Bittensor (TAO)

Bittensor (TAO)

$223.08 +1.35% 24H

- 93شاخص احساسات اجتماعی (SSI)+23.02% (24h)

- #19رتبهبندی نبض بازار (MPR)+69

- 72اشاره 24 ساعته در شبکههای اجتماعی+132.26% (24h)

- 85%نسبت صعودی 24 ساعته KOL46 KOL فعال

- خلاصه

- سیگنالهای صعودی

- سیگنالهای نزولی

شاخص احساسات اجتماعی (SSI)

- دادههای کلی93SSI

- روند SSI (7ر)قیمت (7ر)توزیع احساساتبسیار صعودی (24%)صعودی (61%)خنثی (11%)نزولی (4%)اطلاعات آماری SSI

رتبهبندی نبض بازار (MPR)

- تحلیل هشدار

پستهای X

Robin τ OnChain_Analyst Tokenomics_Expert A10.16K @Robin_T100

Robin τ OnChain_Analyst Tokenomics_Expert A10.16K @Robin_T100 Robin τ OnChain_Analyst Tokenomics_Expert A10.16K @Robin_T100114 4 2.51K اصلی >روند TAO پس از انتشارصعودی

Robin τ OnChain_Analyst Tokenomics_Expert A10.16K @Robin_T100114 4 2.51K اصلی >روند TAO پس از انتشارصعودی- روند TAO پس از انتشارصعودی

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG Andy ττ FA_Analyst OnChain_Analyst S10.21K @bittingthembits145 8 4.69K اصلی >روند TAO پس از انتشارصعودی

Andy ττ FA_Analyst OnChain_Analyst S10.21K @bittingthembits145 8 4.69K اصلی >روند TAO پس از انتشارصعودی FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG

FREKI ANCIENT CRYPTO OG | 2011 | HBAR XRP BTC ETH Influencer Educator B9.93K @Freki_OG Tseu Tseu - τao TA_Analyst Educator S5.24K @tseutseutao

Tseu Tseu - τao TA_Analyst Educator S5.24K @tseutseutao 235 17 11.71K اصلی >روند TAO پس از انتشاربسیار صعودی

235 17 11.71K اصلی >روند TAO پس از انتشاربسیار صعودی The Scope De-Fi Educator Media B17.21K @ScopeDefi

The Scope De-Fi Educator Media B17.21K @ScopeDefi The Scope De-Fi Educator Media B17.21K @ScopeDefi8 4 408 اصلی >روند TAO پس از انتشارخنثی

The Scope De-Fi Educator Media B17.21K @ScopeDefi8 4 408 اصلی >روند TAO پس از انتشارخنثی Punisher ττ FA_Analyst OnChain_Analyst A7.47K @CryptoZPunisher

Punisher ττ FA_Analyst OnChain_Analyst A7.47K @CryptoZPunisher

Score D6.94K @webuildscore8 0 336 اصلی >روند TAO پس از انتشاربسیار صعودی

Score D6.94K @webuildscore8 0 336 اصلی >روند TAO پس از انتشاربسیار صعودی Robin τ OnChain_Analyst Tokenomics_Expert A10.16K @Robin_T100

Robin τ OnChain_Analyst Tokenomics_Expert A10.16K @Robin_T100 Robin τ OnChain_Analyst Tokenomics_Expert A10.16K @Robin_T100

Robin τ OnChain_Analyst Tokenomics_Expert A10.16K @Robin_T100 251 32 5.80K اصلی >روند TAO پس از انتشاربسیار صعودی

251 32 5.80K اصلی >روند TAO پس از انتشاربسیار صعودی Punisher ττ FA_Analyst OnChain_Analyst A7.47K @CryptoZPunisher

Punisher ττ FA_Analyst OnChain_Analyst A7.47K @CryptoZPunisher CoinMarketCap Media Educator D6.98M @CoinMarketCap9 1 500 اصلی >روند TAO پس از انتشارصعودی

CoinMarketCap Media Educator D6.98M @CoinMarketCap9 1 500 اصلی >روند TAO پس از انتشارصعودی- روند TAO پس از انتشاربسیار صعودی

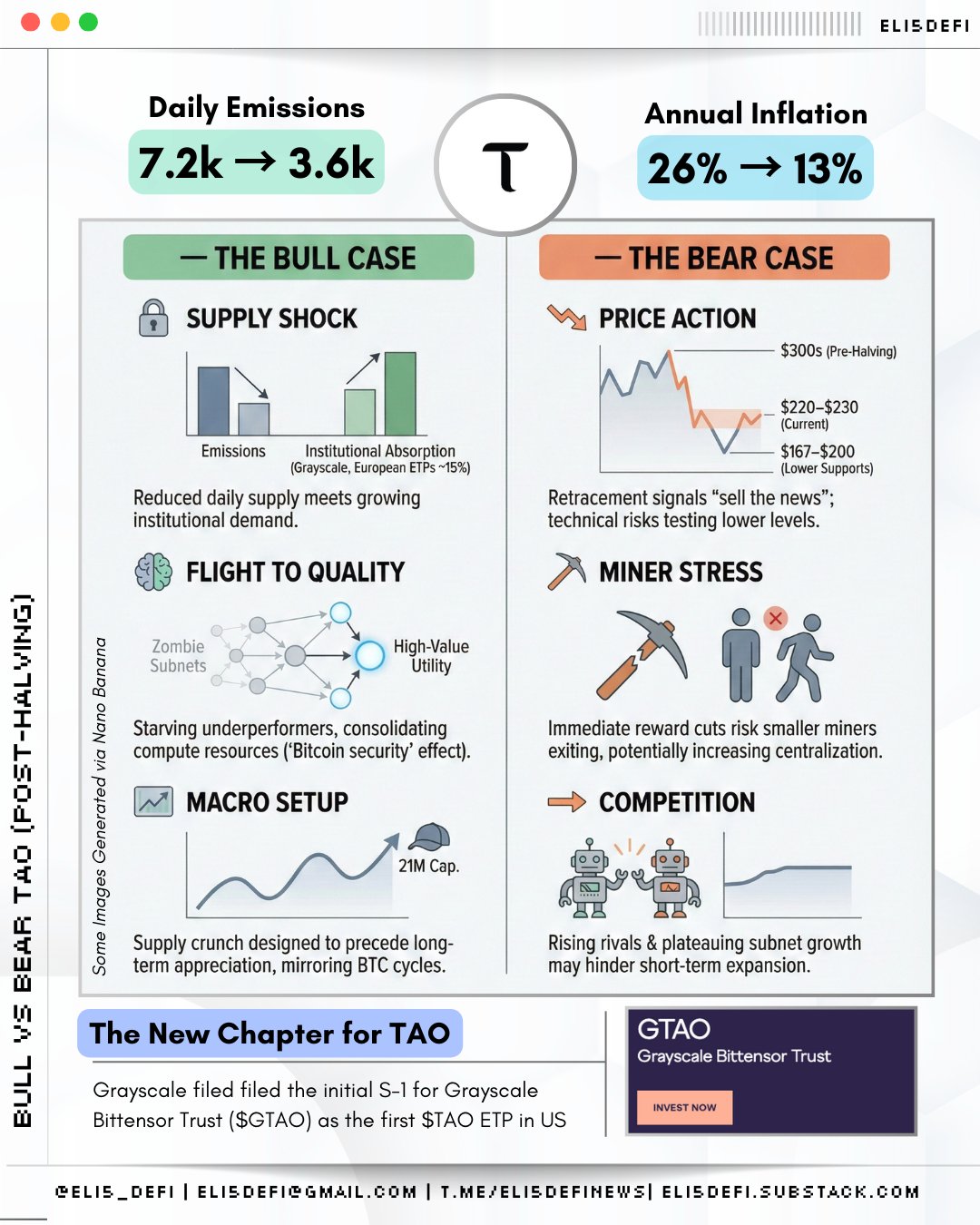

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi

Eli5DeFi Educator DeFi_Expert C43.94K @Eli5defi 36 23 1.02K اصلی >روند TAO پس از انتشارخنثی

36 23 1.02K اصلی >روند TAO پس از انتشارخنثی