ENA (ENA)

ENA (ENA)

$0.1037 -9.90% 24H

- 44Índice de sentimiento social (ISS)- (24h)

- #104Clasificación del pulso del mercado (CPM)0

- 1Mención en redes sociales de 24 h- (24h)

- 100%Ratio alcista de KOL en 24 h1 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales44SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosAlcista (100%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

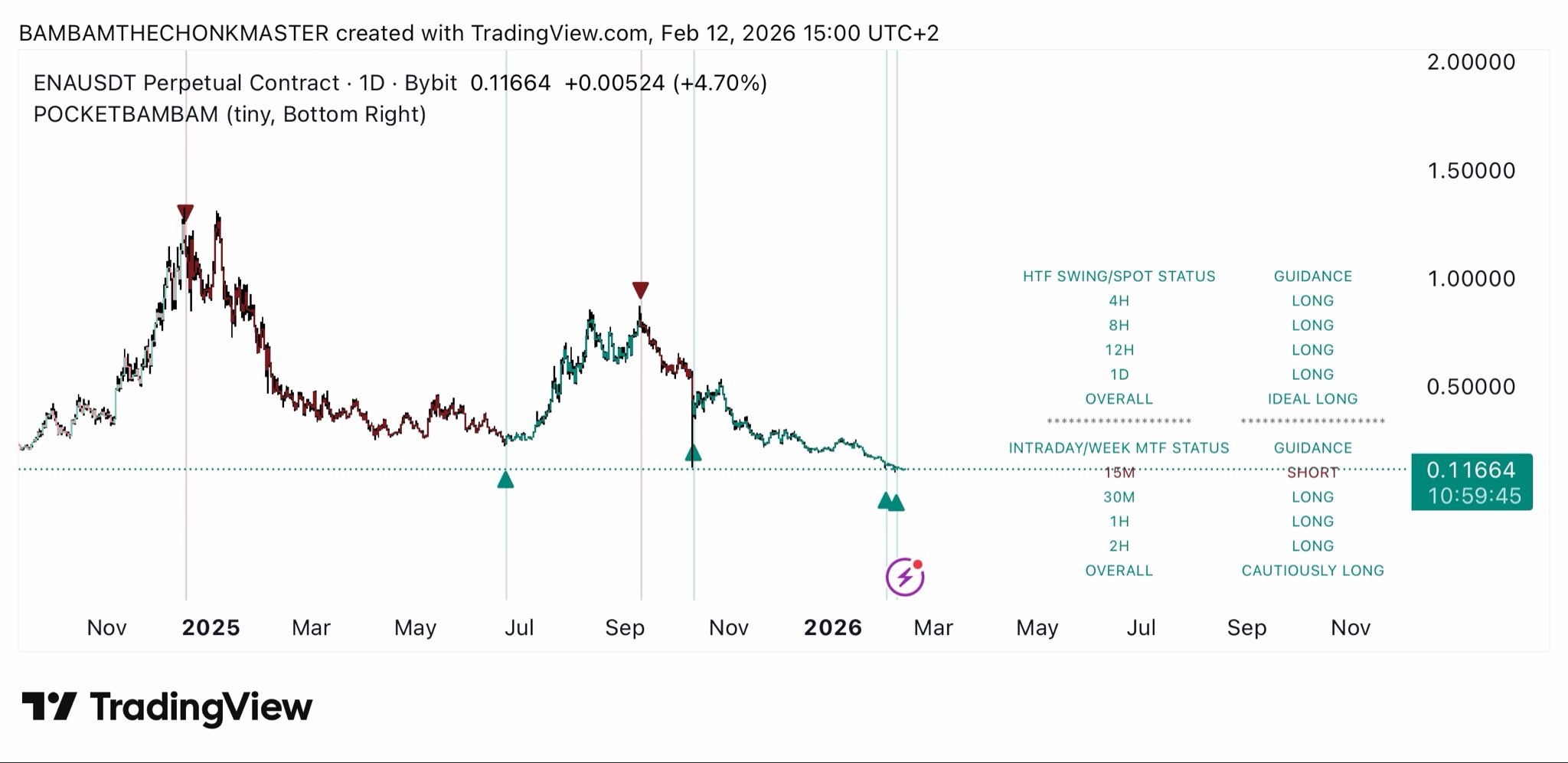

BAMBAM Trader Derivatives_Expert B12.58K @BAMBAMTHECHONK

BAMBAM Trader Derivatives_Expert B12.58K @BAMBAMTHECHONK

BAMBAM Trader Derivatives_Expert B12.58K @BAMBAMTHECHONK

BAMBAM Trader Derivatives_Expert B12.58K @BAMBAMTHECHONK 8 2 1.41K Original >Tendencia de ENA tras el lanzamientoAlcista

8 2 1.41K Original >Tendencia de ENA tras el lanzamientoAlcista- Tendencia de ENA tras el lanzamientoExtremadamente bajista

- Tendencia de ENA tras el lanzamientoBajista

- Tendencia de ENA tras el lanzamientoExtremadamente alcista

- Tendencia de ENA tras el lanzamientoAlcista

- Tendencia de ENA tras el lanzamientoExtremadamente alcista

BAEK_PRO🌊 Researcher Educator B4.54K @baek_project

BAEK_PRO🌊 Researcher Educator B4.54K @baek_project BAEK_PRO🌊 Researcher Educator B4.54K @baek_project

BAEK_PRO🌊 Researcher Educator B4.54K @baek_project 82 51 7.77K Original >Tendencia de ENA tras el lanzamientoBajista

82 51 7.77K Original >Tendencia de ENA tras el lanzamientoBajista- Tendencia de ENA tras el lanzamientoBajista

Emperor Osmo 🐂 🎯 D91.92K @Flowslikeosmo

Emperor Osmo 🐂 🎯 D91.92K @Flowslikeosmo Emperor Osmo 🐂 🎯 D91.92K @Flowslikeosmo

Emperor Osmo 🐂 🎯 D91.92K @Flowslikeosmo 53 17 5.85K Original >Tendencia de ENA tras el lanzamientoAlcista

53 17 5.85K Original >Tendencia de ENA tras el lanzamientoAlcista- Tendencia de ENA tras el lanzamientoNeutral