Berachain (BERA)

Berachain (BERA)

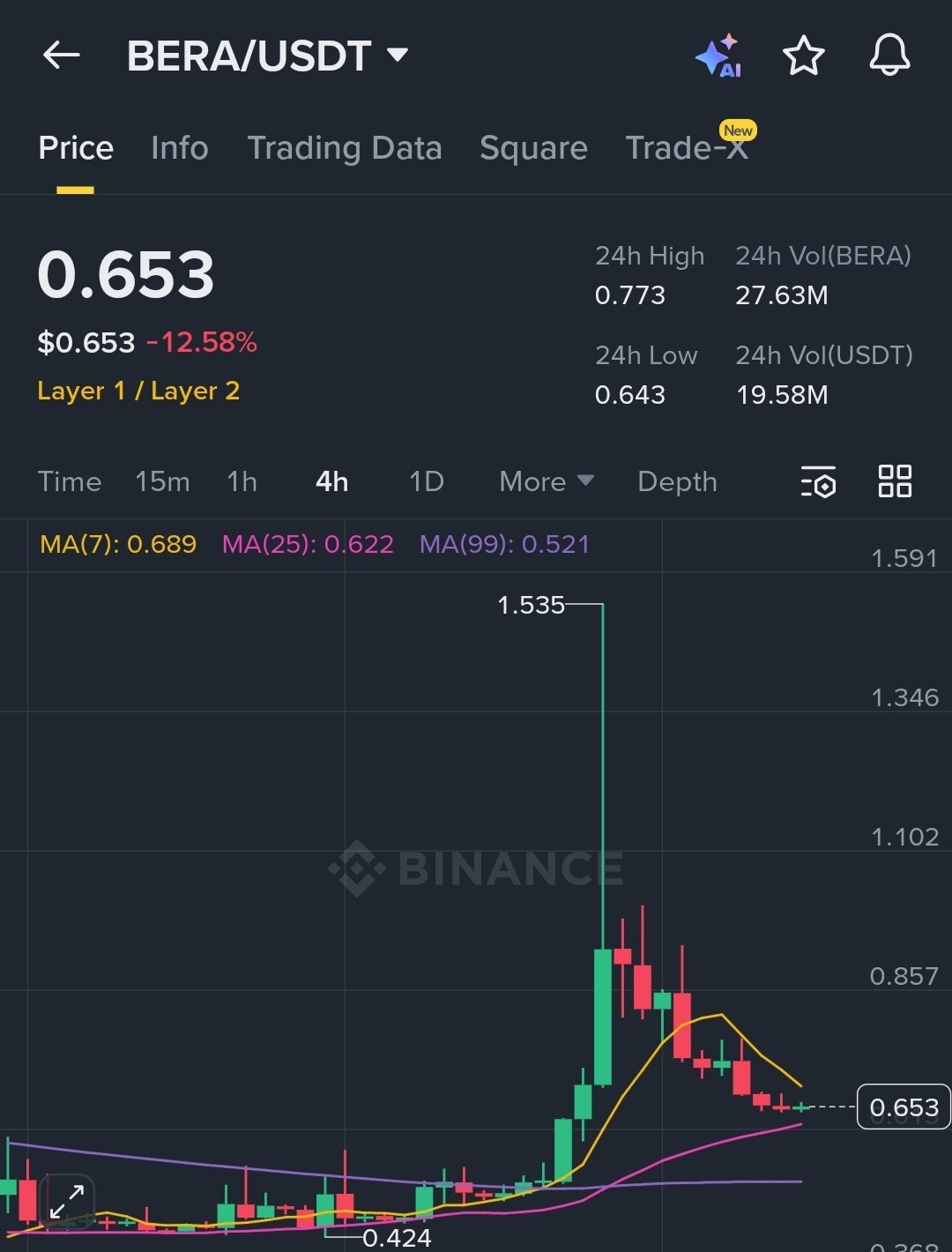

$0.5275 -1.68% 24H

- 47Índice de sentimiento social (ISS)- (24h)

- #7Clasificación del pulso del mercado (CPM)0

- 2Mención en redes sociales de 24 h- (24h)

- 0%Ratio alcista de KOL en 24 h2 KOL activo

- Resumen

- Señales alcistas

- Señales bajistas

Índice de sentimiento social (ISS)

- Datos generales47SSI

- Tendencia ISS (7 días)Precio (7 días)Distribución de sentimientosExtremadamente bajista (100%)Perspectivas de ISS

Clasificación del pulso del mercado (CPM)

- Alerta Insight

Publicaciones de X

Caio Villa - (Cripto Villa) TA_Analyst Trader B26.03K @CriptoVilla

Caio Villa - (Cripto Villa) TA_Analyst Trader B26.03K @CriptoVilla Rio👾 D6.81K @Riowgmi

Rio👾 D6.81K @Riowgmi 5 0 123 Original >Tendencia de BERA tras el lanzamientoExtremadamente bajista

5 0 123 Original >Tendencia de BERA tras el lanzamientoExtremadamente bajista- Tendencia de BERA tras el lanzamientoExtremadamente bajista

- Tendencia de BERA tras el lanzamientoExtremadamente bajista

⚜️BAŞKAN TEKNİK~KRİPTO⚜️ Technical Analyst Educator S5.82K @BaskanTeknik_K

⚜️BAŞKAN TEKNİK~KRİPTO⚜️ Technical Analyst Educator S5.82K @BaskanTeknik_K

⚜️BAŞKAN TEKNİK~KRİPTO⚜️ Technical Analyst Educator S5.82K @BaskanTeknik_K

⚜️BAŞKAN TEKNİK~KRİPTO⚜️ Technical Analyst Educator S5.82K @BaskanTeknik_K 63 1 3.75K Original >Tendencia de BERA tras el lanzamientoBajista

63 1 3.75K Original >Tendencia de BERA tras el lanzamientoBajista 𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy

𝕋𝕖𝕞𝕞𝕪🦇🔊 DeFi_Expert Educator C41.53K @Only1temmy 63 12 13.10K Original >Tendencia de BERA tras el lanzamientoExtremadamente bajista

63 12 13.10K Original >Tendencia de BERA tras el lanzamientoExtremadamente bajista- Tendencia de BERA tras el lanzamientoExtremadamente bajista

FIP Crypto | Footprint OnChain_Analyst Educator C20.30K @fipcrypto

FIP Crypto | Footprint OnChain_Analyst Educator C20.30K @fipcrypto FIP Crypto | Footprint OnChain_Analyst Educator C20.30K @fipcrypto14 3 1.23K Original >Tendencia de BERA tras el lanzamientoBajista

FIP Crypto | Footprint OnChain_Analyst Educator C20.30K @fipcrypto14 3 1.23K Original >Tendencia de BERA tras el lanzamientoBajista- Tendencia de BERA tras el lanzamientoExtremadamente bajista

- Tendencia de BERA tras el lanzamientoNeutral

wyck 📴 Educator Influencer C227.06K @wyckoffweb

wyck 📴 Educator Influencer C227.06K @wyckoffweb

wyck 📴 Educator Influencer C227.06K @wyckoffweb

wyck 📴 Educator Influencer C227.06K @wyckoffweb 84 30 6.70K Original >Tendencia de BERA tras el lanzamientoBajista

84 30 6.70K Original >Tendencia de BERA tras el lanzamientoBajista