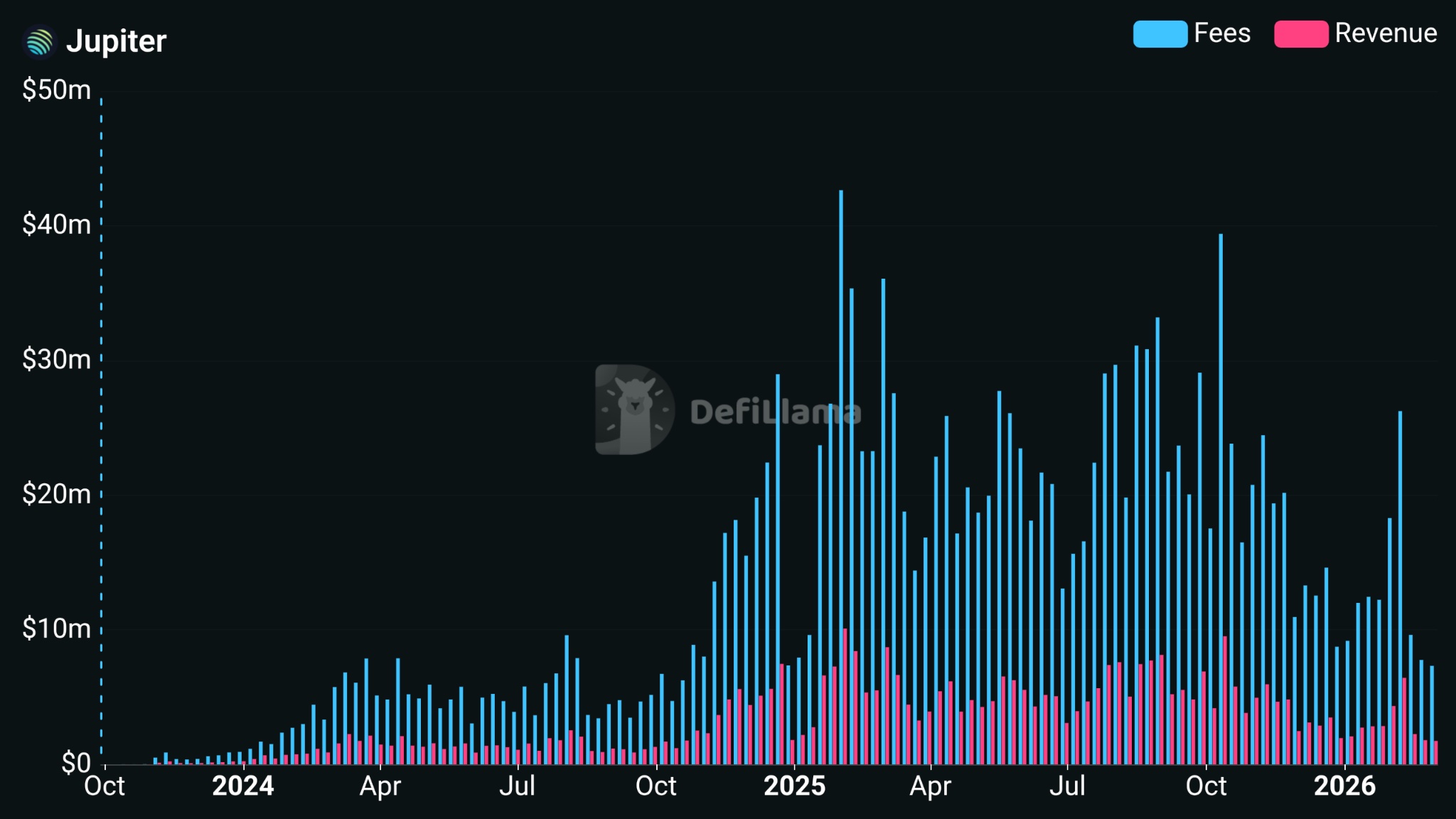

Jupiter (JUP)

Jupiter (JUP)

$0.1767 -5.76% 24H

- 39Índice de sentimiento social (ISS)-22.16% (24h)

- #80Clasificación del pulso del mercado (CPM)+49

- 2Mención en redes sociales de 24 h-50.00% (24h)

- 100%Ratio alcista de KOL en 24 h1 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales39SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente alcista (100%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug

THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug

THEDEFIPLUG FA_Analyst OnChain_Analyst C52.72K @TheDeFiPlug 154 25 13.18K Original >Tendencia de JUP tras el lanzamientoExtremadamente alcista

154 25 13.18K Original >Tendencia de JUP tras el lanzamientoExtremadamente alcista- Tendencia de JUP tras el lanzamientoExtremadamente alcista

Mars_DeFi Researcher Educator B29.66K @Mars_DeFi

Mars_DeFi Researcher Educator B29.66K @Mars_DeFi Mars_DeFi Researcher Educator B29.66K @Mars_DeFi

Mars_DeFi Researcher Educator B29.66K @Mars_DeFi 58 24 2.43K Original >Tendencia de JUP tras el lanzamientoAlcista

58 24 2.43K Original >Tendencia de JUP tras el lanzamientoAlcista- Tendencia de JUP tras el lanzamientoBajista

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda

Kash (🐱, 🐐) DeFi_Expert Community_Lead A48.81K @kashdhanda molu D12.90K @molusol

molu D12.90K @molusol 72 18 3.76K Original >Tendencia de JUP tras el lanzamientoExtremadamente alcista

72 18 3.76K Original >Tendencia de JUP tras el lanzamientoExtremadamente alcista- Tendencia de JUP tras el lanzamientoExtremadamente alcista

- Tendencia de JUP tras el lanzamientoExtremadamente alcista

- Tendencia de JUP tras el lanzamientoBajista

- Tendencia de JUP tras el lanzamientoAlcista

- Tendencia de JUP tras el lanzamientoAlcista