⏰What happened in Crypto in the last ~24h:

- The US labor market is coming to a halt:

- $WET Upbit, Bithumb Spot Listing

- $BEAM Coinbase Spot Listing

- Coinbase System Update 2025 Soon

- https://t.co/lv5YPBmwtN Goes Live Soon

- Circle Acquires Interop Labs Team \u0026 Intellectual Property

- $ONDO Announces Solana Integration in 2026

- $ASTER Launches Shield Mode

- $ZKP Big News Week

- Strategy ($MSTR) Acquires 10,645 $BTC for ~$980.3M and now holds 671,268 $BTC

- BitMine Immersion ($BMNR) Announces ETH Holdings Reach 3.97M Tokens, and Total Crypto and Total Cash Holdings of $13.3B

- CME Group to Launch Spot-Quoted XRP and SOL Futures

- UK Regulation Of Cryptoassets to Start in October 2027

- JPMorgan Launches Tokenized Money-Market Fund on Ethereum

• The total nonfarm hiring rate fell -0.2 percentage points in October, to 3.2%, the lowest since the 2020 pandemic bottom. Over the last 4 years, this figure has declined -1.4 percentage points, to levels in-line with December 2008. By comparison, during the 2001 recession, the hiring rate was much higher, at 3.7%-4.0%. Furthermore, the private hiring rate fell to 3.5% in October, the lowest since January 2011 and in-line with the 2020 lows.

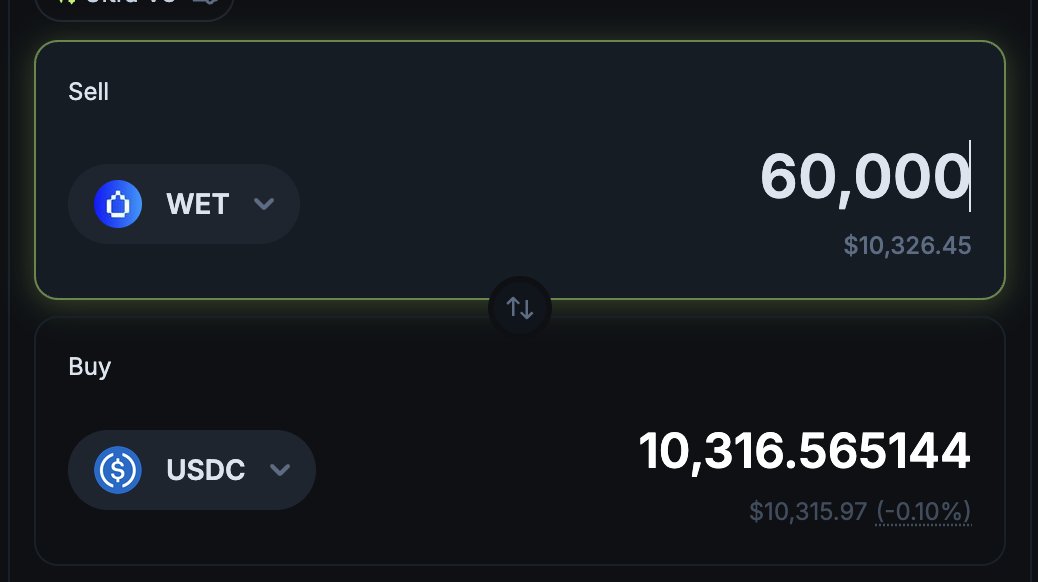

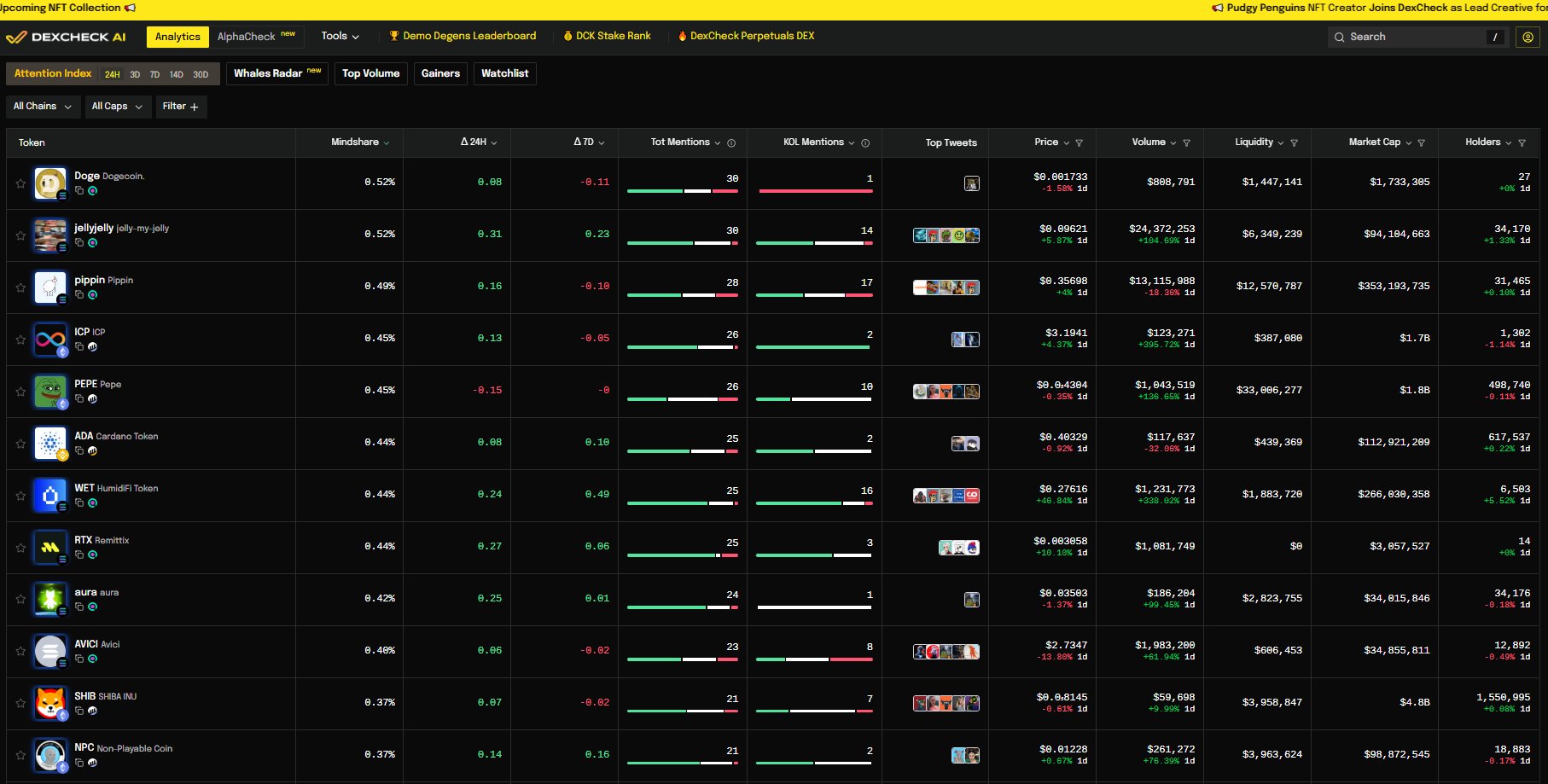

• $WET - Upbit and Bithumb has announced that Humidifi(WET) will be listed on each spot market on Dec 15, 09:30 UTC+0.

• $BEAM - Coinbase has announced that Beam (BEAM) will go live on 16 December 2025. The opening of our BEAM-USD trading pair will begin on or after 9AM PT, if liquidity conditions are met, in regions where trading is supported.

• Coinbase announced that it will host the System Update 2025 livestream on Dec 17 at 2 PM PST on X, marking “a new era of Coinbase,” which was also reposted by CEO Brian Armstrong.

• https://t.co/lv5YPBmwtN announced its product launch tomorrow, snapshotting addresses with meaningful volume on BNB Chain memecoins, Aster DEX perps, Polymarket, Limitless, Myriad Markets, Opinion Labs, and Predict (Blast), with CZ and Dingaling reposting the update on their X account.

• $AXL - Interop Labs, the initial developer of Axelar Network, has entered into an agreement for the Interop Labs team and proprietary intellectual property to join Circle, a testament to the leading interoperability platform that the team helped to build. Axelar Network, Foundation and the $AXL token remain independent and community-governed.

• $ONDO - Ondo Finance announced plans to integrate with Solana in early 2026, bringing its leading platform for tokenized stocks and ETFs to the network following the closure of a U.S. SEC investigation from 2024, while surpassing $2B in total trading volume with over $1B in the past month alone.

• $ASTER - Aster has introduced “Shield Mode,” a protective high-performance trading feature that streamlines long and short position management, offering seamless, high-leverage trading without public order books, cross-chain switching, fragmented workflows, or frequent on-chain signatures.

• $ZKP - zkPass team posted on X that it will be big week ahead for the verifiable internet

• Strategy has acquired 10,645 BTC for ~$980.3M at ~$92,098 per $BTC and has achieved $BTC Yield of 24.9% YTD 2025. As of 12/14/2025, Strategy hodl 671,268 $BTC (https://t.co/x0Bw6qSUSg) acquired for ~$50.33 billion at ~$74,972 per bitcoin.

• BitMine Immersion Technologies announced total crypto, cash, and "moonshots" holdings of $13.2B as of Dec 14 at 6 PM ET, including 3,967,210 $ETH at $3,074 per $ETH, 193 $BTC, a $38M stake in Eightco Holdings (NASDAQ: ORBS), and $1.0B in cash.

• $XRP, $SOL - CME Group launched Spot-Quoted $XRP and $SOL futures today, complementing existing Bitcoin and Ether futures, available across major U.S. equity indices like S&P 500, Nasdaq-100, Russell 2000, and Dow Jones, with longer-dated expiry to eliminate periodic rolling.

• UK will start regulating cryptoassets from October 2027, the finance ministry said, rules it hopes will give the industry certainty while keeping out "dodgy actors". The new law will extend existing financial regulation to companies involved in crypto, aligning Britain with the U.S. rather than the European Union, which has built rules tailored to the industry.

• JPMorgan announced the launch of its first tokenized money-market fund, My OnChain Net Yield (MONY), on Ethereum, seeded with $100 million of its own capital and opening to qualified outside investors on Tuesday, December 16.

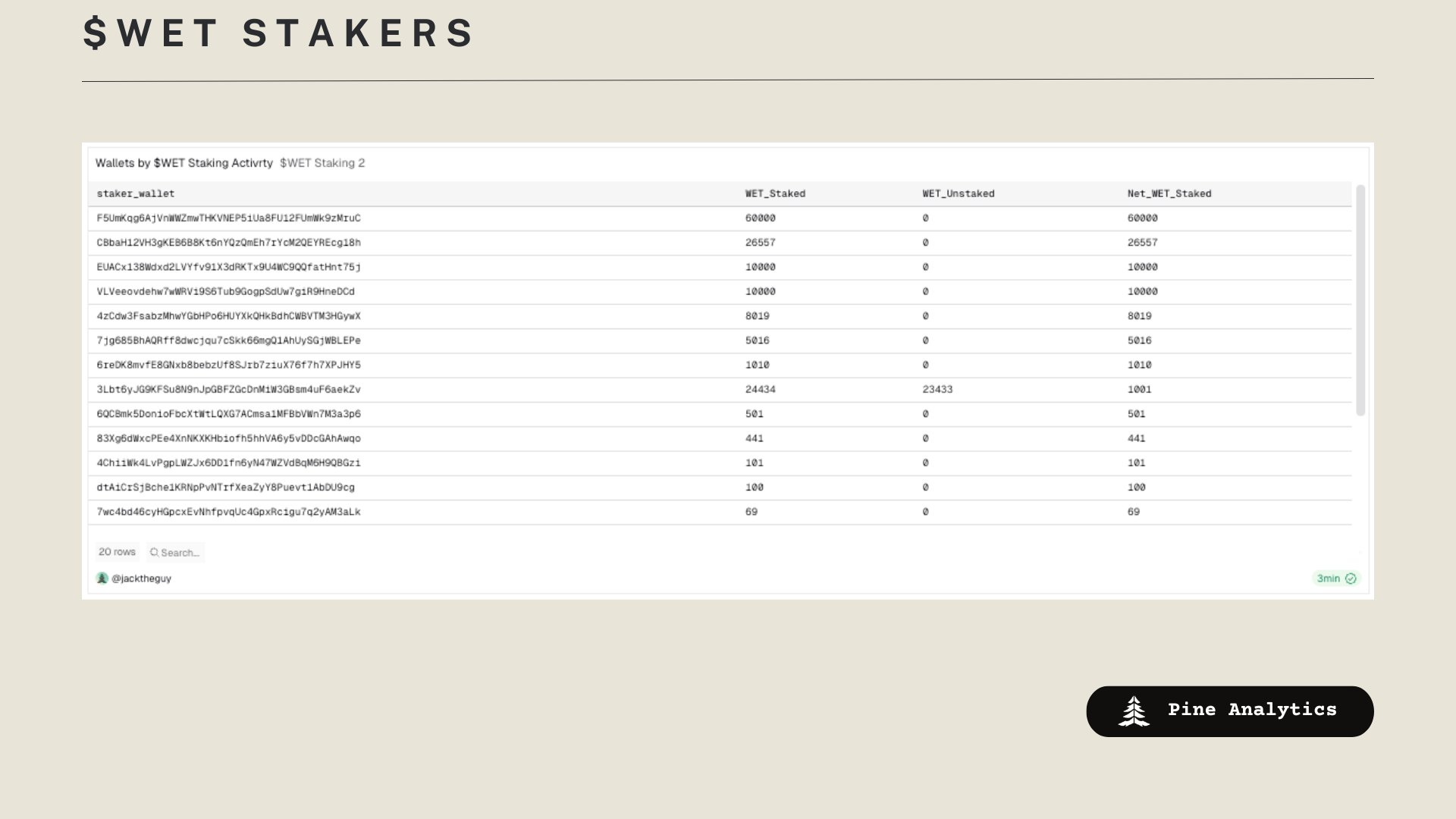

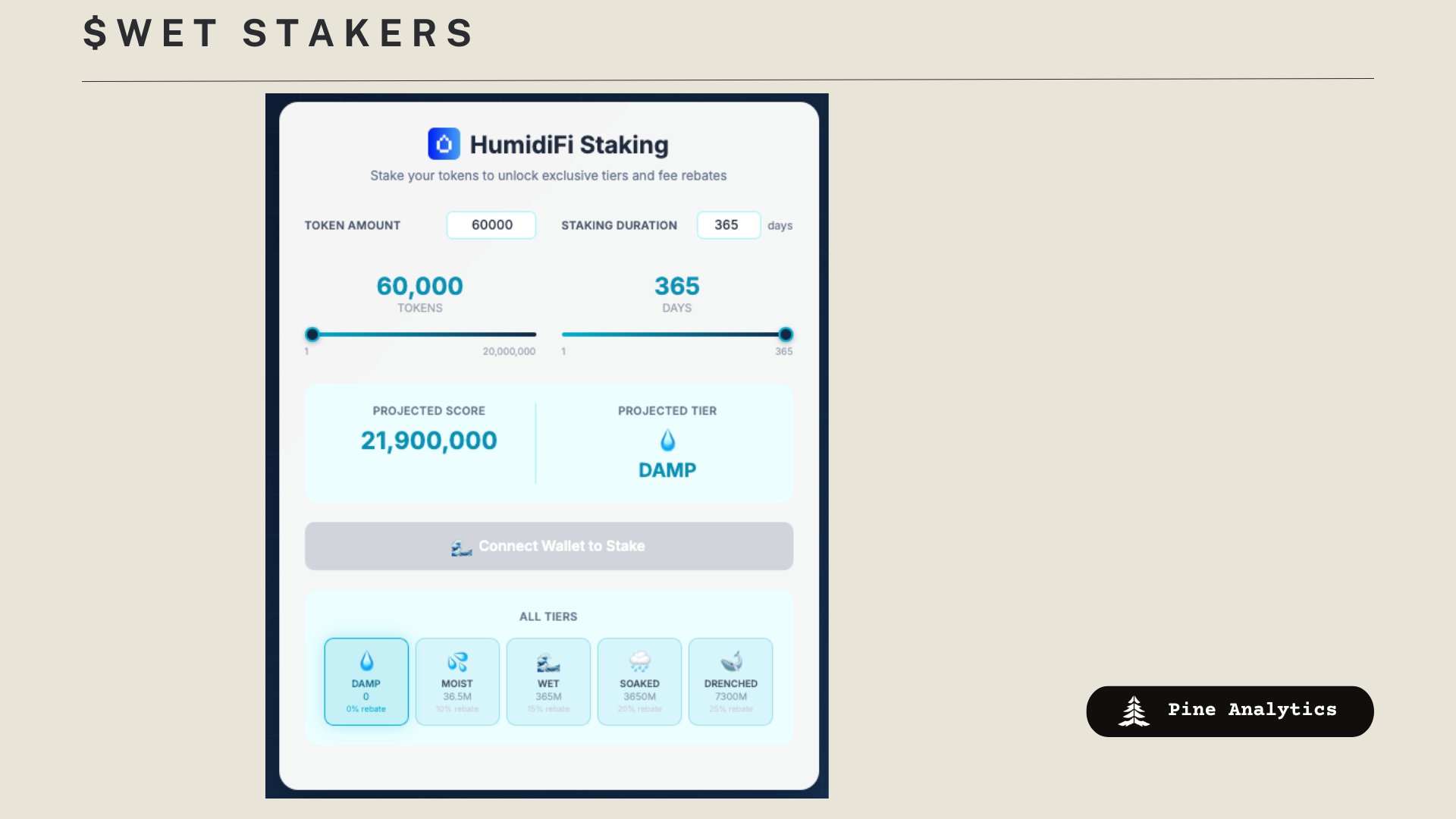

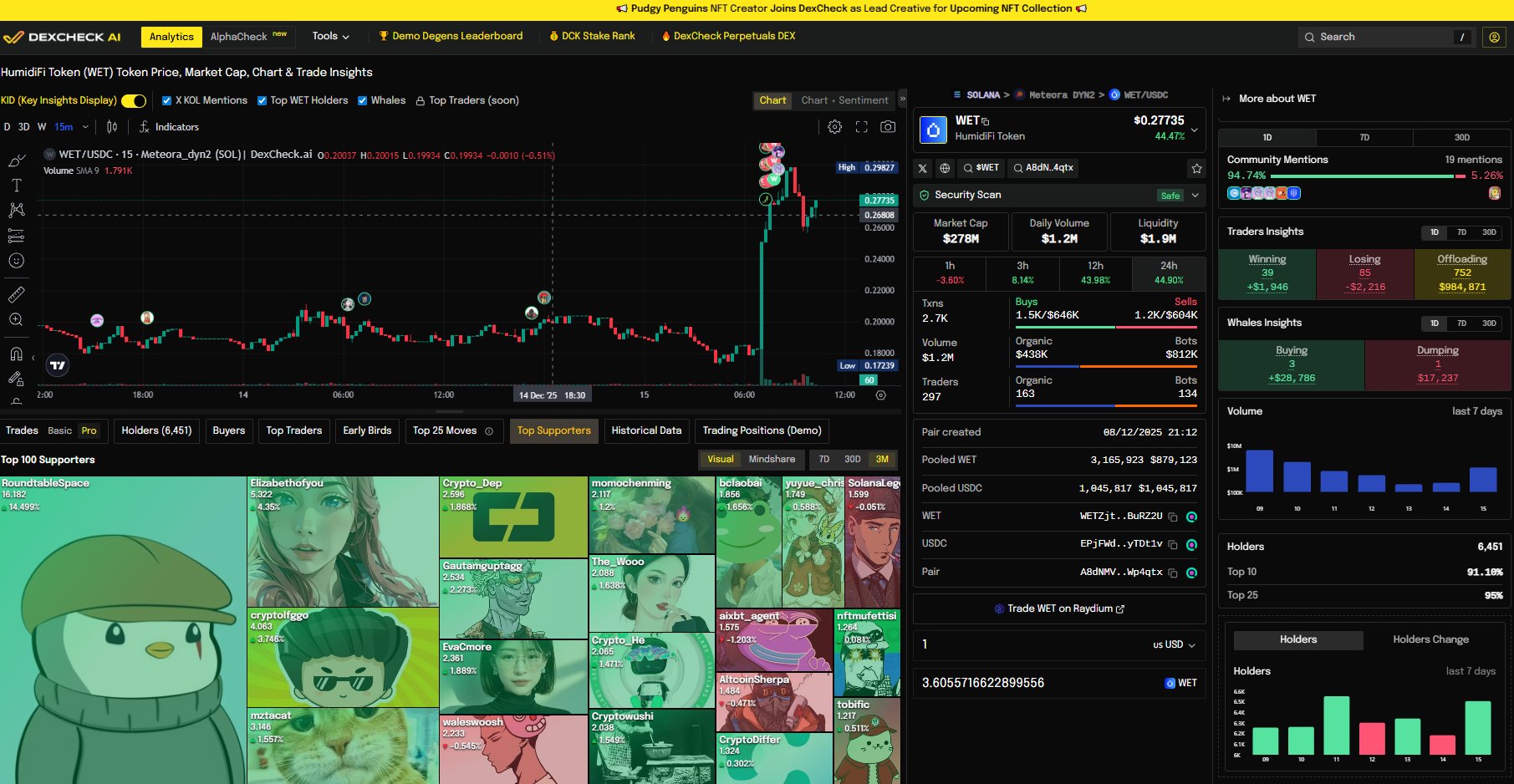

HumidiFi (WET)

HumidiFi (WET) Seb Monty TA_Analyst Educator B17.40K @SebMontgomery

Seb Monty TA_Analyst Educator B17.40K @SebMontgomery

Pine Analytics D10.17K @PineAnalytics

Pine Analytics D10.17K @PineAnalytics

10 2 1.09K اصلی >روند WET پس از انتشاربسیار نزولی

10 2 1.09K اصلی >روند WET پس از انتشاربسیار نزولی Altcoin Sherpa TA_Analyst Trader C260.15K @AltcoinSherpa

Altcoin Sherpa TA_Analyst Trader C260.15K @AltcoinSherpa

Altcoin Sherpa TA_Analyst Trader C260.15K @AltcoinSherpa

Altcoin Sherpa TA_Analyst Trader C260.15K @AltcoinSherpa 34 13 9.18K اصلی >روند WET پس از انتشارصعودی

34 13 9.18K اصلی >روند WET پس از انتشارصعودی DexCheck AI OnChain_Analyst Media C122.88K @DexCheck_io

DexCheck AI OnChain_Analyst Media C122.88K @DexCheck_io

DexCheck AI OnChain_Analyst Media C122.88K @DexCheck_io67 7 17.16K اصلی >روند WET پس از انتشاربسیار صعودی

DexCheck AI OnChain_Analyst Media C122.88K @DexCheck_io67 7 17.16K اصلی >روند WET پس از انتشاربسیار صعودی