#Roadmap 🇳🇱

#LombardFinance ( $BARD ) — Complete Roadmap 🧵

From a mission to activate sleeping Bitcoin to building full Bitcoin Capital Markets: #LombardFinance has rapidly evolved into a fundamental infrastructure layer for Bitcoin on‑chain finance.

Here is the full journey: Past → Present → Future

#CryptoRoadmap

📜 Past: Development & Launch

LombardFinance was founded with one clear objective: to transform Bitcoin from a passive store of value into productive, programmable capital within the on‑chain economy.

Key milestones:

🔹 Fundamental Research Phase

The founding team defines the core principles of non‑custodial Bitcoin yield, decentralized security, and institutional infrastructure. The focus is on Bitcoin staking without sacrificing ownership, safety, or trust assumptions.

🔹 Introduction of LBTC

Launch of LBTC (Lombard Bitcoin), a yield‑bearing liquid‑staked Bitcoin token that is 1:1 backed by BTC. LBTC is secured by a decentralized consortium of institutional parties, avoiding single points of failure found in traditional wrappers.

🔹 Protocol Launch & Native Yield

Rollout of the Lombard protocol emphasizing native Bitcoin yield through mechanisms such as Babylon staking. BTC holders earn returns while their capital remains liquid and deployable.

🔹 Early DeFi Integrations

LBTC is integrated into leading DeFi protocols for lending, trading and collateral use‑cases. Early cross‑chain expansion positions LBTC as a multi‑chain Bitcoin primitive.

🔹 Security & Trust Infrastructure

Implementation of Proof‑of‑Reserves, audits and compliance layers to meet institutional standards and build trust among both retail and professional users.

🔹 Community & Ecosystem Formation

The first developers, partners and users adopt LBTC and lay the foundation for a broader Bitcoin DeFi ecosystem built on Lombard infrastructure.

Impact:

The shift from passive Bitcoin holdings to a safe, liquid, yield‑generating on‑chain asset, laying the foundation for Bitcoin Capital Markets.

#LombardFinanceGeschiedenis

⚡ Present: Current Status & Developments

LombardFinance today operates as a mature Bitcoin‑infrastructure protocol and positions LBTC as a core component within BTCFi.

Ecosystem Expansion:

LBTC is widely used in DeFi for lending, trading and structured products. Integrations with wallets, exchanges and protocols on multiple chains provide easy access to Bitcoin yield and liquidity.

Capital Markets Infrastructure:

The protocol expands beyond liquid staking and develops Bitcoin Capital Markets middleware, including vaults, tokenized products and curated DeFi marketplaces for both retail and institutional users.

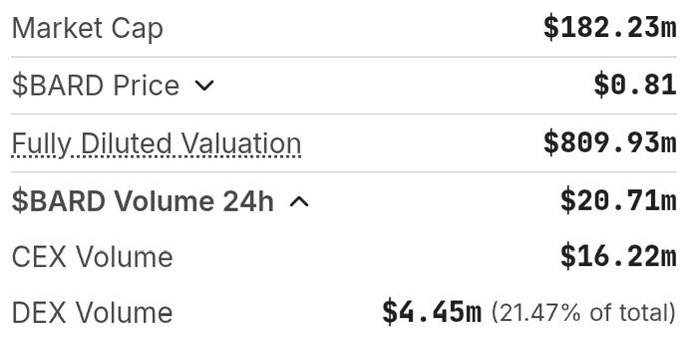

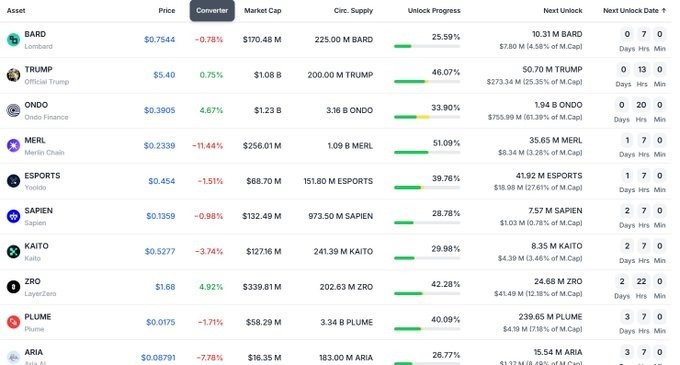

Governance & $BARD Utility:

The $BARD token is live as a native governance and security asset. Through staking and the Liquid Bitcoin Foundation, token holders vote on validator selection, protocol fees, roadmap priorities and ecosystem grants.

Developer Enablement:

Bitcoin Connect and the Lombard SDK provide developers with standardized tools to build native Bitcoin products without managing custody, validators or cross‑chain infrastructure.

Institutional Positioning:

Strategic integrations and asset acquisitions strengthen Lombard’s cross‑chain Bitcoin infrastructure and underline Lombard’s role as a reliable gateway to Bitcoin on‑chain finance.

#LombardFinanceNu #BitcoinDeFi

🚀 Future: Planned Roadmap (Long‑term Vision)

The future of LombardFinance follows a multi‑phase strategy designed to accelerate adoption and capital efficiency within the Bitcoin economy.

Key Roadmap Directions:

🔹 Scaling Bitcoin Capital Markets

Expansion of liquid Bitcoin markets via cross‑chain primitives, basic trade vaults, tokenized yield strategies and institutional financial products.

🔹 Growth of Developer & Infrastructure Tools

Further rollout of the Lombard SDK and Bitcoin Connect to additional chains, wallets and exchanges to accelerate developer adoption and ecosystem growth.

🔹 Permissionless Bitcoin Products

Launch of new permissionless Bitcoin wrappers and tokenized BTC instruments, maintaining decentralization and security.

🔹 Deeper Financial Integration

Connecting Bitcoin with real‑world finance rails and advanced DeFi protocols to position BTC as core collateral within the global on‑chain economy.

🔹 Enable the Bitcoin Economy

Long‑term focus on open standards and modular infrastructure that makes Bitcoin programmable at scale, allowing builders to innovate freely without central dependencies.

Impact:

Establishing Bitcoin as productive, permissionless capital within DeFi and beyond, with Lombard as a full‑stack gateway for Bitcoin Capital Markets.

Risks & Opportunities:

Technical complexity, ecosystem coordination and cross‑chain security remain challenges. Strong governance, institutional security design and active developer participation ensure long‑term resilience.

#LombardFinanceToekomst #BTCFi

✅ Conclusion

LombardFinance has evolved from a Bitcoin liquid staking protocol to a complete infrastructure layer for Bitcoin Capital Markets.

By activating Bitcoin via LBTC and aligning governance and security with $BARD, Lombard enables a future where Bitcoin flows freely as non‑sovereign, permissionless capital within the on‑chain economy.

For anyone who believes Bitcoin is the foundation of decentralized finance, LombardFinance represents a long‑term infrastructure project built for scale, security and sustainability.

#RoadmapConclusion

🛒 Want to trade $BARD on #WEEX?

WEEX is a global #Exchange where you can easily start crypto and futures trading:

✅ Access to 1,700+ #Altcoins

✅ Up to $30,000 USDT in #Bonuses for new users

✅ User‑friendly app & web platform

✅ Reliable exchange with millions of traders worldwide

👉 Sign up now via the link below and claim your welcome bonus!

🔗 https://t.co/CVAuP5WkUn

#CryptoJournaal #AltcoinPedia #Bitcoin #Crypto #Exchange #Futures

Want to learn more about #LombardFinance ( $BARD )? Check the official channels and documentation below:

🔹Discord: https://t.co/EwsRmT7PfF

🔹GitHub: https://t.co/hUxxYuuRuh

🔹Telegram: https://t.co/vcEO2FM5Mv

🔹Website: https://t.co/Ue9mMi59VQ

🔹X (Twitter): https://t.co/7tmrI2WETP

⚠️ Important note:

🔹 This post is purely for educational purposes and not financial advice!

🔹 Invest only what you are willing to lose!

-----------------

👇Follow us👇

-----------------

🚨 Follow @CryptoJournaal – the place for independent crypto information:

📰 News | 📊 Facts | 🧠 Backgrounds | 🎓 Education

💬 No sponsored tokens

📜 Fully MiCAR‑compliant

🔍 Knowledge over hype always

📲 Join via:

💬 Telegram: https://t.co/i976fBvtv0

👥 CryptoJournaal-AltcoinPedia Community: https://t.co/3yFdzLLS2O

🐦 X profile: https://t.co/fd2bI2MInh

#Altcoins #Bitcoin #CryptoNieuws #CryptoEducatie #CryptoKoersen