Love this...

"Kaspa should be the protocol that integrates money directly into the fabric of the Internet” from @kasiamessaging chats and @coderofstuff_ https://t.co/Al3lyh2u5a

Love this...

"Kaspa should be the protocol that integrates money directly into the fabric of the Internet” from @kasiamessaging chats and @coderofstuff_ https://t.co/Al3lyh2u5a

From the discussion that happened in byzantine-agreement kasia channel:

“Kaspa has to become the native money protocol of the Internet, the monetary layer.

Just like:

HTTP for web pages,

SMTP for email,

TCP/IP for data flows,

Kaspa should be the protocol tha integrates money directly into the fabric of the Internet”

The best altcoins feel slow before they explode.

If it feels exciting

You are probably late.

$KAS $QUBIC $CARR $QUAI

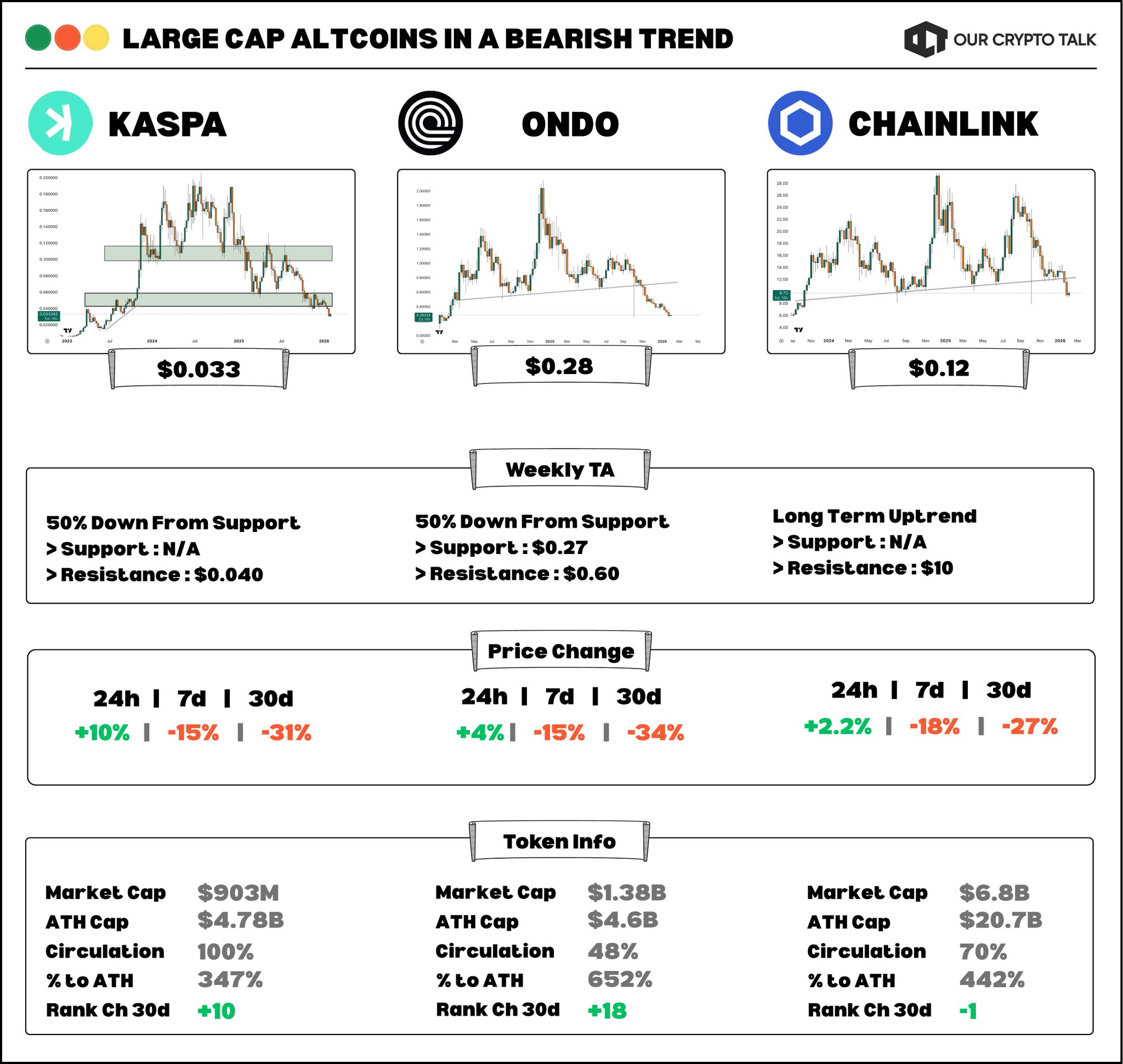

BEAR MARKET FOR LEADERS 👀

$KAS is 50% down from its support

$ONDO is 50% down its uptrend

$LINK broke below $10

At first glance, this looks uncomfortable.

But discomfort is usually where long term entries are formed.

The real question isn’t “is this bearish?”

It’s “is this where selling is already done?”

👉 What price is actually telling you

Bear markets for leaders don’t mean they’re finished.

They mean expectations have been reset.

This is the phase where:

• Weak hands exit

• Late momentum money leaves

• Strong hands start planning, not chasing

That’s how bottoms are built. Slowly. Quietly. Without hype.

> Kaspa

Kaspa has clearly shifted from expansion to defense.

Higher highs are gone. Momentum has cooled.

But here’s the important part that the price is no longer collapsing either.

When an asset drops hard and then stabilizes, it usually means sellers are exhausted.

> Ondo

Ondo is doing what hype‑driven leaders always do after their first major cycle.

Narratives brought it up fast.

Price is now letting time correct what speed distorted. This is where many people wait for “confirmation” and miss the zone entirely.

With Ondo Summit and other catalysts, we can expect some short term recovery.

> Chainlink

Chainlink is the cleanest structurally, and that’s not an accident.

Yes, a key level broke.

Yes, medium‑term momentum has rolled over.

But LINK hasn’t lost relevance fundamentally and markets often bottom when excitement disappears, not when fear peaks.

This is distribution turning into digestion. That transition matters.

👉 The real risk isn’t buying here

It’s waiting for comfort

Most people buy large caps:

• After trends return

• After breakouts confirm

• After narratives feel “safe” again

That’s also when risk is highest.

Buying lows isn’t about catching the exact bottom.

It’s about buying when selling pressure is already done.

🥇 Join our YouTube family – be among the first lucky 3000! 🎉

https://t.co/tMOG0EY5Jq