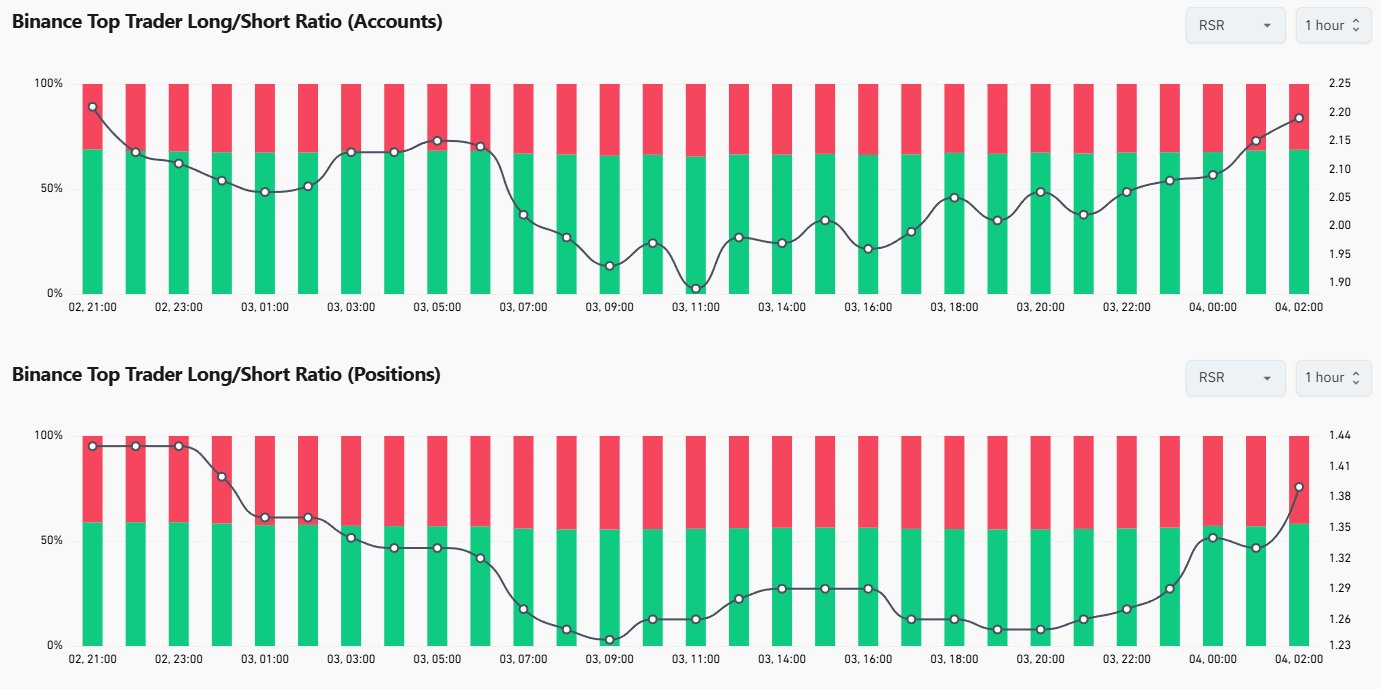

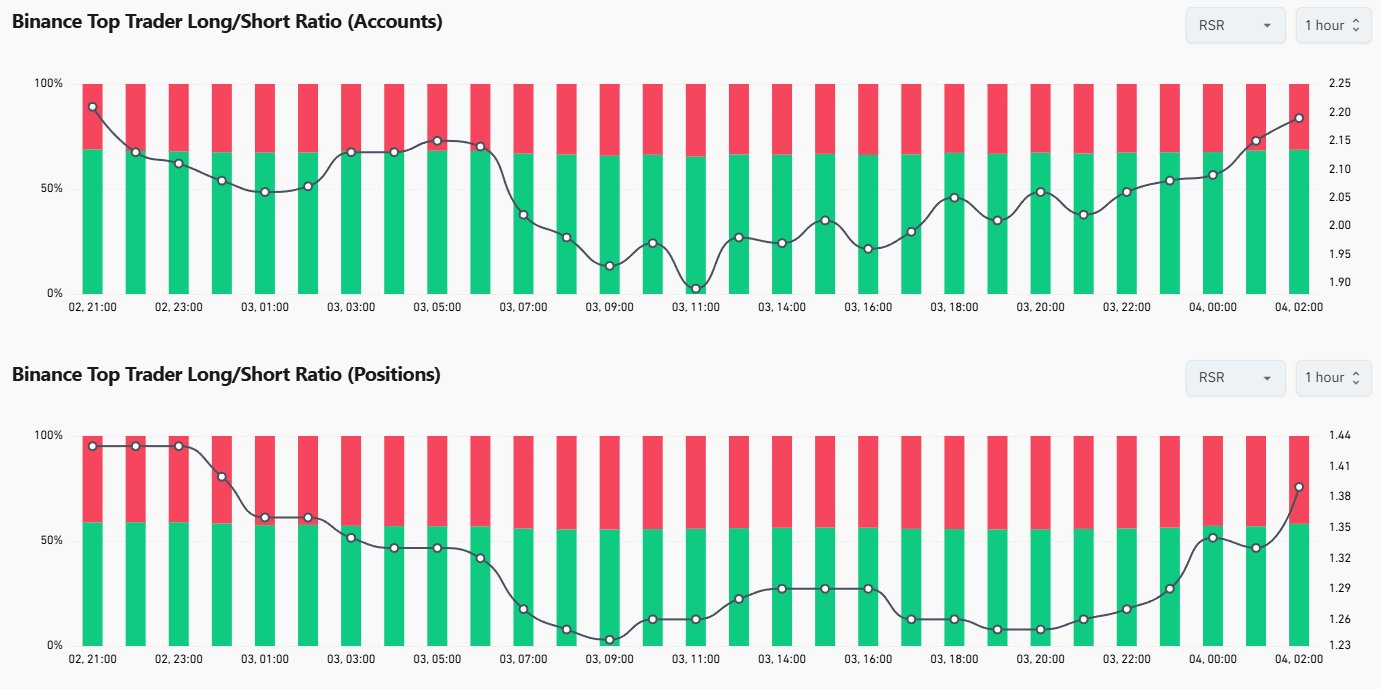

Binance top trader's $RSR long positions have started to increase again. https://t.co/NrtwfROfUk

Binance top trader's $RSR long positions have started to increase again. https://t.co/NrtwfROfUk

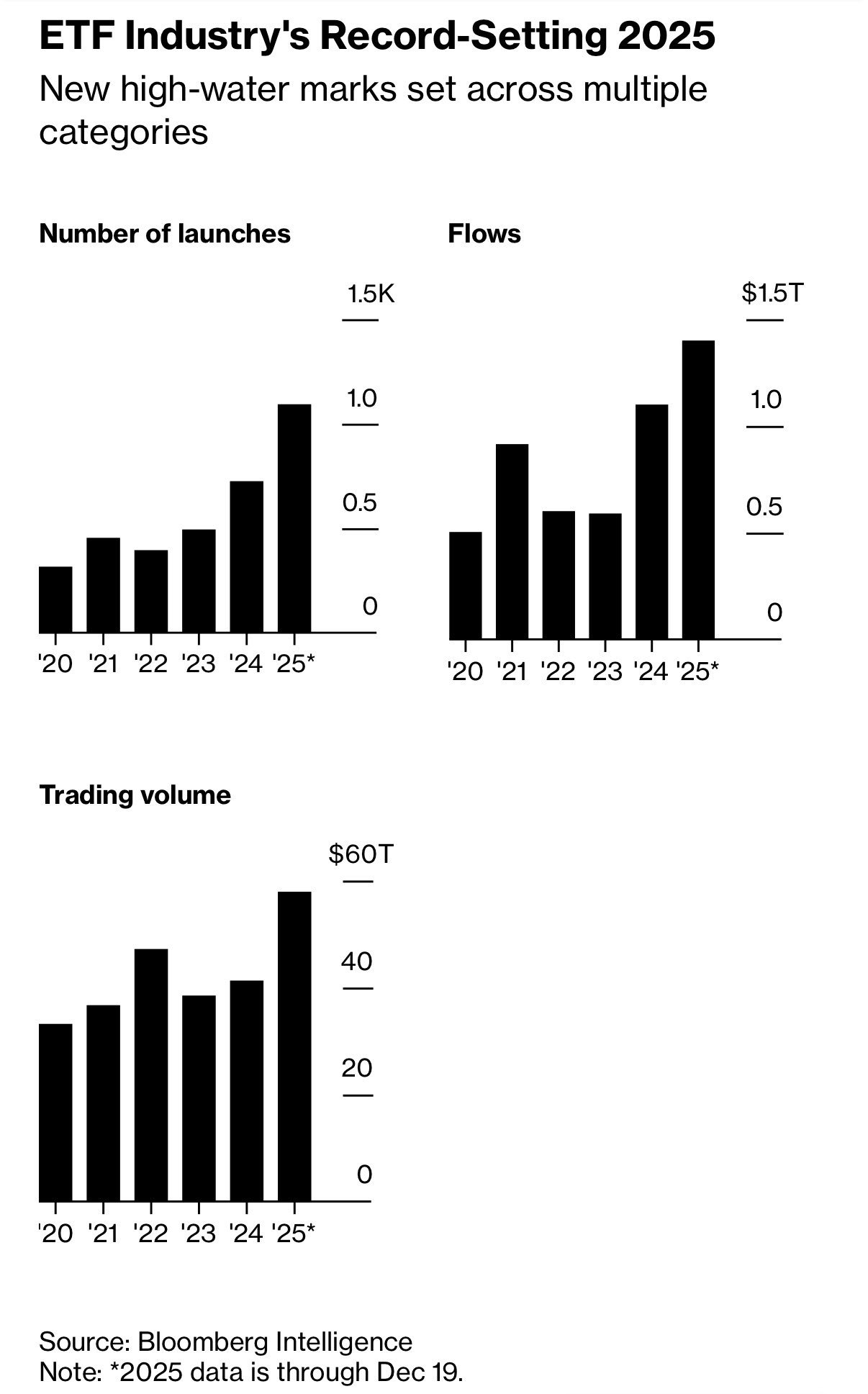

ETFs had an incredible 2025.

They saw record inflows, launches, and trading volume in 2025 and we expect those numbers to grow even more this year.

But here's the problem:

ETFs only trade during market hours.

As more assets move onchain, the real opportunity is 24/7 trading.

Instead of being restricted to market hours, investors will be able to buy and sell fund-like products anytime from anywhere in the world.

More trading hours = more liquidity = a more legitimate product

That’s exactly what @reserveprotocol is building with DTFs.

While ETFs showed the demand, onchain funds will unlock the next evolution.

Crypto index ETFs are projected to capture 2-10% of 2026 ETF inflows.

But ETFs still settle in days, trade during market hours, and charge 0.5%+ fees.

DTFs settle instantly, trade 24/7, and you actually hold the underlying.

That’s the unlock we’re chasing.

People are lazy (and that’s not a bad thing).

Most investors don’t want to pick individual assets or constantly manage positions.

They want to invest once and forget about it.

That’s why funds exist: mutual funds, hedge funds, ETFs, and index products.

The problem today is access.

You need different platforms, accounts, and layers of KYC to invest in different types of funds.

But that's about to change with blockchain.

As the real‑world asset (RWA) wave accelerates, these funds will eventually move onchain.

Instead of juggling platforms, all you’ll need is a decentralized wallet.

As more assets come onchain, demand will naturally shift toward onchain funds which is EXACTLY what @reserveprotocol is building.

That’s where investing is heading.