrahim ($/acc)🥷🧭 FA_Analyst Influencer B65.06K @Ibrahim04jh

Ibrahim ($/acc)🥷🧭 FA_Analyst Influencer B65.06K @Ibrahim04jh

Ibrahim ($/acc)🥷🧭 FA_Analyst Influencer B65.06K @Ibrahim04jh116 14 5.47K Original >Tendance de ARB après le lancementNeutre

Ibrahim ($/acc)🥷🧭 FA_Analyst Influencer B65.06K @Ibrahim04jh116 14 5.47K Original >Tendance de ARB après le lancementNeutre Pinnacle Crypt 💎🥷🦾 Influencer Community_Lead B11.23K @PinnacleCrypt

Pinnacle Crypt 💎🥷🦾 Influencer Community_Lead B11.23K @PinnacleCrypt Veee D3.88K @vikktorrrre

Veee D3.88K @vikktorrrre 4 3 286 Original >Tendance de ARB après le lancementExtrêmement haussier

4 3 286 Original >Tendance de ARB après le lancementExtrêmement haussier Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 56 29 2.20K Original >Tendance de ARB après le lancementHaussier

56 29 2.20K Original >Tendance de ARB après le lancementHaussier Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi

Eli5DeFi Educator DeFi_Expert C44.47K @Eli5defi 56 29 2.20K Original >Tendance de ARB après le lancementExtrêmement haussier

56 29 2.20K Original >Tendance de ARB après le lancementExtrêmement haussier