Arbitrum (ARB)

Arbitrum (ARB)

$0.1902 -1.81% 24H

- 68شاخص احساسات اجتماعی (SSI)+0.85% (24h)

- #142رتبهبندی نبض بازار (MPR)-27

- 24اشاره 24 ساعته در شبکههای اجتماعی-14.29% (24h)

- 96%نسبت صعودی 24 ساعته KOL17 KOL فعال

- خلاصه

- سیگنالهای صعودی

- سیگنالهای نزولی

شاخص احساسات اجتماعی (SSI)

- دادههای کلی68SSI

- روند SSI (7ر)قیمت (7ر)توزیع احساساتبسیار صعودی (33%)صعودی (63%)خنثی (4%)اطلاعات آماری SSI

رتبهبندی نبض بازار (MPR)

- تحلیل هشدار

پستهای X

yellowpanther 黄豹 💎 Influencer Community_Lead C174.40K @yellowpantherx

yellowpanther 黄豹 💎 Influencer Community_Lead C174.40K @yellowpantherx Arbitrum Japan D3.57K @Arbitrum_jpn

Arbitrum Japan D3.57K @Arbitrum_jpn

37 22 848 اصلی >روند ARB پس از انتشاربسیار صعودی

37 22 848 اصلی >روند ARB پس از انتشاربسیار صعودی Gilmo FA_Analyst OnChain_Analyst A15.46K @0xgilllee

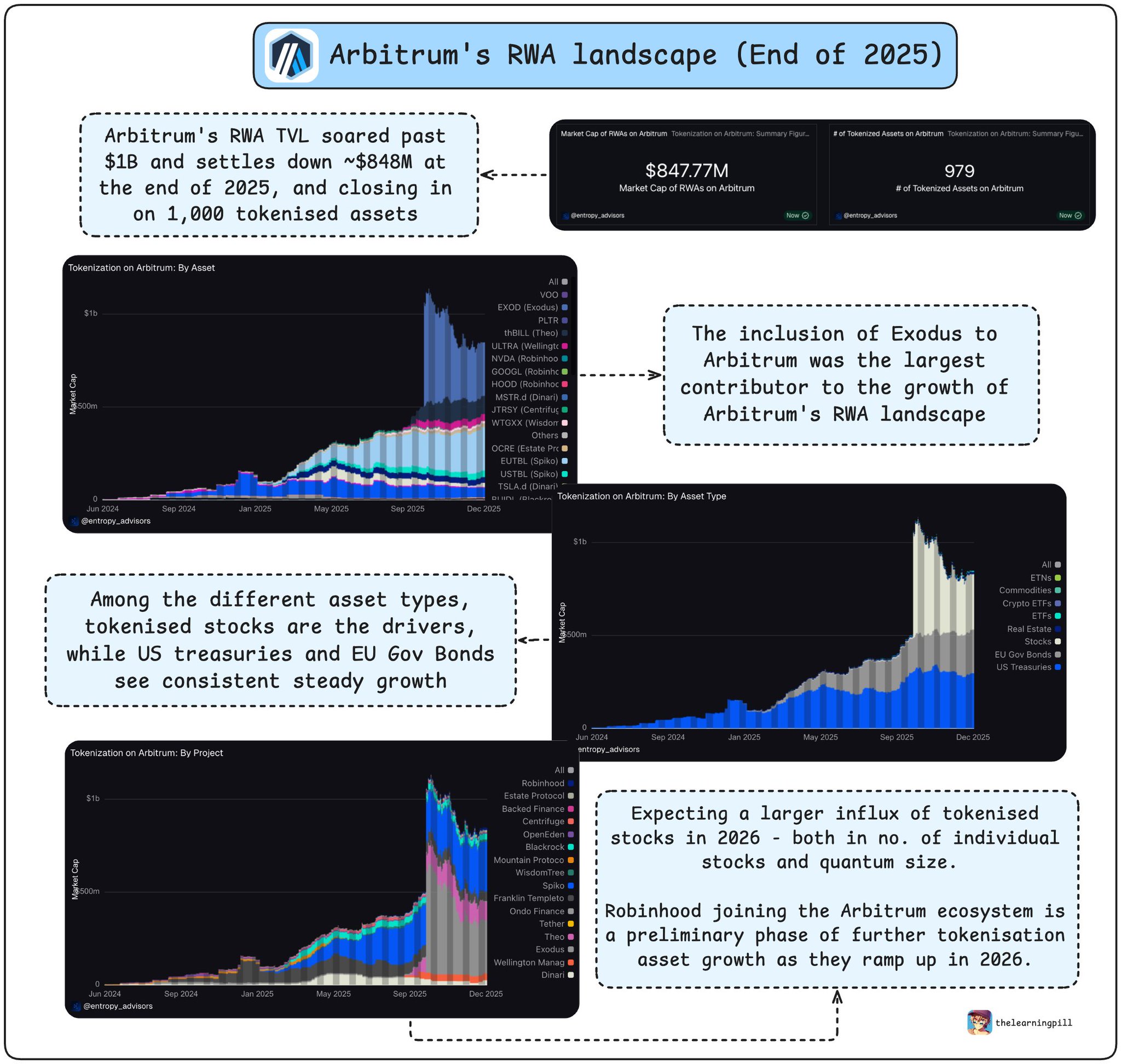

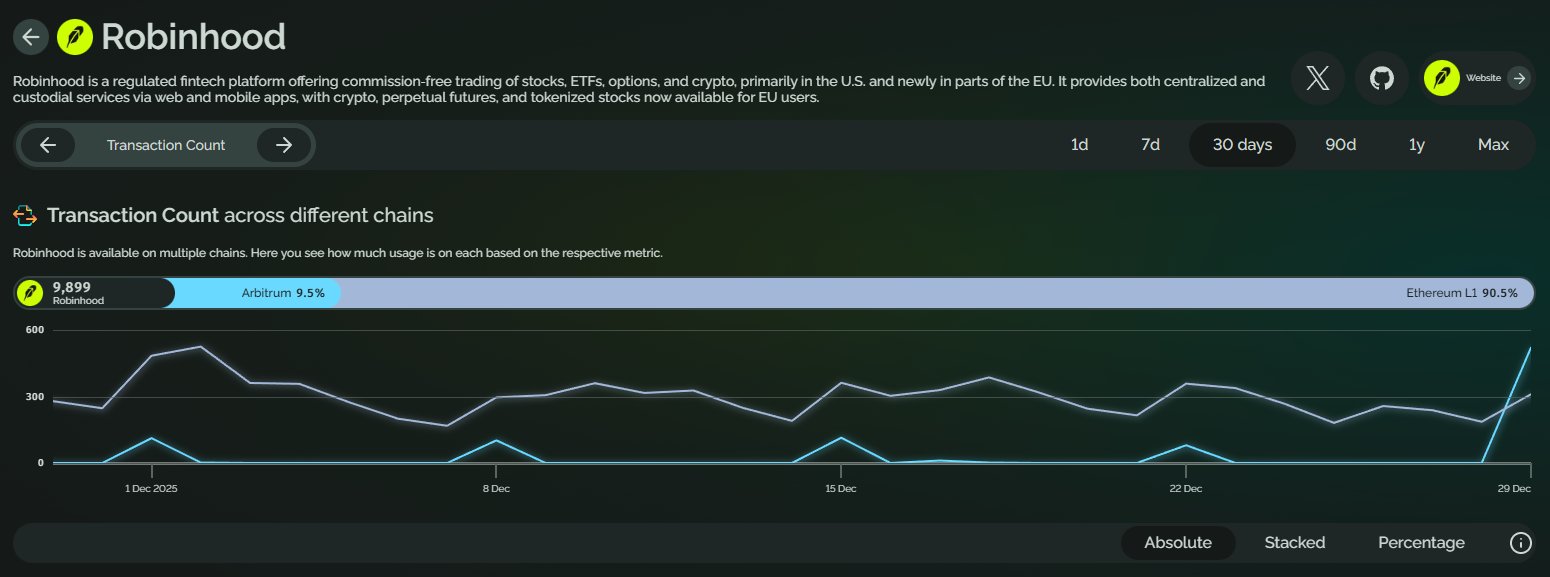

Gilmo FA_Analyst OnChain_Analyst A15.46K @0xgilllee The Learning Pill 💊 D23.29K @thelearningpill

The Learning Pill 💊 D23.29K @thelearningpill 65 47 1.39K اصلی >روند ARB پس از انتشاربسیار صعودی

65 47 1.39K اصلی >روند ARB پس از انتشاربسیار صعودی- روند ARB پس از انتشارصعودی

- روند ARB پس از انتشاربسیار صعودی

- روند ARB پس از انتشارصعودی

Javi🥥.eth Community_Lead Influencer B61.98K @jgonzalezferrer

Javi🥥.eth Community_Lead Influencer B61.98K @jgonzalezferrer Arbitrum D1.17M @arbitrum

Arbitrum D1.17M @arbitrum 169 93 3.04K اصلی >روند ARB پس از انتشارصعودی

169 93 3.04K اصلی >روند ARB پس از انتشارصعودی- روند ARB پس از انتشارصعودی

- روند ARB پس از انتشارصعودی

𝗵𝘂𝗻𝘁𝗲𝗿 Community_Lead Media B15.69K @BFreshHB

𝗵𝘂𝗻𝘁𝗲𝗿 Community_Lead Media B15.69K @BFreshHB growthepie 🥧📏 D11.82K @growthepie_eth

growthepie 🥧📏 D11.82K @growthepie_eth 54 21 1.41K اصلی >روند ARB پس از انتشاربسیار صعودی

54 21 1.41K اصلی >روند ARB پس از انتشاربسیار صعودی Eliza Media Influencer B92.42K @WEB3Eliza

Eliza Media Influencer B92.42K @WEB3Eliza Eliza Media Influencer B92.42K @WEB3Eliza48 33 1.57K اصلی >روند ARB پس از انتشارصعودی

Eliza Media Influencer B92.42K @WEB3Eliza48 33 1.57K اصلی >روند ARB پس از انتشارصعودی