ORDER (ORDER)

ORDER (ORDER)

$0.08255 -0.91% 24H

- 24Índice de sentimiento social (ISS)-58.49% (24h)

- #113Clasificación del pulso del mercado (CPM)-41

- 1Mención en redes sociales de 24 h-50.00% (24h)

- 0%Ratio alcista de KOL en 24 h1 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales24SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosBajista (100%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

- Tendencia de ORDER tras el lanzamientoBajista

코루🍊 FA_Analyst DeFi_Expert B35.26K @colu_farmer

코루🍊 FA_Analyst DeFi_Expert B35.26K @colu_farmer

코루🍊 FA_Analyst DeFi_Expert B35.26K @colu_farmer

코루🍊 FA_Analyst DeFi_Expert B35.26K @colu_farmer 9 4 1.26K Original >Tendencia de ORDER tras el lanzamientoExtremadamente alcista

9 4 1.26K Original >Tendencia de ORDER tras el lanzamientoExtremadamente alcista- Tendencia de ORDER tras el lanzamientoExtremadamente alcista

0xdahua|大华 🎮. |🧠SENT 丨 MemeMax ⚡️ Founder DeFi_Expert B34.13K @0xdahua

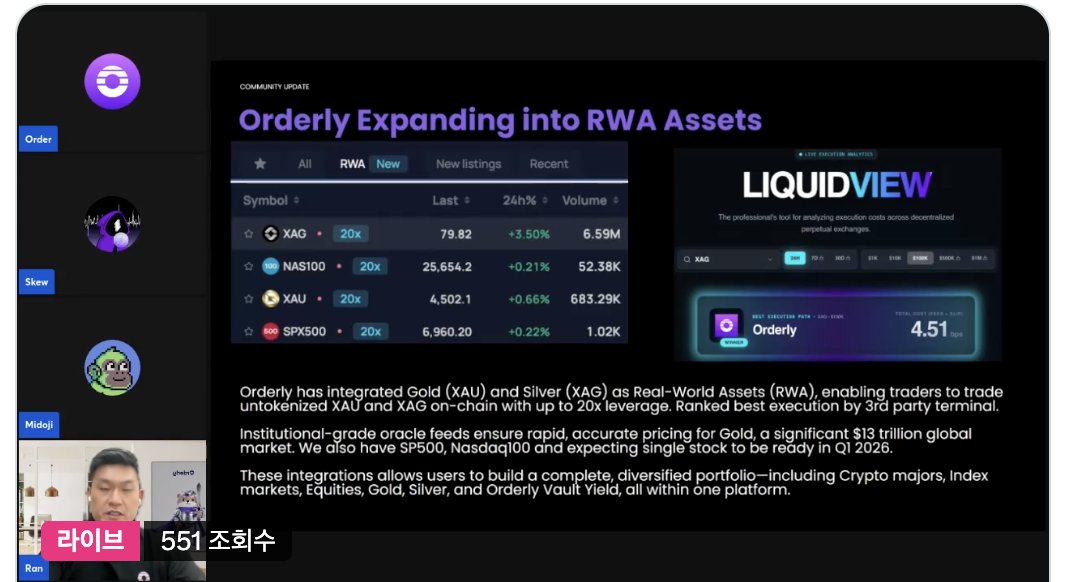

0xdahua|大华 🎮. |🧠SENT 丨 MemeMax ⚡️ Founder DeFi_Expert B34.13K @0xdahua Orderly D390.17K @OrderlyNetwork

Orderly D390.17K @OrderlyNetwork 56 51 941 Original >Tendencia de ORDER tras el lanzamientoExtremadamente alcista

56 51 941 Original >Tendencia de ORDER tras el lanzamientoExtremadamente alcista Marques Ken FA_Analyst DeFi_Expert B13.03K @Ken_marque

Marques Ken FA_Analyst DeFi_Expert B13.03K @Ken_marque Orderly D390.17K @OrderlyNetwork

Orderly D390.17K @OrderlyNetwork 31 25 1.36K Original >Tendencia de ORDER tras el lanzamientoExtremadamente alcista

31 25 1.36K Original >Tendencia de ORDER tras el lanzamientoExtremadamente alcista Tom 😾 Educator Influencer C57.53K @TomWeb33

Tom 😾 Educator Influencer C57.53K @TomWeb33 Orderly D390.17K @OrderlyNetwork

Orderly D390.17K @OrderlyNetwork 108 110 789 Original >Tendencia de ORDER tras el lanzamientoExtremadamente alcista

108 110 789 Original >Tendencia de ORDER tras el lanzamientoExtremadamente alcista- Tendencia de ORDER tras el lanzamientoBajista

Veymon Media Community_Lead B3.30K @Lucis_Veymon0 0 0 Original >Tendencia de ORDER tras el lanzamientoAlcista

Veymon Media Community_Lead B3.30K @Lucis_Veymon0 0 0 Original >Tendencia de ORDER tras el lanzamientoAlcista Veymon Media Community_Lead B3.30K @Lucis_Veymon0 0 0 Original >Tendencia de ORDER tras el lanzamientoAlcista

Veymon Media Community_Lead B3.30K @Lucis_Veymon0 0 0 Original >Tendencia de ORDER tras el lanzamientoAlcista Veymon Media Community_Lead B3.30K @Lucis_Veymon

Veymon Media Community_Lead B3.30K @Lucis_Veymon Veymon Media Community_Lead B3.30K @Lucis_Veymon6 4 1.48K Original >Tendencia de ORDER tras el lanzamientoAlcista

Veymon Media Community_Lead B3.30K @Lucis_Veymon6 4 1.48K Original >Tendencia de ORDER tras el lanzamientoAlcista

- Sin datos