Bittensor (TAO)

Bittensor (TAO)

$176.65 -5.61% 24H

- 79Índice de sentimiento social (ISS)+12.64% (24h)

- #55Clasificación del pulso del mercado (CPM)+72

- 45Mención en redes sociales de 24 h+46.67% (24h)

- 71%Ratio alcista de KOL en 24 h23 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales79SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (24%)Alcista (47%)Neutral (29%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

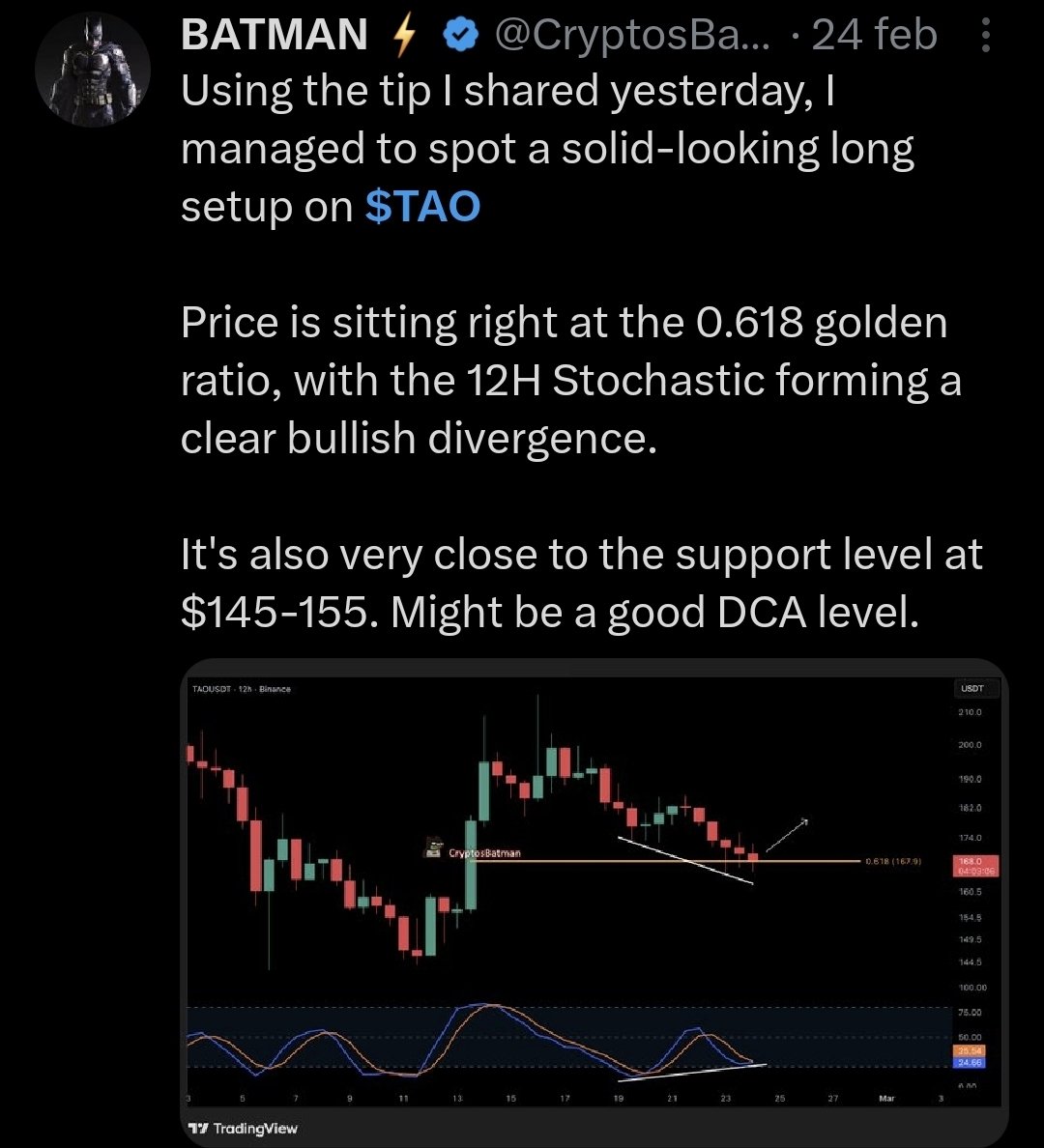

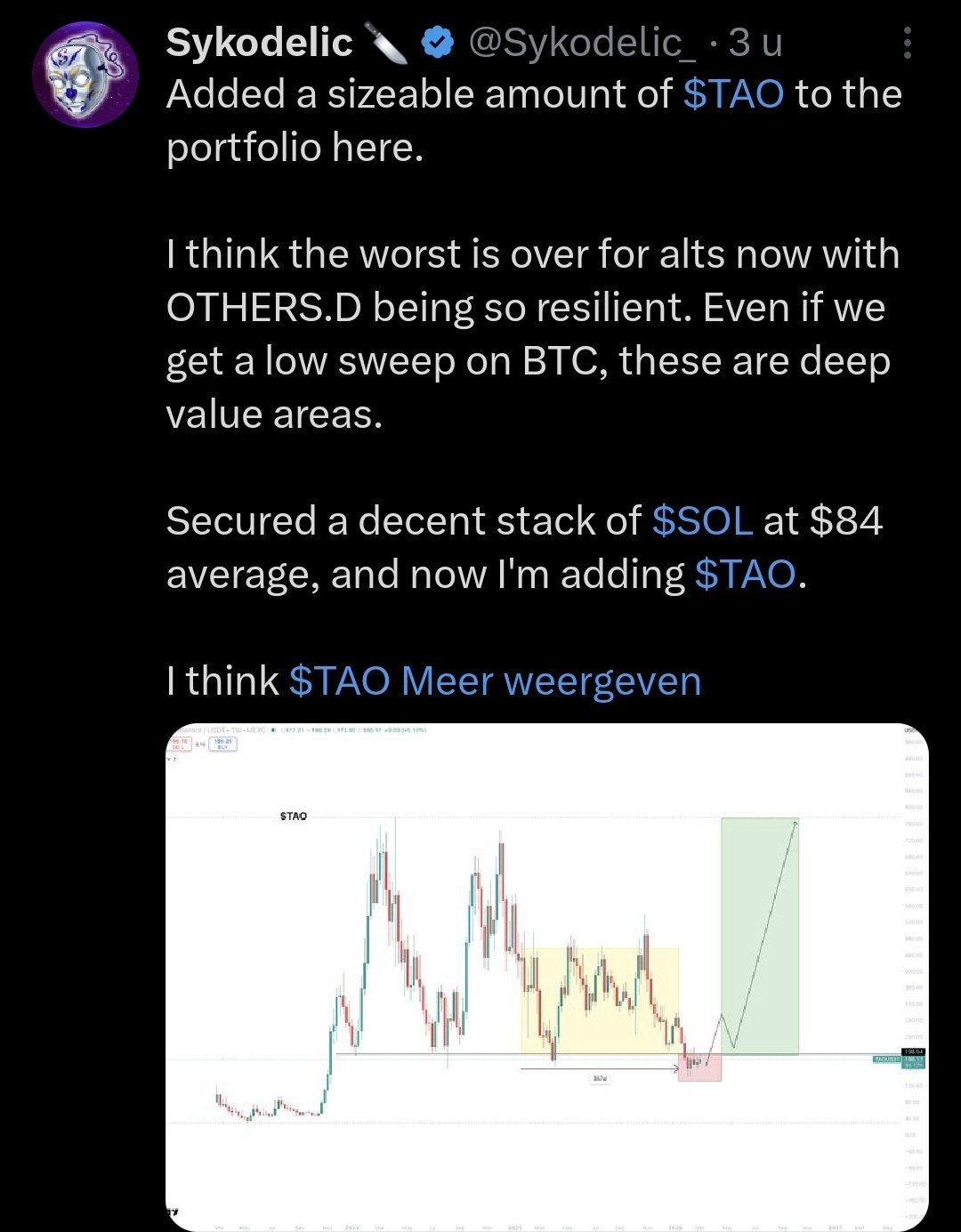

Publicaciones de X

- Tendencia de TAO tras el lanzamientoExtremadamente alcista

WIZZ🥷 ( beware scammers ) TA_Analyst Trader C813.84K @CryptoWizardd

WIZZ🥷 ( beware scammers ) TA_Analyst Trader C813.84K @CryptoWizardd RVCrypto FA_Analyst Tokenomics_Expert C70.62K @RvCrypto

RVCrypto FA_Analyst Tokenomics_Expert C70.62K @RvCrypto

213 16 12.34K Original >Tendencia de TAO tras el lanzamientoExtremadamente alcista

213 16 12.34K Original >Tendencia de TAO tras el lanzamientoExtremadamente alcista- Tendencia de TAO tras el lanzamientoNeutral

Mark Jeffrey VC Tokenomics_Expert C68.54K @markjeffrey

Mark Jeffrey VC Tokenomics_Expert C68.54K @markjeffrey Barry Silbert Founder VC C783.89K @BarrySilbert612 30 43.47K Original >Tendencia de TAO tras el lanzamientoNeutral

Barry Silbert Founder VC C783.89K @BarrySilbert612 30 43.47K Original >Tendencia de TAO tras el lanzamientoNeutral Mark Jeffrey VC Tokenomics_Expert C68.54K @markjeffrey

Mark Jeffrey VC Tokenomics_Expert C68.54K @markjeffrey Yuma Dev Founder A9.78K @YumaGroup319 8 72.12K Original >Tendencia de TAO tras el lanzamientoAlcista

Yuma Dev Founder A9.78K @YumaGroup319 8 72.12K Original >Tendencia de TAO tras el lanzamientoAlcista Andy ττ FA_Analyst OnChain_Analyst S10.39K @bittingthembits

Andy ττ FA_Analyst OnChain_Analyst S10.39K @bittingthembits Yuma Dev Founder A9.78K @YumaGroup23 0 891 Original >Tendencia de TAO tras el lanzamientoExtremadamente alcista

Yuma Dev Founder A9.78K @YumaGroup23 0 891 Original >Tendencia de TAO tras el lanzamientoExtremadamente alcista- Tendencia de TAO tras el lanzamientoNeutral

Yuma Dev Founder A9.78K @YumaGroup

Yuma Dev Founder A9.78K @YumaGroup TAO Telegraph — Bittensor Media D1.16K @taotelegraph15 0 943 Original >Tendencia de TAO tras el lanzamientoNeutral

TAO Telegraph — Bittensor Media D1.16K @taotelegraph15 0 943 Original >Tendencia de TAO tras el lanzamientoNeutral- Tendencia de TAO tras el lanzamientoAlcista

KaWis Community_Lead Educator B1.52K @_KaWisLeo

KaWis Community_Lead Educator B1.52K @_KaWisLeo Rayah τensor τ_τ D4.24K @Obsessedfan5

Rayah τensor τ_τ D4.24K @Obsessedfan5 16 2 567 Original >Tendencia de TAO tras el lanzamientoAlcista

16 2 567 Original >Tendencia de TAO tras el lanzamientoAlcista