Pendle (PENDLE)

Pendle (PENDLE)

$1.2216 -4.42% 24H

- 70Índice de sentimiento social (ISS)+43.81% (24h)

- #21Clasificación del pulso del mercado (CPM)+43

- 2Mención en redes sociales de 24 h+100.00% (24h)

- 100%Ratio alcista de KOL en 24 h2 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales70SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (50%)Alcista (50%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

Sébastien Derivaux Founder DeFi_Expert A12.25K @SebVentures

Sébastien Derivaux Founder DeFi_Expert A12.25K @SebVentures Steakhouse Financial D9.18K @SteakhouseFi

Steakhouse Financial D9.18K @SteakhouseFi 20 1 1.03K Original >Tendencia de PENDLE tras el lanzamientoAlcista

20 1 1.03K Original >Tendencia de PENDLE tras el lanzamientoAlcista- Tendencia de PENDLE tras el lanzamientoExtremadamente alcista

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth

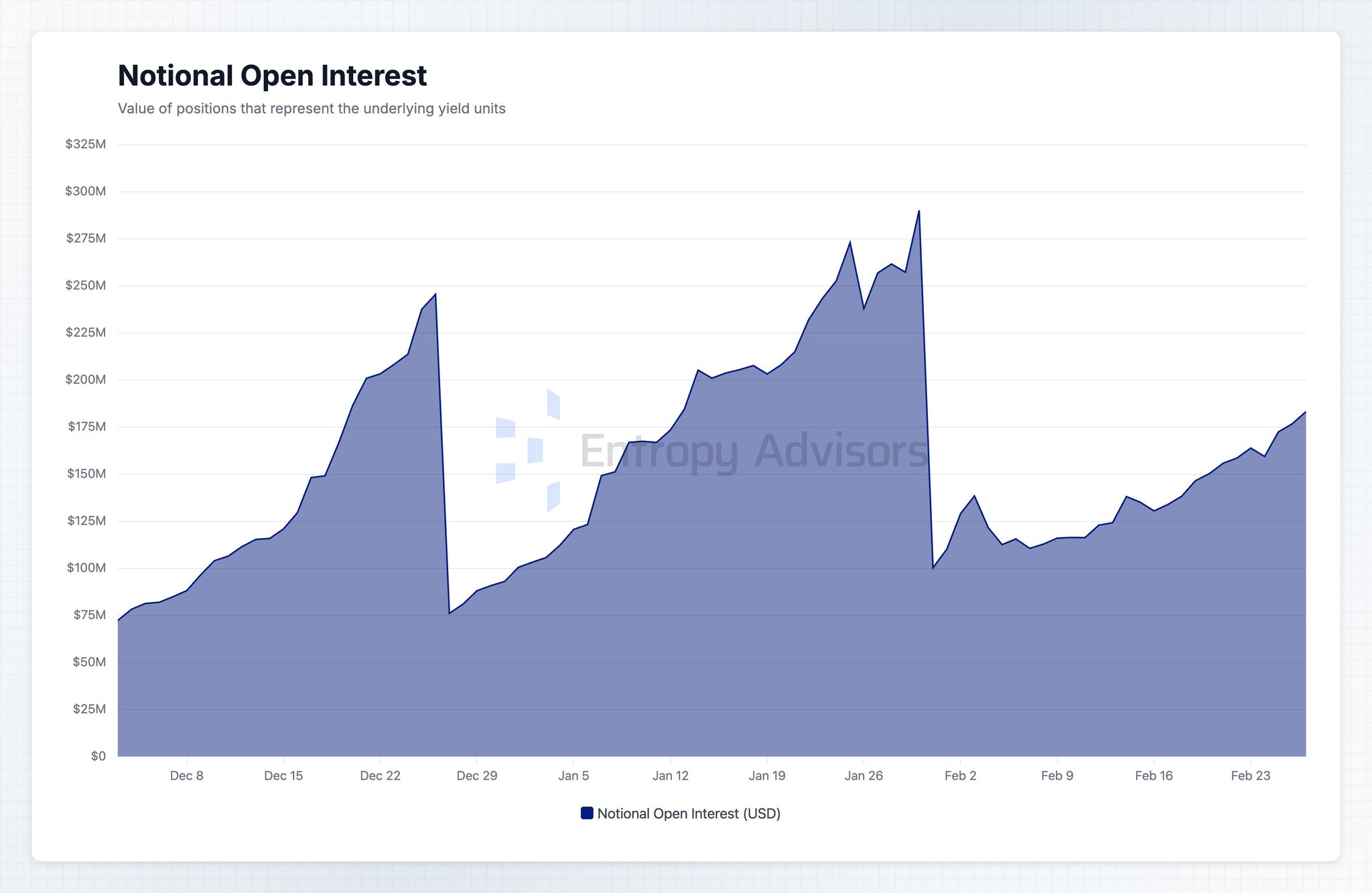

MobΞth Researcher Tokenomics_Expert B3.60K @MobWeth Entropy Advisors D3.80K @EntropyAdvisors

Entropy Advisors D3.80K @EntropyAdvisors 51 1 8.22K Original >Tendencia de PENDLE tras el lanzamientoExtremadamente alcista

51 1 8.22K Original >Tendencia de PENDLE tras el lanzamientoExtremadamente alcista- Tendencia de PENDLE tras el lanzamientoAlcista

Crypto Onizuka FA_Analyst DeFi_Expert B15.79K @slamboto_v2

Crypto Onizuka FA_Analyst DeFi_Expert B15.79K @slamboto_v2 Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 96 8 5.57K Original >Tendencia de PENDLE tras el lanzamientoAlcista

96 8 5.57K Original >Tendencia de PENDLE tras el lanzamientoAlcista nairolf Tokenomics_Expert Influencer A38.11K @0xNairolf

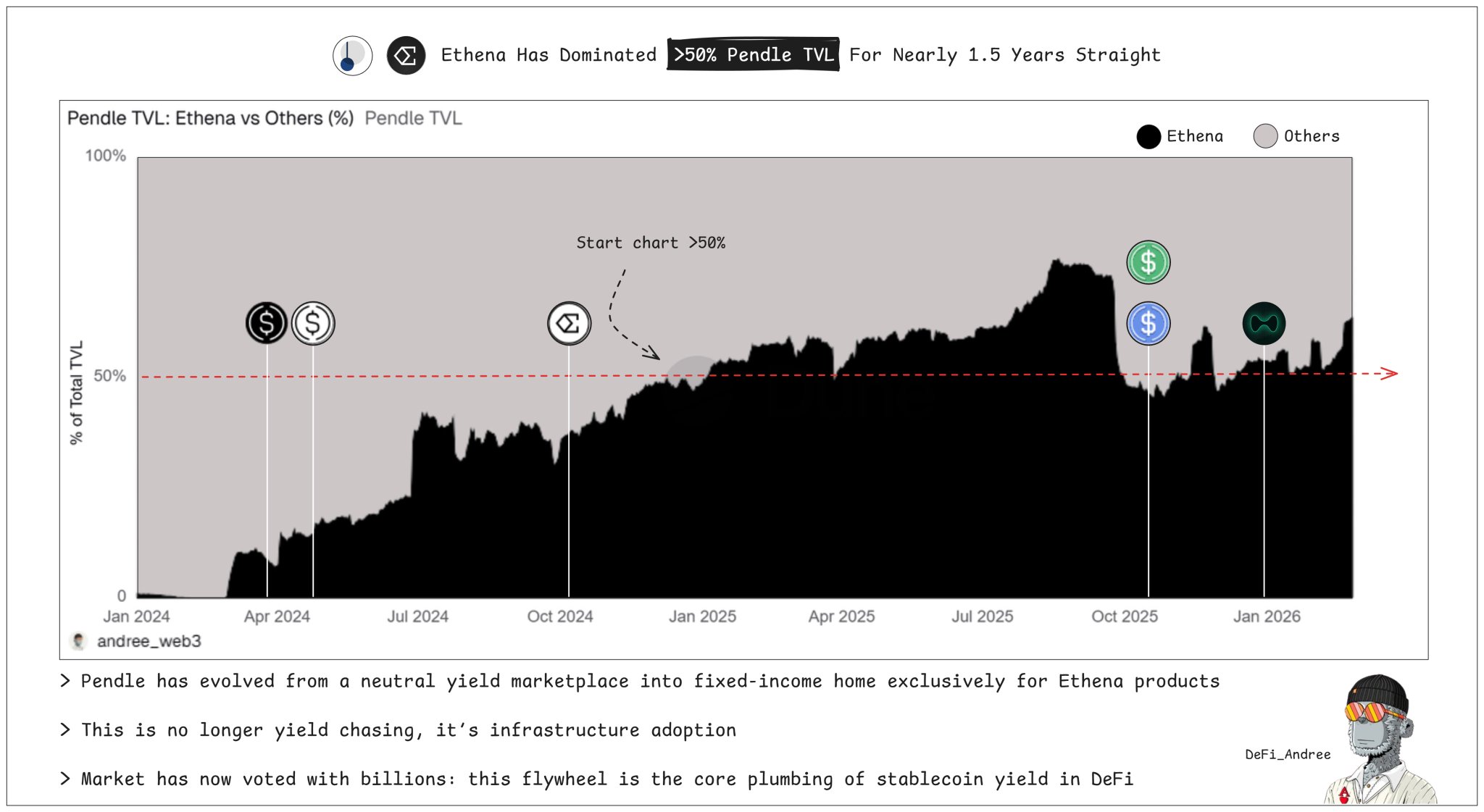

nairolf Tokenomics_Expert Influencer A38.11K @0xNairolf DeFi Andree D7.33K @DeFi_Andree

DeFi Andree D7.33K @DeFi_Andree 52 11 4.67K Original >Tendencia de PENDLE tras el lanzamientoExtremadamente alcista

52 11 4.67K Original >Tendencia de PENDLE tras el lanzamientoExtremadamente alcista- Tendencia de PENDLE tras el lanzamientoBajista

- Tendencia de PENDLE tras el lanzamientoAlcista

- Tendencia de PENDLE tras el lanzamientoAlcista

The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor

The DeFi Investor 🔎 DeFi_Expert Tokenomics_Expert B161.62K @TheDeFinvestor Pendle D160.07K @pendle_fi

Pendle D160.07K @pendle_fi 147 15 13.67K Original >Tendencia de PENDLE tras el lanzamientoAlcista

147 15 13.67K Original >Tendencia de PENDLE tras el lanzamientoAlcista