Switchboard Protocol دادههای قیمت لحظهای

قیمت امروز Switchboard Protocol برابر با $ 0.011 (SWTCH/USD) است. با ارزش بازار برابر با $ 1.97M USD. حجم معاملات 24 ساعته $ 619.24K USD, تغییر قیمت 24 ساعته به میزان -11.90% و عرضه در گردش برابر با 171.61M SWTCH.

Switchboard Protocol SWTCH تاریخچه قیمت USD

قیمت Switchboard Protocol را برای امروز، 7 روز، 30 روز و 90 روز پیگیری کنید

دوره

تغییر

تغییر (%)

امروز

0

-13.70%

7روزها

--

--

30روزها

--

--

90روزها

0

-83.36%

تجارت SWTCH در سه مرحله

یک حساب کاربری رایگان ایجاد کنید، حساب خود را شارژ کنید، افزودن سپس ارز دیجیتال خود را انتخاب کنید

Switchboard Protocol اطلاعات بازار

$ 0.010 محدوده ۲۴ ساعته $ 0.013

بالاترین رکورد زمانی

$ 2.14

همیشه پایین

$ 0.0098

تغییر ۲۴ ساعته

-11.90%

حجم ۲۴ ساعت

$ 619,241.72

عرضه در گردش

171.60M

SWTCH

مارکت کپ

$ 1.97M

حداکثر عرضه

1.00B

SWTCH

ارزش بازار کاملاً رقیقشده

$ 11.47M

معامله SWTCH

کسب درآمد حتی بدون دانش مالی

Put your idle crypto to work and earn passive income through savings, staking, and more.Switchboard Protocol X Insight

The Switchboard DAO is coming soon, and SWTCH holders will obtain protocol governance rights.

Governance of the Switchboard Protocol rests with SWTCH holders.

The Switchboard DAO. Coming very soon. https://t.co/qmj3Ximueb

22 روزها قبل

روند SWTCH پس از انتشار

اطلاعاتی موجود نیست

صعودی

The Switchboard DAO is coming soon, and SWTCH holders will obtain protocol governance rights.

Switchboard delivers excellent performance but is undervalued in market cap, with a valuation mismatch suggesting upward potential.

Crazy to see Switchboard delivering millisecond-level performance while sitting at a $6M market cap. Feels like the market hasn’t caught up to the fundamentals yet. $BTC $ETH

Do you think this kind of tech-versus-market mismatch is about to correct ? $HYPE

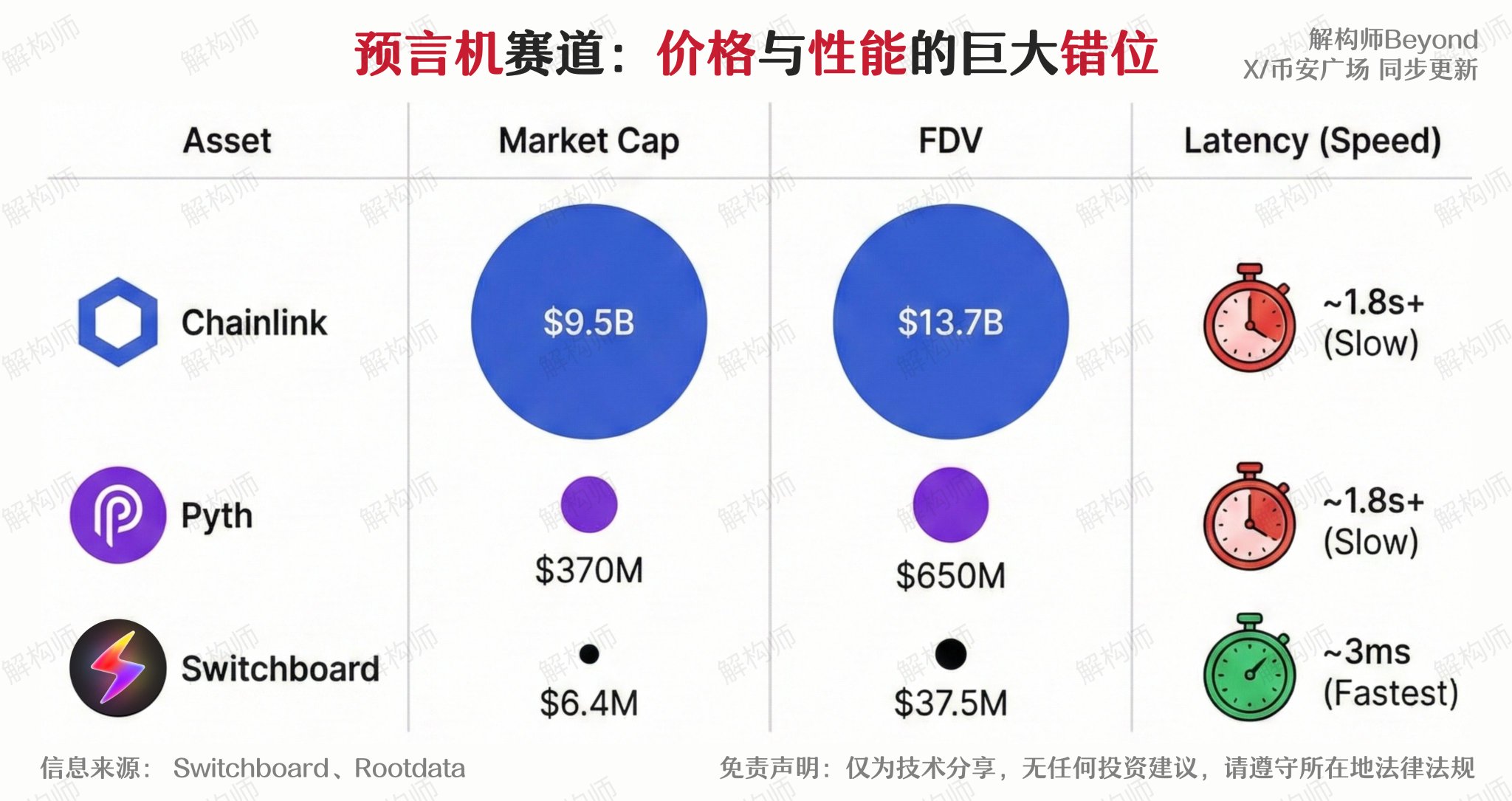

Recently, while reviewing data on the oracle sector, I discovered a very puzzling phenomenon:

There is an extreme mismatch between asset prices and product performance

I'm not sure whether the market hasn't reacted yet or still uses old valuation logic in this sector. The current market cap ladder looks like this:

- Chainlink $LINK market cap 9.5 billion / FDV 13.7 billion

- Pyth $PYTH market cap 370 million / FDV 650 million

- Switchboard $SWTCH market cap 6.4 million / FDV 37.5 million

Switchboard's market cap is even less than 2% of Pyth's

Usually such valuation gaps imply a comprehensive lag in technology or ecosystem, but after dissecting the actual business data, the situation is exactly the opposite

1/ Actual tests of latency and block inclusion rate

In DeFi, especially on high‑frequency chains like Solana, speed is not only an experience factor but also the foundation of risk control

- Pyth on‑chain latency is about 1.8 seconds, and without paying priority fees, there is roughly a 30% chance of failing to be included on time

- Switchboard latency is only 3–4 milliseconds, thanks to the TEE architecture and Surge model; even without priority fees, there is a 95% chance of block inclusion in the next slot

2/ Differences in architecture models

Most oracles on the market, including Chainlink and Pyth, still rely on consensus propagation or are permission‑based, which limits scalability to some extent

Switchboard follows the TEE (Trusted Execution Environment) route, making it currently the only millisecond‑level oracle that can operate “permission‑less”

Its newly launched on‑chain subscription model allows anyone to pay for data streams directly with tokens, without sales intermediaries or API approvals

This is the form that Web3 infrastructure should have

3/ Business load capacity

Although its market cap is only a little over 6 million, it already covers leading protocols such as Jito, Drift, Kamino, protecting over $5 billion of on‑chain value

/

On one side, a mainstream asset with a market cap of $370 million but latency of 1.8 seconds; on the other, a technical asset with a market cap of $6.4 million but latency of only 3 milliseconds

This kind of fundamental‑to‑market inversion is extremely rare

It may mean that pricing power in the oracle sector is still held by brand inertia rather than technology and efficiency

But if the market eventually returns to rationality, this asymmetry itself is worth watching

@switchboardxyz @hermidao1

57 روزها قبل

روند SWTCH پس از انتشار

اطلاعاتی موجود نیست

صعودی

Switchboard delivers excellent performance but is undervalued in market cap, with a valuation mismatch suggesting upward potential.

SWTCH coin is up over 31% in 24 hours, the tweet predicts it will soon reach $2Z, and the image shows a recent price surge.

SWTCH is up; $2Z soon. https://t.co/2ANUJei5i4

128 روزها قبل

روند SWTCH پس از انتشار

اطلاعاتی موجود نیست

بسیار صعودی

SWTCH coin is up over 31% in 24 hours, the tweet predicts it will soon reach $2Z, and the image shows a recent price surge.

پیشبینی قیمت

چه زمانی برای خرید SWTCH مناسب است؟ آیا اکنون باید SWTCH بخرم یا بفروشم؟

از دیدگاه تجزیه و تحلیل فنی بر اساس تحلیل تکنیکال 4 ساعته SWTCH، سیگنال معاملاتی نگهداری است. بر اساس تحلیل تکنیکال 1 روزه SWTCH، سیگنال معاملاتی نگهداری است.

پیشبینی Beacon

پیشبینی احتمالی قیمت (24 ساعت آینده)crypto.loading

درباره Switchboard Protocol

Switchboard Protocol (SWTCH) is a cryptocurrency launched in 2025and operates on the Solana platform. Switchboard Protocol has a current supply of 1,000,000,000 with 171,606,373 in circulation. The last known price of Switchboard Protocol is 0.01226693 USD and is up 14.16 over the last 24 hours. It is currently trading on 53 active market(s) with $2,253,140.26 traded over the last 24 hours. More information can be found at https://switchboard.foundation/.

بیشتر بخوانید

کاوش بیشتر

کشف BM

لیستینگ جدید

MOLTEN Molten

0 0.00%

NVOON Novo Nordisk Ondo Tokenized

0 0.00%

CRMON Salesforce Ondo Tokenized

0 0.00%

USFRON WisdomTree Floating Rate Treasury Fund Ondo Tokenized

0 0.00%

CEGON Constellation Energy Ondo Tokenized

0 0.00%

OKLOON Oklo Ondo Tokenized

0 0.00%

ANTIHUNTER AntiHunter

0 0.00%

QCOMON Qualcomm Ondo Tokenized

0 0.00%

FIGON Figma Ord Shs Ondo Tokenized

0 0.00%

PDDON PDD Holdings Ondo Tokenized

0 0.00%