Alright class, portfolios ready! 🦞🏦

Today we're exploring tokenization: how RWAs like stocks, bonds, and real estate become digital tokens on blockchain.

@StellarOrg is leading this revolution. The SDF aims to power $3 billion in real-world asset value on Stellar in 2025.

Notebooks open, let's tokenize! 📖👇

1️⃣ What is Asset Tokenization?

Tokenization turns real-world assets into digital tokens on blockchain.

Think of it as creating a digital twin: a stock, bond, or property becomes a token you can send, trade, or hold in your wallet.

• Stocks & Equities: Own fractional shares of companies

• Bonds & Treasuries: US government debt as tokens

• Real Estate: Own a piece of a building

• Commodities: Gold, silver, oil as digital assets

• Money Market Funds: Investment funds on-chain

On Stellar, digital assets can be issued 24/7 from almost anywhere in the world, with a global distribution ecosystem reaching 180 countries.

The token represents ownership. The blockchain proves it. No paperwork, no middlemen.

🦞🤤 Matt: Wait, so I can own part of a building with a token?

🦞🤓 Jake: How is this different from just buying stocks on Robinhood?

Yes Matt! Fractional ownership means you can buy $100 of a $10 million building.

Jake, tokenized assets trade 24/7, settle in seconds, and you actually own them in your wallet. No broker holding them for you.

2️⃣ Why Stellar for Tokenization?

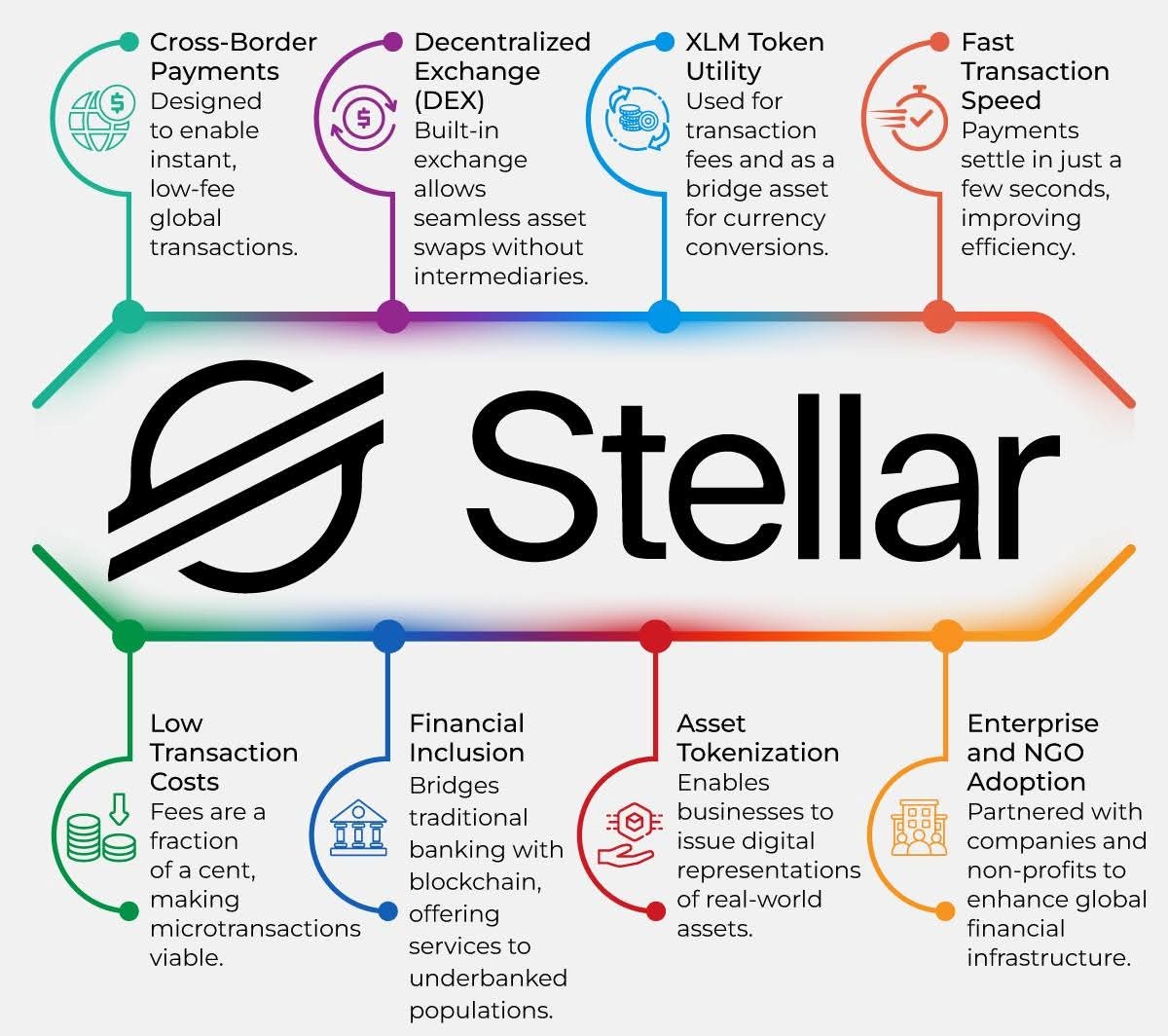

Several key factors make Stellar ideal for RWAs: low transaction costs with near-zero fees, fast settlements in seconds, and a robust framework for security and compliance.

Here's why institutions choose Stellar:

• Speed: Transactions settle in 5 seconds. Traditional finance takes 2-3 days.

• 24/7 Markets: Trade tokenized assets anytime. No market hours.

• Global Access: Send assets anywhere instantly. No borders.

• Built-in Compliance: Manage transactions with built-in controls for approving, revoking, and freezing assets.

• Cost: Transaction fees around $0.00055 per operation. Banks charge percentages.

The tokenized RWA market has doubled over the past year to $26 billion and is projected to grow into a trillion-dollar market by 2030.

Stellar isn't just joining this revolution. It's leading it.

🦞😈 Ozzy: So Wall Street is finally coming to crypto?

🦞🤤 Matt: Can regular people use tokenized assets or just big banks?

Yes Ozzy! Partners include Franklin Templeton, WisdomTree, Paxos, Ondo, and SG Forge (Société Générale's blockchain division).

Matt, anyone can access them! That's the point. USDY in LOBSTR is a tokenized asset earning yield from US Treasuries.

3️⃣ Real Examples on #Stellar

Tokenization isn't a theory. It's happening now on Stellar:

• Franklin Templeton: The Franklin OnChain U.S. Government Money Fund (FOBXX) is a regulated US mutual fund issuing each share as a BENJI token on Stellar. Hundreds of millions in tokenized treasuries.

• Archax: UK-regulated digital asset platform tokenized Aberdeen Asset Management's money market fund on Stellar. Access to 100+ tokenized funds.

• Ondo Finance (USDY): Yield-bearing stablecoin backed by short-term US Treasuries, combining stablecoin functionality with DeFi yield (Already live in LOBSTR!).

• Mercado Bitcoin: Announced $200 million RWA issuance on Stellar.

• Visa: Integrated Stellar into its stablecoin settlement platform.

Stellar aims to power $110 billion in RWA volume by the end of 2025. That's not hype. That's institutional money moving on-chain.

🦞🤓 Jake: So USDY in my LOBSTR wallet is actually backed by US Treasuries?

🦞🤤 Matt: Can I buy Franklin Templeton's fund through LOBSTR?

Yes Jake! USDY's yield comes from real Treasury Bills held by Ondo Finance.

Matt, BENJI tokens require specific access, but more tokenized assets are coming to Stellar wallets. USDY is just the beginning.

4️⃣ Risks to Know

Tokenization is powerful, but not without risks:

• Regulatory uncertainty: Laws vary by country. Some tokenized assets may have restrictions.

• Counterparty risk: The issuer must actually hold the underlying asset. Trust matters.

• Liquidity risk: Some tokenized assets may have thin markets. Hard to sell quickly.

• Smart contract risk: Bugs in token contracts could cause problems.

• KYC requirements: Many tokenized securities require identity verification.

Stellar joined the ERC-3643 Association to improve cross-chain compliance between Stellar and Ethereum, ensuring secure, verified transactions for tokenized assets.

🦞😈 Ozzy: What if Franklin Templeton goes bankrupt? Do I lose my tokens?

🦞🤤 Matt: Is this legal everywhere?

Ozzy, tokenized funds have the same protections as traditional funds. But always understand what backs your token.

Matt, regulations vary. US persons may have restrictions on some assets. Always check compliance.

5️⃣ To Conclude

Quick recap, what did we learn?

🦞🤓 Jake: Tokenization turns real assets like bonds and stocks into blockchain tokens that trade 24/7.

🦞🤤 Matt: Stellar is leading with Franklin Templeton, Archax, Ondo, and Visa already building on-chain.

🦞😈 Ozzy: Stellar targets $3 billion in tokenized assets by 2026, a 10x increase from 2024.

Perfect! Tokenization is bringing Wall Street to blockchain. Faster settlements, lower costs, global access, true ownership.

The RWA market is projected to grow into a trillion-dollar industry by 2030. Stellar is positioning itself at the center of this transformation.

Next time you hold USDY in LOBSTR, remember: you're holding a piece of the future of finance.

Class dismissed, dear LOBSTRS! See you next time! 🦞

Stellar (XLM)

Stellar (XLM) Roarxprince Influencer Media A3.10K @Roarxprince

Roarxprince Influencer Media A3.10K @Roarxprince Roarxprince Influencer Media A3.10K @Roarxprince43 13 629 اصلی >روند XLM پس از انتشارصعودی

Roarxprince Influencer Media A3.10K @Roarxprince43 13 629 اصلی >روند XLM پس از انتشارصعودی 🥖Tokenicer✲⥃⬢ Researcher Educator B62.91K @Tokenicer

🥖Tokenicer✲⥃⬢ Researcher Educator B62.91K @Tokenicer 🥖Tokenicer✲⥃⬢ Researcher Educator B62.91K @Tokenicer

🥖Tokenicer✲⥃⬢ Researcher Educator B62.91K @Tokenicer 244 11 16.28K اصلی >روند XLM پس از انتشارصعودی

244 11 16.28K اصلی >روند XLM پس از انتشارصعودی InvestingHaven FA_Analyst OnChain_Analyst D6.79K @InvestingHaven

InvestingHaven FA_Analyst OnChain_Analyst D6.79K @InvestingHaven

InvestingHaven FA_Analyst OnChain_Analyst D6.79K @InvestingHaven0 1 65 اصلی >روند XLM پس از انتشارصعودی

InvestingHaven FA_Analyst OnChain_Analyst D6.79K @InvestingHaven0 1 65 اصلی >روند XLM پس از انتشارصعودی Dao world TA_Analyst OnChain_Analyst A18.97K @Koreanteacher1

Dao world TA_Analyst OnChain_Analyst A18.97K @Koreanteacher1 Stellar Media Community_Lead C842.02K @StellarOrg27 1 1.55K اصلی >روند XLM پس از انتشارصعودی

Stellar Media Community_Lead C842.02K @StellarOrg27 1 1.55K اصلی >روند XLM پس از انتشارصعودی Scopuly - Stellar Wallet Educator DeFi_Expert B15.31K @scopuly

Scopuly - Stellar Wallet Educator DeFi_Expert B15.31K @scopuly Stellar Media Community_Lead C842.02K @StellarOrg1.52K 64 115.95K اصلی >روند XLM پس از انتشارصعودی

Stellar Media Community_Lead C842.02K @StellarOrg1.52K 64 115.95K اصلی >روند XLM پس از انتشارصعودی 🇬🇧 ChartNerd 📊 TA_Analyst Trader A22.38K @ChartNerdTA

🇬🇧 ChartNerd 📊 TA_Analyst Trader A22.38K @ChartNerdTA

Stellar Media Community_Lead C842.02K @StellarOrg49 2 3.26K اصلی >روند XLM پس از انتشارصعودی

Stellar Media Community_Lead C842.02K @StellarOrg49 2 3.26K اصلی >روند XLM پس از انتشارصعودی Mr. Man FA_Analyst Regulatory_Expert A39.97K @MrManXRP

Mr. Man FA_Analyst Regulatory_Expert A39.97K @MrManXRP Stellar Media Community_Lead C842.02K @StellarOrg1.52K 64 115.95K اصلی >روند XLM پس از انتشارصعودی

Stellar Media Community_Lead C842.02K @StellarOrg1.52K 64 115.95K اصلی >روند XLM پس از انتشارصعودی